Even with all new wafer fabs coming on stream in 2022, capacity utilization in semiconductor manufacturing remains extremely tight at 93.0%. This current outlook is provided by the February update of the well-known McClean Report 2022, which analyzes the trends in wafer starts up to 2026 and provides an overview of the IC industry's current production capacities.

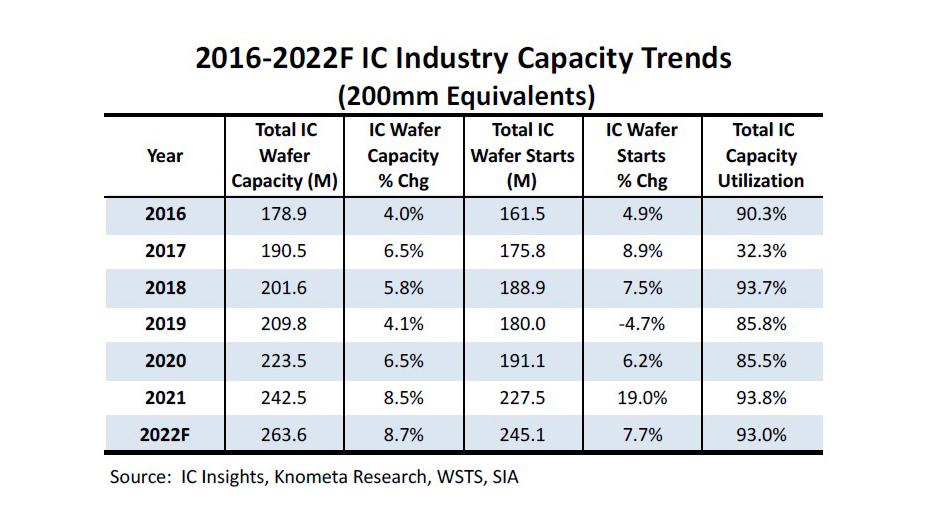

The number of 'wafer starts' is traditionally the benchmark for the volatile ups and downs of the semiconductor industry with sharp swings from year to year. Over the past five years, according to the new report by well-known US analyst Bill McClean, the growth rate of wafer starts has ranged from -4.7% in 2019 to +19.0% in 2021. The installed production capacity in relation to the number of processed wafers also fluctuates in line with market demand, albeit not as dramatically as the number of wafer starts (the new wafers introduced into all IC production process flows). Over the last five years, wafer capacity growth rates have fluctuated between 4.0% in 2016 and 8.5% in 2021, as shown in Figure 1.

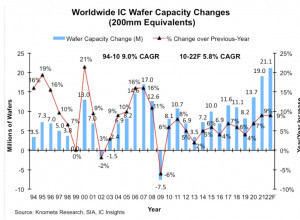

Figure 2: Global changes in wafer capacity between 1994 and 2022 (200 mm equivalents)Looking back historically, the global IC industry also experienced a decrease in wafer capacity for the first time. This happened in 2002, as shown in Figure 2. Seven years later, in the catastrophic year of 2009, there was an even greater loss of wafer capacity with a record 6%. This decline in the IC manufacturing base was triggered by sharp cuts in industry capital layouts of 29% in 2008 and as much as 40% in 2009. At the same time, much of the existing older 200mm diameter wafer manufacturing was shut down in response to the severe downturn in demand for semiconductor products. Semiconductor capacity grew by 8.5% in 2021 and is forecast to grow by 8.7% in 2022, with a record high in wafer starts.

Figure 2: Global changes in wafer capacity between 1994 and 2022 (200 mm equivalents)Looking back historically, the global IC industry also experienced a decrease in wafer capacity for the first time. This happened in 2002, as shown in Figure 2. Seven years later, in the catastrophic year of 2009, there was an even greater loss of wafer capacity with a record 6%. This decline in the IC manufacturing base was triggered by sharp cuts in industry capital layouts of 29% in 2008 and as much as 40% in 2009. At the same time, much of the existing older 200mm diameter wafer manufacturing was shut down in response to the severe downturn in demand for semiconductor products. Semiconductor capacity grew by 8.5% in 2021 and is forecast to grow by 8.7% in 2022, with a record high in wafer starts.

This sharp increase in capacity is primarily due to the ten new 300 mm wafer fabs that are starting up this year - three fewer than in 2021. The biggest increase is likely to come from the new fabs for memory devices from SK Hynix and Winbond. There will also be three new fabs from the world's largest contract manufacturer TSMC (two in Taiwan, one in China). Further 300-mm fabs are being built at CR Micro for power semiconductors, at Silan for discrete power semiconductors and sensors, at Texas Instruments for analog components, at ST/Tower for mixed-signal RF and power components and foundry services, as well as a new foundry fab at SMIC.

Despite rising inflationary pressures, ongoing supply chain issues and other disruptions to economic activity, Bill McClean believes demand for ICs should remain robust. His forecast for the number of ICs delivered in 2022 anticipates growth of 9.2%. Even with the ten new fabs announced, capacity utilization will remain at the extremely high level of 93.0% - only slightly below the previous year's figure of 93.8%.