It is not easy to get a consistent picture of how the global semiconductor market will develop: Several forecasts from analysts and official industry sources come up with different assessments. And these differ considerably.

The data is actually clear, not difficult to ascertain and has been in reliable hands for years. However, the imponderables of short and medium-term market development obviously do not allow for a quantitative approximation of the forecasts.

Tobias Pröttel, WSTSTheanalysis of the 'World Semiconductor Trade Statistics Organization' (WSTS), a semi-official non-profit body founded in 1986 with currently 42 member companies in the four industrial regions of the world, which regularly reports on the state of the industry, paints a rather optimistic picture. It is based in Silicon Valley, California, but has had a German administrator named Tobias Pröttel in Wörth, Bavaria, in the district of Erding near Munich since June 2022.

Tobias Pröttel, WSTSTheanalysis of the 'World Semiconductor Trade Statistics Organization' (WSTS), a semi-official non-profit body founded in 1986 with currently 42 member companies in the four industrial regions of the world, which regularly reports on the state of the industry, paints a rather optimistic picture. It is based in Silicon Valley, California, but has had a German administrator named Tobias Pröttel in Wörth, Bavaria, in the district of Erding near Munich since June 2022.

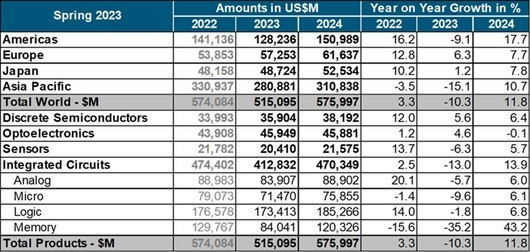

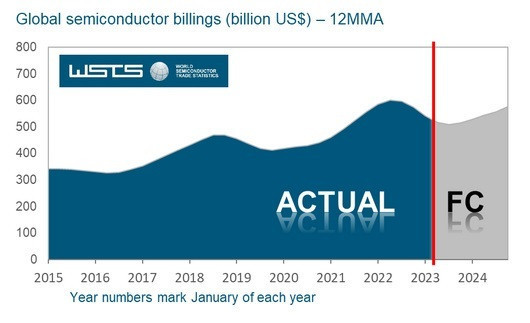

WSTS forecasts that the global semiconductor market will shrink by 10.3% to a total of just USD 515 billion in 2023. Another disappointment after the already modest result for 2022, which saw growth of 3.3 %. This was more or less stagnation for the chipmakers, who are used to success. As is well known, the decline was triggered by the prevailing inflationary trends, disruptions to global supply chains due to geopolitical turbulence and the muted surge in demand from high-tech consumers in the wake of the coronavirus pandemic.

Two main product categories are excluded from this: discrete and optoelectronic components. The WSTS expects them to grow by 5.6% and 4.6% respectively this year. The decline of around 35% in memory components in all categories points particularly strongly into negative territory. Among other things, this is due to the rapid fall in prices and the reduction in stocks on the part of users.

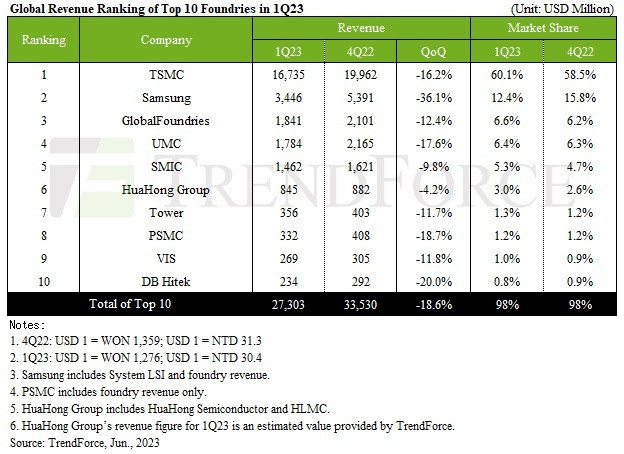

The situation reports of the leading chip foundries, as reported by the Taiwanese analyst 'TrendForce' at the beginning of June, are completely in line with this. The ten leading contract manufacturers unanimously reported an18.6% decline in their figures in the first quarter of 2023. For market leader TSMC, the decline amounted to 16.2%. The Korean company Samsung was hit harder with a drop of 36.1%. This also led to shifts in the rankings, with Global Foundries holding up remarkably well.

The chip markets in Europe and Japan fared better, at least in nominal terms, with increases in turnover of 6.3% and 1.2% respectively. However, the downturn in the other regions is all the more serious, with a fall of 9.1 % in North and South America and a downright disastrous 15.1 % in Asia-Pacific.

With so much current bad news, a more positive outlook for the future is naturally called for: according to the WSTS, growth in the semiconductor market is expected to return to 11.8% next year and reach a total volume of USD 576 billion. Memory components in particular are expected to see a massive recovery of more than 43% - to $120 billion. All regions are expected to participate in this upturn according to their starting position.

WSTS Spring Semiconductor Forecast to 2024 in billion $

WSTS Spring Semiconductor Forecast to 2024 in billion $

Regional distribution of semiconductor sales up to 2024

Regional distribution of semiconductor sales up to 2024

Global ranking of the ten leading chip foundries

Global ranking of the ten leading chip foundries

Devastating forecast

Malcolm PennSofar so good, if it weren't for the eternal troublemaker (and yet highly renowned) contrarian Malcolm Penn and his British analysis company 'Future Horizons'. Back in May 2022, he predicted a real crash in the chip market for 2023 with a decline of up to 26% in the various product categories. On average, the decline was expected to be 22 %. In January 2023, he maintained this devastating forecast. In May 2023, he softened his outlook slightly to -20%, with a likely contraction of between 18% and 22%. He refuses to give a serious outlook for 2024.

Malcolm PennSofar so good, if it weren't for the eternal troublemaker (and yet highly renowned) contrarian Malcolm Penn and his British analysis company 'Future Horizons'. Back in May 2022, he predicted a real crash in the chip market for 2023 with a decline of up to 26% in the various product categories. On average, the decline was expected to be 22 %. In January 2023, he maintained this devastating forecast. In May 2023, he softened his outlook slightly to -20%, with a likely contraction of between 18% and 22%. He refuses to give a serious outlook for 2024.

Another highly respected market analyst, Gartner, is more in line with the WSTS. Its forecast for 2023 predicts a decline of 11.2% to a total of 532.2 billion dollars, followed by a substantial upturn of 18.5% in 2024. Richard Gordon, until recently Gartner's Vice President, attributes the current decline in the memory markets to the reduction in excess capacity and surplus inventories with corresponding price reductions. As usual in the volatile chip industry, this will lead to an undersupply of specific memory components in 2024, with the consequence of price increases across the board.

"The semiconductor industry is facing a number of long-term challenges. The previous decades of high-volume and high-price market drivers are coming to an end. This is particularly true in the PC and smartphone markets, where innovation is slowing." According to Gordon, in future the chip market will no longer be driven by consumer spending as it is today (31%), but more by the capital requirements of innovative industries such as automotive, aerospace and the military. In this respect, it is also a decided return to the market constellations in the early days of computer chips.