Rarely has the future economic development been as confusing as it is at the moment. The war in Ukraine, justified sanctions, which are also causing us considerable damage, increasing debt, galloping inflation, disrupted supply chains, lockdown in parts of China and - on top of all this - the hard-fought China-US conflict.

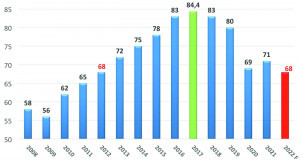

Fig. 1: Global passenger car market in millions of vehicles (Image: Friedrichkeit, Data: VDA/CAR)A look at the global passenger car market in millions of vehicles(Fig. 1) shows the whole disaster. Since the peak year of 2017, sales figures are expected to fall significantly from 84.4 million units to 67.6 million units. This is -19% and represents a ten-year low (see 2012). The only consolation is that the automotive market is not only empty in Germany, demand cannot be met and delivery times are sometimes one year. As a result, manufacturers are demonstrating their pricing power, partly due to higher energy, material and procurement costs. At the same time, used car prices have risen significantly, especially for newer new cars.

Fig. 1: Global passenger car market in millions of vehicles (Image: Friedrichkeit, Data: VDA/CAR)A look at the global passenger car market in millions of vehicles(Fig. 1) shows the whole disaster. Since the peak year of 2017, sales figures are expected to fall significantly from 84.4 million units to 67.6 million units. This is -19% and represents a ten-year low (see 2012). The only consolation is that the automotive market is not only empty in Germany, demand cannot be met and delivery times are sometimes one year. As a result, manufacturers are demonstrating their pricing power, partly due to higher energy, material and procurement costs. At the same time, used car prices have risen significantly, especially for newer new cars.

This is why car dealers in Germany are not complaining too much, as the haggling over discounts has also slowed down considerably - you can earn almost the same or more with fewer vehicles.

Almost nothing works without China

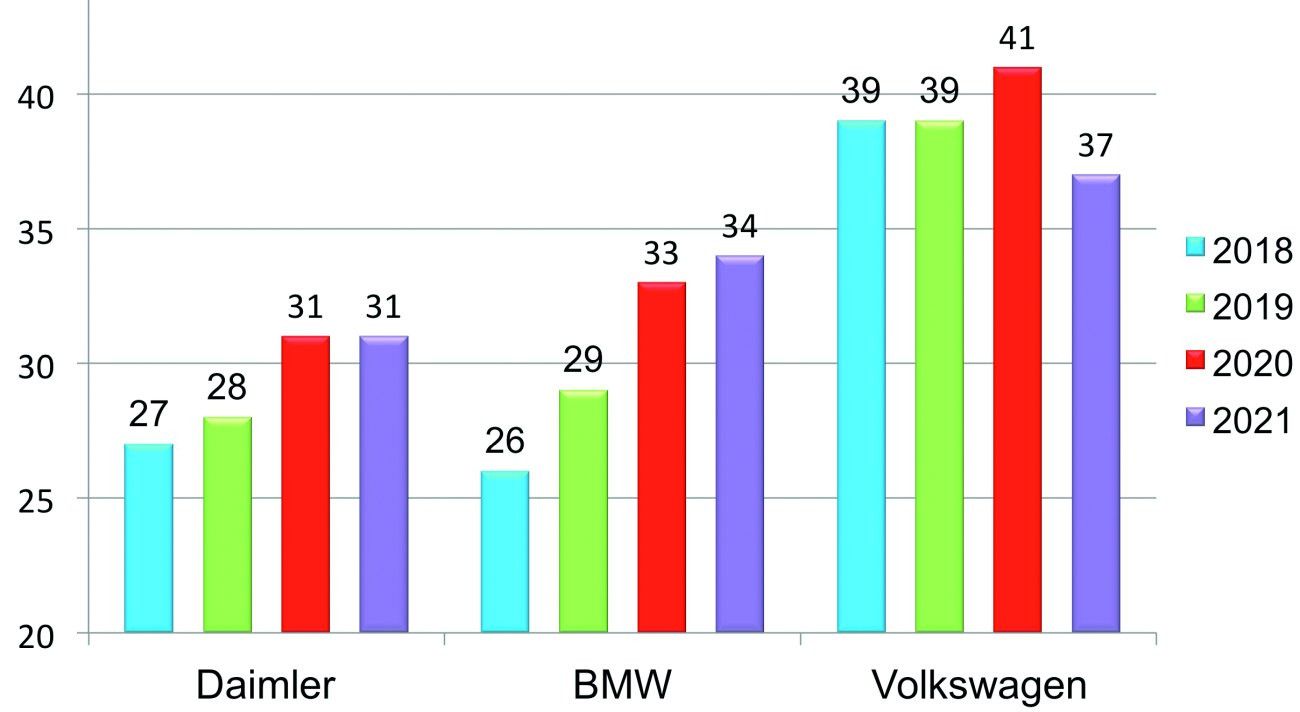

The export share of the three major German car manufacturers to China has continued to grow in recent years. At Mercedes and BMW it is around a third, at the Volkswagen Group around 40%(Fig. 3). These are high-margin vehicles with full equipment. The profits are used to finance a large part of the developments in Europe and the USA.

