Electrical energy is the only product that always has to be generated literally at the same moment it is consumed. Nevertheless, it is practically always available in full - whether it is used or not. How does that work? And can electroplating systems perhaps help to keep it that way?

2.3 Secondary control

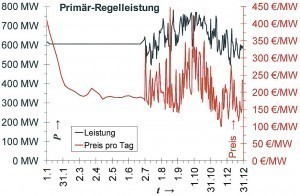

Fig. 10: Primary control reserve provided in Germany and the prices paid for it in 2019Secondary control reserve"aFRR (automatic frequency restoration reserve)" must be fully available within 5 minutes. As the name suggests, this process is also automated. After 15 minutes at the latest, the secondary control reserve should have completely replaced the primary control reserve so that it is available again for balancing processes (e.g. accumulators are recharged, pumped storage power plants can switch back to pumping mode if necessary, if they had switched from pumping to "turbining" as quickly as possible due to the event shortly before). However, the response times overlap with those of the primary control reserve (Section 2.2) and the minute reserve (Section 2.4): "When determining the actual aFRR value, any provision of FCR and mFRR must be taken into account. The determination of the aFRR actual value is coordinated in detail between the reserve provider and the TSO (transmission system operator)" [1]. However, storage units are required to contain energy for at least one hour and to be recharged in a maximum of 4 hours.

Fig. 10: Primary control reserve provided in Germany and the prices paid for it in 2019Secondary control reserve"aFRR (automatic frequency restoration reserve)" must be fully available within 5 minutes. As the name suggests, this process is also automated. After 15 minutes at the latest, the secondary control reserve should have completely replaced the primary control reserve so that it is available again for balancing processes (e.g. accumulators are recharged, pumped storage power plants can switch back to pumping mode if necessary, if they had switched from pumping to "turbining" as quickly as possible due to the event shortly before). However, the response times overlap with those of the primary control reserve (Section 2.2) and the minute reserve (Section 2.4): "When determining the actual aFRR value, any provision of FCR and mFRR must be taken into account. The determination of the aFRR actual value is coordinated in detail between the reserve provider and the TSO (transmission system operator)" [1]. However, storage units are required to contain energy for at least one hour and to be recharged in a maximum of 4 hours.

As the blame for any disruption is attributed to the control area in which the deviation from the plan occurred, it is now the responsibility of this control area alone to ensure that the frequency is correct again. "The second control stage, secondary control, is activated in the respective countries or control zones in order to maintain the planned energy exchange while simultaneously supporting the frequency of 50 Hz" [2]. The affected control area now has to put a little more on the right-hand scale than on the left-hand scale for a while so that the other control areas can "reduce their credit balance" during this time and put a little less on the right-hand side than on the left, as it had been the other way round immediately after the incident to avoid power outages (Fig. 11).

This means that there is no longer such a rush, as a widespread disruption has already been safely avoided. However, who has to contribute how much and when is precisely regulated in detail [3]. The frequency is stable again - but no longer at the target value. This is now to be remedied. To do this, a few anomalies need to be addressed first:

