After long speculation by specialist media and financial analysts, more or less official confirmation came from the US Semiconductor Industry Association (SIA) on October 28, 2022: The global chip market has been in a definitive downturn since the third quarter of 2022. This could result in a tangible chip recession in 2023 with a drop in sales volume of around 20%. Some observers even see this as a catastrophic "crash". The SIA represents the figures of almost all US chipmakers and around two thirds of suppliers outside the USA.

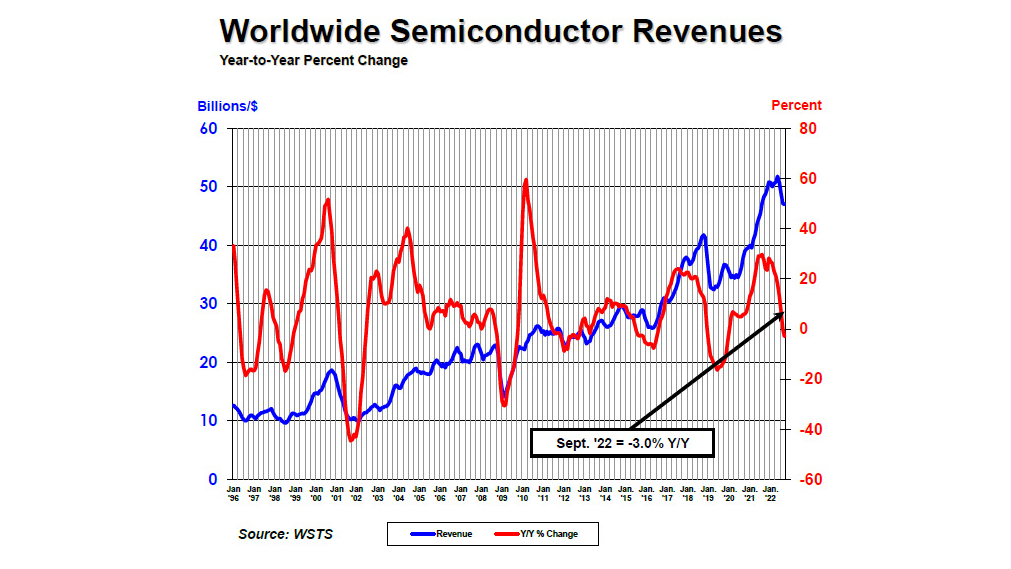

According to the SIA, global chip manufacturer sales in September 2022 were 0.5% lower than in August and 3% lower than in September 2021. This is shown in Figure 1. Extrapolated to the third calendar quarter of 2022, global sales amounted to 141 billion dollars. This represents a loss of 3.0% compared to the same quarter of the previous year and, even more ominously, a loss of 6.3% compared to the second quarter. The SIA figures are based on data from the WSTS (World Semiconductor Trade Association), a supranational non-profit organization to which the European ESIA (European Semiconductor Industry Association) also belongs. It is an average value averaged over three months in order to smooth out the monthly fluctuations somewhat.

"After strong growth in the first half of 2022, global semiconductor sales declined year-on-year in September for the first time since January 2020 under the influence of macroeconomic headwinds," comments John Neuffer, President and CEO of the SIA. "However, the long-term outlook remains favorable as semiconductors become an ever larger and more important part of our digital economy."

Special regional developments

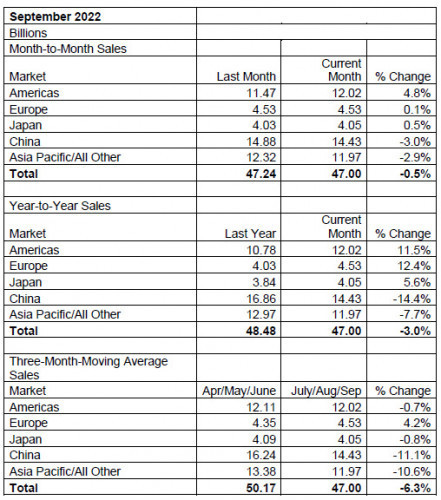

Even more revealing in the picture of the coming semiconductor recession are its regional triggers and key figures: Sales were still up 4.8% month-on-month from August to September in North and South America, 0.5% in Japan and 0.1% in Europe. By contrast, they fell by 2.9% in the Pacific economic region and by 3% in China. In a year-on-year comparison with 2021, Europe is the frontrunner this time with growth of 12.4%, closely followed by the "Americas" with 11.4% and Japan with 5.6%. The Pacific region (-7.7%) and China (-14.4%) suffered losses. In the case of China, this is primarily due to the tough coronavirus lockdown measures. See table 1.

