Dependence on Asian manufacturers is still high

The market for e-cars is booming. Around 200,000 e-cars were sold in Germany in 2020. IHS Markit estimates global sales of e-cars at 4 million in 2021, an increase of 70%. Global sales are expected to grow to 12.2 million by 2025.

Volkswagen sold around 230,000 e-cars worldwide in 2020: 2.5% of total production. This year, 800,000 units are already planned(Fig. 1).

Further growth rates are also considerable. According to a study by the Boston Consulting Group, the global market share for e-cars will rise from 3% at present to 7% in 2025 and 18% in 2030(Fig. 2).

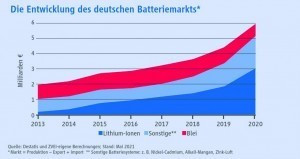

In 2020, the German battery market grew by 35% year-on-year to €5.9 billion(Fig. 3). Lithium-ion batteries accounted for the largest share with a volume of €3 billion and growth of 63%. Applications here were e-cars, power tools, e-bikes and smartphones. Other batteries such as nickel-cadmium, alkaline-manganese, zinc-air, etc. also grew. In contrast, the market for lead batteries shrank by 26% to €740 million. Applications here include starter batteries for cars or buffer batteries for data centers or hospitals. Overall, the German battery market grew by 172% between 2014 and 2020, which shows the growing importance of energy storage systems.

New battery generation in the EQS

Fig. 4: Final inspection of an EQS at Mercedes Factory 56 in SindelfingenWhenthe new electric flagship from Mercedes was unveiled in May of this year, a new generation of batteries was also launched. With an output of up to 385 KW, the EQS is supplied with a battery of over 100 KWh. The EQC used lithium-ion batteries with cathodes consisting of nickel, cobalt and manganese in a material ratio of 6:2:2. In the EQS, the cathode-material mix has now been improved to 8:1:1. In particular, the ecologically and socially questionable mining of cobalt has been reduced.

Fig. 4: Final inspection of an EQS at Mercedes Factory 56 in SindelfingenWhenthe new electric flagship from Mercedes was unveiled in May of this year, a new generation of batteries was also launched. With an output of up to 385 KW, the EQS is supplied with a battery of over 100 KWh. The EQC used lithium-ion batteries with cathodes consisting of nickel, cobalt and manganese in a material ratio of 6:2:2. In the EQS, the cathode-material mix has now been improved to 8:1:1. In particular, the ecologically and socially questionable mining of cobalt has been reduced.

Daimler buys the new battery cells from the Chinese companies CATL and Farasis.

Top 10 battery manufacturers worldwide

CATL from China, the No. 1, had a global market share of 24% in 2020. A battery capacity of 14.4 GWh was produced in the first quarter of 2021. Main customers are Tesla, Peugeot, Hyundai, Honda, BMW, Toyota, VW and Volvo.

No. 2 is Lucky Goldstar Chem from Korea with a 23.5% global market share, which produced 11.9 GWh in Q1. Tesla is the largest customer.

Japan's Panasonic is No. 3 with a global market share of 18.5% and 9.1 GWh production. Tesla is also the largest customer here. The TOP 3 hold two-thirds of the global market with 66%. The Chinese company Built Your Dreams (BYD) follows in fourth place with a global market share of 6.7% and production of 3 GWh. This is mainly used for its own e-car production and to a lesser extent by other e-car manufacturers within China. 5th place goes to Samsung SDI from Korea with a global market share of 5.8% and 2.3 GWh production, followed by SK Innovation, also from Korea, with 5.4% and 1.3 GWh.

In 7th place is China Aviation Lithium Battery Technology (CALB) with 1.4 GWh production. No. 8 is Japan Automotive Battery Supply (AESC) with 0.8 GWh production. In 9th place is China's Gotion High-Tech with 0.8 GWh production and in 10th place is Japan's GS Yuasa with 0.3 GWh production. All data refer to the 1st quarter of 2021.

