Infineon plans to invest €5 billion to respond to the increased demand for semiconductors - if this is supported by an appropriate level of public funding. Infineon justifies the future target business model, which sets financial targets over the cycle, with increasing momentum in the target markets of automotive, industrial and IoT applications as well as renewable energies, among others. Based on an exchange rate of the US dollar to the euro of 1.00, revenue growth is expected to average more than 10% instead of the previous 9% +. Infineon also anticipates a significant improvement in profitability as a result of this growth: the Segment Result Margin is expected to average 25% in the future, compared to 19% previously.

Infineon has big plans

The main factors for the increase in earnings will be an increasing share of system solutions, a higher-value product/technology mix as a result of portfolio management, the expansion of cost-efficient 300 mm production and a disproportionately low increase in functional costs due to digitalization and scaling effects. The Group is including an explicit free cash flow target in its target business model instead of the previously stated investment ratio. Adjusted for major investments in front-end buildings, the free cash flow over the cycle should be in the range of 10% to 15% of sales.

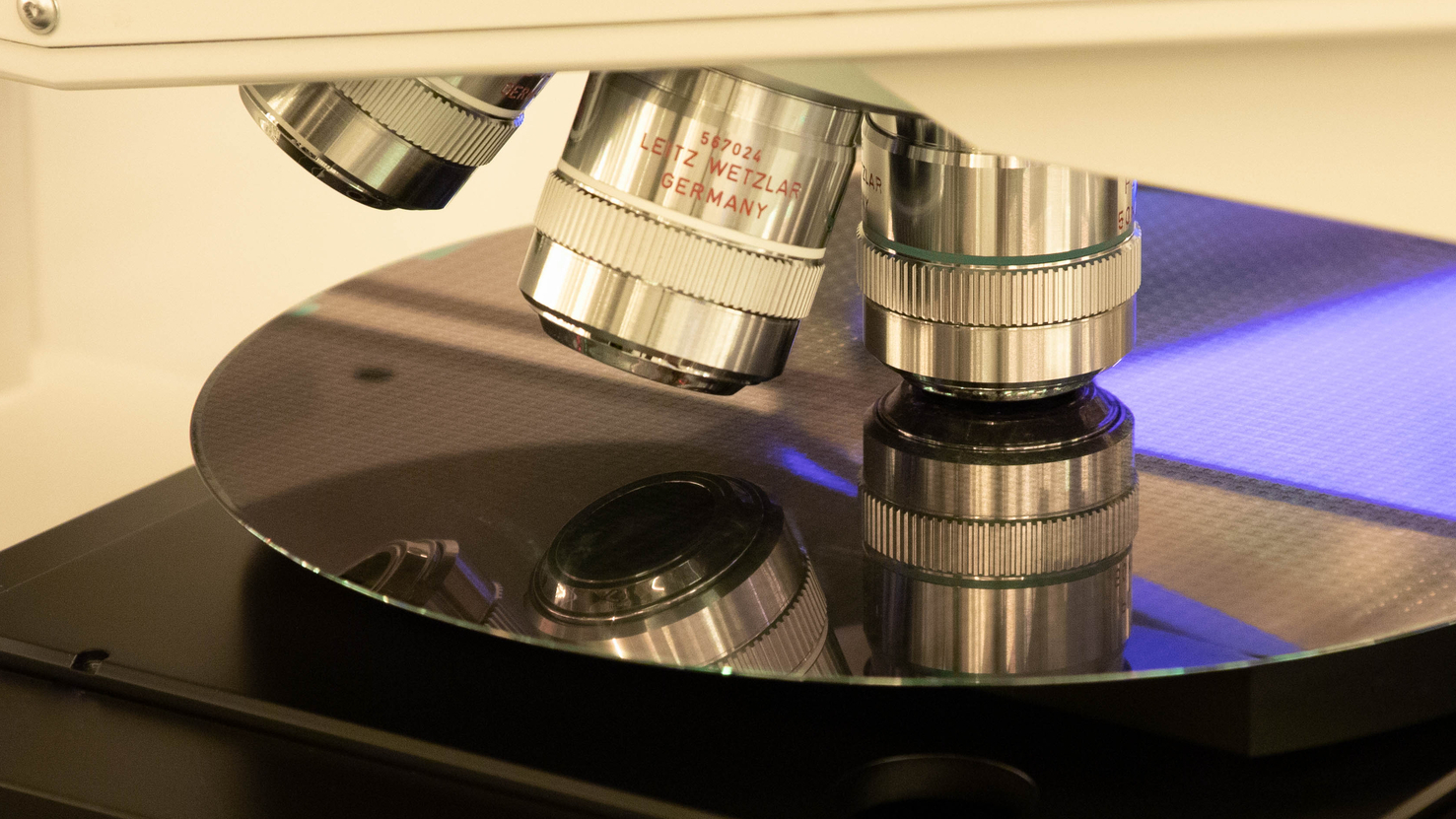

Planned production site in Dresden

In order to meet the expected growth in analog/mixed-signal and power semiconductors, Infineon plans to expand its 300 mm production capacity. The planned production site is Dresden. However, according to Infineon, this will only be possible if the investment receives an appropriate level of public funding. The planned investment sum of €5 billion would be the largest single investment in Infineon's history. At full capacity utilization, the annual sales potential of the planned factory would be at the level of the investment. The new plant is expected to create up to 1,000 new jobs and could be ready for production in fall 2026.

Business development in 2022

In the fourth quarter of the 2022 financial year, Group sales increased by € 525 million or 15% to € 4,143 million after € 3,618 million in the previous quarter. All segments contributed to the sales growth. The increase in sales was supported by the stronger US dollar compared to the previous quarter. The adjusted gross margin increased to 46.3% after 45.4% in the previous quarter. The segment result rose to € 1,058 million in the fourth quarter after € 842 million in the third quarter. The segment result margin improved to 25.5% after 23.3% in the previous quarter. Free cash flow improved to € 709 million in the fourth quarter after € 440 million in the previous quarter. Cash flow from operating activities from continuing operations rose to € 1,580 million after € 996 million in the third quarter.

