The high cost of energy, the extreme shortage of skilled workers and labor, the bureaucracy: there are many factors that place a heavy burden on the surface finishing industry. In order to always have an up-to-date picture of the economic situation, the Verband für die Oberflächenveredelung von Aluminium e. V. (VOA) regularly conducts surveys among its member companies and takes the results into account in its discussions with politicians and business representatives.

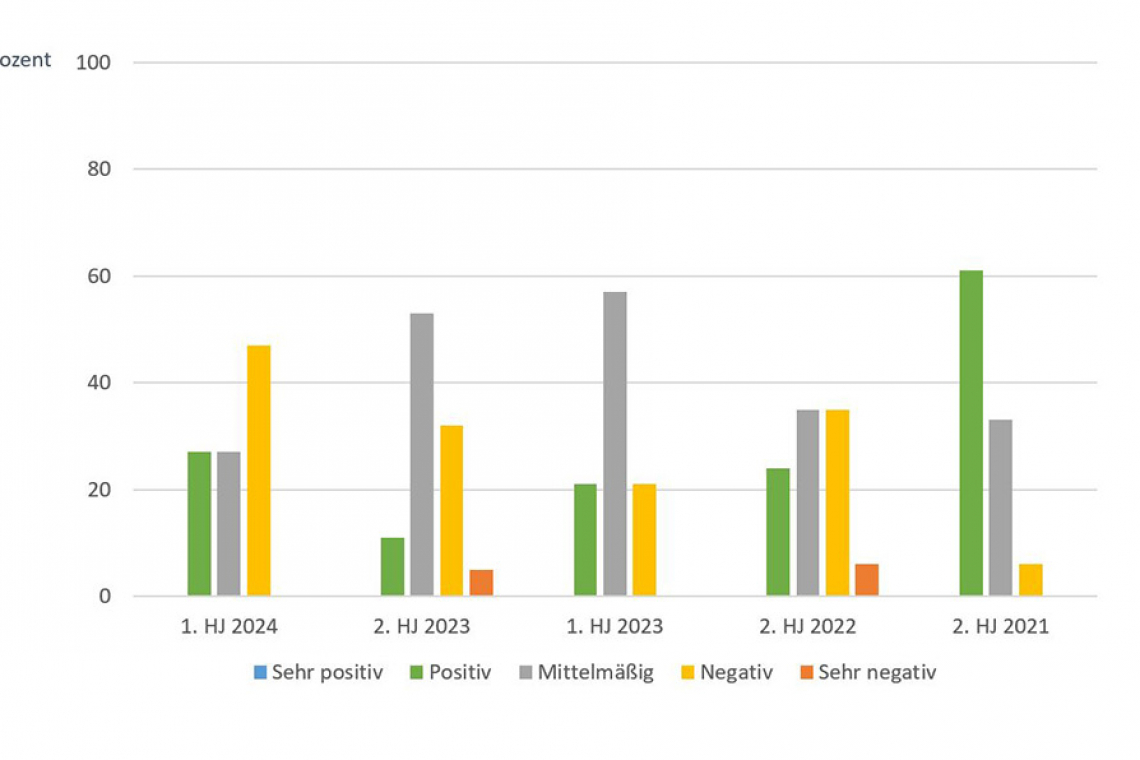

The current results from spring 2024, which the association compares with previous surveys, make this clear: Members' assessment of the economic development of companies is in line with the general situation and the forecasts of leading economic institutes. The creeping downward trend in the economy has been shaping the mood of the surface finishing industry since last autumn and is dampening the forecasts for 2024. Although there are no extremes with "very positive" or "very negative" assessments of the member companies in the evaluation of the current survey in March 2024 and measured against the "positive" and "mediocre" assessments for 2024, 53% see their economic situation as reasonably optimistic, but in October 2023 it was still 64% and in 2021 even 94%.

Currently, 47% of participating VOA members rate the development of their company as "negative"

The current results in detail: 47%, or just under half of the participating VOA members, currently rate the development of their company as "negative". In each case, 27% expect a "moderate" or "positive" development. There have been shifts from "average" in both the positive and negative direction - in October 2023, 53% of participating VOA members still expected "average" development, while only 37% expected "negative" and 11% expected "positive". A shift from a "very negative" assessment of 5% of VOA members in October 2023 to a "negative" assessment in March 2024 is also likely.

Capacity utilization of VOA member companies is 71% according to the current survey

The capacity utilization of VOA member companies is 71% according to the current survey. Compared to the previous survey in October 2023, it decreased by 19% on average, falling for the fifth time in a row. In 2021, capacity utilization still averaged 90% during the coronavirus pandemic. Turnover also fell for 73% of companies compared to the previous year, with an average decrease of 15% Only 20% of companies saw their turnover remain the same, while only 7% saw an increase. In comparison: in 2021, only 11% were affected by a decline in turnover.

In terms of orders already received this year, 73% of VOA members also noticed a decline, by an average of 17% compared to the previous year. Here too, a comparison with 2021 illustrates the current negative trend. Back then, only 6% of companies reported a drop in order figures. This development comes as no surprise, as the construction industry is currently struggling with massive losses and 93% of VOA member companies are mainly active in the construction/architecture sector. The positive aspect: despite the poor situation, there were no redundancies in 2024 or 2023.

In an international comparison, Germany is lagging behind economically and is at risk of losing touch. This is also reflected in the survey results for the surface finishing industry. Negative factors remain: The high energy prices are having a "considerable" impact on 60% of the companies participating in the survey and are "threatening the existence" of 7%. At 80%, they are also currently the main reason for the limited production of VOA member companies, while the shortage of labor and skilled workers and the effects of the Russia-Ukraine war rank second and third at 60% and 40% respectively. Supply bottlenecks only affect 13% of companies.