Have you ever tried to sell an electric car? It's difficult, as any car dealer will tell you, but selling a used e-car is almost impossible.

Two major factors are the rapidly advancing technical progress, especially in battery technology, and the immense repair costs if important components such as the battery fail.

Booster development time

Up to now, the development speed for a new model at German manufacturers has been more than 50 months. Tesla manages 18 - 24 months and Chinese manufacturers have a development time of around 14 - 18 months. Now German manufacturers are also stepping up the pace in their development departments and want to reduce the development time for new models to 36 months.

Fabless e-car manufacturers in China

New e-car manufacturers are developing a business model similar to that in the semiconductor industry with fabless IC manufacturers such as Nvidia, AMD or Qualcom. They concentrate on the design and sales of their chips, but have outsourced wafer production, testing and packaging to third-party companies.

China built 26.1 million cars and around 4 million commercial vehicles last year. According to insiders, this compares with a capacity of 42 million vehicles. The aforementioned fabless e-car manufacturers are taking advantage of this and having the e-motor, battery, power electronics, chassis and chassis produced by external companies.

Cost comparison of e-car versus petrol engine components

The costs for a mid-range car with around 140 KW/190 hp are as follows. A gasoline engine costs 3000 to 4000 €. In contrast, a permanently excited synchronous motor costs 1200 to 1400 €, plus the power electronics at 800 to 1200 €, i.e. a total of 2200 to 2400 €.

At €300, the input gearbox for an electric car is very inexpensive, while a dual-clutch gearbox for a combustion engine costs €2100.

