The Russian electronics industry is finally at a turning point. The sanctions imposed by Western countries, which were significantly tightened in spring 2022 after the start of the Russian war against Ukraine, have highlighted the systemic problems of this giant country's industry - including those of the PCB industry as a key component of electronics production. First part of an analysis.

As much as Russia's war against Ukraine is to be condemned, the fact remains that Russia was, is and always will be part of Europe. History has shown that times of war do not usually last forever and that after them we can hope for a period of reflection and economic cooperation. This should be reason enough to keep an eye on the development of the country's economy despite the war in order to be prepared in terms of knowledge for the phase of normalization of relations between the countries. This report is intended to contribute to this.

Effect of the sanctions

It is impossible to assess the situation of the Russian electronics industry as objectively as possible without taking into account the global political and economic situation. The Russian electronics industry has found itself in a difficult situation because it has become increasingly dependent on Western technologies, machines, auxiliary materials and software in key problem areas, particularly since the turn of the millennium, while at the same time pursuing its own political path, which is not approved by the 'Western' countries - led by the USA. Especially since the annexation of Crimea in 2014 and even more so with the start of Russia's war against Ukraine in February 2022, the tensions between the two sides and thus the problems in the Russian electronics industry have taken on a new quality.

At the end of February 2022, the Bureau of Export Control of the US Department of Commerce announced that it would drastically tighten the sanctions imposed on Russia in 2014 following the annexation of Crimea. Exports of semiconductors, telecommunications equipment, lasers, computers, sensors and equipment or materials for the production of electronics to Russia were particularly affected. The requirements for PCB production are included here. The measures were intended to limit exports or, in some cases, prevent them altogether. Since 2022, as was the case after 2014, it is no longer a question of whether the banned items can be used for military or 'only' dual use, but of general bans. In this respect, Russia has entered a new phase of its existence, so to speak.

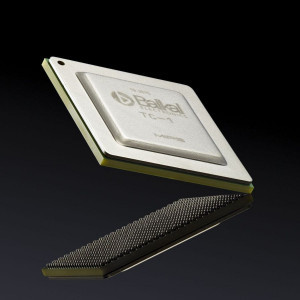

Fig. 1: ARM-based microprocessor Baikal; Image: Baikal ElectronicsAnexample of the impact of the tightened sanctions on the country: The largest Taiwanese IC manufacturer TSMC, in whose factories the Russian microprocessors 'Baikal', 'Elbrus' and 'Skif' were previously manufactured using 28nm technology, ceased cooperation with Russia in 2023(Fig. 1). Taiwan's accession to the sanctions made it impossible to place orders in South Korean and Taiwanese factories as usual. This also affects the procurement of PCBs, including EMS services. At the beginning of April 2022, the EU had already banned the export of semiconductors, PCBs and equipment for electronics production to Russia.

Fig. 1: ARM-based microprocessor Baikal; Image: Baikal ElectronicsAnexample of the impact of the tightened sanctions on the country: The largest Taiwanese IC manufacturer TSMC, in whose factories the Russian microprocessors 'Baikal', 'Elbrus' and 'Skif' were previously manufactured using 28nm technology, ceased cooperation with Russia in 2023(Fig. 1). Taiwan's accession to the sanctions made it impossible to place orders in South Korean and Taiwanese factories as usual. This also affects the procurement of PCBs, including EMS services. At the beginning of April 2022, the EU had already banned the export of semiconductors, PCBs and equipment for electronics production to Russia.

When completing the development of its ARM-based microprocessors in 2020, the Russian fab-less design company Baikal Electronics hoped to have them produced in China thanks to the rapid progress of the Chinese semiconductor industry and thus alleviate the microprocessor situation in its own country. However, the sanctions imposed by the USA on China in the semiconductor sector, particularly with regard to the production of highly integrated circuits in the sector of minimum structure widths ≤ 28nm, did not allow this to happen.

However, based on a Japanese announcement dated August 19, 2023 in [1], it can now be assumed that the US sanctions in the IC sector will partially lose their effect on China (and therefore probably also on Russia) over the next two to four years. The announcement confirms that China's technology for manufacturing high-resolution lithography machines has developed in leaps and bounds under US sanctions pressure. Shanghai Microelectronics announced that successful solutions have been found in 28nm and 14nm lithography machine technology and the equipment is now being adapted for mass production. It is therefore reasonable to expect that the domestic chip industry will accelerate the transition to these technologies in 2024-26. Knowing the Chinese, a broad reform of their semiconductor production is imminent. At the same time, Shanghai Microelectronics also stated that it is now able to provide etching machines for the production of 5nm chips. However, according to relevant experts, China's most important market is currently still the production and export of 40 and 50 nm chips. It is therefore currently 10-12 years behind the international leaders. Given the 'Chinese pace', it is reasonable to assume that China will have caught up with the countries that are still leading the field in terms of cutting-edge semiconductor technologies by 2030. Russia will also benefit from this.

