The global competitive situation in the automotive industry is currently divided into three segments:

- Electromobility: China is now the global market leader in batteries, drive systems, power electronics and, with rapidly increasing importance, software platforms.

- The area of ADAS (Advanced Driver Assistance System) with LiDAR (Light Detection and Ranging) as the shooting star. Europe and Germany were world market leaders here with Bosch, Continental, ZF and Valeo in France, but have already lost the lead in LiDAR systems.

- Complex combustion engines and transmissions in the drivetrain were a German domain. Due to the lack of technological openness in the EU with a ban on combustion engines from 2035, we are losing our pole position here due to a lack of further development, while China is currently publishing the development of a new efficient diesel engine.

After publishing about the rapid progress of automated driving in China in PLUS 9-2024, in this column we want to analyze the LiDAR sensor technology that is important for this.

LiDAR will soon reach the mass market

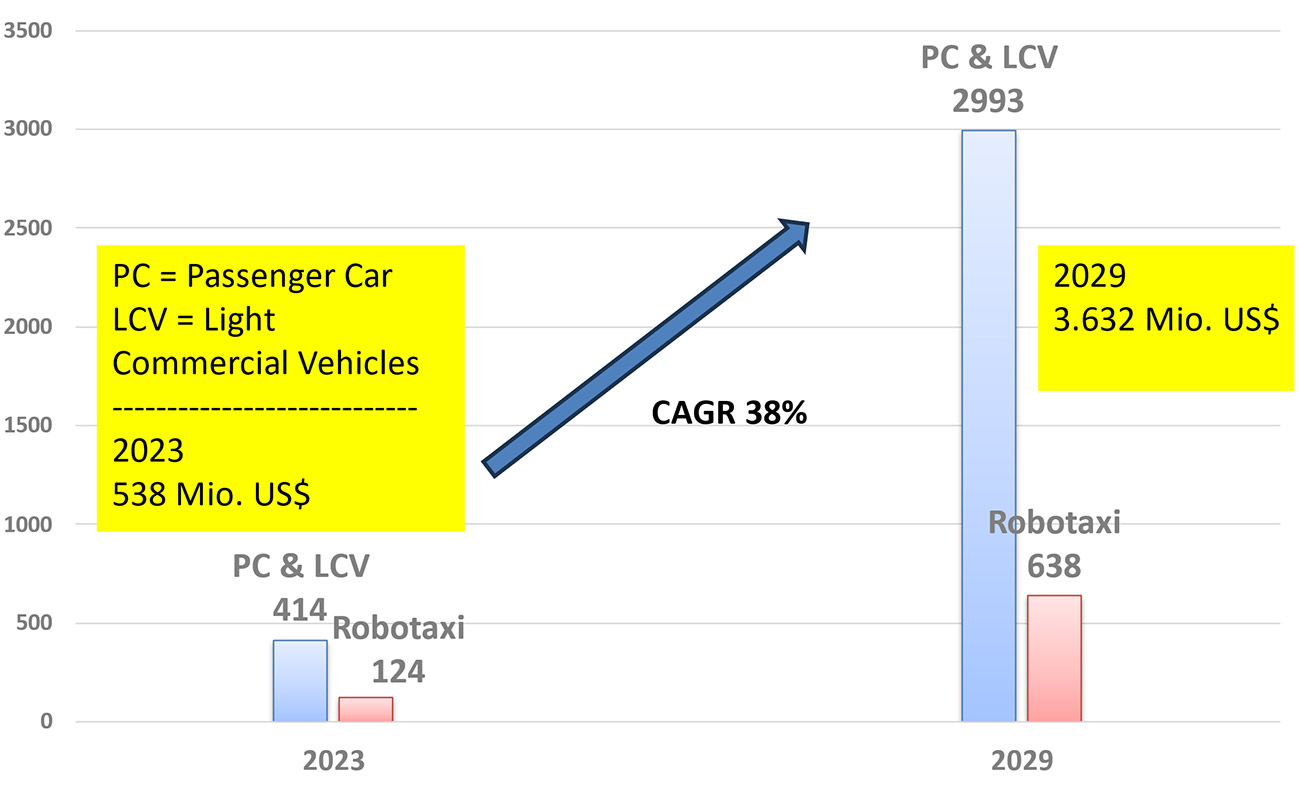

On the way to Level 2 (semi-automated driving), Level 3 (highly automated driving) and Level 4 (fully automated driving) autonomous driving, the demand for LiDAR sensors is increasing by leaps and bounds. Two years ago, in 2022, the market volume for automotive applications was still around USD 300 million. Last year, sales already amounted to USD 538 million, split into USD 414 million for cars and vans and USD 124 million for robotaxis. According to market leader Hesai, a total of around 760,000 LiDAR systems will have been installed in cars by 2023. This is a threefold increase compared to 2022. By 2029, Yole forecasts sales growth to $3.6 billion, of which $3 billion is for cars and vans and $638 million for robotaxis. This corresponds to annual growth of 38 % from 2023 to 2029 and clearly shows the arrival of the mass market(Fig. 1).

