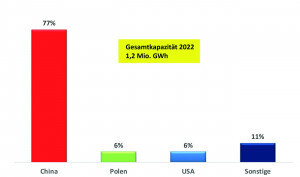

Even though global sales of electric cars are currently weakening somewhat, the production capacity of lithium-ion batteries in GWh is expected to increase eightfold by 2027. Based on a global production capacity of 1.2 million GWh in 2022, Bloomberg forecasts an increase to 8.9 million GWh by 2027(Fig. 1 and 2). China currently still dominates production capacity with 77%, but this is set to fall to 69% by 2027. The USA in particular wants to expand its production capacity to 908 GWh. This is still a large gap compared to China with a planned 6,197 GWh capacity expansion. Germany's plans, with an announced 503 GWh battery production capacity by 2027, are rather questionable given the current reluctance to invest.

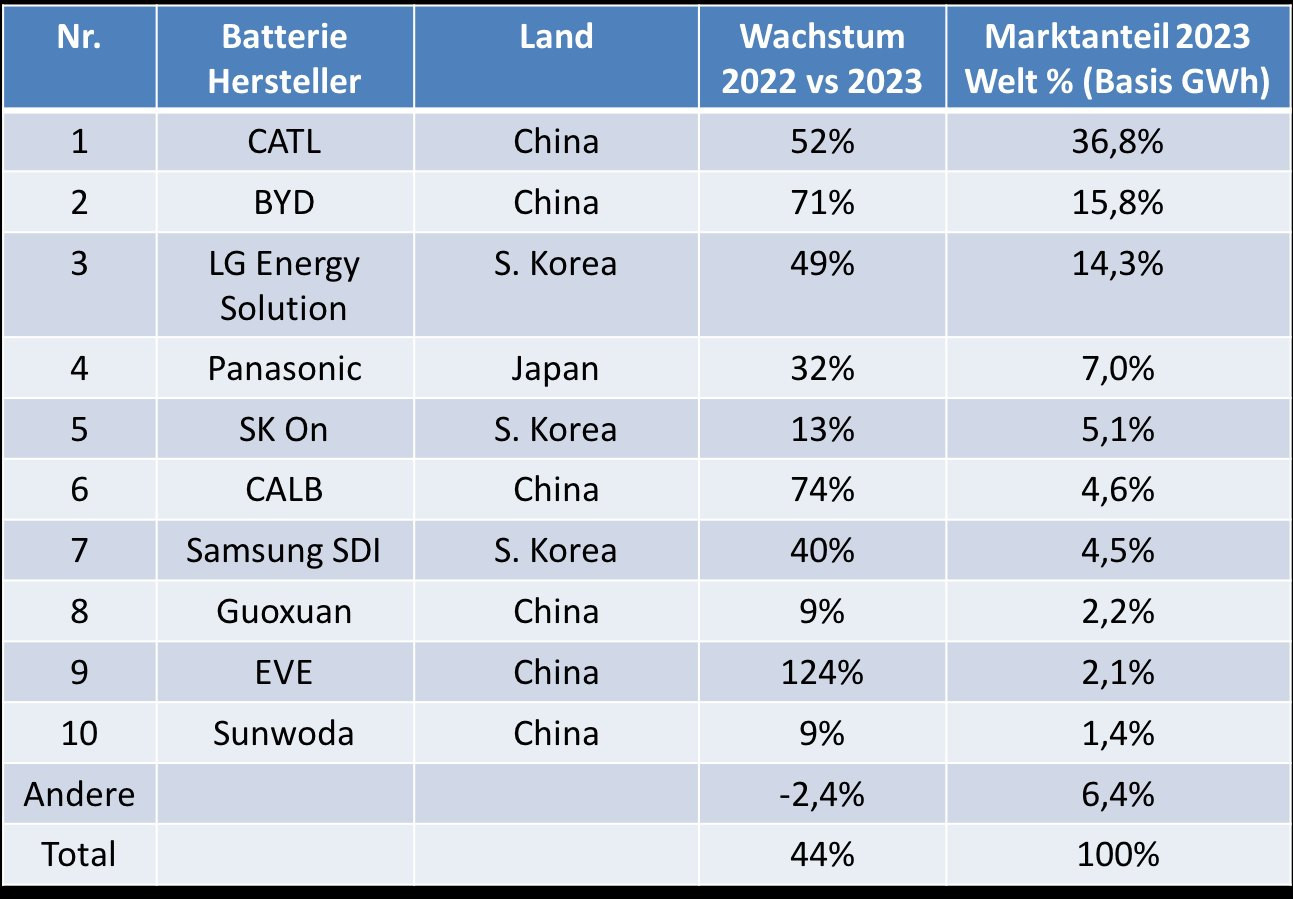

Six of the ten largest car battery manufacturers are in China

China is and will remain the leading market for electromobility in 2023. With 5.14 million BEVs, 23.7% of all new registrations in China were electric cars or hybrids. Europe (EU+EFTA+UK) accounted for around 2 million BEVs or 15.4% of new registrations, while the USA accounted for 1.2 million BEVs or 7.7% of registrations.