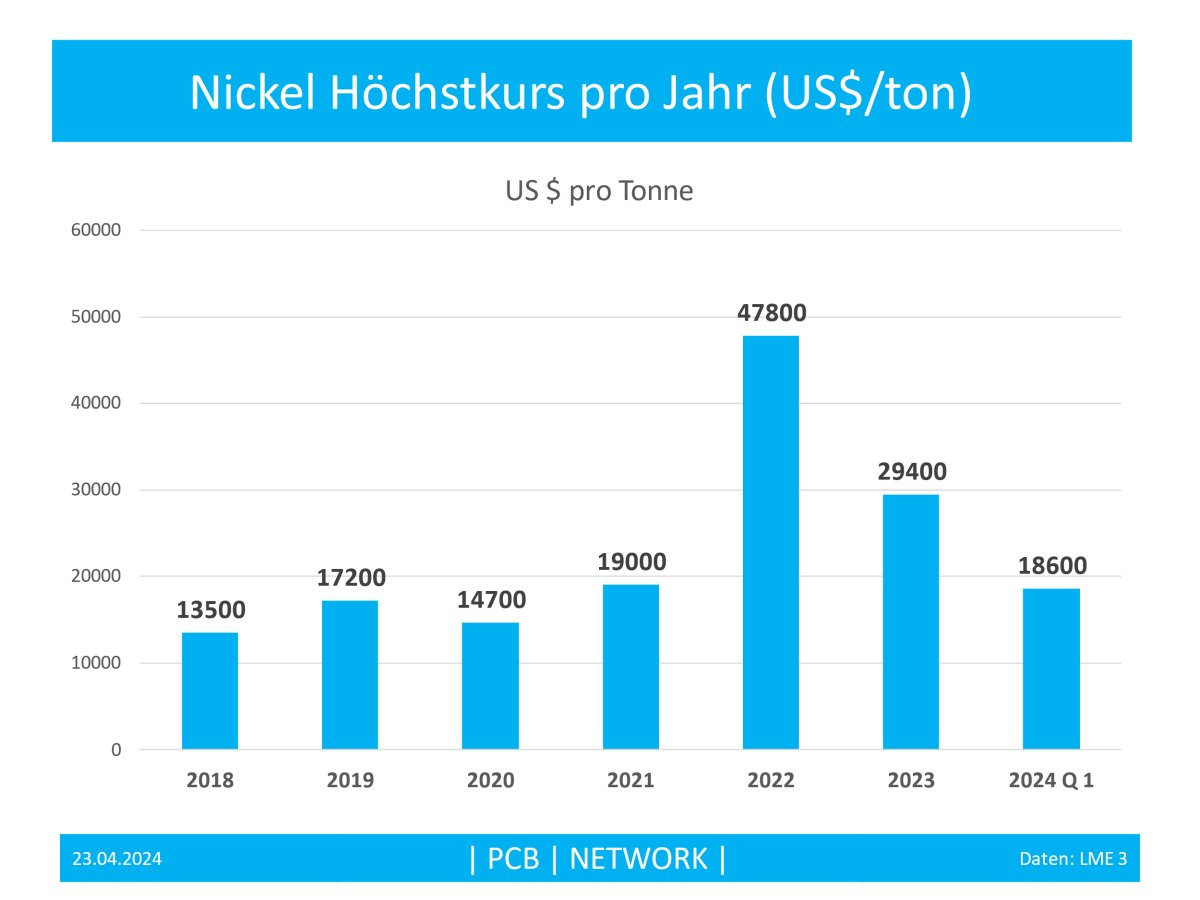

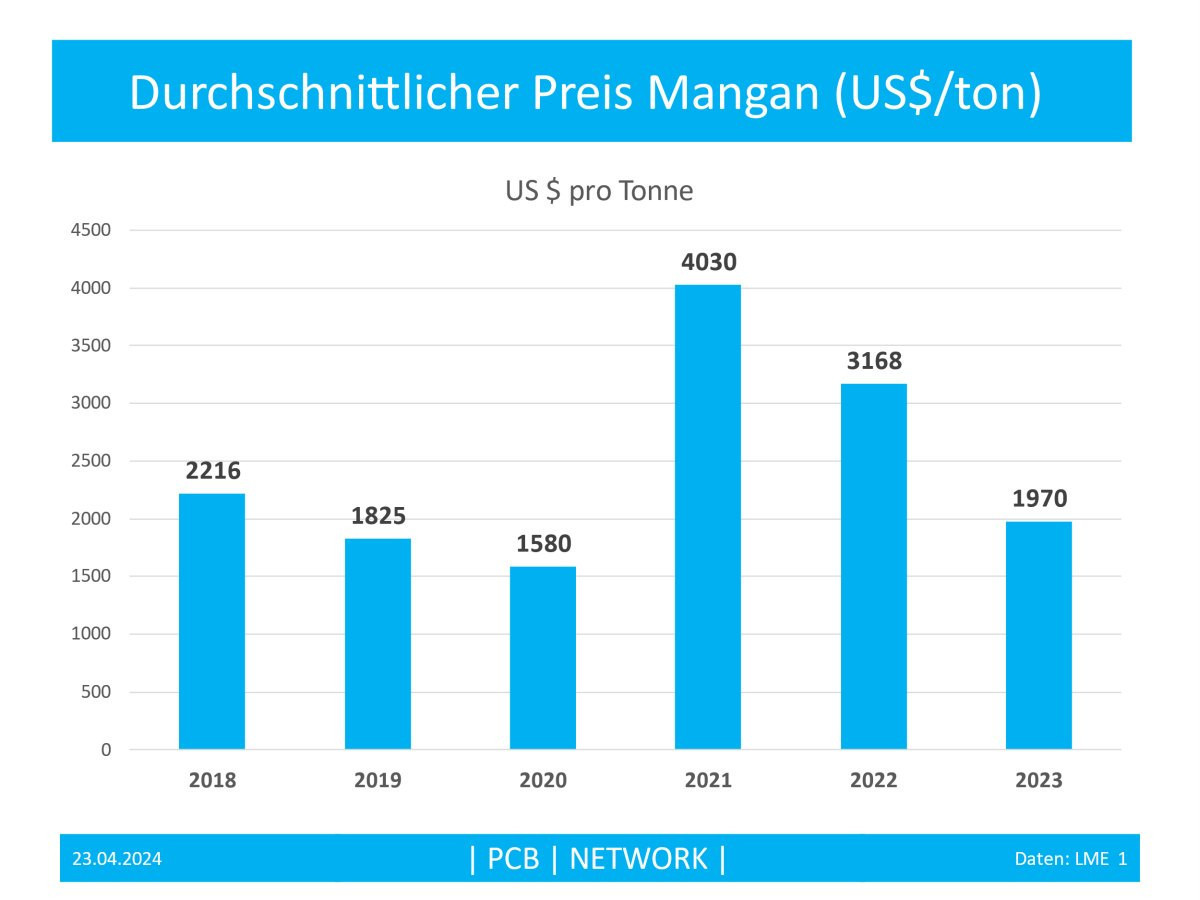

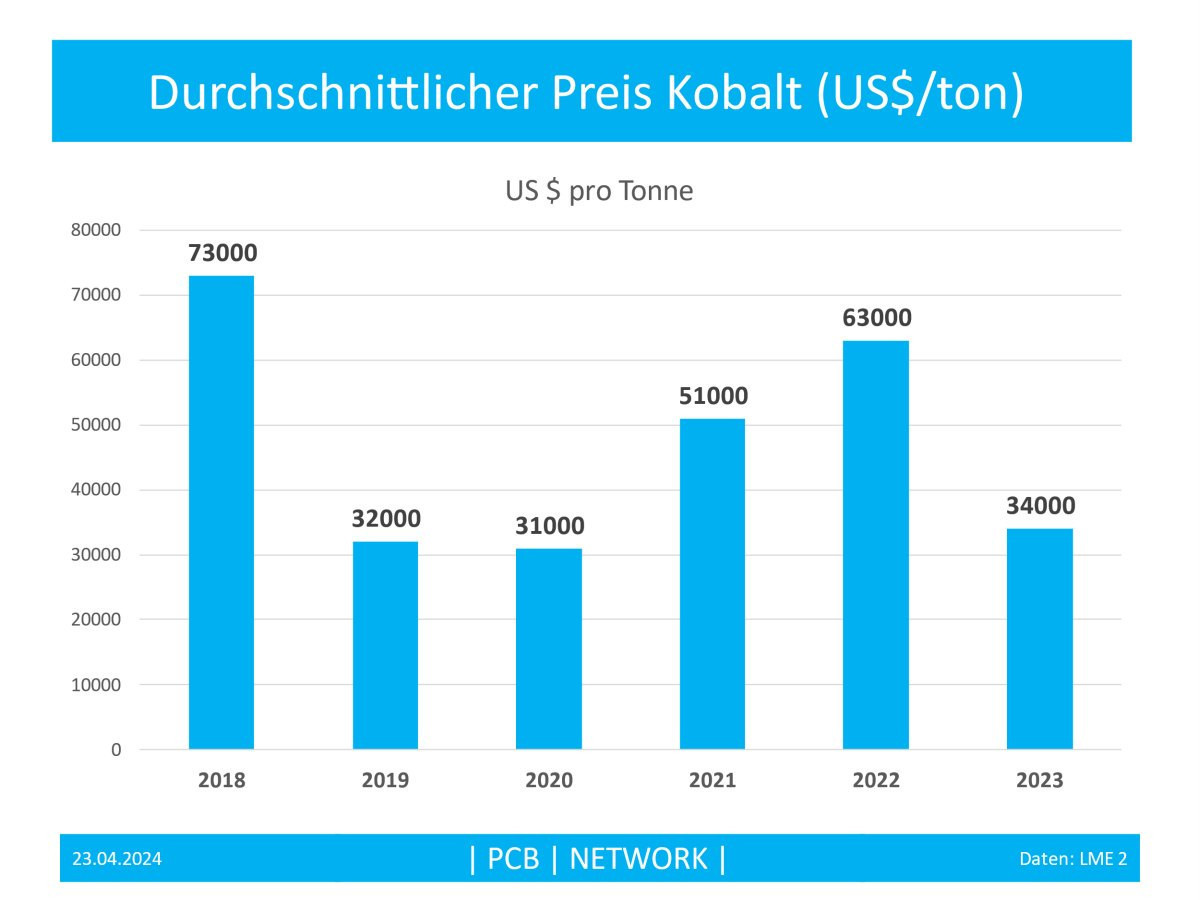

The opposite is true for the energy storage system. For the lithium-ion batteries with a nickel-manganese-cobalt cathode that are most commonly used in Germany(Fig. 2,3,4), raw material prices are the main factor. Lithium-ion batteries are superior to lithium iron phosphate batteries (LFP) in terms of energy density in watt hours per kilogram of battery weight, but also have the highest price. Around €90 per kWh is the cost at cell level and €128 per kWh at battery pack level.

A 60 kWh battery costs around €8000, the gas tank only €100. The costs for heating and cooling are identical at €1000 each.

In summary, this results in around €11,600 for the drivetrain of an electric car versus €6,200 to €7,200 for the drivetrain of a combustion engine of the same power.

LFP batteries are around 25% cheaper, but they only have a battery density of 160 kWh/KG, meaning they require more space and weight for the same range. Lithium iron phosphate batteries are installed in the following models, for example:

