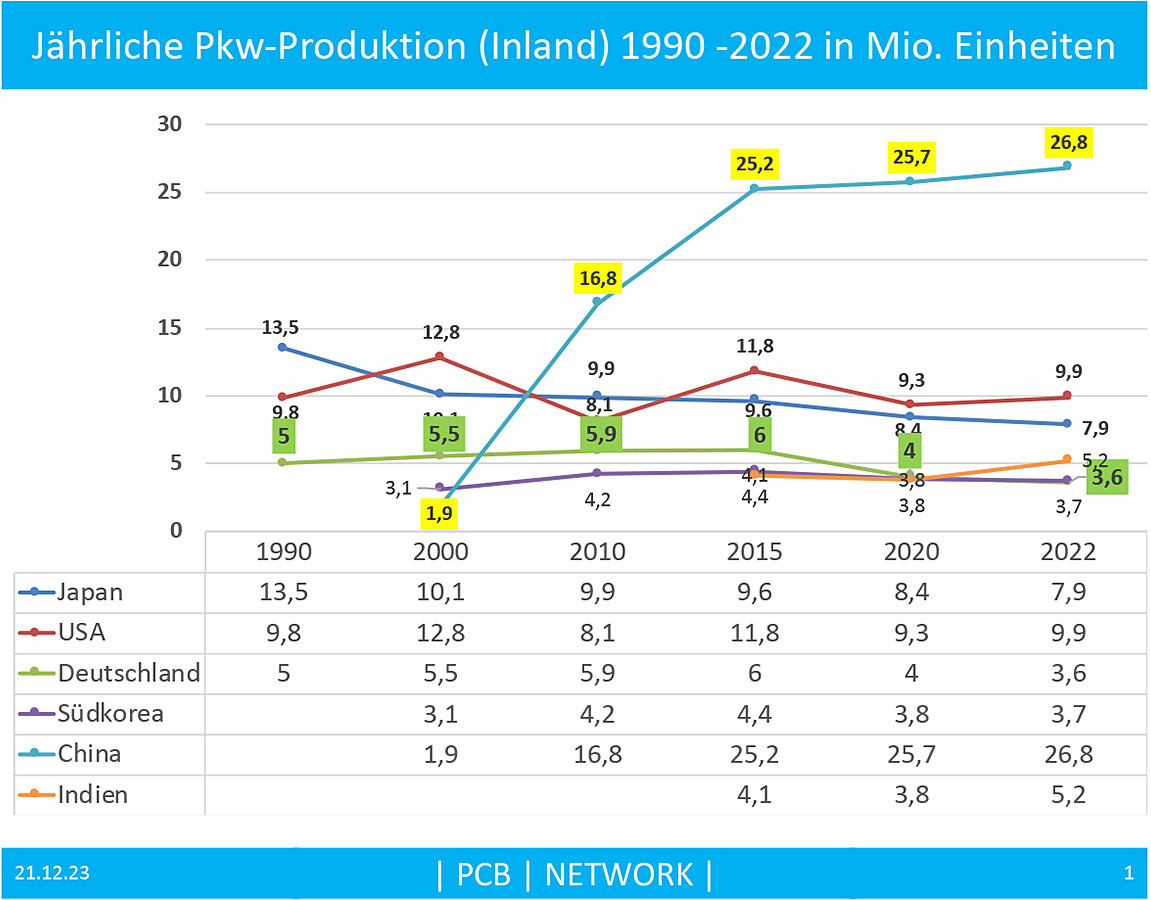

If you are looking for something impressive in today's world, the rise of the Chinese automotive industry is a good example (Fig. 1). From a modest 1.9 million vehicles produced in 2000 to a world-beating 26.8 million vehicles, including 23.8 million passenger cars, in 2022, the success story continues.

The clever Chinese business model of 'market access in exchange for technology transfer', through which Western car manufacturers sold their 'know-how', should not be forgotten. Another growth lever was the joint venture policy. At least a 50% share by a Chinese company was the rule for Western car manufacturers setting up companies in China.

Fig. 1: Motor vehicle production (domestic) in millions of units 1990 - 2022 within the most important automotive countries

Fig. 1: Motor vehicle production (domestic) in millions of units 1990 - 2022 within the most important automotive countries

