Forecasts predict that by 2030, around 48% of all cars sold will be electric. Based on the targets set at the UN Climate Change Conference in Glasgow in November 2021, it is reasonable to speculate that the transition to EVs, which is already well underway in 2021, will accelerate in the current decade. This article looks at how the global PCB industry can benefit from this process and who the key players in this market are.

Fig. 1: Toyota's 2021 Mirai fuel cell carCurrently,not a day goes by without hearing or reading about electric vehicles (EV). The abbreviation EV covers the battery-powered vehicle (BEV), as the Europeans like to distinguish it, the plug-in hybrid vehicle (PHEV), the hybrid vehicle (HEV) and the fuel cell vehicle (FCV, Hydrogen Fuel Cell). The Chinese simply call them all New Energy Vehicles (NEV).

Fig. 1: Toyota's 2021 Mirai fuel cell carCurrently,not a day goes by without hearing or reading about electric vehicles (EV). The abbreviation EV covers the battery-powered vehicle (BEV), as the Europeans like to distinguish it, the plug-in hybrid vehicle (PHEV), the hybrid vehicle (HEV) and the fuel cell vehicle (FCV, Hydrogen Fuel Cell). The Chinese simply call them all New Energy Vehicles (NEV).

We have known electric vehicles for many years as golf carts, forklift trucks, electric bicycles, etc. With the advent of powerful lithium-ion batteries, long-distance electric vehicles became possible. Some can travel more than 800 km on a fully charged battery, although such a premium model is still very expensive. It is said that Toyota's new FCV Mirai ('future' in Japanese), launched in 2020, can travel 850 km on three hydrogen tanks. In May 2021, it was announced that during a test drive in and around Paris, with all three tanks filled once, a distance of more than 1000 km was driven using a fuel-efficient driving style, which is a new world record. The Mirai was refueled with green hydrogen for the record attempt(Fig. 1, 2).

The battery pack consists of 330 cells with a specific power density of 5.4 kW per liter. The basic version of the Mirai is offered by the manufacturer in Europe for 63,900 euros [1]. Further basic parameters: Hydrogen consumption combined 0.89-0.79 kg/ 100km. Electricity consumption combined 0 kW/100km,CO2 emissions combined 0 g/km. By using AI, the Mirai's Predictive Efficient Drive - as with Toyota hybrids - can learn repeatedly driven routes to optimize battery charging and discharging and maximize fuel consumption and range.

Unlike BEV charging, which still takes many minutes to over an hour, hydrogen gas can be filled in less than five minutes and the cost of pressurized hydrogen gas is no more than regular gasoline, according to Toyota. The company plans to increase Mirai production capacity tenfold by 2030 from the current 30,000 units per year (2021). However, while BEV sales in Europe are experiencing significant growth rates from year to year, the market for FCVs is consistently low. Reasons for this: a sparse network of hydrogen filling stations, high vehicle prices, low acceptance to date

Fig. 2: View of the Mirai's three hydrogen tanks

Tesla leads the sales table

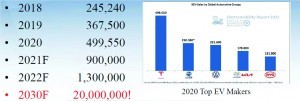

Fig. 3: BEV sales and sales targets at Tesla and the top five EV manufacturers in 2020 The best-selling electric cars are Tesla's BEV models, both in terms of units and dollar value. Tesla sold nearly half a million of its BEV vehicles in 2020 and is targeting 900,000 units sold in 2021 with the Model S, 3, Y, etc., which would represent an increase of more than 70%. According to Tesla, the price for the Tesla Model 3 with a standard range plus of around 450 km was €40,000 in Germany in 2021. After deducting all government purchase incentives and exchange premiums, the buyer is left with around €30,000. With its Model 3, the manufacturer has achieved first place among the best-selling cars in Europe for the first time. As data from the analysis company Jato Dynamics shows, 24,591 vehicles from the series were newly registered in September alone [2]. This is the first time that an electric vehicle has led the monthly market, but also the first time that a vehicle manufactured outside Europe has taken first place.

Fig. 3: BEV sales and sales targets at Tesla and the top five EV manufacturers in 2020 The best-selling electric cars are Tesla's BEV models, both in terms of units and dollar value. Tesla sold nearly half a million of its BEV vehicles in 2020 and is targeting 900,000 units sold in 2021 with the Model S, 3, Y, etc., which would represent an increase of more than 70%. According to Tesla, the price for the Tesla Model 3 with a standard range plus of around 450 km was €40,000 in Germany in 2021. After deducting all government purchase incentives and exchange premiums, the buyer is left with around €30,000. With its Model 3, the manufacturer has achieved first place among the best-selling cars in Europe for the first time. As data from the analysis company Jato Dynamics shows, 24,591 vehicles from the series were newly registered in September alone [2]. This is the first time that an electric vehicle has led the monthly market, but also the first time that a vehicle manufactured outside Europe has taken first place.

