The global chip market has been in a downturn since the third quarter of 2022, that much is certain. At the end of September, the rather optimistic US Semiconductor Industry Association (SIA) agreed with this forecast made by financial analysts. However, the appointed experts cannot agree on when and how much.

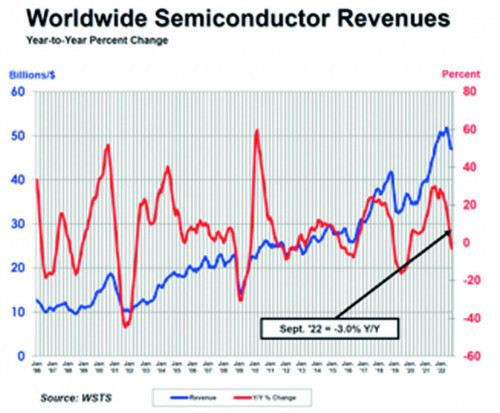

Fig. 1: Global semiconductor sales and annual changes up to September 2022Someobservers, such as British analyst Malcolm Penn (Future Horizons), even predict a veritable 'crash' for 2023: a solid chip recession with a decline in sales volume of around 20%. Others, such as the market researcher Gartner, take a more relaxed view: after rising by 4% in 2022, the chip markets will fall back to the 2021 level by just 3.6% next year - to a market volume of USD 600 billion. Semiconductor Intelligence takes a similar view, albeit somewhat more muted: a decline of 5% in 2023. WSTS (World Semiconductor Trade Statistics) sees a decline of just 4.1% in its November analysis. The 'dark horse' Malcolm Penn immediately objected to these figures: The other analysts were ignoring the highly cyclical course of the chip markets: "They don't want to cause trouble and are tiptoeing around..."

Fig. 1: Global semiconductor sales and annual changes up to September 2022Someobservers, such as British analyst Malcolm Penn (Future Horizons), even predict a veritable 'crash' for 2023: a solid chip recession with a decline in sales volume of around 20%. Others, such as the market researcher Gartner, take a more relaxed view: after rising by 4% in 2022, the chip markets will fall back to the 2021 level by just 3.6% next year - to a market volume of USD 600 billion. Semiconductor Intelligence takes a similar view, albeit somewhat more muted: a decline of 5% in 2023. WSTS (World Semiconductor Trade Statistics) sees a decline of just 4.1% in its November analysis. The 'dark horse' Malcolm Penn immediately objected to these figures: The other analysts were ignoring the highly cyclical course of the chip markets: "They don't want to cause trouble and are tiptoeing around..."

The generally quite reliable tech analyst IC Insights gave a more detailed assessment in its Research Bulletin at the end of November. According to this, the entire semiconductor market is set to shrink by 5% in 2023, with ICs even shrinking by 6%. Only the optoelectronics, sensors and discrete (OSD) segment is expected to see a slight increase. After this cyclical downturn, the semiconductor market is expected to trend upwards again in the following three years and reach a total volume of just under USD 844 billion by the end of 2026, with an average annual increase of 6.5 %.

In September 2022, the SIA reported that global chip manufacturer sales were 0.5 % lower than in August and 3 % lower than in September 2021. This is shown in Figure 1. Extrapolated to the third calendar quarter of 2022, global sales amounted to USD 141 billion. This represents a loss of 3.0 % compared to the same quarter of the previous year and, even more seriously, a loss of 6.3 % compared to the second quarter. The SIA figures are based on data from the WSTS (World Semiconductor Trade Association), a supranational non-profit organization to which the European ESIA (European Semiconductor Industry Association) also belongs. The figures are averaged over three months in order to smooth out monthly fluctuations.

|

Market |

August |

September |

% Change |

|

Americas |

11.47 |

12.02 |

4.8 % |

|

Europe |

4.53 |

4.53 |

0.1 % |

|

Japan |

4.03 |

4.05 |

0.5 % |

|

China |

14.88 |

14.43 |

-3.0 % |

|

Asia Pacific/All Other |

12.32 |

11.97 |

-2.9 % |

|

Total Asia |

47.24 |

47.00 |

-0.5 % |

|

Market |

Last Year |

Current Month |

% Change |

|

Americas |

10.78 |

12.02 |

11.5 % |

|

Europe |

4.03 |

4.53 |

12.4 % |

|

Japan |

3.84 |

4.05 |

5.6 % |

|

China |

16.86 |

14.43 |

-14.4 % |

|

Asia Pacific/All Other |

12.97 |

11.97 |

-7.7 % |

|

Total sales |

48.48 |

47.00 |

-3.0 % |

|

Market |

Apr/May/June |

July/Aug/Sep |

% Change |

|

Americas |

12.11 |

12.02 |

-0.7 % |

|

Europe |

4.35 |

4.53 |

4.2 % |

|

Japan |

4.09 |

4.05 |

-0.8 % |

|

China |

16.24 |

14.43 |

-11.1 % |

|

Asia Pacific/All Other |

13.38 |

11.97 |

-10.6 % |

|

Total sales |

50.17 |

47.00 |

-6.3 % |

|

2Q 2021 |

3Q 2021 |

4Q 2021 |

1Q 2022 |

2Q 2022 |

3Q 2022 |

|

|

total |

3534 |

3649 |

3645 |

3679 |

3704 |

3741 |

Long-term outlook remains favorable

SIA President John Neuffer"After strong growth in the first half of 2022, global semiconductor sales declined year-over-year in September for the first time since January 2020 under the influence of macroeconomic headwinds," comments John Neuffer, President and CEO of SIA. "However, the long-term outlook remains favorable as semiconductors become an ever larger and more important part of our digital economy."

