The world of drones is developing at an unprecedented pace. They are breaking boundaries and redefining possibilities. Since their beginnings in the sky, drones have transformed into versatile machines that are capable of doing things we could only dream of in the past.

Civilian applications range from urban transportation systems for people (Volocopter) to last-mile logistics assistance for goods. In contrast, large military drones have been in use as carriers of weapons such as missiles since the Iraq and Afghanistan conflicts.

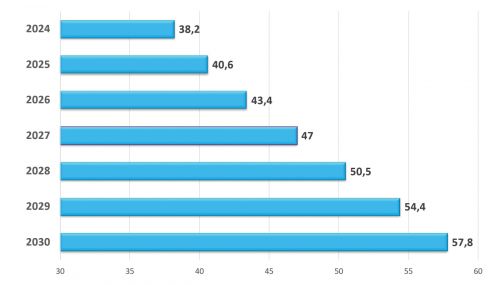

Size and growth of the drone market

The commercial drone industry has proven to be resilient and adaptable despite geopolitical tensions and economic uncertainties in certain regions. The latest report forecasts a compound annual growth rate of 7.3% (CAGR), firmly establishing drones as a key component of automation strategies and digital infrastructure.

According to the analysis, the global market is expected to reach $57.8 billion by 2030, up from an estimated $40.6 billion this year. These figures indicate that the use of drones has increased across all industries and that the entire drone ecosystem - from services and software to hardware and regulations - has matured significantly.

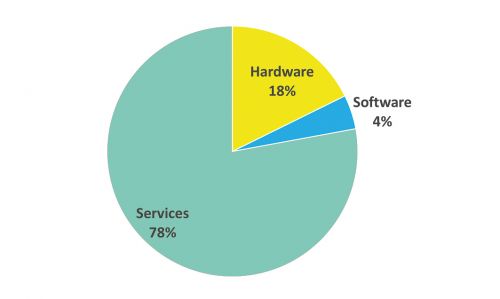

The largest segment of the commercial drone market is the commercial services market, which is expected to generate $29.4 billion this year. The second largest and fastest growing segment is commercial hardware, valued at $6.7 billion. The smallest segment is the commercial software market, which is expected to reach $1.7 billion.

Drones for reconnaissance and as combat drones

Since the beginning of the Ukraine conflict, the topic of drones has come to the fore as the new munition of the 21st century. When a kamikaze drone worth a few thousand euros has a good chance of destroying a €25 million tank, the business case becomes clear.

Combat drones, also known as unmanned combat aerial vehicles (UCAV) or unmanned combat aerial systems (UCAS), are unmanned, armed aircraft that are increasingly being used in military conflicts and are often referred to as 'killer drones' or 'attack drones'.

Drones in Germany:

The Bundeswehr uses unmanned aerial vehicles (UAV) of various types, mainly for reconnaissance and target presentation, and has recently also been procuring kamikaze drones.

Helsing

Helsing, based in Munich, is a German software company founded in 2021 that specializes in the use of artificial intelligence in the defence sector.

