There are many political wishes and dreams, but the reality is often sobering because a lack of expertise, ideology or ignorance means that more is often destroyed than saved during implementation. Having already covered battery technology for electric cars in detail(PLUS 9/22), we now turn to the subject of battery raw materials. The most important cathode material alongside nickel and manganese is cobalt.

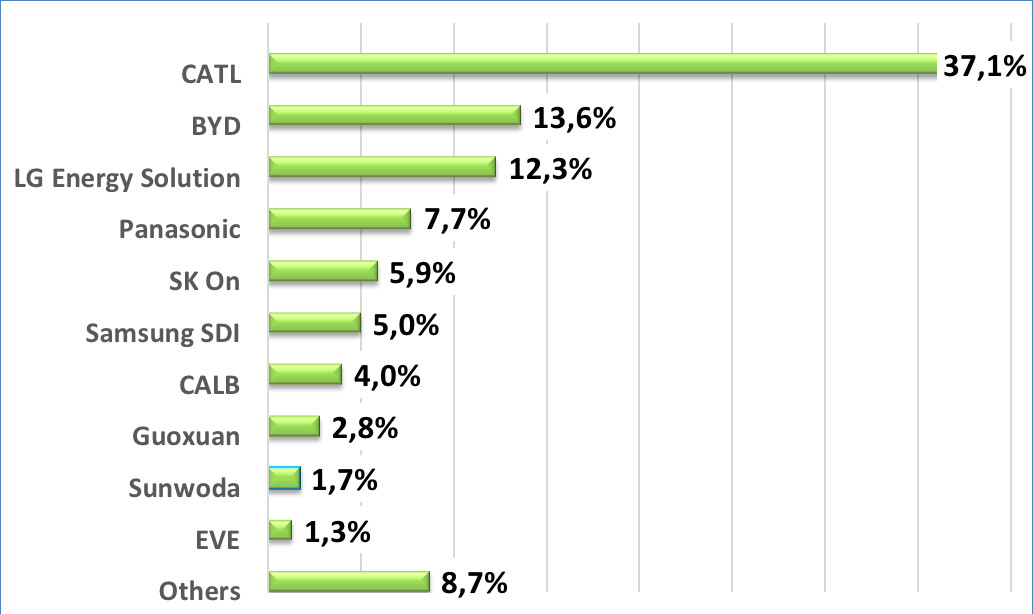

Last year, China dominated the global battery market for BEVs (battery electric vehicles) and plug-in hybrids with 60.5%(Fig. 2). South Korea took second place with a global market share of 23.1% and Japan came in third with a clear lead (7.7%). If we compare the first half of 2022 with the year as a whole, CATL, the Chinese global market leader, and BYD have once again made strong gains. Korea's LG Energy Solution and Japan's Panasonic, on the other hand, lost market share.

Fig. 2: Battery manufacturers by global market share in 2022 in KWh produced (data: SNE Research)

Fig. 2: Battery manufacturers by global market share in 2022 in KWh produced (data: SNE Research)

Production start-up at CATT/CATL in Thuringia

Fig. 3: Aerial view of the new Mercedes-Benz battery factory in Bibb County, Alabama with up to 600 jobs for the EQS SUVThefirst batch of lithium-ion battery cells was produced under series conditions on the newly installed production line in CATL's G2 building(Fig. 1). The installation and commissioning of the remaining lines is in full swing in order to ramp up production.

Fig. 3: Aerial view of the new Mercedes-Benz battery factory in Bibb County, Alabama with up to 600 jobs for the EQS SUVThefirst batch of lithium-ion battery cells was produced under series conditions on the newly installed production line in CATL's G2 building(Fig. 1). The installation and commissioning of the remaining lines is in full swing in order to ramp up production.

The locally produced cells have passed all tests required for CATL's products worldwide, allowing European customers to be supplied with cells from a local plant.

CATL received approval for battery cell production from the state of Thuringia in April 2022, allowing an initial capacity of 8 GWh per year. The plant had already started module production in its G1 building in the third quarter of 2021.

With a total investment of up to €1.8 billion, CATL plans to achieve a production capacity of 14 GWh and create up to 2,000 new jobs in Germany in the future.

Growth in electric cars

Last year, around 10.6 million electric cars were sold worldwide. This figure is expected to increase to 36 million BEVs (battery electric vehicles) by 2030. This corresponds to a battery capacity of 1300 GWh (gigawatt hours), according to calculations by the German Economic Institute. With a cobalt quantity of 4.5 to 15 kg of cobalt for a fully electric vehicle (passenger car) and 1 to 4 kg per plug-in hybrid vehicle, this results in a cobalt requirement of 320,000 tons. This already takes into account technical progress with reduced cobalt content for the cathodes.