Sales rose to € 14.218 billion, which corresponds to an increase of 29% compared to the previous year. The segment result improved to € 3.378 billion, an increase of 63%. The segment result margin rose by 23.8% and free cash flow amounted to € 1.648 billion (previous year: € 1.574 billion).

Outlook for the 2023 financial year

Assuming a €/US$ exchange rate of 1.00, sales of € 15.5 billion plus or minus € 500 million are expected for the 2023 financial year. This corresponds to growth of 9% compared to the previous year. At the center of the sales range, the adjusted gross margin should be around 45% and the segment result margin around 24%.

Investments, defined by the company as investments in property, plant and equipment and other intangible assets including capitalized development costs, of around € 3.0 billion are planned for the new financial year. The focus will be on the construction of the third production building for compound semiconductors at the Kulim site in Malaysia, the planned start of the aforementioned new building in Dresden and the expansion of capacity in front-end production, particularly in Dresden and Villach (Austria).

Depreciation and amortization should amount to around € 1.9 billion in 2023. Taking into account the planned front-end building expansions, free cash flow would reach around € 0.8 billion. Adjusted free cash flow is expected to amount to around € 1.5 billion, or around 10% of the forecast annual revenue of € 15.5 billion.

Dividend proposal for the 2022 financial year

After the dividend for the 2021 financial year was increased by € 0.05 per share compared to the previous year to € 0.27 per share, it is now planned to propose a further increase of € 0.05 per share to the Annual General Meeting in February 2023 in light of the company's improved economic performance in the 2022 financial year. If the Annual General Meeting approves the planned proposal, the dividend payment for the past financial year would increase to € 0.32 per share. The expected total dividend payout would then increase to €417 million after €351 million in the previous year.

On November 15, 2022, Infineon's Management Board held a live webcast for analysts and investors on the key topics discussed here. In addition, the annual results press conference was held with the Management Board. The content is available for download on the company's website.