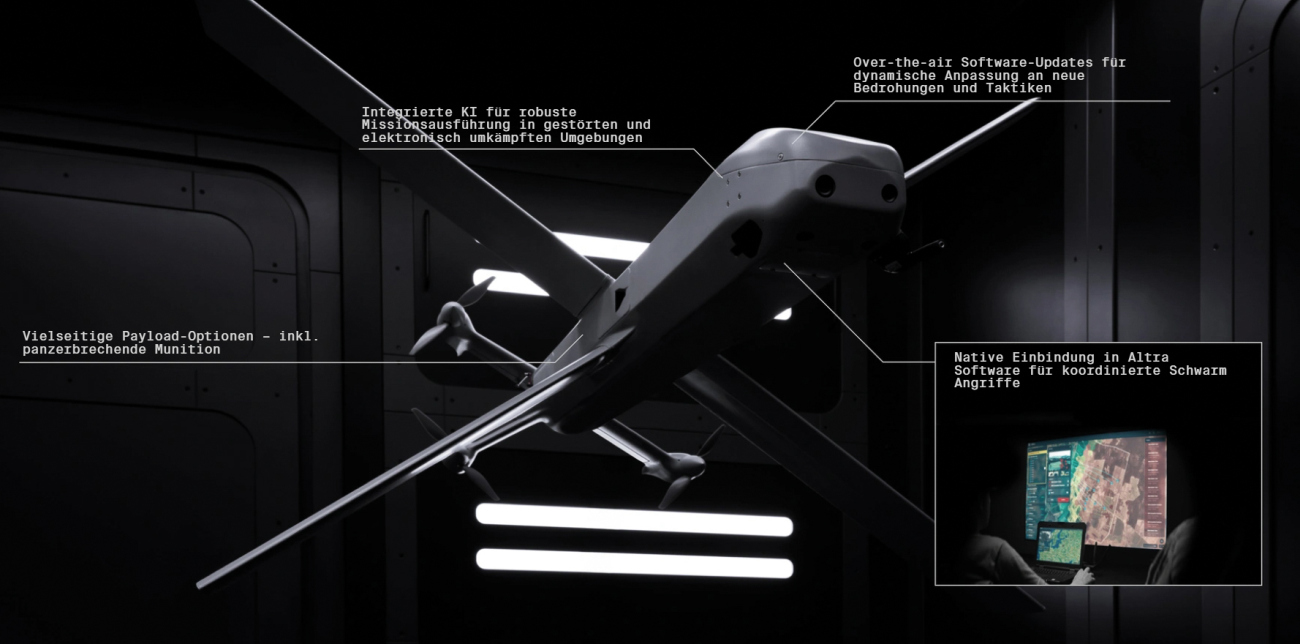

HX-2

An electronically powered X-Wing precision drone system developed by Helsing, which is controlled by AI and is designed to be resistant to jamming.

Since January, Helsing has been producing around 1000 units per month in a new production plant in southern Germany. Production is set to increase tenfold in the medium term.

HX-2 is a new type of strike drone: weighing 12 kg, software-defined and mass producible. It is capable of engaging artillery, armored and other military targets. The drone in X-wing design can fly up to 100 kilometers.

Integrated artificial intelligence ensures that the HX-2 is immune to enemy electronic warfare (EW) measures through its ability to re-identify and engage targets - even without a GNSS signal or continuous data link.

The HX-2 can also be used in a swarm via a dedicated software platform to break through enemy defenses.

Fig. 4: Helsing HX-2, a military drone that is also being used in Ukraine

Fig. 4: Helsing HX-2, a military drone that is also being used in Ukraine

Luna NG from Rheinmetall

LUNA NG, an unmanned aerial system (UAS), is the latest element in the LUNA system for real-time airborne surveillance, detection and localization. With its ultra-light but highly stable fuselage structure made of CFRP (carbon fiber reinforced plastic), it offers a flight time of over 12 hours. The data link range is over 100 km and can be increased even further with optional SatCom equipment. Independent of runways, the aircraft can be launched from almost anywhere using a cable catapult. Landing is carried out autonomously via differential GPS in the network or by parachute. In flight, LUNA NG impresses with its low acoustic, thermal and radar signatures.

With a payload of 30 kg, the Luna NG can carry several kamikaze drones as a carrier drone and deploy them from a distance.