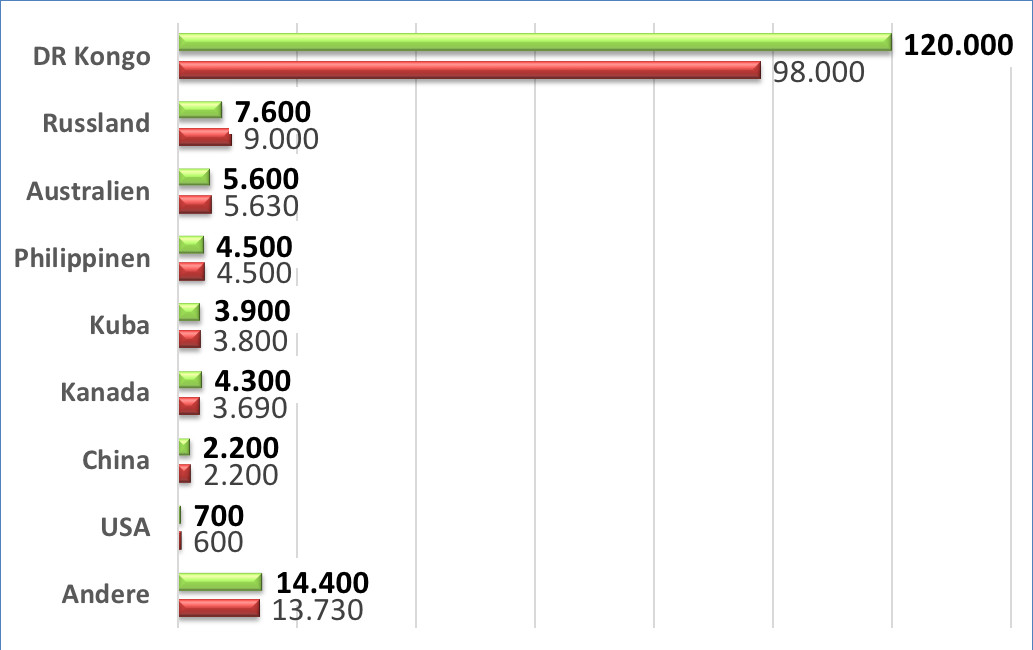

Fig. 4: Mine production of cobalt - selected countries in tons 2020 compared to 2021 (data: Statistica)

Fig. 4: Mine production of cobalt - selected countries in tons 2020 compared to 2021 (data: Statistica)

Worldwide, 163,000 tons of cobalt were mined per year in 2021. Around 75% of this came from the Congo and 5% from Russia(Fig. 4). Western-oriented countries such as Australia, the Philippines, Canada and the USA together produce just under 10 % of global demand. Electromobility will double global cobalt demand to around 320,000 tons by 2030 and lithium demand will increase tenfold.

The dirty cobalt processing takes place in China

It is widely unknown that most of the cobalt ore is then transported to China for further processing. The solution is enriched by thermally leaching the ore with sulphuric acid and subsequent precipitation processes. The intermediate products nickel-cobalt sulphite and hydroxide are further processed into cobalt metal and cobalt chemicals in a refinery process. Around 70% of the aforementioned global production volume is used for battery production, half of which is for electromobility.

No mobility transition without cobalt

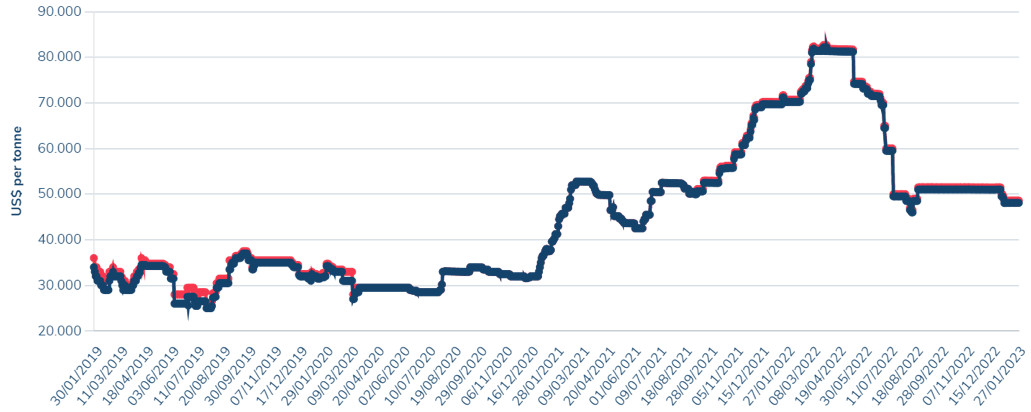

As mentioned above, electromobility is driving the world's hunger for the cathode material cobalt. Figure 5 shows the price trend for cobalt on the London Metal Exchange. The price has hovered at around USD 30,000 per tonne for years. From 2021, with the start of electromobility, it skyrocketed to around $50,000 per tonne and in some cases reached $80,000 per tonne. By comparison, coal costs between $200 and $300 per t.

Fig. 5: Cobalt price trend on the LME (London Metal Exchange) 2019-2023

Fig. 5: Cobalt price trend on the LME (London Metal Exchange) 2019-2023

In a nutshell

- China dominates the global market with a 60.5% market share, with number one CATL and number two BYD together accounting for 50%

- After 10.6 million BEVs (battery electric vehicles) sold in 2022, the share of passenger car sales is set to rise to 36 million BEVs by 2030. This will require a battery capacity of 1300 GWh

- In 2021, 163,000 tons of cobalt were mined worldwide. Cobalt is primarily used as a cathode material. Taking technical progress into account, at least 320,000 tons of cobalt would have to be mined by 2030

- The price of cobalt has risen by 70% since 2021 and is currently around $50,000 per tonne

Conclusion: China's dependence on cobalt is enormous due to long-term supply contracts with the Republic of Congo. Around 50% of the world's cobalt deposits are located in the Katanga region. China is the world's largest processor of cobalt ore through thermal leaching with sulphuric acid. With a price of $50,000 per tonne, fuelled by electromobility, around 20% of mining in the Congo takes place in completely unregulated private excavations without any occupational health and safety, often using child labor. Both the thermal leaching of cobalt ore with sulphuric acid and even more the child labor in the Congolese ore mines are an extremely dirty business, which we like to ignore in great hypocrisy and certainly do not want to have in Europe. We pay the price of dependency!

Stay optimistic and fight for an ideology-free economic policy that is based on reality.

Best regards

Yours

Hans-Joachim Friedrichkeit