Semiconductor sales worldwide were like riding a rollercoaster this year. After USD 573 billion in 2022, the first half of 2023 saw a significant downturn, but slight growth returned in the second half of the year. The Semiconductor Industry Association (SIA) expects a decline of 10% this year to a total of USD 515 billion.

The PC and smartphone market will hardly provide any growth impetus in 2023. By contrast, drivers are artificial intelligence, electromobility and high-performance computing, which will ensure a strong upturn again in 2024. According to a study by McKinsey, the semiconductor industry is expected to break the one trillion dollar sales barrier by 2030.

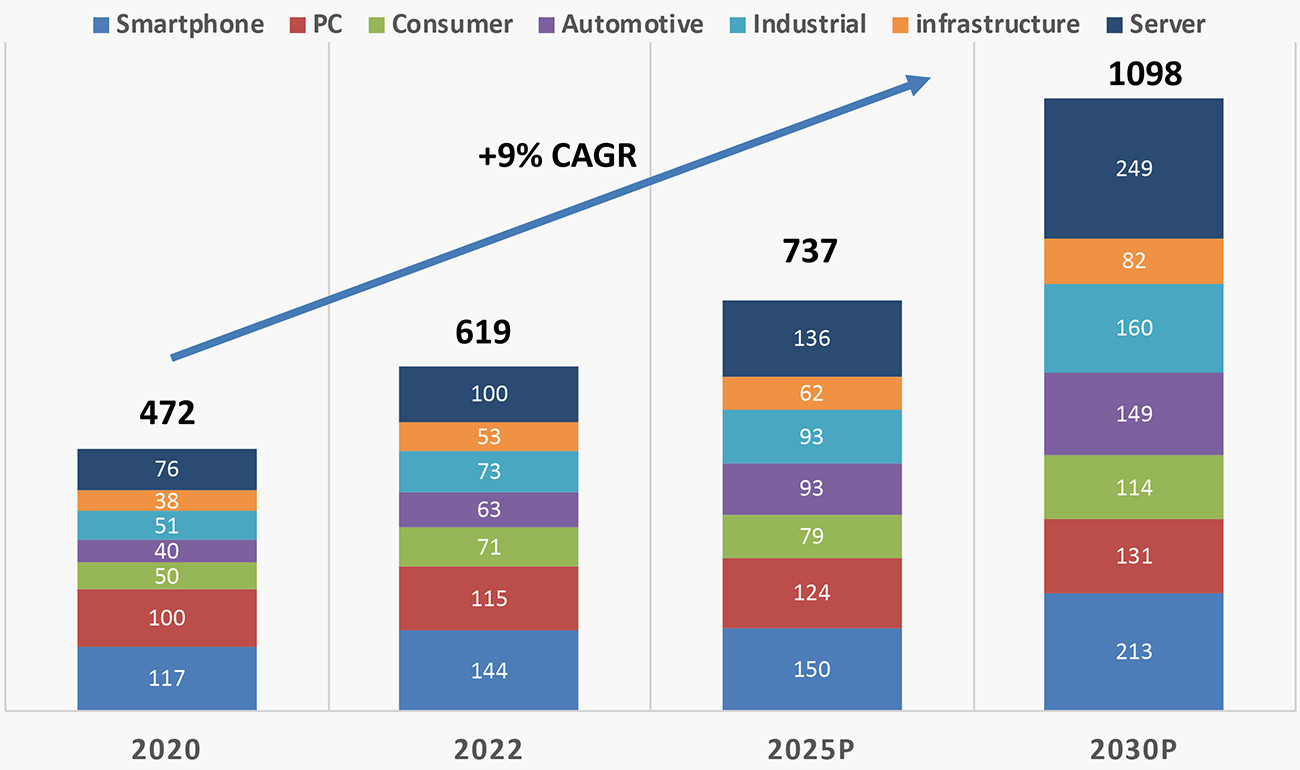

According to the projections of the Semiconductor Industry Association (SIA) and ASML, the Dutch global market leader in exposure systems, demand for semiconductors will grow by an average of 9% per year (CAGR 2020-2030). Of course, the projection does not rule out interim ups and downs.(Fig. 1).