Fig. 3: The Volkswagen Group's network in China. In 2021, Volkswagen started construction of a new MEB plant in China. Volkswagen Anhui is the Group's third pure electric car plant in China after Anting (SAIC VW) and Foshan (FAW VW) (Image: VW)

Fig. 3: The Volkswagen Group's network in China. In 2021, Volkswagen started construction of a new MEB plant in China. Volkswagen Anhui is the Group's third pure electric car plant in China after Anting (SAIC VW) and Foshan (FAW VW) (Image: VW)

In the meantime, models and equipment are being developed exclusively for the Chinese market. This also applies to battery electric vehicles (BEVs), as China is the world's largest market for passenger cars with electric drives(Fig. 4).

Fig. 4: Export share China 2018 to 2021 (Image: Friedrichkeit, Data: CAR)

Fig. 4: Export share China 2018 to 2021 (Image: Friedrichkeit, Data: CAR)

The German car manufacturers Volkswagen, Daimler and the BMW Group together exported around 5.4 million vehicles to China in 2021. That was 38.2% of the total of 14.16 million new vehicles produced in Europe.

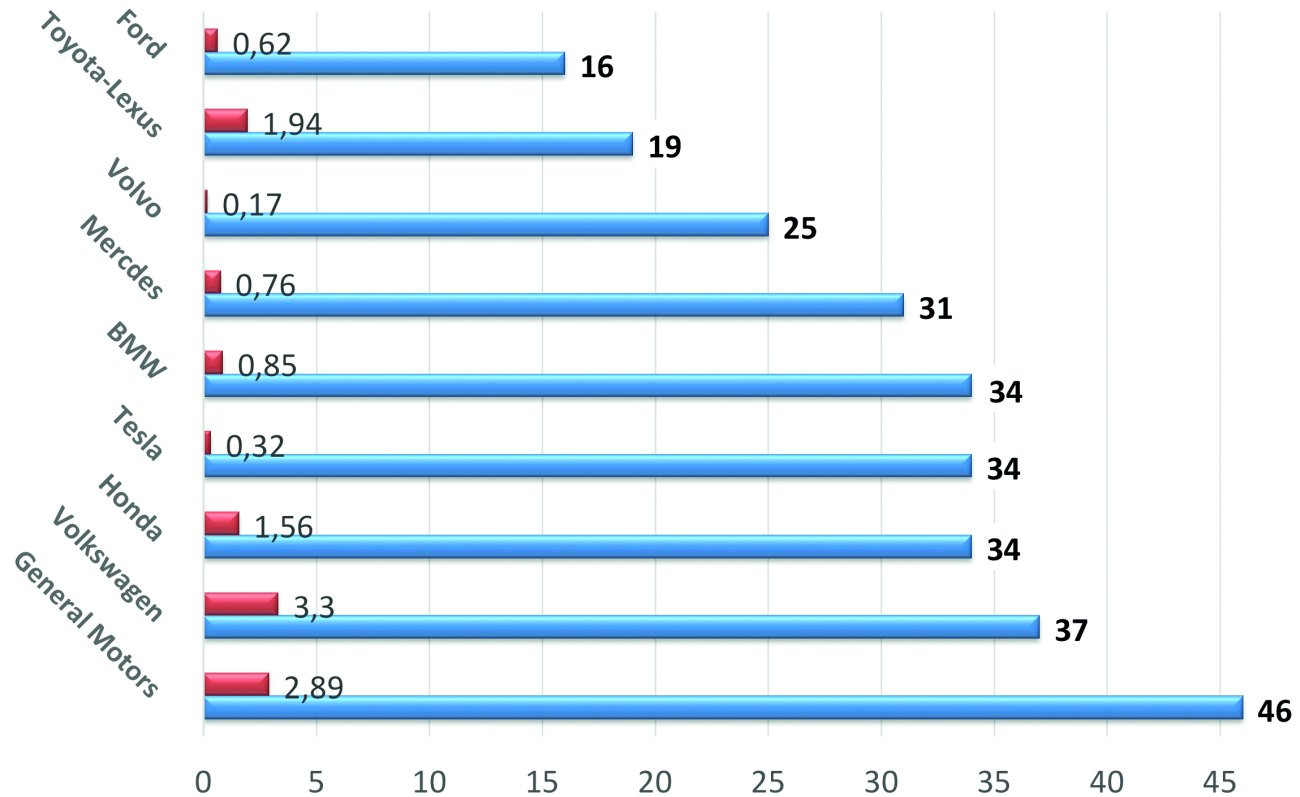

The link with China is also significant internationally. Figure 5 clearly shows that companies such as US-based General Motors generate 46% of their sales, or 2.89 million units, in China, as does Tesla with 34% or 320,000 vehicles. The world's largest manufacturer, the Japanese Toyota-Lexus Group, exports 1.94 million units, which corresponds to a 19% share. Honda is present on the Chinese market with 1.56 million vehicles, which corresponds to 34% of sales.

