Power semiconductors play a central role in developments in mobility and energy. Technological trends in the automotive industry and renewable energies provide growth and technological impetus for power electronics - and vice versa. This shows that ever higher power density and integration are required, while on the other hand requirements for reliability and service life limit the technical scope.

As much as it can only be outlined in the title and short introduction, the statements made are causing more than just a raised eyebrow in many people: Power semiconductors are a driving force in electronics production? You have to take a step back if you simply consider the situation: In the electronics industry, the consumer electronics sector is on course to exceed the 1,000 billion sales mark (in $) globally in the next three to four years. Power electronics currently has a global turnover of between 30 and 40 billion dollars and will probably have doubled this figure by 2030 [1]. The fact that power electronics is not a niche market becomes clear when you look a little closer at the pear/apple comparison: the consumer sector is an end product market, whereas power electronics is largely a component market. Power devices are built into almost every consumer electronics product - just think of power supplies.

Power devices or power modules are bought in and 'designed in' - they are therefore elements of the entire electronics value chain, have their purchase value and ultimately make their proportionate contribution to achieving the trillion in sales of consumer electronics mentioned as an example. Exactly what this share is is a matter for those who calculate with the proverbial sharp pencil. The requirements for power electronics in the automotive and renewables segments currently differ from this classic calculation with components, which are also under constant price pressure in such a structure. This is not about standard products, but about integrated solutions - for example with the help of mixed-signal solutions - and technology enabling. More on this below.

Power electronics made in Europe

First of all, there is another point that also raises at least one eyebrow, namely the keyword 'in Europe' in the headline. On the one hand - and here you have to go a long way to get to the other - the manufacturers of power semiconductors have a special significance in the global microelectronics industry, even from a European perspective. In 2020, only around 10% of the total number of microchips manufactured worldwide came from the EU, but if you only look at the production of power electronics components, companies from Europe have a much more important say worldwide - even leading the way in some areas.

If you take a closer look, however, there is also a problem: although many of these companies are based in Europe, a very large proportion of their sales and production are in Asia. One example is Infineon, the No. 1 European semiconductor manufacturer with a turnover of €14.2 billion in 2022: with a market share of 26.4%, the company was once again the leader in the Chinese electromobility boom in the first half of 2022 and sold 45.8% more power semiconductors there than in the same period in 2021. Infineon primarily meets this demand from its Asian production sites.

However, a lot is also happening in Europe in terms of production capacities - not least driven by the European Chips Act: by 2030, more than € 15 billion in additional public and private investments are to be mobilized and a total of more than € 43 billion in investment funds will flow into the semiconductor industry. This should double the share of global chip production manufactured in the EU to 20% [2]. Greater competitiveness and resilience in semiconductor technologies and applications should also help to ensure that digitalization and decarbonization can go hand in hand.

Power electronics is not a niche market

The industry association 'Silicon Saxony' states: "Power semiconductors that can reliably switch high currents even under difficult conditions are important for energy, mobility and many industrial applications." Europe needs them to achieve its economically and ecologically ambitious goals. At this point, it should be noted that Europe is not alone in pursuing these goals. Around the world, but above all in China, the switch from previous energy sources to electricity can be observed in more and more applications. The increasing electrification of mobility and heating, ventilation and air conditioning (HVAC) applications worldwide is driving the demand for power electronics.