- BYD: Seal, Atto 3, Han, TANG

- Tesla: Model 3 rear-wheel drive, Model Y rear-wheel drive

- MG: MG4 Standard, ZS EV Standard, MG5 Electric Standard

- ORA: ORA Funky Cat 48 kWh

Fig. 2: Maximum prices per year for cathode material nickel in $/t

Fig. 2: Maximum prices per year for cathode material nickel in $/t

Fig. 3: Average price for cathode material manganese in $/t

Fig. 3: Average price for cathode material manganese in $/t

Fig. 4: Average price for cathode material cobalt in $/t

Fig. 4: Average price for cathode material cobalt in $/t

Audi counters with cutting-edge technology

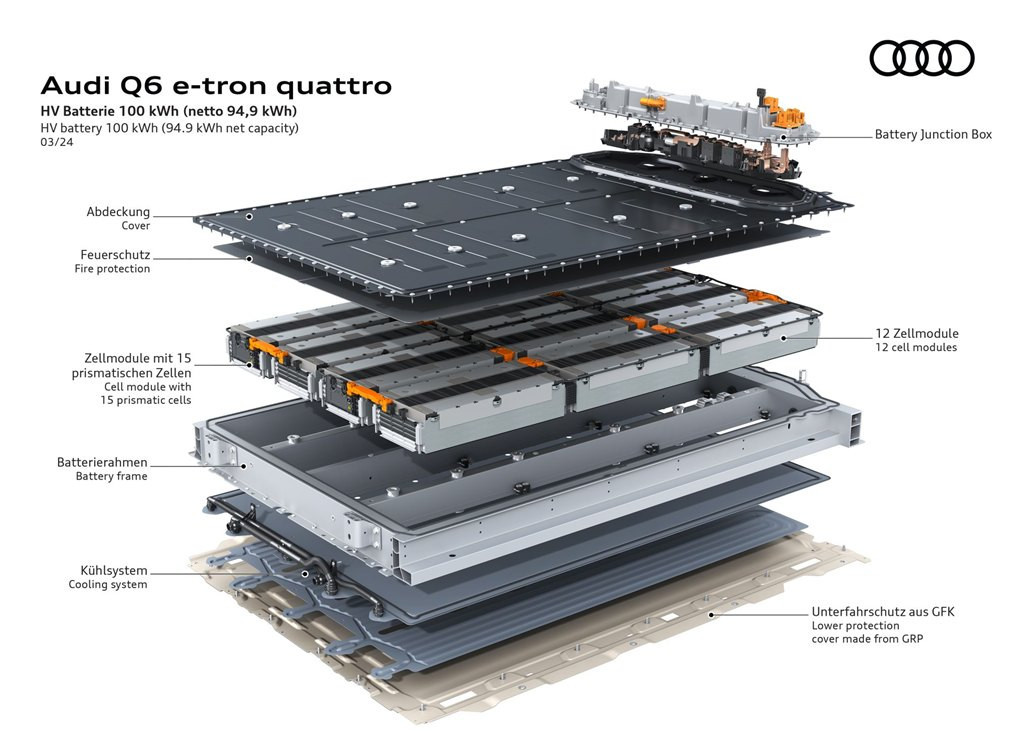

The new battery pack from Audi consists of 12 cell modules, each with 15 prismatic cells. It uses NMC 811 technology with a cathode chemistry based on 80 % nickel, 10 % manganese and 10 % cobalt. This achieves an exceptional energy density of 300 Wh/kg at cell level. The energy content of the system is 100 kWh with a voltage level of 800 V, which allows a range of 625 km.

This is Audi's attempt to set itself apart from the Chinese mass market technology.

Fig. 5: Structure of the Audi A6 e-tron battery system with 300 Wh/kg energy density

Fig. 5: Structure of the Audi A6 e-tron battery system with 300 Wh/kg energy density

Game changer: sodium-ion battery?

The sodium-ion battery could become a game changer. It is up to 40% cheaper (target 50 $/kWh) than Li-ion batteries. It is also independent of critical materials such as cobalt or lithium, which are mined under problematic conditions. The risk of fire is also significantly lower with this type, which also emits less heat, meaning that the cells can be packed more densely.

The first vehicle series, such as the JAC Yiwei EV, have been on the market for several months(Fig. 1). The capacity of the battery is 25 kWh with an energy density of 120 Wh/kg. The range should be 252 km according to the Chinese E10X standard. BYD also intends to follow soon with the Seagull model, as does global market leader CATL, both of which have invested heavily in this battery technology.