There are signs of a turning point in the automotive market. For many months now, only new registrations of electric cars have been growing in Europe, while sales of petrol and diesel vehicles have fallen sharply.

Recently, a Tesla company representative announced that the company plans to deliver around 20 million units in 2030(Fig. 3). This figure is not too high, as many countries around the world are considering banning the sale of cars with internal combustion engines (ICEs) by 2030.

Other car manufacturers are keeping a close eye on this exciting market. These include the traditional companies, of course, but also new companies that have never produced cars in the past. Many of the latter are based in China (there are said to be over 300). In addition, there are new players such as IT groups like Amazon and electronics giants like Sony, Hon Hai (Foxconn) etc., which have recently expressed serious ambitions to participate in the car market of the near future. This raises the following question: Will Tesla be able to maintain its leading position in the coming years, e.g. by building the new BEV factories in Germany (Grünheide near Berlin) and in China?

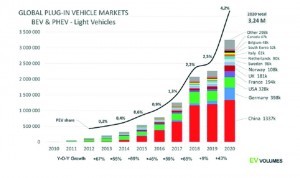

Fig. 4: Development of the EV sales market up to 2020Thereare many forecasts about the future sales of electric vehicles. What all these forecasts have in common is 'UP and UP', i.e. high and even higher. Figure 4 shows how the real sales market for 'light EV cars' (passenger cars) of the BEV and PHEV types has developed up to 2020. Last year, it already amounted to over 3.3 million vehicles. The three largest markets were China, Germany and the USA. Based on the ratio of the population of these countries, Germany's position in this group of three is already considerable.

Fig. 4: Development of the EV sales market up to 2020Thereare many forecasts about the future sales of electric vehicles. What all these forecasts have in common is 'UP and UP', i.e. high and even higher. Figure 4 shows how the real sales market for 'light EV cars' (passenger cars) of the BEV and PHEV types has developed up to 2020. Last year, it already amounted to over 3.3 million vehicles. The three largest markets were China, Germany and the USA. Based on the ratio of the population of these countries, Germany's position in this group of three is already considerable.

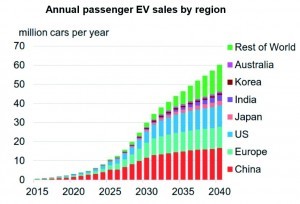

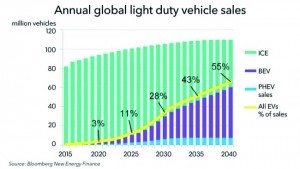

Figure 5 shows how Bloomberg New Energy Finance believes things will develop up to 2040. China, Europe and the USA are the leading regions of the world, although China, with its huge population, is probably somewhat underestimated by the authors of the data for 2040. Figure 6 clearly demonstrates the process of the gradual transition to EVs, as already indicated by the monthly sales figures from September 2021. According to the Bloomberg report from 2018, passenger cars and light vehicles similar to passenger cars will already account for 55% of total vehicle sales in this group by 2040.

Other market research companies are taking a bolder approach to their estimates: Research and Markets, for example, assumes in its February 2021 report that electric vehicles will account for 48% of all new cars sold by 2030 [3]. The market research company Canalys estimates in its report 'Electric vehicle outlook: 2021 and beyond' from February 2021 that EVs will also account for around 48% of all cars sold in 2030 [4]. Is this hidden cooperation with Research and Markets?

These examples show, on the one hand, that it is very difficult to estimate the pace of development of the EV market with any degree of accuracy and, on the other hand, that the pace is increasing significantly from year to year.

Acceleration factor: falling battery prices

Lithium-ion battery prices fell by 89% between 2010 and 2020, with the volume-weighted average reaching USD 137/kWh [5]. Underlying material prices will play a greater role in the future, but the introduction of new chemistries, new manufacturing techniques and simplified pack designs are driving prices down further. Tesla reported in early November 2021 that its electric cars will soon be gradually equipped with cheaper batteries. The magic point of 100 USD/kWh is seen as crucial for the further development of EV sales. It is expected to be reached in 2023, when electric cars will be price-competitive with conventional cars and sales figures will grow significantly [6]. According to Bloomberg, the almost complete electrification of all road transport will account for around 25% of global electricity demand in 2050, which means that enormous additional electricity generation capacity will have to be provided in the form of 'green energy' compared to now - in parallel with the transition from the current fossil to 'green' electricity.