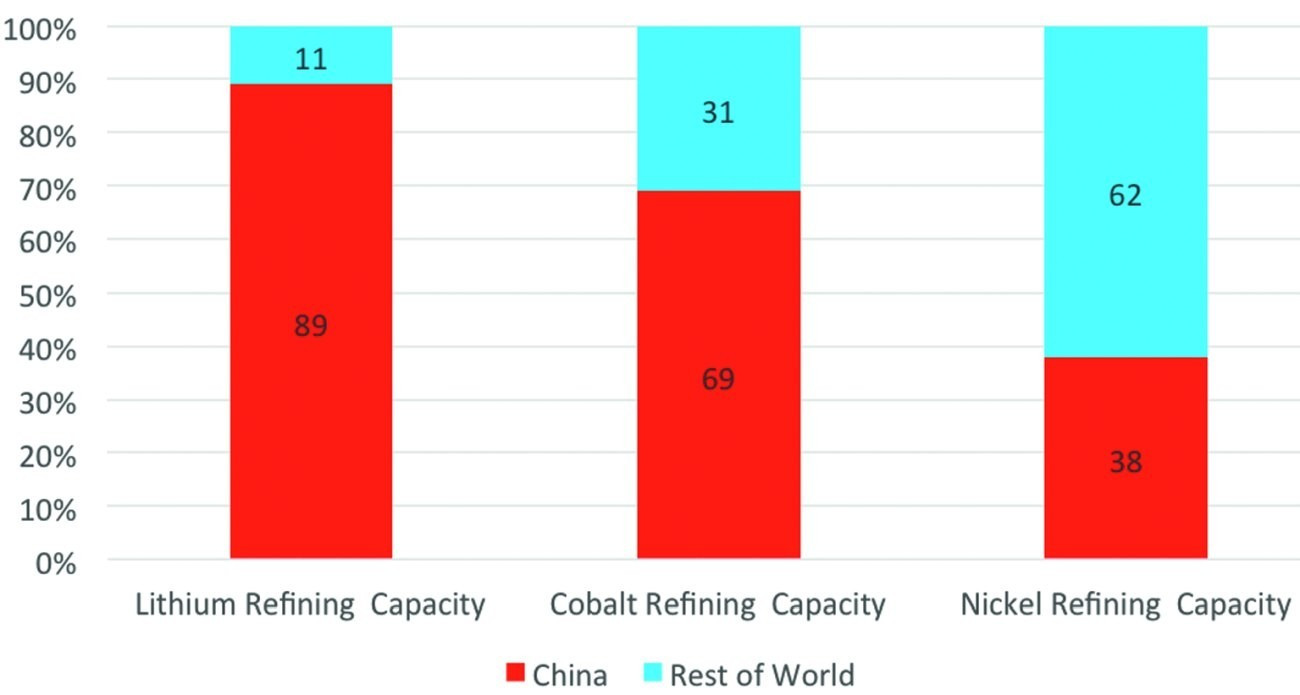

Dependence on China for battery-related raw materials remains very high(Fig. 5). Especially for lithium and cobalt, China leads to a dangerous accumulation with global refinery capacities of 89% and 69% respectively.

Fig. 5: China's share of global capacities for refining the key battery raw materials lithium, cobalt and nickel

Fig. 5: China's share of global capacities for refining the key battery raw materials lithium, cobalt and nickel

In the ZVEI chart 'Import of cells and batteries to Germany 2020', Poland is on a par with China for the lithium-ion batteries commonly used in today's vehicles, with a volume of €1.6 billion. However, it should not be forgotten that the import volume of cells and batteries from Europe of €2.6 billion is mainly produced by Chinese, Korean and Japanese subsidiaries.

Battery factories in Germany

In Kaiserlautern, a European consortium of the companies PSA-Opel with Total and Saft is planning a battery cell production plant with a capacity of 24 GWh. In Saarland, in Überherrn, Svolt is also planning a capacity of 24 GWh for 2022. In Erfurt, Thuringia, CATL is currently building a capacity of initially 14 GWh to 100 GWh. In Bitterfeld-Wolfen, Daimler and the Turkish car manufacturer Togg have joined forces with the Chinese battery manufacturer Farasis to build a battery production facility with 16 GWh by 2022. Northvolt and VW are planning a 16 GWh production facility in Salzgitter for 2024 with expansion to 24 GWh.

|

2020 |

2019 vs. 2020 |

2014 vs 2020 |

|

|

Production |

3.7 billion € |

+23% |

+84% |

|

Export |

5.0 billion € |

+24% |

+144% |

|

Import |

7.3 billion € |

+33% |

+225% |

|

Employees as at 31.12.2020 |

11.930 |

+25% |

+44% |

The best-known battery production facility under construction is Tesla's Gigafactory in Grünheide with a capacity of 100 GWh.

|

Total |

of which lithium-ion |

|

|

world |

7.3 billion € |

5.4 billion € |

|

Europe |

3.8 billion € |

2.6 billion € |

|

thereof |

||

|

Poland |

1.8 billion € |

1.6 billion € |

|

Czech Republic |

0.3 billion € |

0.1 billion € |

|

Hungary |

0.6 billion € |

0.3 billion € |

|

Asia |

3.4 billion € |

2.8 billion € |

|

thereof |

||

|

China |

1.9 billion € |

1.6 billion € |

|

Japan |

0.3 billion € |

0.2 billion € |

|

South Korea |

0.9 billion € |

0.9 billion € |

The future: solid-state batteries

Solid-state batteries are another beacon of hope: VW has so far invested a total of 300 million dollars in the American company Quantumscape. Their solid-state batteries are said to enable an energy density at cell level of one kilowatt hour per liter, which is around twice as high as conventional lithium-ion batteries. Charging times should also be significantly reduced: the VW ID.4, for example, currently charges in 25 minutes - at best - for a journey of 450 kilometers. This charging time is set to fall to twelve minutes with the introduction of Quantumscape's solid-state batteries in 2025.

In a nutshell:

- The German battery market grew at an accelerated rate of 35% to €5.9 billion in 2020. The share of lithium-ion batteries achieved growth of 63% vs. previous year to € 3 billion.

- Two thirds of global battery capacities are in the hands of CATL/China, LG Chem/South Korea and Panasonic/Japan.

- China owns 89% of the raw material supply and refinery capacities for lithium and 69% for cobalt.

- Mercedes has further condensed the raw material mix of the battery cathodes in its EQS presented in May. Instead of a material ratio of 6:2:2 of nickel, cobalt and manganese, the material mix has been improved to 8:1:1.

- Mine production of lithium currently amounts to 82,000 tons per year. However, according to the Geological Survey, demand is expected to rise to 1.8 million tons by 2030. It is doubtful whether the main producing countries of Australia (40,000 tons), Chile (18,000 tons) and China (14,000 tons) will manage a 22-fold increase in production by 2030.

For a long time, batteries were seen as a poor relation that should be purchased cheaply as a commodity. In the meantime, however, most automotive CEOs have realized that access to the entire supply chain, from raw materials to battery cell production and battery management systems, can be essential for e-mobility. This is why battery factories with a planned battery cell capacity of > 200 GWh by 2024 are currently under construction in Germany. One major drawback: these are mostly Asian manufacturers.

The German research structure is well positioned for solid-state batteries. With a doubling of power density and significantly faster charging times, solid-state batteries are set to go into mass production by the end of the decade.

I wish you a wonderful vacation season and stay tuned.

Best regards

Hans-Joachim Friedrichkeit

contact

F