In a nutshell

- The development time for a new type of car is 14 - 24 months for Chinese manufacturers and Tesla, about half that of German manufacturers, who are aiming for 36 months instead of 50 months as a new target

- The component costs for a mid-range e-car with 140 KW/190 PS power for the complete drive train including battery and electronics are around €11,600. The costs for a combustion engine of the same power including engine, dual-clutch gearbox, tank, etc. are around €6500

- The price-driving raw material costs of lithium, manganese, cobalt and nickel have returned to a relatively normal level after record levels in 2021/2022. Lithium carbonate reached a peak price of 80,000 $/t in 2022. Less than $14,000/t was paid at the beginning of this year

- The mass production of sodium-ion batteries that has just started in China could be a game changer. Battery price targets of significantly < €50 per Wh and a lack of dependence on critical raw materials are beacons of hope

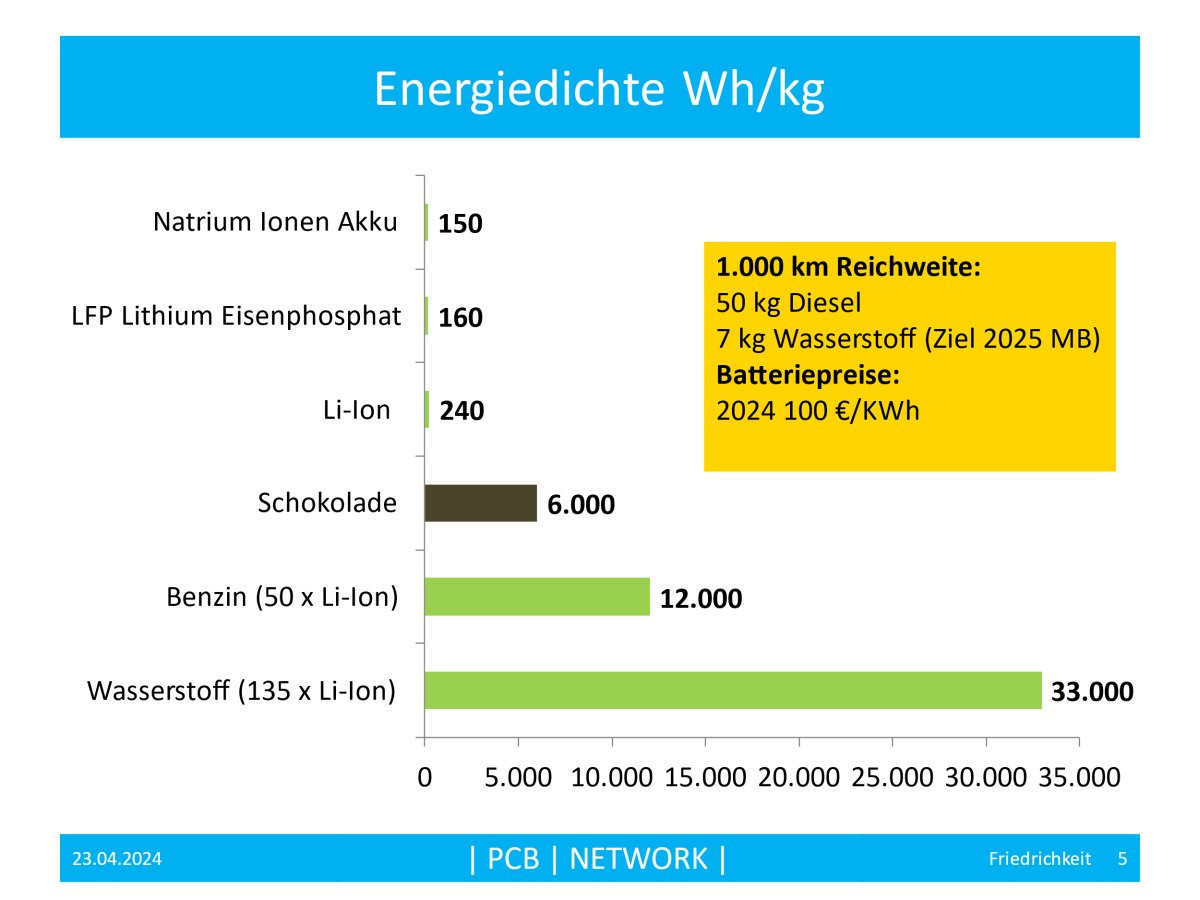

If you look at Figure 6 Energy density in Wh/kg, you can see that there is still a long way to go in terms of development. A modern diesel car consumes around 50 kg (61 l) of fuel for 1000 km of driving, while a hydrogen vehicle manages with around 7 kg of H2. With a consumption of 18 KWh/100 km, an electric car requires around 180 KWh. A corresponding battery for a non-stop journey would therefore weigh at least 750 kg and cost around €25,000 today.

Fig. 6: Energy density in Wh/kg battery weight or fuel weight

Fig. 6: Energy density in Wh/kg battery weight or fuel weight

Many roads lead to Rome, hopefully we will find the right one.

Stay with us

Best regards

Best regards

Yours

Hans-Joachim Friedrichkeit