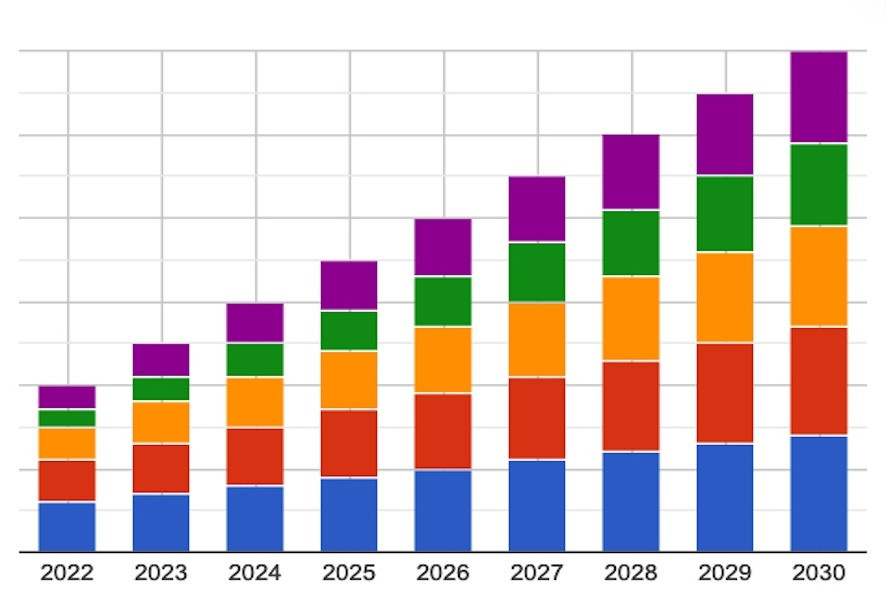

Infineon is once again at the forefront of the expansion of production capacities in Europe - with its new production facility in Villach/Austria and the new Dresden construction project presented in fall 2023, where mixed-signal and power chips will be produced from 2026. Bosch, Renesas and Wolfspeed are other power electronics manufacturers that are currently investing or planning new production capacities. Against this backdrop, the Skyquest market study mentioned in [1] on the sales development of power electronics in the current decade (around USD 40 billion in 2024, around USD 80 billion in 2030) comes to the conclusion that Europe will therefore grow in this area of electronics largely in line with the overall trend and with other regions of the world (see bar chart).

The forecast growth in power electronics in the individual regions of the world (blue = Asia/Pacific, red = North America, orange = Europe, green = Latin America, purple = Africa/Middle East)

The forecast growth in power electronics in the individual regions of the world (blue = Asia/Pacific, red = North America, orange = Europe, green = Latin America, purple = Africa/Middle East)

Threats for location and industries

Which brings us to the other side of the coin: While a certain public fatigue can currently be observed in Europe with regard to the topic of electromobility, in other regions of the world this topic continues to grow dynamically and unabated. There is concern about what this could mean for the future of the European automotive industry. German manufacturers in particular are finding it difficult to present products that are still wanted in the necessary quantities in the relevant markets around the world. At the same time, electromobility is being irresponsibly denigrated at home - the lines of argument are illogical and inspired by defiant wishful thinking, as business journalist Dirk Specht makes clear [3].