2.3.1 Only called-up secondary control reserve is remunerated

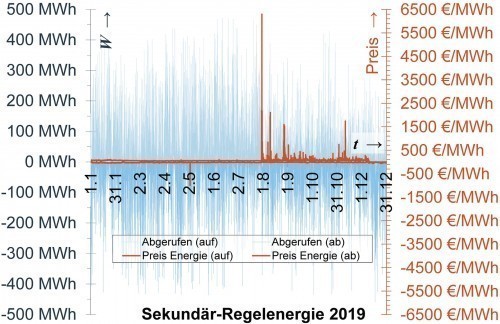

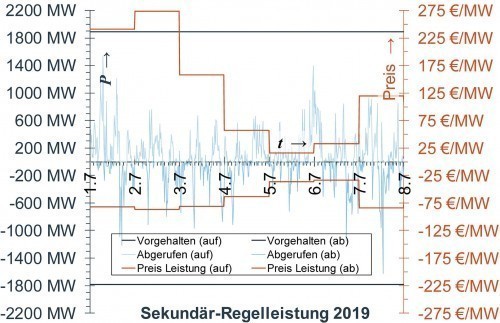

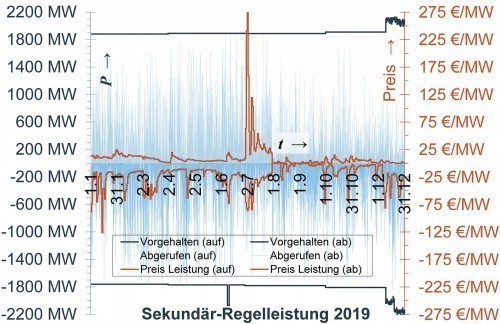

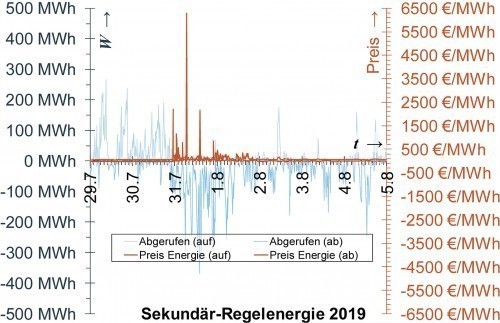

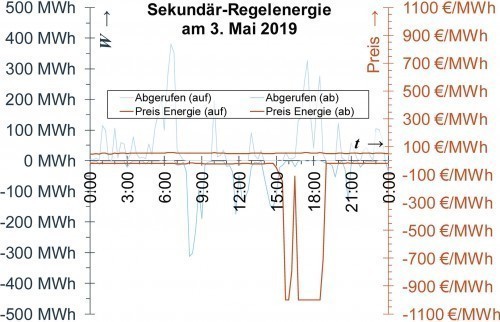

On the market for secondary control, both the power (Fig. 11) and the energy (Fig. 12) are remunerated; in contrast to primary control power (Fig. 10), however, only the called-up power is remunerated, not the available power. The available capacity changes only slightly and remains almost constant throughout the year. It was only on December 10, 2019 that the available capacity suddenly began to fluctuate, and the value changed several times a day from then on - albeit comparatively slightly. The retrieved values, on the other hand, fluctuate wildly every quarter of an hour throughout the year - after all, that is the purpose of the exercise. They should actually be recorded and traded to the second. However, this fails due to practical feasibility.

2.3.2 Simultaneously positive and negative

In contrast to primary balancing energy, the following is noticeable when looking at the data, values and diagrams:

- There is positive and negative balancing power.

- There is positive and negative balancing energy.

- There are positive and negative prices for both.

Positive and negative balancing power and balancing energy do not have to be provided by the same power plants. After all, the prices are not the same either. The values and figures and their signs are to be understood as follows:

- In the case of positive balancing energy, a positive price means a payment by the transmission system operator to a provider of balancing energy; a negative price, on the other hand, means a payment by the balancing energy provider to the system operator, i.e. a repayment or a kind of "penalty payment" for delivery in the wrong direction.

- In the case of negative balancing energy, a positive price means a payment from the supplier to the grid operator (in this case, the supplier has again delivered in the wrong direction), and a negative price means a payment from the grid operator to the supplier (because in this case, the supplier has again delivered what the grid needed at that moment and what had been ordered).

Fig. 15: Positive and negative balancing energy are largely, but not completely, mutually exclusive: There is overlap; prices are also negotiated for bothThewhole thing then applies accordingly to balancing power just as it does to control energy. At first glance, it may seem surprising that a supplier sometimes actually delivers in the wrong direction (i.e. consumes electricity when delivery is expected, or vice versa), but situations are conceivable - even in electroplating technology - in which a large consumer is usually switched on when negative balancing power is required and switched off when positive balancing power is required, but in urgent cases production concerns take precedence over the market price of electricity. Such cases must of course remain the exception, otherwise the regulation of the grid will not work! In fact, these situations are the exception; as a rule, the quantities supplied roughly correlate with the prices (Fig. 11, 12).

Fig. 15: Positive and negative balancing energy are largely, but not completely, mutually exclusive: There is overlap; prices are also negotiated for bothThewhole thing then applies accordingly to balancing power just as it does to control energy. At first glance, it may seem surprising that a supplier sometimes actually delivers in the wrong direction (i.e. consumes electricity when delivery is expected, or vice versa), but situations are conceivable - even in electroplating technology - in which a large consumer is usually switched on when negative balancing power is required and switched off when positive balancing power is required, but in urgent cases production concerns take precedence over the market price of electricity. Such cases must of course remain the exception, otherwise the regulation of the grid will not work! In fact, these situations are the exception; as a rule, the quantities supplied roughly correlate with the prices (Fig. 11, 12).