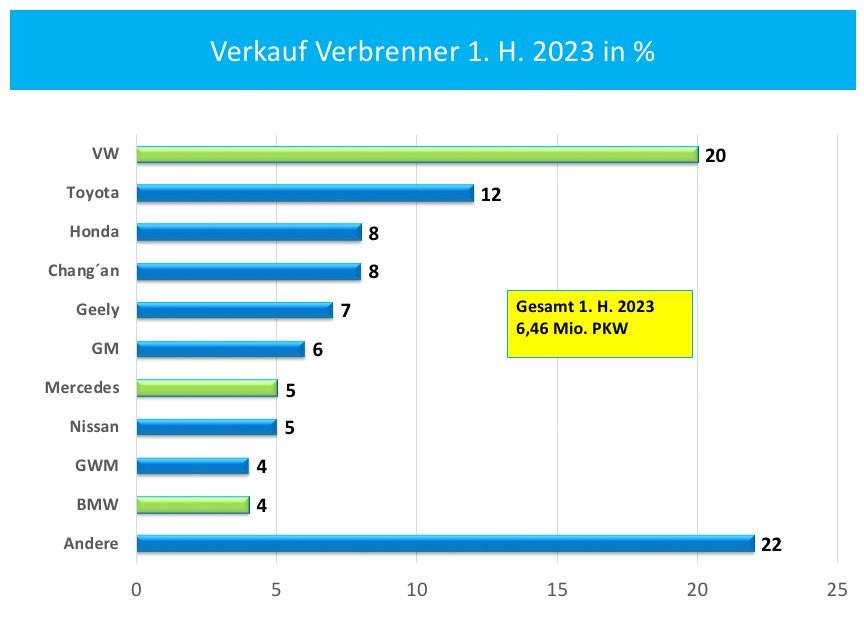

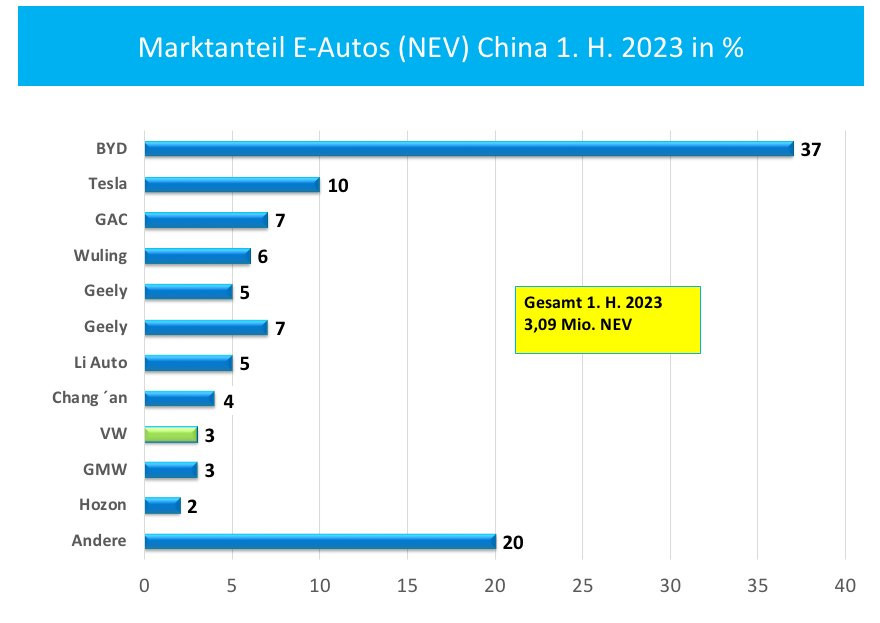

VW thus became the market leader in the Chinese market for combustion engines(Fig. 2) and achieved a market share of 19.3% in 2022. Today, on the other hand, VW has a modest 3% market share in the promising e-car segment in H1 2023(Fig. 3). The market leader in this segment is BYD with 37% battery electric and hybrid cars, which are classified as New Electric Vehicles (NEV) in China, followed by Tesla with 10%.

Fig. 2: Sales of combustion engines in China 1st half 2023 in %

Fig. 2: Sales of combustion engines in China 1st half 2023 in %

Fig. 3: Market share of electric cars (NEV) China 1st half 2023 in %

Fig. 3: Market share of electric cars (NEV) China 1st half 2023 in %

The global passenger car market is growing again

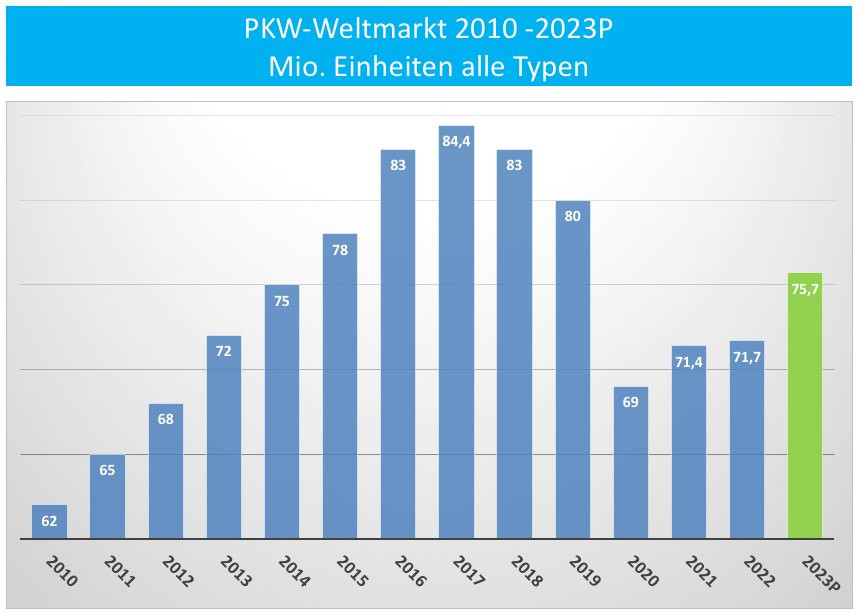

Even before the coronavirus pandemic, the global car market had been shrinking since 2017, even if politicians liked to use the Ukraine war as an excuse(Fig. 4). The crash then followed the pandemic in 2020 to 69 million units and did not move much in 2021 and 2022. According to VDA estimates, the market only grew by 6% to 75.7 million cars last year.