Fig. 5: Passenger car sales of international brands in China as a percentage of total sales and in millions of units in absolute terms (chart: Friedrichkeit, CAR data)

Fig. 5: Passenger car sales of international brands in China as a percentage of total sales and in millions of units in absolute terms (chart: Friedrichkeit, CAR data)

The gap is widening further

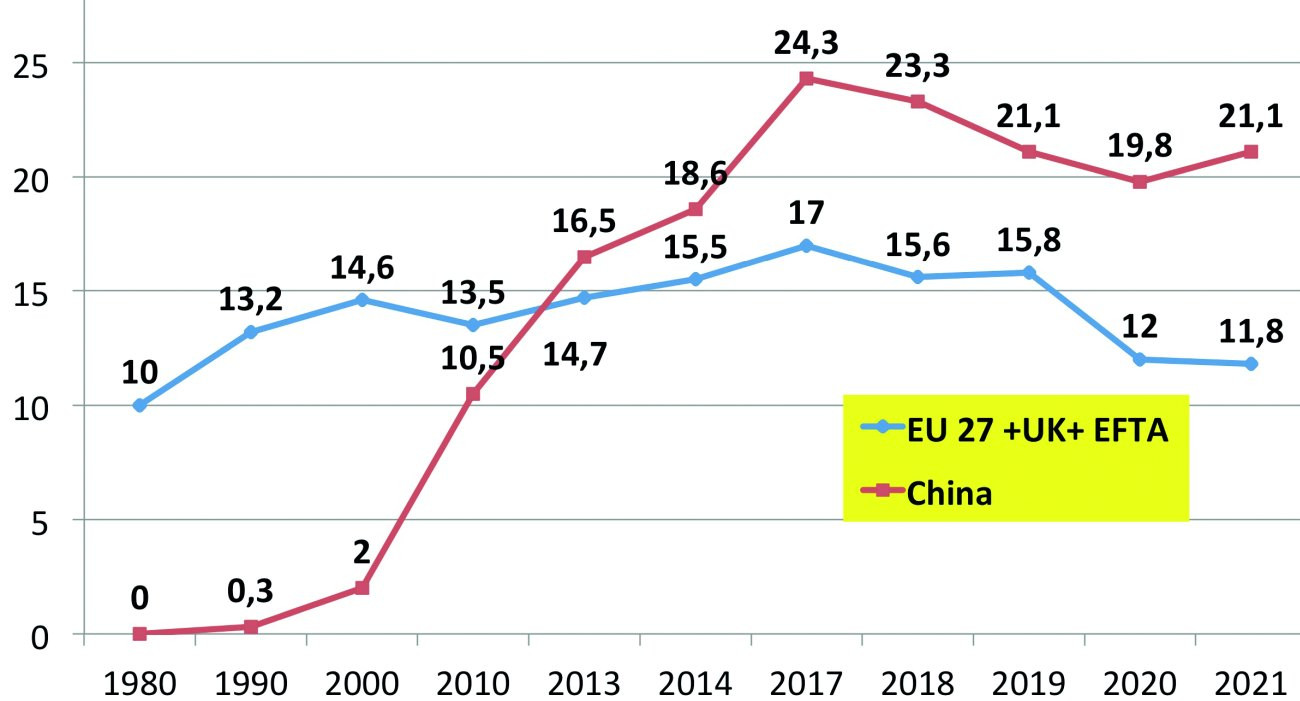

The gap has been widening since 2012(Fig. 6). Today, the entire European market (EU27 + UK + EFTA) is only just under half the size of the Chinese market. While Chinese sales grew by 7% even in the coronavirus crisis year of 2021, Europe suffered a decline of 1.4%. The outlook for 2022 is even gloomier. Only 806,000 new vehicles were sold on the German market from January to April 2022. This corresponds to a decline of -9% compared to the previous year and -32% compared to the pre-coronavirus year 2019.

Fig. 6: Passenger car sales EU27 + UK + EFTA versus China in million units 1980-2021 (chart: Friedrichkeit, data: VDA)

Fig. 6: Passenger car sales EU27 + UK + EFTA versus China in million units 1980-2021 (chart: Friedrichkeit, data: VDA)

Market slump for chips from 2023?

According to Malcom Penn, CEO of Future Horizons at IFS2022, the chip problem will be solved in 2023. He sees a recession with falling demand meeting with increased production capacities, resulting in overcapacity from 2023, which could lead to a market slump of up to -23%.

In a nutshell

- The global passenger car market is currently stagnating at the 2012 level of just under 70 million vehicles. By comparison, the peak year was 2017 with 84 million passenger cars.

- China is not only a vital sales market for the three major German automotive groups with a 31% to 40% share of sales. Other international manufacturers such as General Motors, Honda, Tesla and Toyota also generate a significant proportion of their sales and earnings here.

- In 2021, China continued to grow by 7% to €21.1 billion, while the Europe of 27 + UK + EFTA market only generated €11.8 billion.

Conclusion: "Only those who offer digitally networked solutions will be successful on the global market - and speed counts even more than in traditional electrical engineering," says Dr. Gunther Kegel, ZVEI President. Or to paraphrase the Americans: Be fast or be food.

I wish you a successful end to the first half of the year

Best regards

Yours

Hans-Joachim Friedrichkeit