The global electromobility market is expected to grow from € 30 billion last year to € 200 billion in 2035(Fig. 1, 2). It is expected to triple to € 90 billion by 2025 and increase fivefold to € 150 billion by 2030.

The market volume includes Power-train Systems (PTS) such as 48 V eMotors, DCDC & OBC as well as Thermal Systems (THS) Battery Cooler, Coolant eHeater. In addition, there are Comfort & Driving Assistance Systems (CDA) radar, LiDAR, driver monitoring and visibility systems such as front headlights, interior lighting, near field projection for reflecting onto the windshield.

Fig. 2: Market forecast for electromobility 2021 to 2035 in € billion (left) Fig. 3: Market forecast for Advanced Driver Assistance Systems (ADAS) 2021 to 2035 in € million (Valeo) (right)

Fig. 2: Market forecast for electromobility 2021 to 2035 in € billion (left) Fig. 3: Market forecast for Advanced Driver Assistance Systems (ADAS) 2021 to 2035 in € million (Valeo) (right)

Even greater growth is predicted for the ADAS market, driven primarily by class 2 and 3 semi-autonomous driving(Fig. 3). Here, ADAS such as dynamic 77 GHz distance radar, lane keeping systems, traffic sign recognition, monitoring of traffic behind when overtaking or changing lanes, etc. are currently conquering the mid-range and compact class passenger cars.

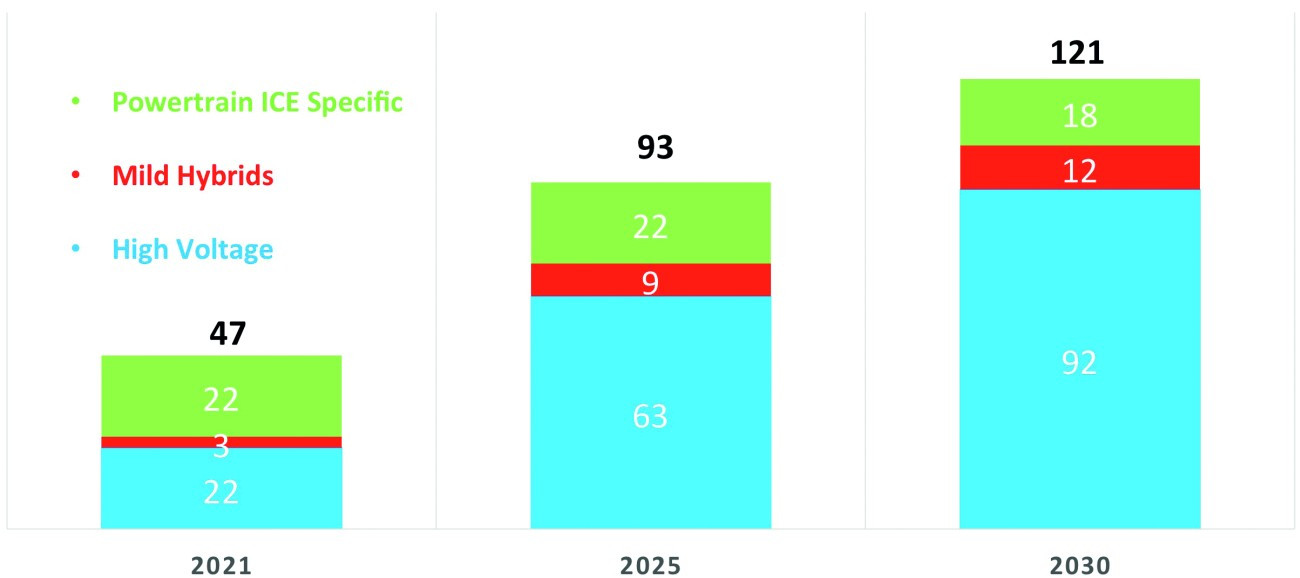

High growth in Mild Hybrid & High Voltage

The Powertrain ICE specific segment, i.e. the powertrain in combination with a combustion engine, is on a downward trend(Fig. 4). In contrast, the mild hybrid segment has quadrupled from a global market volume of € 3 billion to € 12 billion in 2030. This includes all 48V systems. The high-voltage segment with e-motors, inverters, DCDC converters and on-board chargers (OBC) is the heavyweight, growing from €22 billion to €92 billion.

Fig. 4: Market forecast for high voltage & mild hybrids 2021-2030

Fig. 4: Market forecast for high voltage & mild hybrids 2021-2030

In the market: Stage 1-3 in preparation: Stage 4

- Level 0 refers to non-automated driving, in which the driver performs all driving functions themselves, even if support systems (e.g. ABS) are available.

- Level 1, 'assisted driving', is characterized by the fact that only certain assistance systems (e.g. adaptive cruise control) help to operate the vehicle.

- In level 2, 'semi-automated driving', many functions such as parking, lane keeping, general longitudinal guidance, acceleration and braking are taken over by the system (e.g. the traffic jam assistant). However, the driver must keep a constant eye on this.

- The latter no longer has to be guaranteed in level 3, 'highly automated driving'. Otherwise, the system independently performs the driving tasks mentioned in level 2 and also brakes, steers, changes lanes or overtakes, while the driver can focus on other things. If necessary, however, the system prompts the driver to take the lead.

