Development of the markets for electronic components and assemblies

Moderated by Karen Baumgarten, Senior Manager PR & Communications ZVEI, Nicolas Schweizer, Chairman of the ZVEI PCB and Electronic Systems Association, and Michael Dehnert, ZVEI Managing Director Electronic Components and Systems and PCB and Electronic Systems, provided information on the market development for electronic components and assemblies at a press conference. The Ukraine war, inflation and the pandemic continue to impact the global economy. The IMF therefore anticipates a slowdown in the global economy and expects only slight growth worldwide in 2023, with regional differences. GDP is even forecast to fall by 0.3% in Germany. The German electrical and digital industry will record growth of around 4% in 2022. However, sentiment indicators fell significantly in the fall. The German market for electronic components is expected to see double-digit growth to over € 22 billion in 2022, exceeding the pre-crisis level of 2019. The global market is expected to be worth over USD 792 billion in 2022, of which over USD 78 billion for printed circuit boards and over USD 613 billion for semiconductors. The global market for electronic assemblies will reach almost USD 1253 billion. In Germany, the situation is characterized by a still high order intake in the E&E industry as well as high energy prices and high material costs. In addition, the availability of materials remains critical and supply chains are disrupted. All of this is weighing on the economy and poses a risk of a possible economic recession in 2023. For the coming year, the ZVEI is forecasting growth rates in the mid-single-digit range for the markets for electronic components and assemblies. Nicolas Schweizer noted: "We have an exciting year ahead of us."

Importance of the EMS sector for the industry

The ZVEI's Services in EMS initiative organized a panel discussion focusing on the importance of the EMS sector for the industry. Moderated by Johann Wiesböck, Elektronik Praxis, the panel included Michael Velmeden, cms electronics, Markus Aschenbrenner, Zollner Elektronik, Carsten Ellermeier, Prettl Electronics, Peter Morla, Herkules-Resotec Elektronik, and Thomas Lacker, binder introbest. At the opening, Johann Wiesböck said that although the EMS industry has great potential and is economically significant, it is little known. The panelists added to this. Thomas Lacker emphasized that EMS strengthen the local value chain. Carsten Ellermeier noted that EMS had different margins than OEMs despite a large proportion of engineering services. Michael Velmeden said that the EMS industry was not being asked to manufacture ventilators despite its proven expertise in the manufacture of medical technology. It must become more visible. Markus Aschenbrenner added that the true value of the EMS industry is not known, because it does much more than just assemble. The cause, as everyone agrees, lies in the past. This is because many EMS companies were initially created by outsourcing assembly from groups and larger companies. However, a lot has changed in the meantime. For example, the digitalization of the supply chain is underway and, in addition to manufacturing, engineering services are also part of the standard portfolio of the EMS sector. Everything up to the complete device or system is offered according to customer requirements. According to Michael Velmeden, electronics has become a key enabling industry and it is therefore important to ensure EMS services. Short innovation cycles can no longer be realized by OEMs alone. EMS support is necessary and offers additional potential locally. All panel participants agree that partnership at eye level is required today and that this is an essential contribution to success. The megatrends of safety and sustainability also require a general rethink. It is important to create identification with the products, i.e. to be aware of doing something good. The EMS sector has the technological and industrialization expertise required to implement the 'electrifying ideas' in line with the new ZVEI slogan. The EMS sector must confidently explain what it does and also invest in its marketing. Peter Morla is certain: "It won't work without us."