It is therefore no wonder that CATL will remain the leader in the market for electric car batteries in 2023(Figure 3), as CATL dominates the Chinese market. CATL also has a very strong second place outside China.

Fig. 3: Top 10 battery manufacturers in 2023 - basis GWh (data: SNI Research 10-2023)

Fig. 3: Top 10 battery manufacturers in 2023 - basis GWh (data: SNI Research 10-2023)

CATL recorded year-on-year growth of 52.1% (178.9 GWh) in 2023, making it the only battery supplier in the world to account for more than 30% of the global market share. CATL has expanded its presence from the domestic market to overseas and recorded growth on all continents except China in 2023, almost doubling compared to the same period last year. CATL's batteries are used in major electric car models in the Chinese domestic market, such as GAC Group's Aion Y and Geely's ZEEKR 001, as well as vehicles from the world's largest OEMs such as the Tesla Model 3/Y, BMW iX and Mercedes EQS. As the batteries are used in a wide range of vehicle models, CATL is experiencing continuous growth. LG Energy Solution has lost its second place to BYD because the Chinese battery manufacturer has greatly expanded its market position thanks to its automotive business.

As a battery manufacturer, BYD has so far almost exclusively supplied its own automotive business.

What is new is that BYD is now supplying LFP batteries to Tesla.

The Korean companies SK On and Samsung SDI have lost market share in favor of the Chinese battery manufacturers CALB and EVE Energy, which are benefiting from the fast-growing Chinese NEV market.

Panasonic, the only Japanese company in the top 10 list, recorded year-on-year growth of 32.3% with 33.8 GWh. Panasonic is one of Tesla's most important battery suppliers and installs the majority of its batteries in Tesla models on the North American market. Although the company announced a decline in its battery cell production last September, Panasonic's growth has been driven by the Tesla Model Y, sales of which increased rapidly compared to the same period last year.

No European or American battery manufacturer made it into the top 10 ranking.

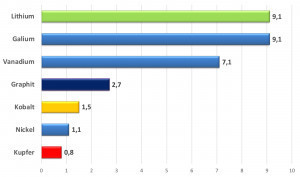

Growth in demand for raw materials by 2050 vs. 2020

- Lithium: The demand for lithium is expected to increase tenfold by 2050. The main focus of mining is in Chile and by far in Australia. The high water requirement for extraction in the dry areas of the Atacama Desert is the main risk here(Figure 4)

- Gallium for the production of semiconductors and solar cells is extremely rare and hardly recyclable. High water consumption and environmental risks make extraction difficult. 90% of supplies come from China, which poses a particular supply risk.

- Graphite is the ideal material for the anode. It is applied to a copper foil together with binders and usually with conductive additives, forcing the lithium atoms to find a fixed place in the lattice structure of the material. This has the following advantages: higher cycle stability, better performance during fast charging and higher quality consistency compared to other battery types. Looking at production capacities by country as a percentage, China dominates the battery anode market with 92.6%. (see PLUS 11/2023)

- Copper: Copper demand is also expected to increase 0.8-fold. The main producing countries Chile and Peru will struggle to meet the rising demand, even though copper is highly recyclable.

In a nutshell

- According to a Bloomberg analysis, the expansion of production capacities for batteries is set to increase eightfold by 2027. China's market share is expected to be 70%, the USA wants to increase its battery capacities to 10% and Germany, with doubts, to 6%.

- CATL remained the global market leader last year with 36.8%, now followed by BYD with 15.8%. Korea's LG Energy Solution was pushed into third place with a market share of 14.3%.

- As the leading market for electromobility, China is driving battery production in the country with 5.14 million electric cars. Europe (EU+EFTA+UK) only produced around 2 million BEVs and the USA 1.2 million BEVs.

- The demand for raw materials such as lithium, gallium, graphite, cobalt and copper will increase tenfold in some cases by 2050. De-risking is hardly possible in some cases due to producing countries such as China or the Congo.

Batteries are a key component of the energy transition. With the umbrella concept for battery research, the BMBF is laying the foundations for excellent battery research, sustainable value chains and rapid transfer from research to application. This is more or less the dream of the politicians.

The fact is that six of the ten largest battery manufacturers for electromobility come from China. No European or American battery manufacturer has made it into the top 10.

The global market leader CATL alone invests around €2 billion in research and development, while German funding for battery research is irritatingly low.

Despite all the bad news, don't lose your sense of humor.

Best regards

Best regards

Yours

Hans-Joachim Friedrichkeit