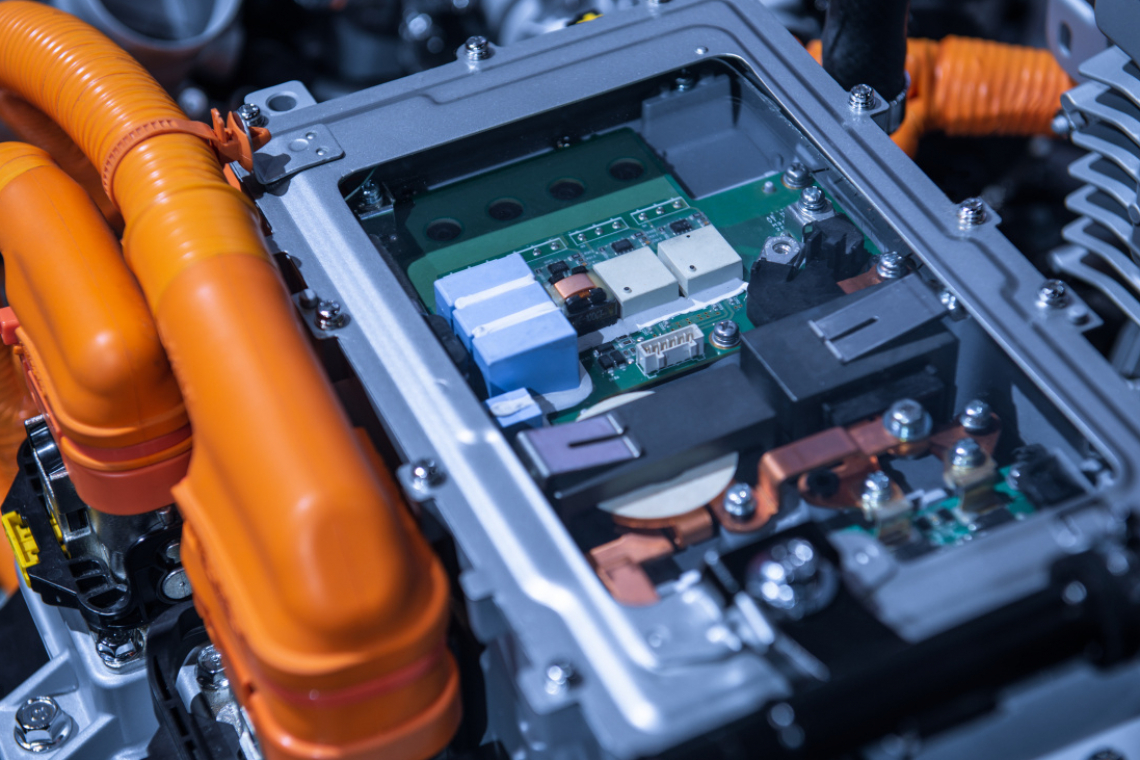

It is true that electronics are already accounting for an increasing proportion of the total value of conventional cars - and power electronics are playing a growing role in this. According to a recent Roland Berger study, the average value of the electronics component in a vehicle is currently $3,000 and is expected to reach an average of over $7,000 by 2025 [4]. However, this trend could come to an abrupt halt if Europe no longer participates adequately in the development and production of electromobility. It is primarily due to the electrification of the drivetrain that the share of power electronics is growing dynamically and the trend identified by the Roland Berger study is continuing. However, logic applications are also continuing to develop - the wishes of e-car buyers for 'driving smart devices' and the unbroken trend towards greater vehicle autonomy are causing this share of electronics to grow. Both trends are merging here and leading to more and more mixed-signal applications.

More awareness of power electronics

The same applies to energy technology: generation and distribution must be much more flexible than in the past in order to regulate supply and demand on the electricity market. As a result, load switches, control intelligence and networking are moving ever closer together. In the substation and other classic application fields of energy technology, these applications remain physically at a distance. However, space plays just as important a role in substations or household applications - PV converters for rooftop PV, balcony power plants, smart home systems or HVAC including heat pumps, to name just a few examples - as it does in automotive applications. Power and logic are moving ever closer together at system level and in some cases already at board and chip level. And the increasing number of household appliances and cordless power tools are also demanding more from the modules than was previously the case. According to market researcher Mordor Intelligence [1], advanced power electronics can save around 50% of the energy lost when converting mains or battery voltages into the voltages used in electronic devices. "However, despite the enormous importance of power electronics, awareness of its role in modern industrial society must also be increased among the well-informed public."

Technological aspects and trends

Prof. Dr.-Ing. Nando KaminskiAftergallium nitride (GaN), silicon carbide (SiC) is increasingly establishing itself as a new material in power electronics. SiC power semiconductors can increase the efficiency of energy conversion, withstand higher voltages and currents and withstand higher operating temperatures than conventional silicon-based components. These so-called wide-bandgap semiconductors offer the advantage of lower switching losses and thus enable operation at higher switching frequencies. In addition, the magnetic auxiliary components and filters can be designed smaller, which in turn contributes to the goal of smaller installation space. All these factors offer significant advantages for power supplies, circuit breakers in wind or solar power systems and converters for electric drives in mobility and industry. Nevertheless, the pressure on developers remains. "The mission profiles are becoming more and more demanding," says Prof. Dr.-Ing. Nando Kaminski, Head of the Institute for Electrical Drives, Power Electronics and Components (IALB) at the University of Bremen [7]. He summarizes the trends in assembly and connection technology: "On the one hand, chips are mounted directly on cooling elements without carriers - for example by Semikron - on the other hand, housings are being omitted and, for example, the flip-chip approach of logic systems is also being transferred to power electronics." This poses major challenges in terms of maintaining or even improving the robustness and reliability of the systems. With these trends, power electronics are increasingly reaching their thermal limits, because where high currents flow, the heat must be dissipated. Other electrophysical aspects of high currents also need to be taken into account. For example, bonding wires are deliberately used as inductors. They are used for damping. "Lead resistances and other so-called 'parasitics' are playing an increasingly important role in system design." The aforementioned approaches to saving installation space and achieving higher power density can also shift some problems to the PCB world. If, for example, humidity and other harsh conditions in the application environment are added to small distances and high voltages, this can mean the early end of the assemblies. Collaboration along the entire chain from chip and system design to assembly level is therefore becoming ever closer and more intensive.