- This is the difference to the next level 4, 'fully automated driving': Here, the guidance of the vehicle (lateral and longitudinal guidance) is permanently taken over by the system, although here too the driver can be asked to take over the guidance if the driving tasks can no longer be handled by the system. However, the system is always able to bring the vehicle from any initial situation into a system state that minimizes risk - e.g. by bringing the vehicle to a standstill on the hard shoulder - if the driver does not take the lead (source: German Parliamentary Research Service).

LiDAR (Light Detection and Ranging)

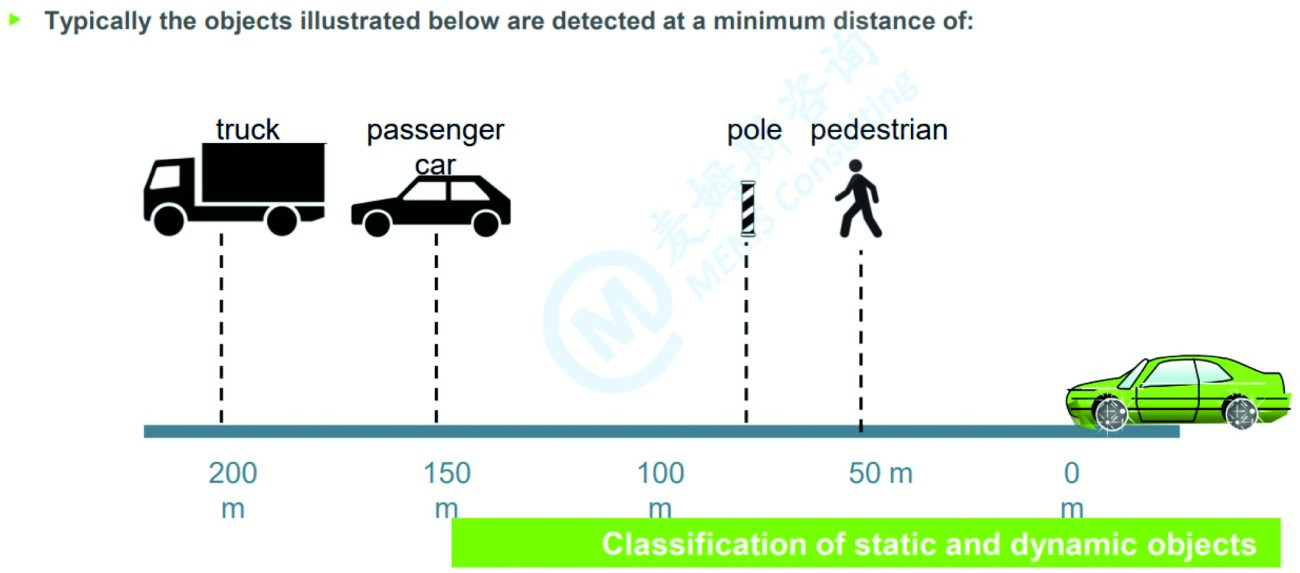

Valeo LiDAR Scala 2 systems are currently installed in the new Mercedes S-Class and the Honda Legend, both of which are approved for highly automated driving. The detection ranges of this system distinguish between dynamic and static objects. While a moving pedestrian is identified at a distance of 50 m at the latest, this happens after 75 m in the case of a boundary post. The minimum identification distance for cars is 150 m, for trucks 200 m(Fig. 5). These minimum distances will increase further with the introduction of Scala 3 in 2023, thus creating additional reaction time.

Fig. 5: LiDAR Scala 2 - minimum detection range

Fig. 5: LiDAR Scala 2 - minimum detection range

In a nutshell

- The market closed 2021 with the sale of 6.5 million electric vehicles (EV) worldwide. Dynamic growth and higher demand for electronics are driving the need for installed electrical/electronic systems. The EV market is expected to triple from € 30 billion to € 90 billion in 2025

- The market for assistance systems (ADAS) is also characterized by strong growth: It is expected to quadruple from €15 billion last year to €25 billion in 2025 and €60 billion by 2030.

- Specifically, the market for mild hybrids (48 V systems) is set to grow from the current € 3 billion to € 12 billion by 2030. According to the forecast, the high-voltage market with electric drives, inverters and OBCs will also quadruple from €22 billion in 2021 to €92 billion in 2030.

- From 2030, 87% of all new vehicles will be equipped with automation systems. Around 30 % level L1, around 50 % level L2, around 6 % L3 and around 1 % L4(Fig. 6)

Fig. 6: The path to autonomous driving is expected to grow at a cumulative average growth rate (CAGR) of 15% p.a. in stages L1-L4 The e-car race is in full swing worldwide: 6.5 million vehicles were sold in 2021 - this year the mark of 10 million units is expected to be broken.

Fig. 6: The path to autonomous driving is expected to grow at a cumulative average growth rate (CAGR) of 15% p.a. in stages L1-L4 The e-car race is in full swing worldwide: 6.5 million vehicles were sold in 2021 - this year the mark of 10 million units is expected to be broken.

Tesla sold 936 thousand (+87% vs. previous year), VW 758 thousand, China's SAIC 683 thousand and BYD, China 594 thousand units. Tesla aims to sell 1.5 million vehicles in 2022.

The world is not waiting for Germany. This includes the fact that our former leading global position in the automotive industry is on the brink of collapse. It's time to wake up from our slumber and do the necessary things. What counts is, as in soccer, the goals and not the shots on target, i.e. the results.

Stay optimistic.

Best regards

Yours

Hans-Joachim Friedrichkeit

Contact us at

F