Demand for PCs is expected to grow by only 3% p.a. and for smartphones by 6%. The 'shooting star' is the automotive industry at +14% p.a.

Driven by new technologies such as AI, VR and AR, demand for data storage, data transmission and data analysis is increasing worldwide, with IC demand at +13% p.a. The industrial electronics segment is also one of the disproportionately high growth areas at +12% p.a.

Fig. 1: IC demand by industry 2020-2030P in billion USD (data ASML, SIA)

Fig. 1: IC demand by industry 2020-2030P in billion USD (data ASML, SIA)

Investment trend in the semiconductor industry

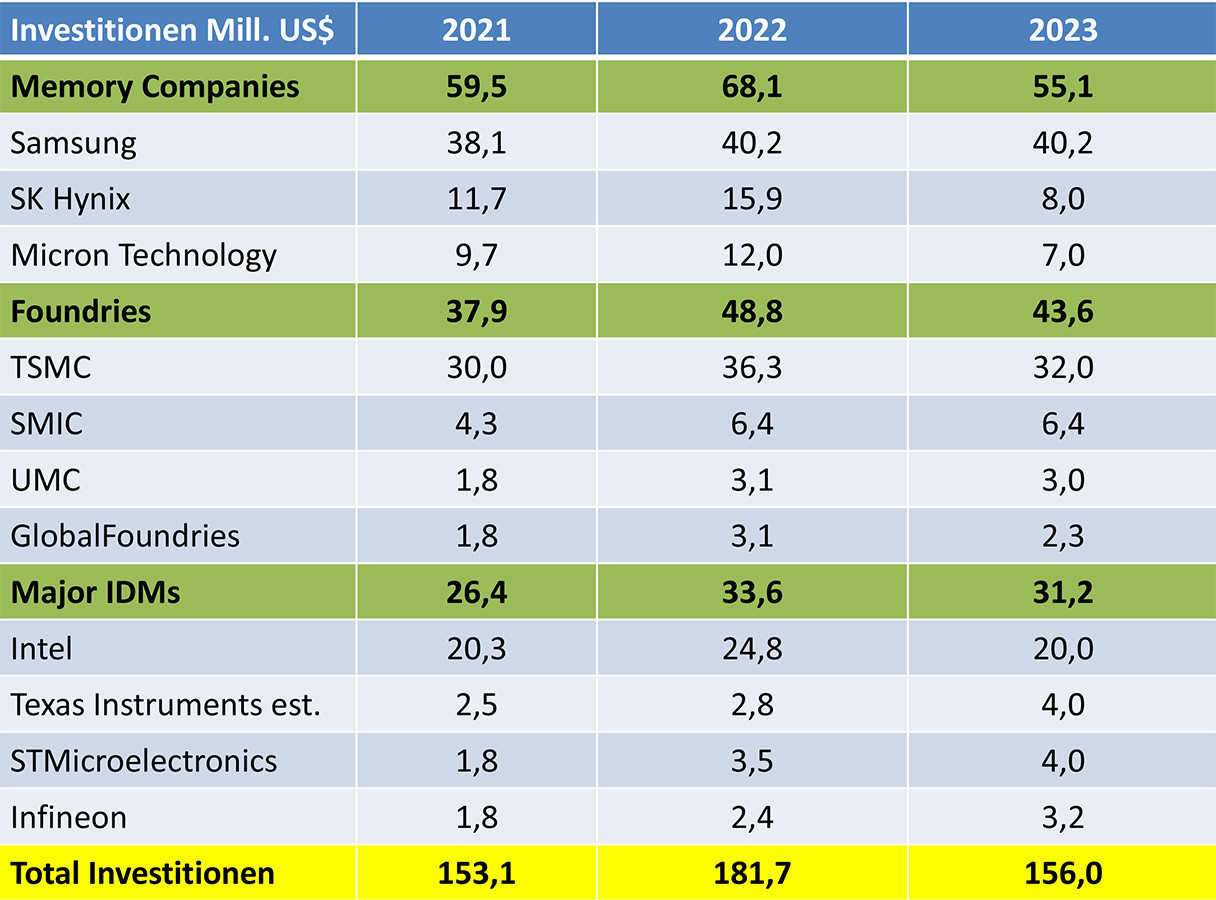

Strong investment years for the semiconductor industry were 2021 with +35% investment volume and 2022 with +19%. According to an analysis by 'Semiconductor Intelligence', the investment volume is set to shrink by -14% this year(Fig. 2).