Fig. 1: Market volume in $ for LiDAR automotive applications 2023 - 2029 for cars, vans and robo-taxis

Fig. 1: Market volume in $ for LiDAR automotive applications 2023 - 2029 for cars, vans and robo-taxis

The top 9 LiDAR manufacturers

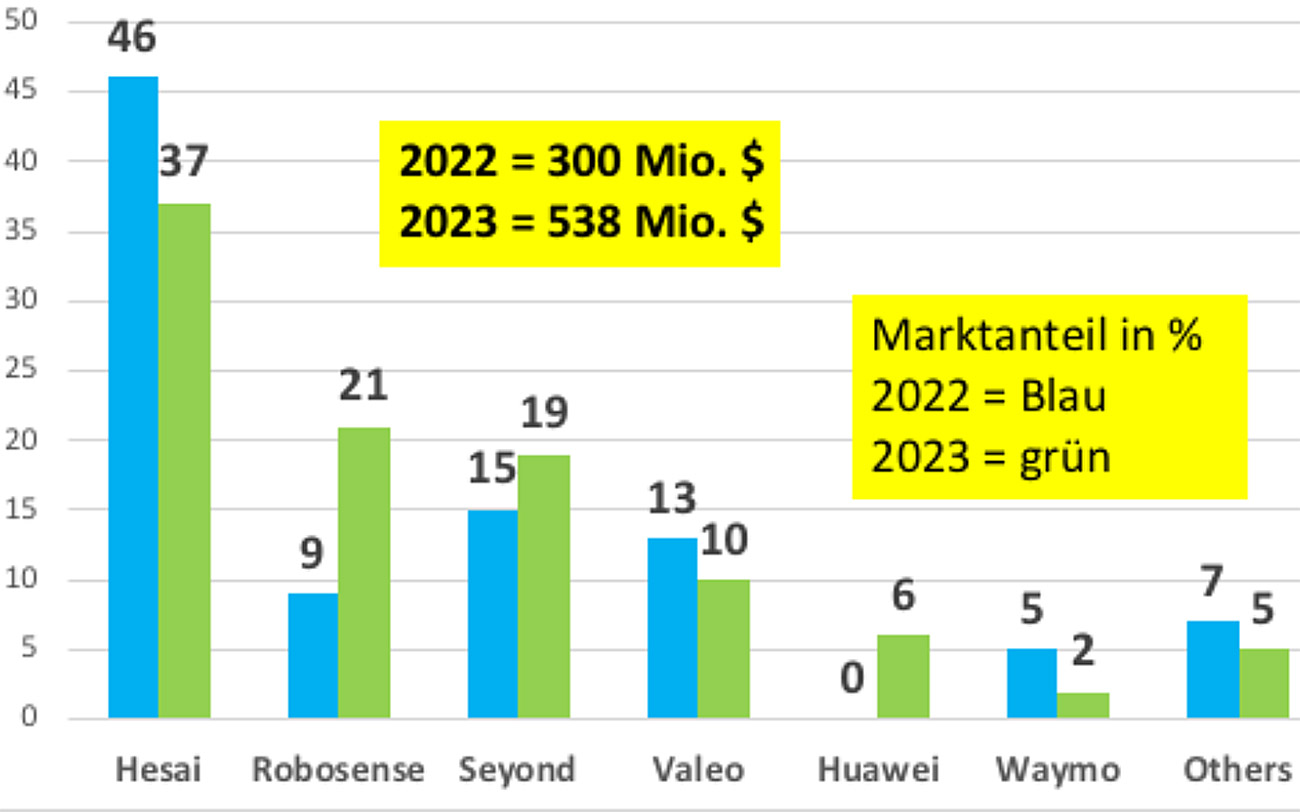

Table 1 lists the top 9 LiDAR manufacturers by market share in 2023. In the meantime, Chinese manufacturers dominate with a global market share of 85%, ahead of Europe/France with 10% and the USA with 3%.(Fig. 2). This illustrates the high use of these sensors in Chinese e-car production, but also for newly developed combustion engines. German manufacturers have withdrawn from this new mega market. Bosch and ZF have withdrawn from development, and Continental also recently discontinued its collaboration with long-range LiDAR manufacturer AEye. Shanghai-based Hesai is the current market leader with 220,000 LiDAR sensors delivered in 2023. Hesai is particularly strong in LiDAR equipment for robotaxis with a market share of 74% for this $124 million market. Hesai supplies 18 OEMs and Tier 1 suppliers worldwide and has secured the contract to develop ADAS devices for around 70 vehicle models by the first quarter of 2024.