Prof. Dr.-Ing. Nando KaminskiAftergallium nitride (GaN), silicon carbide (SiC) is increasingly establishing itself as a new material in power electronics. SiC power semiconductors can increase the efficiency of energy conversion, withstand higher voltages and currents and withstand higher operating temperatures than conventional silicon-based components. These so-called wide-bandgap semiconductors offer the advantage of lower switching losses and thus enable operation at higher switching frequencies. In addition, the magnetic auxiliary components and filters can be designed smaller, which in turn contributes to the goal of smaller installation space. All these factors offer significant advantages for power supplies, circuit breakers in wind or solar power systems and converters for electric drives in mobility and industry. Nevertheless, the pressure on developers remains. "The mission profiles are becoming more and more demanding," says Prof. Dr.-Ing. Nando Kaminski, Head of the Institute for Electrical Drives, Power Electronics and Components (IALB) at the University of Bremen [7]. He summarizes the trends in assembly and connection technology: "On the one hand, chips are mounted directly on cooling elements without carriers - for example by Semikron - on the other hand, housings are being omitted and, for example, the flip-chip approach of logic systems is also being transferred to power electronics." This poses major challenges in terms of maintaining or even improving the robustness and reliability of the systems. With these trends, power electronics are increasingly reaching their thermal limits, because where high currents flow, the heat must be dissipated. Other electrophysical aspects of high currents also need to be taken into account. For example, bonding wires are deliberately used as inductors. They are used for damping. "Lead resistances and other so-called 'parasitics' are playing an increasingly important role in system design." The aforementioned approaches to saving installation space and achieving higher power density can also shift some problems to the PCB world. If, for example, humidity and other harsh conditions in the application environment are added to small distances and high voltages, this can mean the early end of the assemblies. Collaboration along the entire chain from chip and system design to assembly level is therefore becoming ever closer and more intensive.

According to a recent study, the average value of the electronics component in a vehicle currently amounts to 3,000 $

and is expected to reach over $7,000 by 2025

Conclusion beyond technological aspects

Power electronics is a key technology for efficient industrial regions. There are currently risks here that initially have nothing to do with the technology. Decarbonization is a global priority, if only because of cost efficiency, which has become a major driver beyond any presumed or actual ideological motivation. Societies and economies that refuse to do so or are overly preoccupied with demonstrably much less cost- and energy-efficient special paths of technological openness will lose vital momentum.

Incidentally, cost efficiency does not necessarily translate immediately into revenue. You can rant for a long time about China destroying markets through price dumping or about the USA closing off markets with the CHIPS & Science Act and similar legislative initiatives or building up a huge national debt with IRAs. Photovoltaics is coming into the world today and will continue to do so in enormous overcapacities from Asia. And the entire value or technology chain of electromobility has been very strategically established or occupied by China - and it's not about price dumping. You can compare it with the reactions to Google, Amazon or Tesla. The initial reaction in Europe, especially in Germany, was: they're burning money - that can't go on for long. In the next stage, there was a lot of moaning because these companies defined completely new sectors and have naturally dominated them ever since. Many economists consider the US IRA to be very clever: roughly speaking, the 1:3 leverage turns the offending national debt into a huge investment programme in which the public sector only bears a quarter of the costs in order to reindustrialize the country in defined future industries: Earnings will inevitably flow back at some point - I refer again to the examples of Google, Amazon, Tesla etc.

Meanwhile, Germany is slowing down to a standstill because it is unable to differentiate between consumer debt and infrastructure investments with future-oriented revenue models [5]. Hope remains - because the German research landscape and the Federal Ministry of Education and Research are unimpressed in their dedication to the topic of power electronics in electromobility [6] - and so there is still a chance that the trend forecasts for power electronics in Europe and Germany will remain as positive as the market studies currently show.

References

[1] https://de.statista.com/outlook/cmo/consumer-electronics/weltweit;https://www.mordorintelligence.com/de/industry-reports/power-electronics-market; https://www.skyquestt.com/report/power-electronics-market (accessed: 23.05.2024).

[2] https://de.wikipedia.org/wiki/Europ%C3%A4isches_Chip-Gesetz (accessed: 23.05.2024).

[3] https://dirkspecht.de/2024/05/eine-e-auto-kampagne-mehr/ (Retrieved: 23.05.2024).

[4] https://www.rolandberger.com/de/Insights/Publications/Das-Auto-wird-zu-einem-Computer-auf-R%C3%A4dern.html

[5] https://dirkspecht.de/2024/04/auf-groesseren-buehnen-sollte-der-deutsche-finanzminister-besser-schweigen/ (Retrieved: 23.05.2024).

[6] https://www.elektronikforschung.de/projekte/hiperform (Retrieved: 23.05.2024).

[7] https://www.uni-bremen.de/ialb (Retrieved: 23.05.2024).