Fig. 4: Global passenger car market all types in million units 2010-2023P

Fig. 4: Global passenger car market all types in million units 2010-2023P

Chinese overcapacity is pushing into Europe

The capacity for passenger cars is around 41 million units of combustion E-cars and are therefore only around 58% utilized. According to China experts such as Jörg Wuttke, BASF's long-standing Chief Representative in China and President Emeritus of the European Chamber of Commerce in China, China could increase capacity to around 50 million vehicles by utilizing all shift models.

Market access to the USA is now virtually blocked by the economic dispute and a 25% import duty; the same applies to Japan with a 19% tax rate.

Due to its liberal import restrictions, Chinese exports are now concentrating on the EU.

When will China overrun Europe with e-cars?

When will China overrun Europe with e-cars or 'New Electric Vehicles' (NEVs), as they are called in Chinese? Chinese manufacturers have been opening sales bases in Germany and Europe almost every month since the end of 2022. They also made a major appearance at the International Motor Show (IAA) in Munich in September last year. But the big run has yet to materialize.

Chinese manufacturers such as BYD, Nio and Great Wall delivered just 8,000 cars in Germany in the first ten months of 2023. That is a meagre 2% of all registrations.

Chinese e-cars are still being sold at a price premium of around 50% in Germany and Europe. This means that the price advantage over European brands is currently comparatively small. Added to this is a still rudimentary service and dealer network and Chinese brands that are still little known in this country.

China's limiting factor until 2027: car transportation

Car transport by ship overseas has so far been a specialized business for a few shipping companies with fixed contracts for manufacturers such as VW or Toyota (cover picture). Shipping companies such as Wilh. Wilhelmsen and Wallenius Lines as well as the Norwegian shipping company Höegh are among them. The latter currently operates 5 of the largest transporters for 8,500 cars each, which transport VW models from Bremen to the USA and Asia, for example. At the beginning of 2022, Höegh ordered four new Aurora-class ships with a capacity of 9,100 vehicles. They should be sailing the world's oceans from the second half of 2024.

China is solving this logistics problem in its own way and is building its own fleet. 170 new car carriers have been ordered and will be available by 2026/2027. The turnaround time China-Europe-China is approx. 80 days with an average of 8,000 cars per trip. From 2027, a transport capacity of at least 4 million e-cars per year to Europe, South America and Southeast Asia will be established.

In a nutshell

- According to the VDA, the global passenger car market should grow by 6% to 75.7 million units last year.

- The rise in Chinese car production from 1.9 million vehicles in 2000 to a world-leading 26.8 million vehicles, including 23.8 million passenger cars in 2022, is impressive. This would not have been possible without the transfer of technology from Western companies in exchange for market access.

- According to China experts, Chinese capacity is expected to be 41 million units - a significant overcapacity compared to the 26.8 million vehicles produced.

- With the US and Japanese markets blocked by import duties, Chinese NEV manufacturers are primarily pushing into Europe. So far, the share of new registrations from 1-10/2023 is just 2% (8,000 cars).

- The development of a dealer network and service stations is currently only one obstacle. Another issue is the ability to deliver due to a lack of Ro-Ro ships for transportation from China. China has ordered 170 new ships that will enable an annual transport capacity of at least 4 million cars from 2027.

There are currently 1,470,000 million cars worldwide, with an electric car population of 27.7 million in 2022. According to a study by PWC, 75% of all new registrations in the USA will still be combustion vehicles in 2035 and 35% even in China. In addition, there will be new combustion vehicles in South East Asia, South America and Africa due to the long distances and lack of charging infrastructure.

Who will German car manufacturers leave the production of at least 40 million new combustion engines, which will still be needed worldwide in 2035, to?

The EU's strict ban on combustion engines from 2035 means that European and, above all, German car manufacturers have stopped further developing combustion engines. In 2021, German manufacturers will still have produced 13 million combustion cars worldwide. So who will we leave the production of 40-50 million combustion cars to in 2035?

Perhaps we first need mass redundancies at VW, Mercedes, Bosch, Conti, ZF or smaller suppliers before this no-alternative ban policy is reconsidered with common sense.

I wish you a successful start to 2024.

Yours sincerely

Hans-Joachim Friedrichkeit