ISELED and ILaS take off

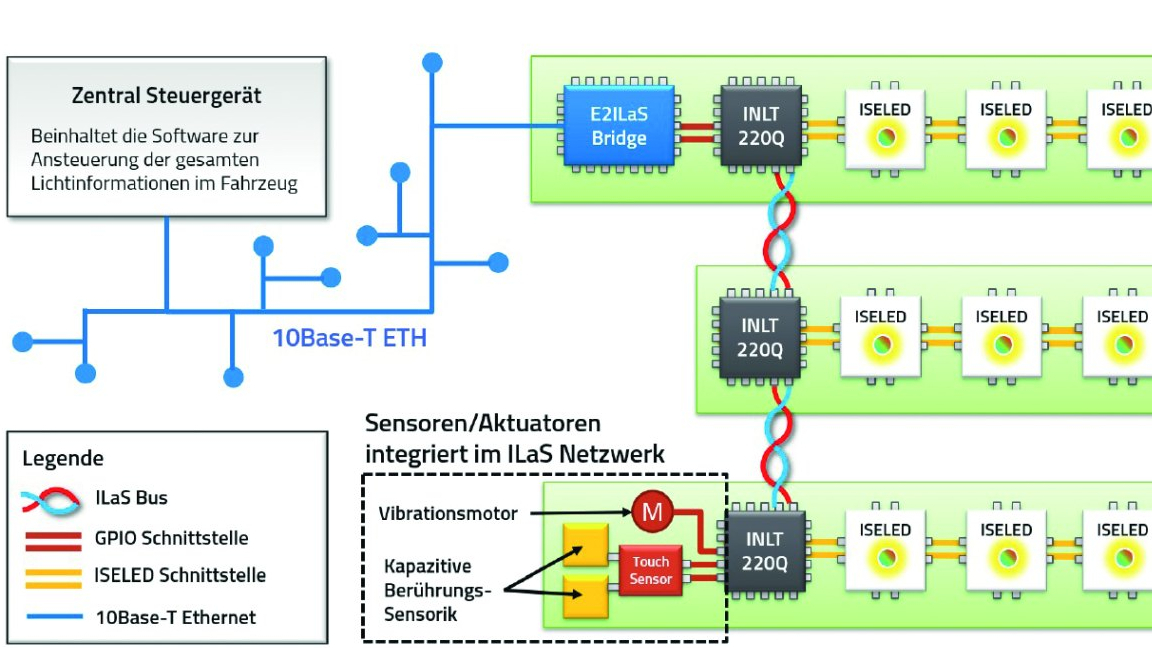

At a press conference, Inova Semiconductors and members of the ISELED Alliance provided information on the state of the art and the latest technologies relating to ISELED (Intelligent Smart Embedded LED) and ILaS (ISELED Light & Sensor Network).

By way of introduction, there was a brief overview of developments since the presentation at electronica 2016: ISELED is an innovative technology based on highly integrated, intelligent LED modules that enables dynamic ambient and functional lighting solutions. The ISELED Alliance is an open industry alliance with the aim of building a comprehensive ecosystem based on ISELED technology, i.e. a complete system solution for innovative automotive lighting. Members include leading Tier 1 companies in the lighting industry, LED and semiconductor manufacturers, specialized lighting designers and many others. There are now 46 companies in the alliance - Analog Devices, Renesas and Simoldes have recently joined - and ISELED products from various manufacturers are available, including a complete demo kit. The first vehicles are also already equipped with it and there are further applications in the aviation and industrial sectors. In 2022, over 75 million ISELED components will be produced. Over 1 billion ISELED components are expected for 2026. And not only the number but also the variety of specific components (such as drivers, controllers, transceivers, microcontrollers, etc.) is increasing. For example, Inova Semiconductors is currently launching the ILaS bus transceiver INLT220Q (sample already available). The Inova roadmap for ISELED and ILaS products was explained: The second generations of Smart LED controllers and ILaS bus transceivers are planned for 2023 and the third generation as early as 2024.

NXP presented its latest microcontrollers for the ISELED/ILaS ecosystem. This is the new S32K3 Automotive MCU series, which is now available.

Elmos presented its first product with ILaS interface. It is the LED driver and gateway single-chip solution E521.45 (ELA-0891), which supports smart and discrete RGBs with ILaS. Prototypes will be available in early 2024.

Analog Devices has developed a technology called ADI E2B that enables efficient Ethernet connectivity to edge sensors and actuators. One of the first products in this family supports efficient bridging from 10Base-T1S to ISELED/ILaS without the need for a microcontroller on the edge node. This technology facilitates the integration of ISELED/ILaS into future automotive Ethernet-based architectures. Analog Devices introduced the new Ethernet-to-ILaS bridge chip E2B Hub AD330x, which is available in samples.

Asteelflash, a subsidiary of USI (which is part of ASE Holding), presented an integrated supply chain solution for automotive interior lighting jointly developed by Asteelflash, USI and Inova. It consists of driver ICs, LEDs and passive components. The ILaS protocol used in the solution can control various client modules including bus interfaces and decoding as well as the power management unit. The turnkey offering, from end-to-end process to design-to-manufacturing, is said by USI/Asteelflash to be a plug-and-play gateway for ambient lighting in vehicles.