Despite its well-intentioned digital affinity, the ZVEI press conference at electronica 2020 took some getting used to. The topic was 'Market development of electronic components and assemblies' on November 10.

Like the entire trade fair, the traditional press conference was not held in the usual conference room at the West Entrance due to the coronavirus, but as a modest home office video link with Johann Weber, Chairman of the ZVEI PCB and Electronic Systems Association, and Christoph Stoppok, ZVEI Managing Director of 'Electronic Components and Systems' and 'PCB and Electronic Systems'. In substance, it was the same procedure as always: both presenters gave the latest figures and a concise assessment of the situation on the markets for electronic components - both worldwide and broken down to Europe and Germany.

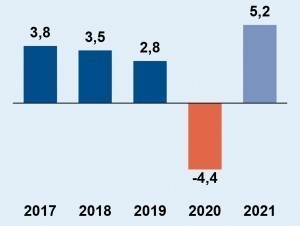

The fact that the overall economic situation is currently anything but satisfactory was a recurring theme in both presentations. According to Weber, the recovery from what the IMF calls the "worst economic crisis since the 1930s" will be determined by the further course of the pandemic. Global GDP growth was already in decline between 2017 and 2019. It is likely to reach -4.4% in 2020. In Germany, the slump will amount to -6%. In the third quarter, there was a (prematurely) optimistic increase of 8.2 %. However, German industrial production was 14% below the previous year's level by the end of August. Weber: "Corona is plunging the economy into a deep recession"(Fig. 1). Fig. 1: Global GDP growth in percent (source: International Monetary Fund IMF)

Fig. 1: Global GDP growth in percent (source: International Monetary Fund IMF)

The coronavirus is hitting the economy as a supply and demand shock in almost all sectors, especially consumer services, only dampened by the targeted economic policy of the industrialized countries. According to Weber, the initially positive signs of an "uneven recovery" have also been severely curbed by renewed national and regional lockdown restrictions so far this year. Weber: "The level of uncertainty remains extremely high".

On the current situation in the electrical and electronics industry from the ZVEI's perspective: Following a severe slump in the spring (albeit less severe than during the 2008/09 financial crisis), at least the ZVEI's business climate index has recovered somewhat(Fig. 2). However, it still remains in negative territory. Nevertheless, capacity utilization is back above 80% in the fourth quarter of 2020, which is only 0.7% lower than at the beginning of the year. The industry expects the recovery to be U-shaped, i.e. flat. Participants in a ZVEI survey see the 'system dispute' between China and the USA as an additional burden. So far, however, this has not yet led to a forced expansion of other Asian locations on the part of German companies. Fig. 2: Business climate index in October, in balances (source: Destatis and ZVEI's own calculations)

Fig. 2: Business climate index in October, in balances (source: Destatis and ZVEI's own calculations)

Electronic components recorded a substantial decline in sales in 2019: Globally, this amounted to 9.8% to $589.3 billion. Overall, however, 2020 remained at this level. Figure 3 shows this trend for the world's industrial regions. China has the largest market share with 38%, followed by Asia/Pacific with 25%. Europe, which has been expanded to EMEA, holds just 9%. Fig. 3: Global markets for electronic components by region

Fig. 3: Global markets for electronic components by region

Global market trends: losses already in 2018 and 2019

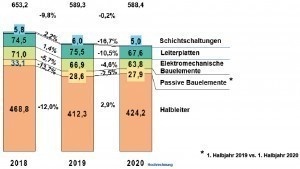

The global market trends determined by the ZVEI for the various component categories are also interesting: layered circuits, printed circuit boards, electromechanical and passive components and semiconductor components. They already recorded significant declines in the years 2018 to 2019. Only semiconductor components have increased again (at least numerically) by 2.9% since 2019(Fig. 4). As is well known, the global market for semiconductor components has been dominated by China for years, which will also increase its share in 2020 (by 1.2 %). The same applies to the Asia/Pacific region. After a virtually euphoric 2018 (with total sales of USD 469 billion), most analysts expect the global semiconductor markets to experience a slump that is likely to continue into 2021.

The German market for electronic components is essentially following the global trends: 2019 with a 5.1% drop in sales to €19.9 billion, followed this year by an expected further coronavirus-related decline of 14.6%. The same trend can be seen for assemblies: in 2019, sales fell by 8.2% to €30.2 billion. For 2020, the ZVEI expects a further decline of 14.6%. The European components market recorded a relatively mild slump of 1.6% to a total of €55.4 billion in 2019. However, this negative trend intensified in 2020 with a drop of 14.5%. Fig. 4: Global market for components by product category

Fig. 4: Global market for components by product category

Conclusion: The high-tech industry is hoping for calmer times. Changes in demand profiles and pandemic-related structural shifts in the traditional customer base for electronic products and manufacturing-related services are already clearly visible. They are also likely to soon redefine the industry's innovation behavior.