This means that power and energy as well as their prices can be positive and negative at the same time (which of course only applies to the power and energy quantities actually used, not to the mere provision - Fig. 15). For this reason, positive and negative prices are shown with the same lines in the diagrams, because as a rule - confirmed by exceptions - they can still be clearly distinguished, as the prices for positive power or energy are always in the upper half and the prices for negative power or energy are always in the lower half. The fact that both occur at the same time may be due to the vastness of the grid, its impedances and its limited load capacity. A shortage situation can therefore possibly be better regulated by a control measure in the immediate vicinity than compensated for by a distant surplus situation.

2.3.3 Supply and demand determine the price - or do they?

The day with the highest price for (positive) balancing power at EUR 273.85/MW on July 2, 2019 did not leave a clear mark on the course of demand or vice versa. Nothing of the sort can be observed for either positive or negative output (Fig. 13). However, this can also be interpreted to mean that the prices have exerted their steering effect in advance. After all, they are negotiated in advance.

2.3.4 Output prices and energy prices do not correlate

The above-mentioned extreme price peak for power - 27 times higher than the annual average - by no means occurs at the same time as the price peak for energy (Fig. 14). This shows an even more extreme peak: on July 31, 2019 from 6:45 h to 7:00 h, 1 MWh of negative balancing energy cost the pittance of EUR 6295.25 - 107 times the annual average of EUR 58.76. Meanwhile, the values at 6:30 h were 52.00 euros and at 7:00 h 54.00 euros, i.e. even below the annual average. Presumably at some point between 6:30 and 6:45, an unscheduled

an unforeseen supply disruption occurred in a larger area, and the "jolt in the system" was already compensated by 7:00 a.m. - thanks to the aFRR.

2.3.5 Negative balancing energy is sometimes available at positive prices

Although the average price for 1 MWh of negative balancing energy is slightly negative at EUR -18.57, the maximum value of EUR 2107.12 is significantly higher than the minimum value of EUR -999. And on July 31, 2019 at 6:30 h (see section 2.3.4 above), the price for 1 MWh of negative balancing energy was EUR 75.67, at 6:45 h only EUR 6.99 and at 7:00 h EUR 75.14 again. The fact that the prices for negative balancing power go into negative as well as positive territory, while the prices for positive balancing power start at 0 and thus only reach into positive territory, must perhaps be interpreted as meaning that some plants supplied (more) energy at a time when (increased) consumption or a decline in production was actually agreed. A total of 2491 out of 35040 quarter-hour values are negative. This is not an overwhelming number, but it is not exactly negligible either - one in fourteen values to be precise. However, only every twelfth value is positive. The price for balancing energy is therefore zero for a good 84% of the year. During this time, the relevant providers are "only" paid for keeping the power available (like the fire department, which cannot be employed elsewhere, let alone hired out abroad, because there is no fire at the time).

2.3.6 Control energy not much more expensive than "normal" electricity

The above-mentioned average annual price for 1 MWh of positive balancing energy of EUR 58.76 is only 43% higher than the annual average of EUR 41.18 paid for "normal" electricity on the EEX energy exchange. The annual average household electricity tariff in 2019 was 30.85 ct/kWh [4], i.e. €308.50/MWh. Control energy is therefore a "great" deal for a quarter of an hour here and there, but not on average over the year - but a galvanic plant cannot offer positive control energy anyway. In addition, however, there is the remuneration for keeping the power available in the event of an emergency. Here, as described, electroplating can primarily offer negative power. However, this accounts for a much smaller share of sales.

Literature

[1]Published in: ETG Member Information 2(2011) p. 11

[2]N. Furrer; A. Chacko; A. Stimmer; C. Imboden: Cross-border SDL offers, Bulletin SEV/AES 2/2015, p. 20

[3]https://transparency.entsoe.eu

[4]Volume-weighted average price with taxes across all contract categories for household customers from 2,500 kWh/a to 5,000 kWh/a, 2019 monitoring report of the Federal Network Agency(https://www.bundesnetzagentur.de/DE/Sachgebiete/ElektrizitaetundGas/Unternehmen_Institutionen/DatenaustauschundMonitoring/Monitoring/Monitoringberichte/Monitoring_Berichte_node.html)