Gartner forecasts a rosy outlook for global chip sales. The rollercoaster ride continues. With around $600 billion in 2021 and 2022, two balanced years. Last year, the market shrank by 10.9% to USD 534 billion, mainly due to the weak first half of the year. According to the latest Gartner forecast, chip demand is expected to grow to USD 624 billion this year, corresponding to +16.8 %. Gartner also predicts growth of 15.5% to USD 721 billion in 2025, driven in particular by the AI and automotive segments.

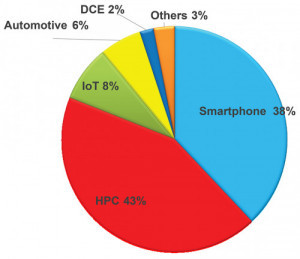

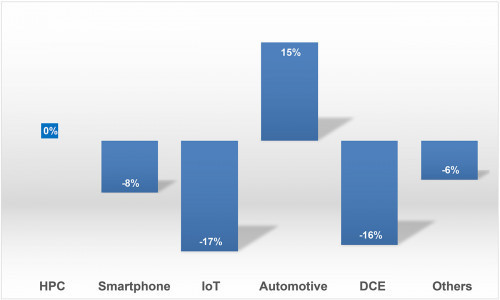

Taiwan Semiconductor Manufacturing Company Limited (TSMC) is the world's largest semiconductor manufacturer in terms of revenue, ahead of Intel and Samsung, and the world's largest independent contract manufacturer of semiconductor products. Looking at the industry segments that TSMC supplies, high-performance computers (HPC) will have a 43% share in 2023, ahead of smartphones with 38%(Fig. 1). Internet of Things (IoT) accounts for 8% of revenue, Automotive for 6% and Data Communication Equipment (DCE) for 2%. Growth by segment also varies from quarter to quarter (QoQ)(Fig. 2). HPC is flat, smartphone as a seasonal item at -8% over the full year 2023, IoT at -17%, but automotive at a stable +15%.

Production in a 12″ wafer fab at Taiwan Semiconductor Manufacturing Company Limited

Production in a 12″ wafer fab at Taiwan Semiconductor Manufacturing Company Limited

A look into the future

Even the current situation is impressive. In Q4 2023, three quarters of the TSMC technology portfolio already consisted of high-performance chips with 3 nm to 16 nm structures. 3 nm chips have grown to a 15% share of sales, 35% have 5 nm nodes, followed by 17% with 7 nm structures and 8% with 16 nm nodes.

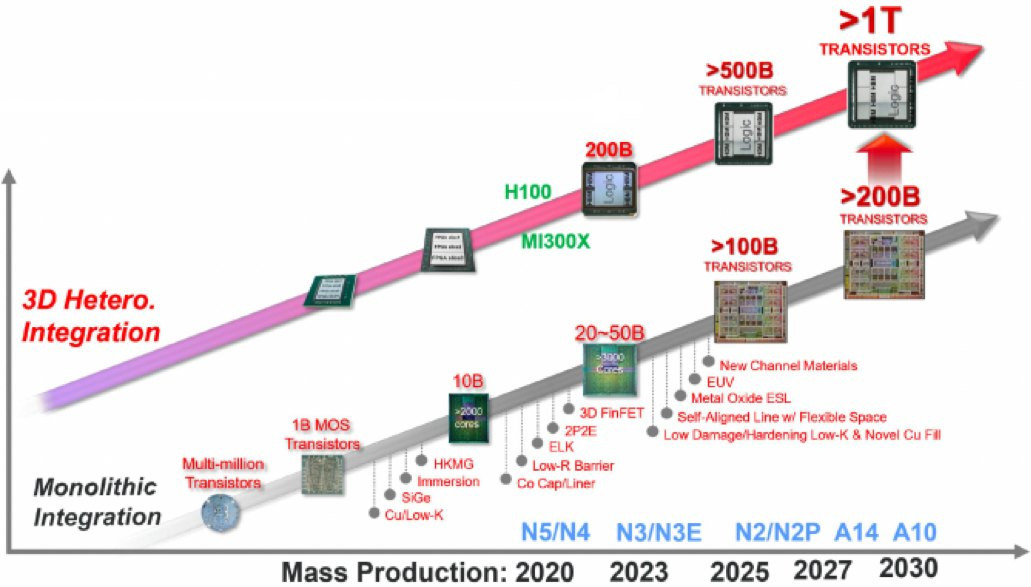

The TSMC roadmap was presented at the most recent IEDM conference and shows the ambitious targets up to 2030(Fig. 3).

200 billion transistors are to be achieved in a monolithic design by 2030. Currently, the largest monolithic TSMC chip for Nvidia, the H100, has 80 billion transistors.

Intense competition between Samsung, Intel and TSMC for 2 nm processes

But the competition is not sleeping either. The current chiplet designs are getting bigger and bigger. For comparison: Intel's Ponte Vecchio has over 100 billion transistors and AMD's new MI300 has 146 billion transistors. TSMC's goal is to accommodate one billion transistors in one package by 2030 using multiple 3D stacked chiplets.

Intel is also pursuing similarly ambitious goals with chiplets and advanced packaging. What is particularly interesting about this timetable is that Intel is already planning the production of its own 2 nm process, called Intel 20A, for 2024. After that, the transition to 1.8 nm or Intel 18A is expected in 2025. These are still targets that will not always be achieved. At present, Intel is said to be on schedule. If Intel can actually produce a 20A CPU called Arrow Lake this year, it will theoretically have overtaken TSMC for the first time in a long time. This has been Intel's catch-up strategy all along with its 'five-nodes-in-four-years' plan that began in 2021.

Samsung Electronics has been producing in the SF3E process with 3nm nodes since 2022. The switch to 2nm nodes (SF2) is scheduled for 2025. The SF1.4 (1.4 nm) process is expected to go into mass production in 2027.

This announcement intensifies competition in advanced semiconductor manufacturing, especially in the development of 2.5D/3D Integrated Heterogeneous Structure Packaging between the three major semiconductor foundry giants.

To the point

- This year, global chip demand is expected to grow to USD 624 billion, corresponding to +16.8%. Growth of 15.5 % to USD 721 billion is also forecast for 2025, driven in particular by the AI and automotive segments.

- Global market leader TSMC produced 67% of its chips in the 3 nm, 5 nm and 7 nm structure in Q4 2023, with semiconductors with 3 nm nodes already accounting for 15% of sales.

- The main growth at TSMC in Q4 2023 was probably due to seasonal factors: smartphones with +27% (QoQ), high-performance computers with +17% and the automotive segment with +13%.

- TSMC and Intel want to produce structures up to 1nm by 2030. This should enable one billion transistors in one housing using several 3D stacked chiplets.

The so-called 'rat race', a merciless competition between the chip giants, has been going on since Intel lost the technological lead to TSMC several years ago. It is exacerbated by the smouldering Taiwan conflict, as TSMC has its most technologically advanced fabs in Taiwan to date. The economic war for global economic leadership between the USA and China has been boosted by the Ukraine war and the new East-West conflict, which is being exacerbated by the new Middle East conflict. The race for the chip industry as a substantial future technology plays a key role in this. The desire for security of supply and protection of the technology, particularly in the defense sector, has led to a three-digit billion dollar wave of investment in new semiconductor production plants in the USA, Europe and Japan, with no end in sight.

I wish you a successful February. Please stay with us.

Best regards

Best regards

Yours

Hans-Joachim Friedrichkeit