Xiaomi Tech was founded in 2010 by Lei Jun with the aim of marketing smartphones at affordable prices. The Xiaomi Phone 1 was launched in August 2011. By 2013, 10 million of the Xiaomi Phone 2 had already been sold. Today, 15 years after its foundation, the company is the third largest smartphone manufacturer in the world and in 2021 it surprisingly also entered the e-car business and employs 42,000 people(Fig. 1).

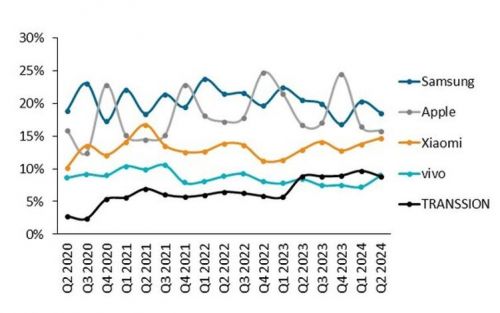

Looking at global smartphone shipments, Xiaomi has achieved a solid third place after Samsung and Apple(Fig. 2). Xiaomi currently occupies 5th place in the Chinese smartphone market, after VIVO, Huawei, OPPO and Honor. The market share was 13.1% in Q2 2023 and grew to 14% in Q2 2024, a growth of 16.5%(Fig. 3).

The leap into the e-car segment

In March 2022, the first prototype of an intelligent e-car is completed and the Xiaomi Auto 1 is presented to the public. Series production is announced for 2024. On December 28, 2023, Chairman Lei Jun unveils the SU7. The aim is to be able to compete with Tesla and Porsche, which earns the SU7 the nickname Porsche killer(Fig. 1). With a 101 kWh battery, a range of 700 km according to CLTC and acceleration from 0 to 200 km/h in 10.7 seconds are specified. The China price is €28,000 to €30,000 depending on the equipment.

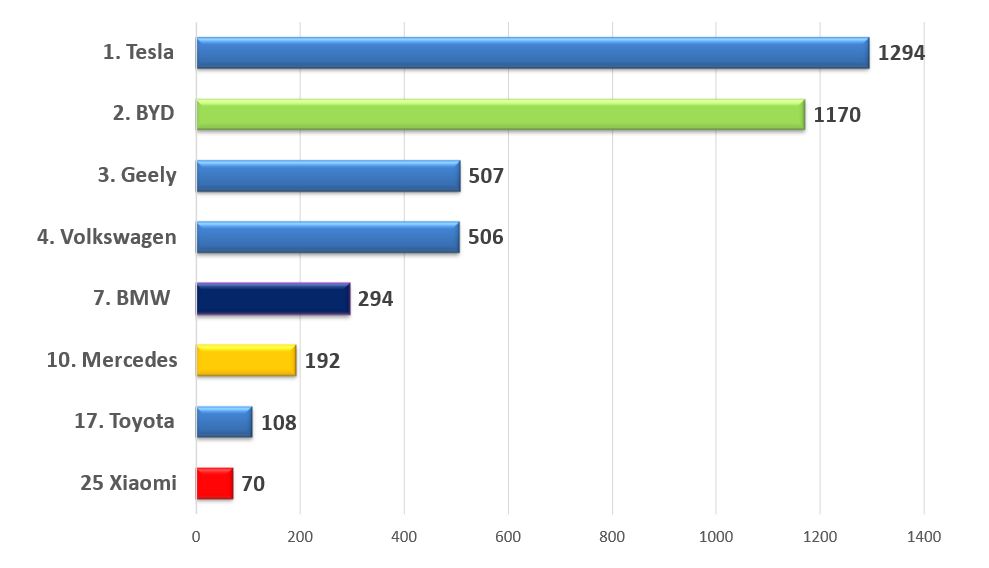

Sales began in March 2024 and, according to the company, are expected to have resulted in annual sales of 130,000 vehicles(Fig. 4). Following this rapid market success, Goldman Sachs has increased the potential for 2025 from 290,000 units to 350,000 units. The forecast for 2026 has also been raised from 480,000 vehicles to 650,000 units.

With almost 22,000 BEVs sold in January, the year has at least got off to an excellent start.

The SU7 Ultra will now follow later this year with a sales target of 10,000 units.

The operating loss for the e-car segment amounted to €900 million last year. It is expected to fall to less than €500 million in 2025 and could break even in 2026. There are currently around 100 NEV manufacturers in China, which includes battery electric cars and hybrid cars, as Ola Källenius, CEO of Mercedes, explained at a dinner speech. Many are making losses and will not survive the cut-throat price competition. Companies like Xiaomi, however, are more broadly positioned and are making money with their flourishing smartphone business. Fig. 4: Ranking of electric car sales by manufacturer (BEVs only) from Q1 to Q3 2024 in thousands of vehicles

Fig. 4: Ranking of electric car sales by manufacturer (BEVs only) from Q1 to Q3 2024 in thousands of vehicles

Speed of development

German car manufacturers have so far required a development time of 54 months. This is to be reduced by 25% to 40 months due to pressure from China and the USA through Tesla.

Tesla was the game changer with 2.5 - 3 years.