SIA President John Neuffer"After strong growth in the first half of 2022, global semiconductor sales declined year-over-year in September for the first time since January 2020 under the influence of macroeconomic headwinds," comments John Neuffer, President and CEO of SIA. "However, the long-term outlook remains favorable as semiconductors become an ever larger and more important part of our digital economy."

Special regional developments

Even more revealing in the picture of the feared semiconductor recession are its regional triggers and key figures: Sales still rose by 4.8% per month from August to September in North and South America, by 0.5% in Japan and by 0.1% in Europe. By contrast, they fell by 2.9% in the Pacific economic region and by 3% in China. In a year-on-year comparison with 2021, Europe is the frontrunner this time with growth of 12.4%, closely followed by the 'Americas' with 11.4% and Japan with 5.6%. The Pacific region (-7.7%) and China (-14.4%) suffered losses. In the case of China, this was primarily due to the tough coronavirus lockdown measures.

Overall, falling sales in the third quarter were already beginning to emerge in Asia and China, while the Europeans were and are less affected due to their weaker links with the weaker consumer electronics markets. Rising global inflation and consumer reluctance to spend, the upheavals in the global market caused by the coronavirus pandemic and the war in Ukraine are the main triggers of the chip recession.

Slump among customers

Similarly revealing are the figures presented by the well-known US market researcher IDC for the main customer industries of semiconductor manufacturers: the providers of smartphones and PCs (in all their varieties). In September, IDC forecast a 3.5% decline in smartphone sales in 2022 after a boom growth of 6% in 2021. IDC predicts a recovery of 5% for 2023. PC sales also achieved double-digit growth rates in 2020 and 2021 as a result of the global coronavirus-related lockdown and home office regulations. IDC predicts an 8.2% decline in sales in 2022, followed by an anemic recovery of 1% next year.

This means that the economic situation for semiconductor sales is approaching exactly the scenario predicted by Malcolm Penn since the beginning of the year. Penn is a notorious pessimist about the situation - but this time he has got it exactly right. The sequential decline in the market by the 6.3% now reported by the SIA is greater than the 6.2% he predicted. Penn had also forecast global 3Q sales of $144 billion - slightly more than the current WSTS figure.

The Infineon outlook

And at the end of 2022, Jochen Hanebeck, CEO of Germany's largest semiconductor manufacturer Infineon since April 2022, spoke out in an extensive, almost programmatic interview in the Frankfurter Allgemeine Zeitung. In addition to an outlook on his planned company acquisitions and expansion projects in Europe and Asia and the expected government support measures, he offered a detailed assessment of the general market development: With the geopolitically motivated departure from the long-established globalization of manufacturing and supply chains, it is unavoidable that semiconductors will generally become more expensive. This is because fabs are often relocated to places where they do not have the optimum cost base. This affects the economies of scale and also the start-up costs of production. In Germany, for example, it is the high electricity price level in particular that needs to become more competitive compared to the USA and Asia. And the current 'normalized' - i.e. low - stock market valuation of weakly financed start-ups could quickly turn them into takeover candidates - as a welcome driver for the further consolidation of the chip industry.

Countertrend: Rising wafer deliveries

Incidentally, the overview of silicon wafer deliveries for chip production published by the US association SEMI provides a stark contrast to these negative assessments of the semiconductor markets.

It is quantified as a size whose total area is given in square inches. According to the SEMI Silicon Manufacturers Group (SMG), it reached an impressive 3741 MSI (million square inches) in the third quarter of 2022.

Compared to the same quarter in 2021, this is an increase of 2.5% (3649 MSI). "While the semiconductor industry is facing macroeconomic headwinds, the silicon industry continues to show steady growth from quarter to quarter," says Anna-Riikka Vuorikari-Antikainen, Chairman of SEMI SMG. "As silicon wafers play a fundamental role in this cyclical industry, we remain confident about long-term growth."

Decline in sales for chip design houses

The observation by the globally networked analyst TrendForce (based in Taipei, Taiwan) in mid-December that the turnover of the ten leading chip design houses fell by a total of 5.3% to around € 37.4 billion in the third quarter of 2022 also fits in with this. The main triggers were the current geopolitical upheavals and the rigorous coronavirus lockdown in China, which had an inhibiting effect on the production volume of user industries. The negative effects of the rising global inflation rate and the reduction in inventories among users also made themselves felt.

According to TrendForce, this led to shifts in the ranking of the leading providers: While Qualcomm maintained its top position, Broadcom regained its second place ahead of Nvidia and AMD. Overall, US suppliers were able to maintain their position due to their favorable product mix with a focus on industrial applications, while Asian competitors in particular suffered losses due to declining demand for consumer products (PCs, smartphones). The uncertainties in the price trend for components in the quarter ahead led to a wide variety of inventory strategies - reduction or build-up - with a focus on innovative and lucrative application segments, depending on their assessment.