The focus of the investment cuts will be on memory manufacturers at -19%. SK Hynix and Micron Technology are particularly affected here.

Foundries are expected to cut their investments by -11%, led by GlobalFoundries with -27% and TSMC with -12%.

The investment behavior of integrated chip manufacturers (IDMs) is heterogeneous. While INTEL is cutting back by - 19 %, TI + 43 % est., ST Microelectronics + 14 % and Infineon + 34 % are expected to buck the trend and increase their investments in 2023.

Fig. 2: Investments by the largest semiconductor manufacturers 2021-2023 in USD billion (data: companies, IC INsights, SC Intelligence)

Fig. 2: Investments by the largest semiconductor manufacturers 2021-2023 in USD billion (data: companies, IC INsights, SC Intelligence)

Market shares of foundries

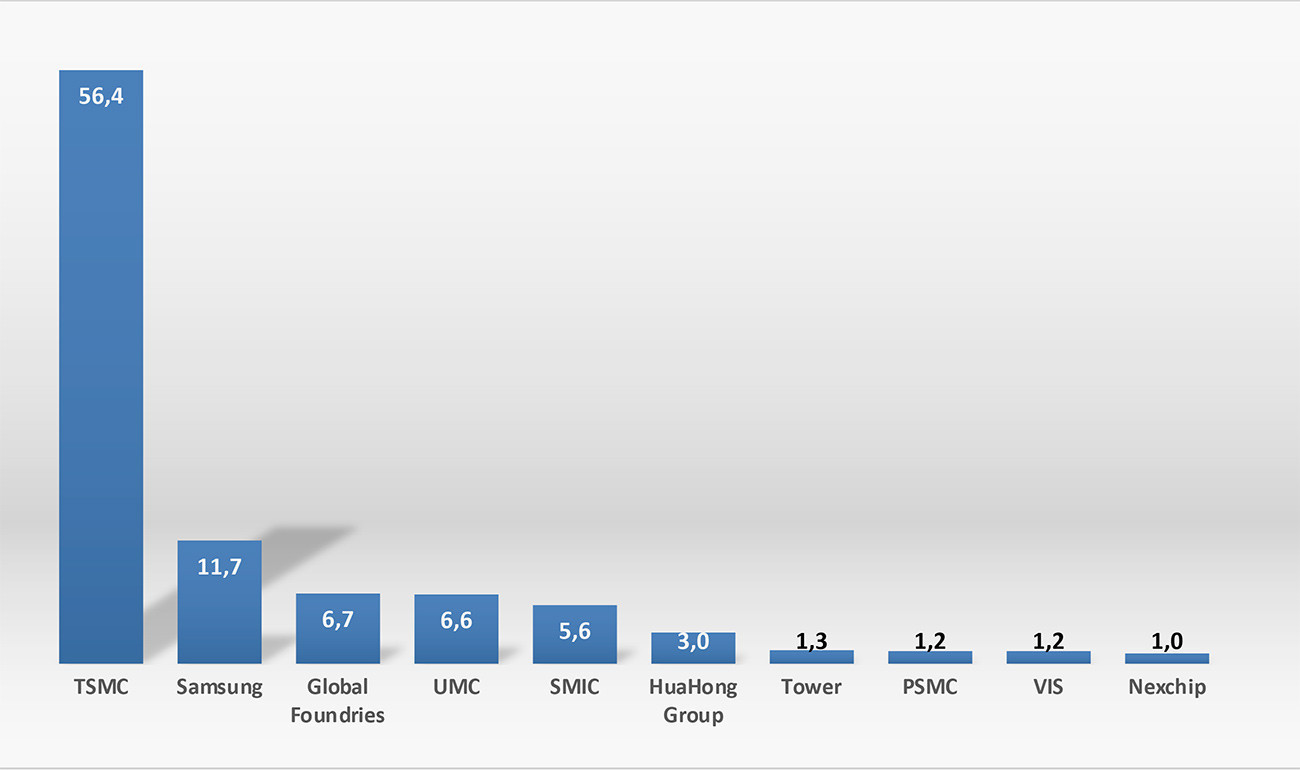

The market shares of the largest contract chip manufacturers (foundries) clearly show the importance of TSMC in Taiwan for the global electronics industry(Fig. 3). With 56.4% in Q2 2023, TSMC is not only a solitaire in terms of size, but also technologically with 2 nm structures.

The gap to No. 2 and No. 3, the Korean global corporation Samsung and the US corporation GlobalFoundries, is enormous.

Fig. 3: Market shares of the TOP 10 contract chip manufacturers (foundries) in Q2 2023 (data: Trendforce)

Fig. 3: Market shares of the TOP 10 contract chip manufacturers (foundries) in Q2 2023 (data: Trendforce)