This example clearly shows two things:

- Sanctions usually only have a temporary effect because they often unleash extraordinary forces to circumvent them or to find suitable solutions of their own

- Sanctions usually lead to the countries affected by them moving closer together and, in some cases, to their strengthening, which is what the authors of the sanctions actually wanted to avoid

The above can also be applied to the Russian electronics industry in general and the PCB industry in particular.

Russia's PCB industry: investments and changes

Due to the tense situation in the Russian electronics industry as a result of the sanctions and the search for solutions, there are increasing calls from experts, authorities and companies to take an even more critical approach to the publication of data on the situation in important parts of the economy. If possible, this data should not be made public because we know how closely the Russian economy is under foreign scrutiny [2]. Only in this case, companies that have fallen under sanctions have the opportunity to operate and develop production. The author also felt this new trend of data restraint in his work and in his contacts.

Some rudimentary statistical figures and other information indicate that the PCB industry in Russia is in the process of reinventing itself and gradually moving to a more efficient and independent basis. Sometimes there is even talk of a 'zero hour', i.e. a general new beginning(Fig. 2). Examples of this follow here. The project is difficult enough, as China is almost a monopolist in the production of glass fibers, copper foils and many other basic materials, as well as printed circuit boards. To a certain extent, the closer China's relations with its neighbor Russia become, the more it actively hinders the development of its own PCB market in Russia. This also applies to the provision of resources for production by Russia itself.

Fig. 2: Will the sight of Western machines in Rezonit's board production soon be a thing of the past? (Plant in Klinu, 2013); Image: Rezonit

Fig. 2: Will the sight of Western machines in Rezonit's board production soon be a thing of the past? (Plant in Klinu, 2013); Image: Rezonit

The Russian market research company TK Solutions published the report 'The PCB market in Russia: current situation' in August 2021, well before the start of the war against Ukraine [3]. It mainly refers to 2020, but also covers the first few months of 2021. It states that the PCB market has been characterized by positive production dynamics in the last two years. The volume of Russian PCB production in 2020 amounted to 26.71 million units, which was 26.5% more than in 2019.

- In May 2021, 2.613 million units were produced, which corresponded to an increase of 8.9% compared to the previous year's figures

- The production value was USD 345 million in 2020 and is expected to rise to USD 417 million in 2024

Central Russia (Moscow region) took first place in the production structure with an average of 49.4% of production in the period 2017-2020, followed by Northwest Russia (St. Petersburg region) in second place with 21.0% of output.

Central Russia's share rose significantly from 32.3% in 2017 to 68.0% in 2020, while Northwest Russia's share of PCB production fell by 29.1% from 36.5% to 7.4% in the same period. It can therefore be assumed that significant parts of PCB production shifted from the St. Petersburg region to the Moscow region or that parts of production in St. Petersburg were discontinued. In addition, however, new production capacities have been built or are still under construction in the Moscow region. One example of this is the Rezonit company.

The export of boards is almost negligible. They fell by 20.6% to 4.7 million US dollars in 2020 compared to 2019. The main exporters in 2018-2020 were the following regions

- Moscow (USD 1.7 million)

- Smolensk region (0.6 million USD)

- St. Petersburg (0.5 million dollars)

Exports were mainly to these countries

- Belarus (39.1 %)

- India (29.7 %)

- Kazakhstan (13.9%)

In 2020, $130 million worth of PCBs were imported into Russia, an increase of $4.4 million or 3% compared to 2019 [3]. Curiously, the quantity of PCBs imported is put at 34,000 tons by weight.

The production value was USD 345 million in 2020 and is expected to rise to USD 417 million in 2024

4] states that Russia only imported $116 million worth of PCBs in 2021, putting it in 37th place in the global import rankings. The boards came mainly from China ($91.9 million), South Korea ($6.61 million), Germany ($2.56 million), Hong Kong ($2.34 million) and Thailand ($1.72 million). However, these figures are not to be trusted. It is known that many Russian companies also have their ordered PCBs assembled in Asian countries, which is probably also due to the sanctions against Russia. Another issue is the dollar-ruble exchange rate at which the respective calculations were made, as the dollar-ruble exchange rate has fluctuated greatly in recent years. Russia's PCB market share of global production in 2021 is given as 0.6% in [4].

It can be assumed that both the country structure of imports and the import volumes have changed significantly since 2022 due to the participation of South Korea and Germany, for example, in the sanctions against Russia. It could be assumed that China is increasingly compensating for the loss of imports from these countries, but this should be viewed with caution. There are also increasing voices in Russia warning against 'quick fixes', i.e. growing dependence on imports from China. There are several reasons for this:

- Uncertainty about how the political situation between China and the USA will develop

- Experience of interrupted supply chains with China due to coronavirus

- Self-sufficiency in strategically important areas for greater independence

The last reason in particular is based on the experience that Russian industry has had to gain over the past ten years, especially with Western countries.