Bloomberg has so far published many contradictory sales forecasts for electric vehicles. Right now, at the end of 2021, Europe has stronger electric vehicle sales than the United States - perhaps politically motivated. Apparently, electric vehicle buyers have been given huge subsidies of up to €10,000 per electric vehicle by the German government. Subsidies seem to come in many different forms: Simple cash support to exemption from highway tolls as in the UK, etc.

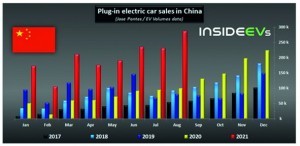

TheCO2 emission limits set by the EU also appear to play a major role. In 2021, they are to be 95 g/km for passenger cars.CO2-neutral(zero emissions) is the slogan of the most important countries in the world. This target will be difficult to achieve as long as the number of ICE cars (cars with combustion engines) is not significantly reduced. Until the end of the year, it is impossible to predict how many new cars will be sold in 2021, especially as most car manufacturers are closing their plants for weeks or even longer due to acute shortages of semiconductor chips and other components: Some are talking about 80-82 million units sold. Sales of electric vehicles could reach around 6 million units in 2021. Although electric vehicles still account for less than 10% of total new car sales in 2021, assuming 80 million units, their growth is phenomenal: from 3.3 million units in 2020 to an expected 6 million in 2021, extrapolating the figures in Figure 7 to the end of 2021. Global EV sales in August 2021 amounted to 516,461 units, an increase of 114% compared to August 2020. China alone could sell 2.2 to 2.4 million electric cars in 2021(Fig. 8). In August, 284 156 units were already sold there. In Germany, the sales figure in August was 53,357 electric vehicles(Fig. 9). The increase compared to August 2020 is 61%. This is 27.6% of total car sales in the country.

Impact on PCB manufacturers

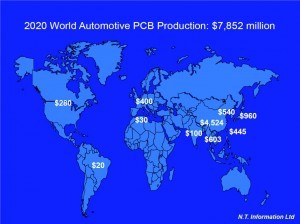

2020 was not a good year for most PCB manufacturers, whose focus is on automotive applications. Their revenue fell by an average of around 20% compared to 2019. So far this year, they have all recovered well. The author's revenue estimate for PCB production in the automotive industry amounted to around $7.85 billion in 2020. Part of this rather large figure is due to the increasing supply of electric vehicles, which use higher quality boards than most internal combustion engine cars. With a recovery of 20% and currency appreciation of around 7% in the countries of the two largest PCB manufacturers in the world, Taiwan and China (around 45% of all automotive PCBs were produced in China in 2020), automotive PCB production could exceed $10 billion in 2021 at floating exchange rates. We shall see.

Tables 1 and 2 on the previous page are the author's estimates of automotive PCB sales by major manufacturers worldwide and geographic regions in 2020, respectively.

|

Rank |

Manufacturer |

Country |

Turnover |

|

1 |

CMK |

Japan |

531 |

|

2 |

Nippn Mektron |

Japan |

520 |

|

3 |

Meiko |

Japan |

490 |

|

4 |

Chin Poon |

Taiwan |

420 |

|

5 |

Kingboard Chem PCB |

China |

410 |

|

6 |

Unimicron |

Taiwan |

380 |

|

7 |

TTM |

USA |

316 |

|

8 |

KCE |

Thailand |

310 |

|

9 |

Tripod |

Taiwan |

309 |

|

10 |

Kinwong |

China |

275 |

|

11 |

WUS |

China |

217 |

|

12 |

AT&S |

Austria |

210 |

|

13 |

Dynamic |

Taiwan |

201 |

|

14 |

Olympic |

China |

145 |

|

15 |

Ellington |

China |

142 |

|

16 |

Nanya PCB |

Taiwan |

120 |

|

17 |

Unitech |

Taiwan |

120 |

|

18 |

ASK PCB (Aoshikan) |

China |

120 |

|

19 |

Victory Giant (VGT) |

China |

105 |

|

20 |

Gultech |

Singapore |

101 |

|

Top 20 Total 2020 |

5442 |

N.T. information Ltd.

|

Rank |

Manufacturer |

Country |

Turnover |

|

21 |

DSBJ |

China |

100 |

|

22 |

Onpress |

China |

95 |

|

23 |

Kyoden |

Japan |

91 |

|

24 |

Bomin |

China |

90 |

|

25 |

Shirai Densi |

Japan |

85 |

|

26 |

CCTC |

China |

85 |

|

27 |

Swiss |

Switzerland |

85 |

|

28 |

Fujitsu Interconnect |

Japan |

70 |

|

29 |

Suntak |

China |

70 |

|

30 |

Shennan Circuits (SCC) |

China |

70 |

|

31 |

APEX International |

Taiwan |

60 |

|

32 |

SZ Fast Print |

China |

60 |

|

33 |

Kyosha |

Japan |

53 |

|

34 |

Shengyi Electronics |

China |

45 |

|

35 |

Kyocera |

Japan |

40 |

|

36 |

Daisho Densi |

Japan |

40 |

|

South Korea estimated |

South Korea |

540 |

|

|

Other estimated* |

Worldwide |

731 |

|

|

Total 2nd group |

2410 |

* Including USA, Europe, India and Southeast AsiaN.T. information Ltd.