Fabless chipmakers

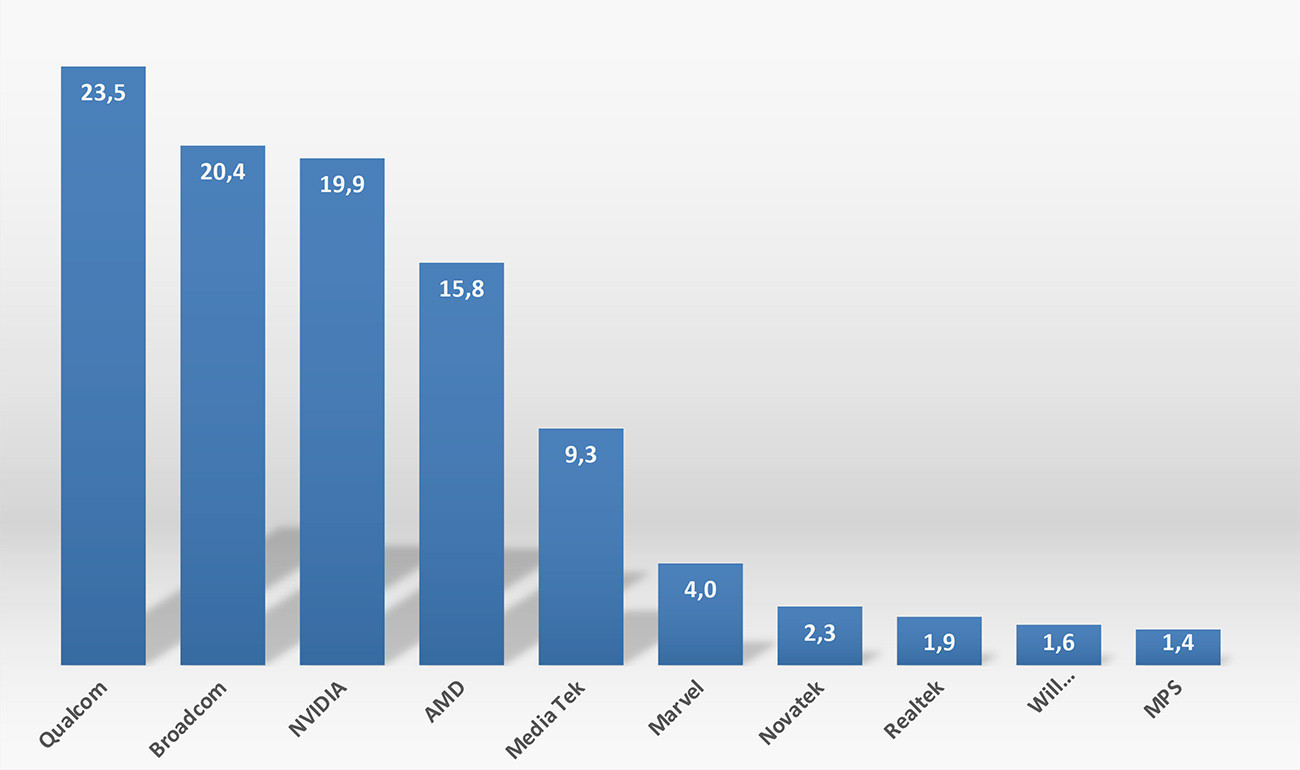

Fabless chipmakers develop the design and hardware, but outsource the production of the chips to foundries such as TSMC. The intellectual property (interlectual property) remains with the chip design houses(Fig. 4). Qualcom and the A. I. 'shooting star' Nvidia are fighting for energy efficiency in object recognition for automated driving in the automotive industry, e.g. at Mercedes and BMW. This involves the number of server queries per watt for recognizing traffic situations. Another example is chatbots for recognizing natural language. Here, samples per watt are counted as a performance feature.

The top 3 design houses Qualcom, Broadcom and Nvidia are in a neck-and-neck race with a market share of around 20% each.

Fig. 4: Market shares of fabless chip manufacturers/design houses in Q1 2023 (data: Trendforce)

Fig. 4: Market shares of fabless chip manufacturers/design houses in Q1 2023 (data: Trendforce)

The demand for A. I. chips is growing rapidly

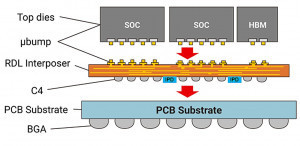

Fig. 5: Chip-on-wafer-on-substrate (CoWoS) packaging from TSMC

Fig. 5: Chip-on-wafer-on-substrate (CoWoS) packaging from TSMC

The use of Generative A. I. models such as Google Bard, ChatGPT and Dall-E is growing rapidly. These technologies require AI chips such as AMD Instinct and Nvidia H100. These semiconductors are manufactured using TSMC's CoWoS (Chip on Wafer on Substrate) packaging technology. As the use of GenAI increases dramatically, the demand for chips is also growing rapidly.

TSMC is expanding its capacity from the current 12,000 wafers per month to 15,000 to 20,000 wafers per month by ordering additional equipment. The target is a capacity of 30,000 wafers per month.

"Generative AI (Artificial Intelligence) is a form of artificial intelligence that generates new content based on specifications and existing information", as the Bigdata Insider defines it. "AI processes and technologies such as trained neural networks, machine learning (deep learning) and AI algorithms are used to generate text, images, audio and video content, program codes, 3D models and more in accordance with instructions."