Fig. 5: Luna NG from Rheinmetall on launch catapult

Fig. 5: Luna NG from Rheinmetall on launch catapult

Requirements Military/defense circuit boards

| Application | Description | PCB requirement | Unique challenge | Future trends |

| Communication systems | Devices such as radio and satellite communication systems | Durable, high performance | Signal integrity, durability | Secure communication, digital communication |

| Weapon systems | Devices such as missile guidance systems and electronic countermeasure systems | Highest reliability, high performance | Safety, reliability | Autonomous systems, advanced weapon systems |

| Surveillance systems | Devices such as radar systems and unmanned aerial vehicles | High-speed data transmission, durable | Signal integrity, durability | AI integration, autonomous systems |

| Navigation systems | Devices such as GPS devices and inertial navigation systems | High precision, reliable | High precision, durability | Advanced navigation functions, autonomous |

Other drone manufacturers incl. China

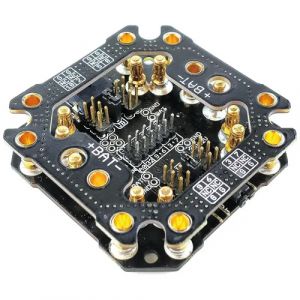

Fig. 6: MES power distribution board (PDB) for UAVsThere are numerous other European drone manufacturers. Among the best known are Quantum Systems from Germany, Parrot Drones from France, Delair from France, UAS Europe from Sweden and Beyond Vision from Germany. Other important players are Terra Drone, Onyx Scan, AltiGator, Flyability and Germandrones. The largest US military drone manufacturers are General Atomics, Lockheed Martin, Boeing and Northrop Grumman. In Israel it is IAI and in Turkey Baykar.

Fig. 6: MES power distribution board (PDB) for UAVsThere are numerous other European drone manufacturers. Among the best known are Quantum Systems from Germany, Parrot Drones from France, Delair from France, UAS Europe from Sweden and Beyond Vision from Germany. Other important players are Terra Drone, Onyx Scan, AltiGator, Flyability and Germandrones. The largest US military drone manufacturers are General Atomics, Lockheed Martin, Boeing and Northrop Grumman. In Israel it is IAI and in Turkey Baykar.

Chinese drone manufacturers such as DJI, the world's largest commercial producer, should not be forgotten. Others are Aerospace CH UAV, AVIC Shenyang Aircraft, Guizhou Guihang, Changying Xinzhi, North Industries Group Corporation (Norinco) and EHang with the military drones Wing Long 3, ANKA-3 and the 'stealth' flying wing CH-5, a Chinese combat drone with up to 24 missiles on board, theoretically with a payload of 1,200 kg and a range of up to 10,000 km.

Printed circuit board demand

Global demand for printed circuit boards amounted to US$ 73-76 billion in 2024. The share for the defense and aerospace sectors is estimated at around US$ 3.6 billion. This corresponds to around 5% of the total PCB market.

The aerospace and defense PCB market is expected to grow to US$ 5.6 billion by 2032, which corresponds to a compound annual growth rate (CAGR) of 5.6%.

In a nutshell

- Drones have become the 'ammunition' of the 21st century and thus one of the weapon systems

- decisive weapon systems for war

- The drone market is expected to be worth $40 billion in 2025, growing at a CAGR of 7.3% until 2030

- With Helsing, Rheinmetall, Quantum Systems and Diehl, there are numerous German manufacturers who have entered this future-oriented business, as well as a whole range of European and Turkish manufacturers

- The PCB market for the military and aerospace segment is estimated at US$ 3.6 billion in 2024 and is expected to grow to US$ 5.6 billion by 2032

Military drones have become one of the most decisive weapon systems in warfare. They range from the General Atomic MQ-9 Reaper with a take-off weight of almost 5,000 kg to the smallest drone, the Black Hornet PD-100 from Norwegian manufacturer Prox Dynamics, which weighs just 32 grams.

The fact is that the sourcing of printed circuit boards and substrates from China for military use must be stopped as quickly as possible. We are supplying China with important information about circuit design and PCB laminate free of charge.

As the old rule of the intelligence services goes: what has been revealed can no longer be sold!

May makes everything new, so I wish us all a little more optimism

Yours

Hans-Joachim Friedrichkeit