Table 1: Three-month average chip sales by geographical region in September and August 2022 (source: SIA/WSTS)

Table 1: Three-month average chip sales by geographical region in September and August 2022 (source: SIA/WSTS)

Overall, falling sales in the third quarter were already beginning to emerge in Asia and China, while the Europeans were and are less affected due to their weaker links with the weaker consumer electronics markets. Rising global inflation and consumer reluctance to spend, the upheavals in the global market caused by the coronavirus pandemic and the war in Ukraine are the main triggers of the chip recession.

Slump among customers

Similarly revealing are the figures presented by the well-known US market researcher IDC for the main customer industries of semiconductor manufacturers: the providers of smartphones and PCs (in all their varieties). In September, IDC forecast a 3.5% decline in smartphone sales in 2022 after a boom growth of 6% in 2021. IDC predicts a recovery of 5% for 2023. PC sales also achieved double-digit growth rates in 2020 and 2021 as a result of the global coronavirus-related lockdown and home office regulations. For 2022, IDC predicts a decline in sales of 8.2%, followed by an anemic recovery of 1% next year.

This brings the economic situation for semiconductor sales closer to the scenario predicted by British tech analyst Malcolm Penn of Future Horizons since the beginning of the year. Penn is a notorious pessimist about the situation - but this time he has got it exactly right. The sequential decline in the market by the 6.3% now reported by the SIA is even greater than the 6.2% he had predicted. Penn had also forecast global 3Q sales of 144 billion dollars - slightly more than the current WSTS figure.

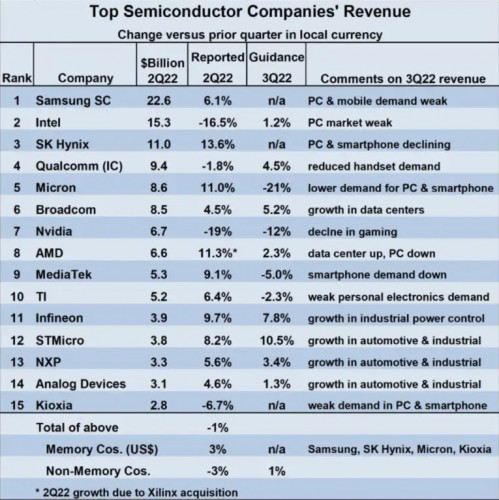

Table 2: Current ranking of the leading semiconductor manufacturers (Source: Semiconductor Intelligence)

Table 2: Current ranking of the leading semiconductor manufacturers (Source: Semiconductor Intelligence)

The ranking of global semiconductor manufacturers and their shifts in the light of these economic developments is shown in the list compiled by US analyst Semiconductor Insights (Table 2).

Countertrend: Rising wafer shipments

A stark contrast to these rather negative assessments of the semiconductor markets is provided by the overview of silicon wafer shipments for chip production just published by the US association SEMI (Table 3)

Table 3: Trends in shipments of silicon wafers up to Q3 2022 in MSI (millions of square inches) (source: SEMI)

Table 3: Trends in shipments of silicon wafers up to Q3 2022 in MSI (millions of square inches) (source: SEMI)

It is quantified as the size of their total area in square inches. According to the SEMI Silicon Manufacturers Group (SMG), it reached a total of 3,741 MSI (million square inches) in the third quarter of 2022. This represents an increase of 2.5% (3 649 MSI) compared to the same quarter in 2021. "While the semiconductor industry is facing macroeconomic headwinds, the silicon industry continues to show steady growth from quarter to quarter," says Anna-Riikka Vuorikari-Antikainen, Chairman of SEMI SMG. "As silicon wafers play a fundamental role in this cyclical industry, we remain confident about the long-term growth."