In a nutshell

- Semiconductor demand is expected to exceed one trillion dollars by 2030 despite strong fluctuations. Drivers are the automotive sector (+14% p.a.) and high-performance computing, e.g. for A.I. (+13% p.a.).

- After strong investments of USD 153 billion (+ 35 %) in 2021 and USD 182 billion (+ 19 %) in 2022, investments are expected to fall to USD 156 billion (- 14 %) this year. The market slump in the first half of 2023 is a factor here.

- TSMC will remain the solitary foundry in Q2 2023 with a global market share of 56%, followed by Samsung with 11% and GlobalFoundries with 7%.

- The three largest fabless manufacturers form a relatively homogeneous group in Q1 2023 with Qualcom, 23%, Broadcom and Nvidia each with 20% market share.

- The demand for A. I. chips in CoWoS packaging technology (Chip on Wafer on Substrate) from TSMC is increasing rapidly. TSMC is currently expanding its capacity from 12,000 wafers per month to 30,000 wafers per month.

Generative AI models such as Google Bard, ChatGPT and Dall-E are changing our world. They make many things easier because they recognize patterns and structures from the analysis of huge volumes of data and generate something new from them. It becomes borderline when, for example, applicants are analyzed and rejected using only AI, or when AI decides whether a difficult operation is necessary without a human being taking part in the decision-making process.

However, we should not stifle a promising and prosperous new field of business with German, i.e. superficial, regulations and laws. Our global competitors have no regard for excessive German sensitivities.

I would like to thank all readers for their suggestions, criticism and comments on the 21st annual report.

My thanks are combined with best wishes for a peaceful Advent and Christmas season.

Stay with us in 2024 as well.

Best regards

Best regards

Yours

Hans-Joachim Friedrichkeit