As will be shown below, the decline in imports can already be seen as a further sign of the expansion of the domestic PCB industry and the increase in independence from PCB imports.

In a report update for 2022-2023 from July 2023, TK Solutions cites the following figures:

- Volume increase in Russian PCB production in 2022 to 36.93 million units, 10.7% more than in 2021

- Production of 3.08 million boards in April 2023, an increase of 8.1% compared to the same period last year

The compound annual growth rate (CAGR) of PCB production for the period 2017-2022 was 9.3 Central Russia led with 60.5% during this period. In second place is no longer the Petersburg region, but the Siberian Federal District with 18%.

Taking into account

- the figures presented

- the political and economic need to promote the replacement of imports

- the measures introduced by the companies themselves and by the Russian government

it can be hypothetically assumed that the Russian PCB market could well be worth $530 million or more in 2024 and that in-house production of PCBs will rise to around $450 million.

Growing demand and more in-house production

The number of PCB manufacturers in Russia has decreased significantly over the last 20 years. At the beginning of the 2000s, there were still around 2000. Today, according to [5], around 150 production facilities remain, which seems very high to the author. Of these, around 30 are independent companies on the market, the 'rest' work in large production associations and mainly or only cover internal requirements. Among the latter is the military-industrial complex. Most of the PCB manufacturers in this 'rest' do not appear in any official industry or market overview. A special feature of Russia's independent PCB manufacturers compared to Western board producers is that in most cases the 'full production cycle' is offered to customers as a service, i.e. including assembly services, which is why one has to be careful with sales figures (if they appear anywhere at all).

Nevertheless, what [6] said about the Russian PCB industry in 2019 still seems to apply: Five of the independent companies, as the top 5, still determine about 80% of Russian PCB production, with Rezonit and Technotech alone contributing about 50%. Interested parties can also find an overview of the 46 most important PCB manufacturers in Russia, their range of services and Internet addresses in [6].

Rapid growth in domestic demand

Experts in Russia warn that if the shrinking process among independent PCB manufacturers continues, only two to three very large, efficient manufacturers could remain in ten years' time, which would be a disaster in view of the growing demand for electronics in Russia. On the other hand, the domestic demand for domestically produced electronic products is growing rapidly for at least two reasons:

- because of the need to replace imports

- because of the objective trend towards increasing electronization and digitalization

For example, in the automotive industry there is a high demand for printed circuit boards that are part of electronic control units (ECU). Today, automotive electronics is one of the most dynamically developing areas of the Russian electronics industry. According to the Autoelectronics and Telematics Consortium, the capacity of the ECU market was estimated at 180 billion rubles in 2022. At the same time, the share of domestic ECU manufacturers did not exceed 25%. By 2030, the market may grow to 415 billion rubles (approx. €4 billion) and the share of Russian suppliers could reach 58%. This alone indicates the need for a significant expansion of the Russian PCB industry and its suppliers.

The military-industrial complex is not taken into account

As mentioned above, a significant proportion of Russian PCB factories are not active in the civilian market. They often produce complex and very high-quality boards, whereby production costs and delivery times are not the focus, as is the case with civilian private board producers. Most factories are part of large manufacturing companies where the production of PCBs is not considered a separate business. For them, it is critical to produce high quality end products, so the majority of these companies are forced to accept the lack of profitability of PCB manufacturing facilities and high costs in order to have confidence in the efficient and timely release of the end product. The production volumes of these manufacturers are generally not included in the statistics published by the state. As a result, the value of PCBs produced in Russia may well be 10-20% higher and could exceed $500 million by 2024.

The second part of this article by Dr. Hartmut Poschmann will be published in issue 11/2023.

References

[1] https://min.news/en/tech/d76dc8f203f7fa48d6bdbbebdbb576f0.html (accessed: 31/08/2023).

[2] https://rg.ru/2022/06/28/eksperty-mery-podderzhki-mikroelektronnoj-otrasli-dolzhny-okazyvatsia-v-tishine.html (Retrieved: 31.08.2023).

[3] https://tk-solutions.ru/russia-rynok-plat-pechatnyh-smontirovannyh/analiz-rynka-pechatnyh-plat-2021 (Retrieved: 31.08.2023).

[4] https://oec.world/en/profile/bilateral-product/printed-circuit-boards/reporter/rus (Retrieved: 31.08.2023).

[5] www.rzd-partner.ru/other/comments/proizvodstvo-pechatnykh-plat-v-rf-renessans-ili-balansirovanie-na-grani-vyzhivaniya/ (Retrieved: 31.08.2023).

[6] Plus 6/2019.