|

Rank 2023 Market share |

LiDAR manufacturer |

Country |

|

1. |

Hesai |

China |

|

2. |

Robosense |

China |

|

3. |

Seyond ex Innovusion |

China |

|

4. |

Valeo |

France |

|

5. |

Huawei |

China |

|

6. |

Waymo |

USA |

|

7. |

Livox |

China |

|

8. |

Ouster (Velodyne) |

USA |

|

9. |

Luminar |

USA |

Fig. 2: The largest LiDAR manufacturers with market shares in % of the global market

Fig. 2: The largest LiDAR manufacturers with market shares in % of the global market

The LiDAR type Falcon K(Fig. 3) can detect targets at a distance of up to 500 meters, with a detection range of 250 m at 10 % reflectivity. The viewing angle is 120° x 25° (HxV), the resolution is 0.06° - 0.06°. The solid state LiDAR has a laser wavelength of 1550 nm. This helps users to recognize hazards and gives the vehicle time to react in time. 4D imaging radar could become a cost-effective competitor to LiDAR. It records distance, speed, direction of arrival and altitude, but so far only has a resolution of 1° compared to 0.06° for LiDAR.

Fig. 3: The Falcon K, from Chinese manufacturer Seyond as an ultra-long range LiDAR

Fig. 3: The Falcon K, from Chinese manufacturer Seyond as an ultra-long range LiDAR

The LiDAR price war has begun

Until two years ago, LiDAR sensors were reserved for high-priced luxury cars such as the Mercedes S Class, BMW 7 or Audi A8, but mass production has now begun. In the battle for pole position in automated driving, Chinese car manufacturers in particular are using multiple LiDAR sensors, some of them redundantly. Originally, LiDAR sensors were precision mechanical monsters with a rotating mirror to deflect the laser beam; today, they are based on semiconductor components in the form of a solid state. As a result, prices have plummeted from several thousand dollars per unit to between 1,000 and 500 dollars. The target price should be around 200 dollars.

Traffic guidance using LiDAR in Tampere/Finland

Fig.: 4 Traffic guidance in Tampere/Finland with 2 Falcon Prime LiDAR sensorsInTampere (Finland), a Seyond Intersection Management Platform (SIMPL) was used. Two 'Falcon Prime' LiDAR sensors were installed at a major intersection to accurately detect and manage the presence of all road users(Fig. 4). This technology ensures precise detection and management of all road users, including children, pedestrians and cyclists. It increases the safety and efficiency of urban mobility.

Fig.: 4 Traffic guidance in Tampere/Finland with 2 Falcon Prime LiDAR sensorsInTampere (Finland), a Seyond Intersection Management Platform (SIMPL) was used. Two 'Falcon Prime' LiDAR sensors were installed at a major intersection to accurately detect and manage the presence of all road users(Fig. 4). This technology ensures precise detection and management of all road users, including children, pedestrians and cyclists. It increases the safety and efficiency of urban mobility.

In a nutshell

- The global LiDAR market volume for automotive applications amounted to USD 300 million in 2022; by 2023, sales had already reached USD 538 million and are expected to reach USD 3.6 billion by 2029.

- Among the top 10 manufacturers, China dominates with 85%, France (Valeo) with a falling 10% and the USA with 3%.

- Today's solid-state long-range LiDARs can detect 'targets' up to 500 m, from 250 m the resolution begins and below that the definition of whether it is a car, pedestrian, cyclist, child, etc., begins.

- LiDARs are also used for traffic guidance, as the lasers allow differentiation between road users even in darkness and uncertain weather conditions.

A LiDAR sensor is not a magic bullet. It is the key sensor for creating a real image of the traffic situation by day and night, supplemented by radar, camera and ultrasonic sensors. Although we were the world market leader in the ADAS (Advanced Driver Assistance System) market with Bosch, Conti, ZF etc. until a few years ago, we have probably given up on the LiDAR segment just as we have on battery production. Not only for batteries, but also here we are threatened by a new dependency on China.

I wish you an imaginative start to the fourth quarter.

Yours

Hans-Joachim Friedrichkeit

contact