Fig. 10: Estimated regional share of automotive PCB production in 2020 As mentioned above, about 45% of automotive PCB boards with the estimated total value of $7.85 billion were produced in China. Major Taiwanese and Japanese automotive PCB manufacturers such as Chin Poon, Tripod, Dynamic, Unimicron and Unitech from Taiwan, and Meiko and CMK from Japan have significant production bases in China. Figure 10 shows the author's estimated regional distribution of automotive PCBs produced in 2020.

Fig. 10: Estimated regional share of automotive PCB production in 2020 As mentioned above, about 45% of automotive PCB boards with the estimated total value of $7.85 billion were produced in China. Major Taiwanese and Japanese automotive PCB manufacturers such as Chin Poon, Tripod, Dynamic, Unimicron and Unitech from Taiwan, and Meiko and CMK from Japan have significant production bases in China. Figure 10 shows the author's estimated regional distribution of automotive PCBs produced in 2020.

As China's capacity for automotive PCBs continues to grow and more and more electric vehicles are produced there, the production value in the country will soon exceed 50% of the global value. China is expected to steadily increase its share. Domestic' automotive PCB production in the US, Europe and Japan will be limited to rush orders, prototypes and small to medium volumes. When it comes to mass production, PCBs will mainly be produced in Asia-Pacific regions, especially in China. By 2025, PCB production for the automotive industry could reach $16-17 billion, almost double the 2020 production. We will see.

Further new business opportunities

While the production prospects of automotive PCB manufacturers presented here directly demonstrate the great opportunities for the industry in automotive manufacturing, they are even greater if we take a closer look at the charging infrastructure still to be developed worldwide for electric cars, equivalent to the existing filling station system. The high share of EVs already expected for 2030 according to Figures 5 and 6 reveals the major dilemma facing many countries with regard to the equivalent number of public and individual charging stations that will then need to be set up and the additional electricity supply capacity required. This also applies to Germany.

Fig. 11: Wallbox charging facilities from Heidelberg can increasingly be found in numerous locations such as hotels, supermarkets and businesses . At the same time, this is an indication that both the semiconductor industry and EMS are facing good business opportunities alongside PCB producers. As demonstrated by Heidelberger Druckmaschinen, companies from outside the industry are also jumping on the 'EV bandwagon'. The German company, traditionally focused primarily on the production of printing machines, has created a new additional business area with the development and production of wallbox charging equipment (e.g. Home Eco), which is to be expanded considerably in the coming years.

Fig. 11: Wallbox charging facilities from Heidelberg can increasingly be found in numerous locations such as hotels, supermarkets and businesses . At the same time, this is an indication that both the semiconductor industry and EMS are facing good business opportunities alongside PCB producers. As demonstrated by Heidelberger Druckmaschinen, companies from outside the industry are also jumping on the 'EV bandwagon'. The German company, traditionally focused primarily on the production of printing machines, has created a new additional business area with the development and production of wallbox charging equipment (e.g. Home Eco), which is to be expanded considerably in the coming years.

It is not only the established European electronics industry that will have to increasingly assert itself against new entrants to the electronics market such as Heidelberg. It will also have to measure itself against the rapid, targeted sales work that Heidelberg, for example, is displaying. Back in April 2020, the company announced that its boxes were already available in France, the UK, Italy, the Netherlands, Austria, Switzerland and Spain. In addition to the established electronics retail chains such as Saturn and Media Markt, it also makes significant use of the Amazon retail platform. The future market for EVs does not just have to be left to Asian countries such as China.

Translation, editing and additions: Dr. Hartmut Poschmann

References:

[1] www.toyota.de

[2] Tesla ends the Golf era, article from 25.10.2021, www.welt.de

[3] https://www.researchandmarkets.com/reports/5451125/electric-vehicle-outlook-2021-and-beyond

[4] www.canalys.com/newsroom/canalys-global-electric-vehicle-sales-2020

[5] https://about.bnef.com/electric-vehicle-outlook/

[6] https://seekingalpha.com/research