Chinese manufacturers have the most consistent platform strategy with around two years, in which some existing basic software + standard battery + chassis were only specifically configured. The key point here was customer wishes, however crazy they may be.

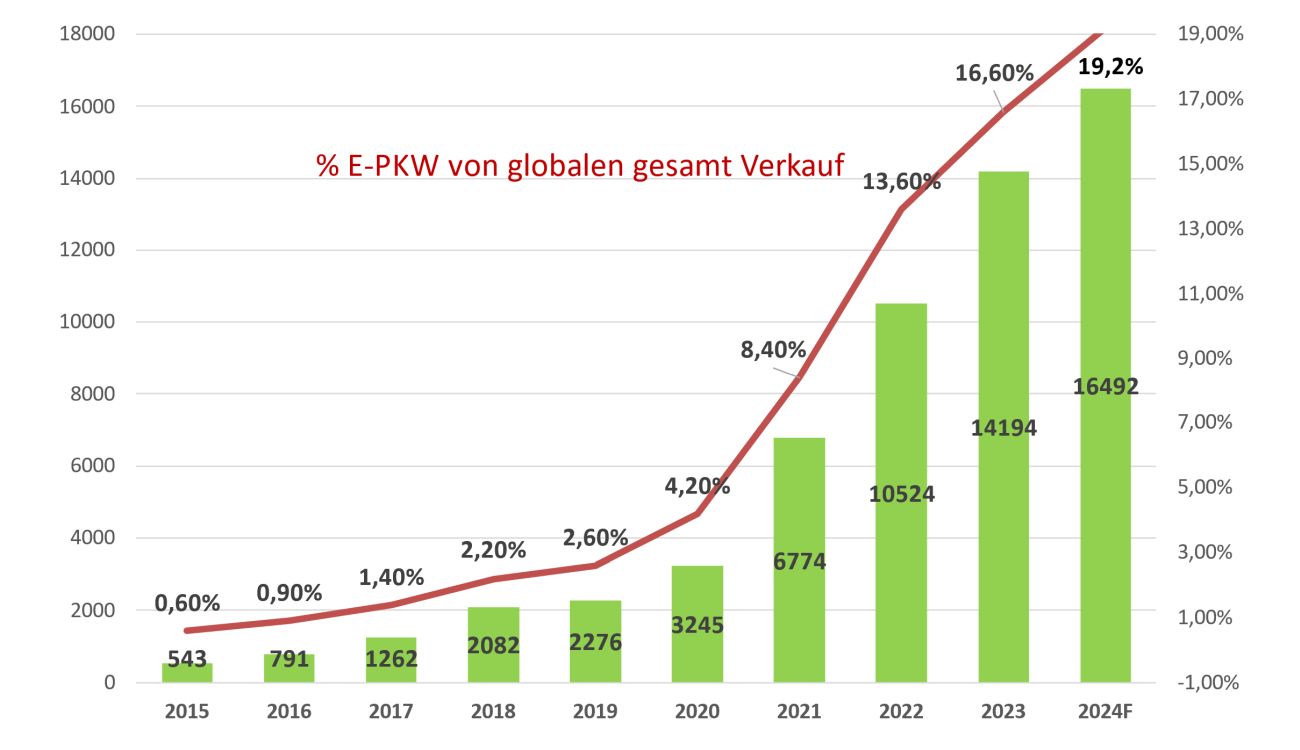

19.2 % of all passenger car sales worldwide are e-vehicles, i.e. battery electric cars and plug-in hybrids, i.e. around 80 % remain combustion vehicles(Fig. 5). Last year, this amounted to 16.5 million e-cars, 66% of which were battery electric cars and 34% plug-in hybrids. The growth rates are declining. While the global e-car market still grew by 55% in 2022, the growth rate fell to 35% in 2023 and 16% in 2024.

Fig. 5: Global sales of electric cars (BEV + PHEV) in thousands of units, as well as the percentage share of NEVs (BEV + PHEV) in total global sales

Fig. 5: Global sales of electric cars (BEV + PHEV) in thousands of units, as well as the percentage share of NEVs (BEV + PHEV) in total global sales

In a nutshell

- The e-car market grew by 16% to 16.5 million vehicles in 2024 after 35% in 2023. The global share of NEVs (BEV + PHEV) was 19.2%.

- Xiaomi is a tech group founded in 2010 with 42,000 employees today.

- The first smartphone was launched in 2011. Today, Xiaomi is the world's third largest smartphone manufacturer.

- In 2021, Xiaomi announced its entry into the e-car segment. In 2024, the SU7, a powerful BEV, was launched on the market, which immediately generated 130,000 sales.

Even if many of the approximately 100 NEV manufacturers in China will not survive, the frontrunners such as BYD, Geely and SAIG-GM are ahead of foreign brands in the domestic Chinese market. In 2019, the share of foreign brands (combustion + electric) was 60%, last year the share had shrunk to 40% and Chinese brands dominated with 60%. This slow squeezing out of foreign brands will continue.

I wish you a strong start to the spring.

Stay optimistic and stay with us.

Best regards

Yours

Hans-Joachim Friedrichkeit