What will remain of German cutting-edge technology after the end of the combustion engine in 2035

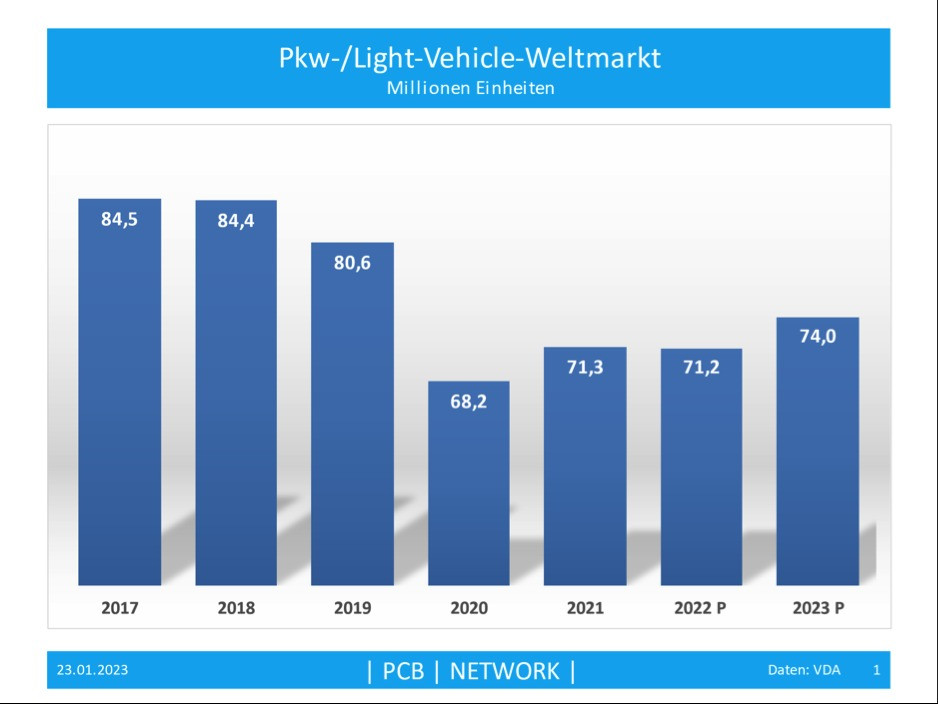

Let's start our analysis with the global market for passenger cars and light vehicles(Fig. 1). After the boom years of 2017 and 2018, the global market shrank by 5% in 2019. At the beginning of the coronavirus crisis, the market then collapsed by 20% before recovering somewhat in 2021 and 2022. However, there is still a gap of -16% compared to 2018, which will be reduced somewhat with forecast growth of 4% in 2023.

Fig. 1: Global passenger car/light vehicle market in millions of units

Fig. 1: Global passenger car/light vehicle market in millions of units

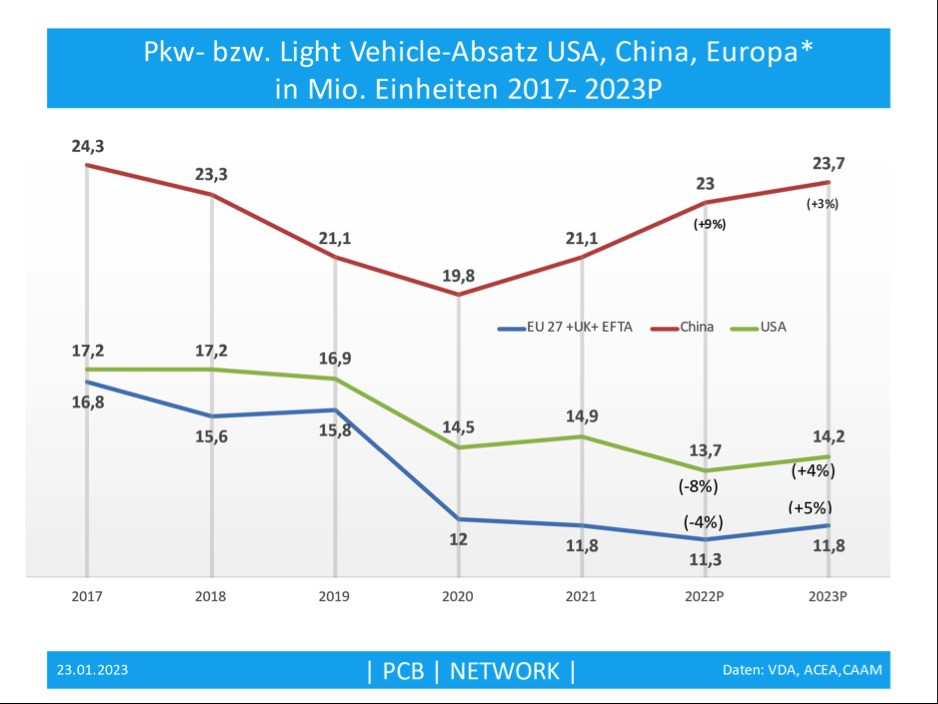

A comparison of the sales trends in China, the USA and Europe* (EU 27 + UK+ EFTA) shows that Europe is continuously losing ground as a market(Fig. 2) The decline in the world's largest market, China, also began in 2017, but the pre-coronavirus sales volumes of 21.1 million vehicles in 2019 were already reached again in 2021. Since then, the Chinese market has been growing continuously and could approach the all-time high of 2017 again in 2023.

Fig. 2: Passenger car and light vehicle sales USA, China, Europe* in million units 2017-2023P

Fig. 2: Passenger car and light vehicle sales USA, China, Europe* in million units 2017-2023P

At 13.7 million vehicles last year, the US market for passenger cars and light vehicles was still -20% below the all-time high of 17.2 million units in 2017. A slight recovery of +4% is possible this year.

The market performed worst in Europe. From 16.8 million vehicles sold in 2017, the market shrank to 11.3 million vehicles last year, which corresponds to a drop of 33%. A slight recovery of 5% is also forecast here.

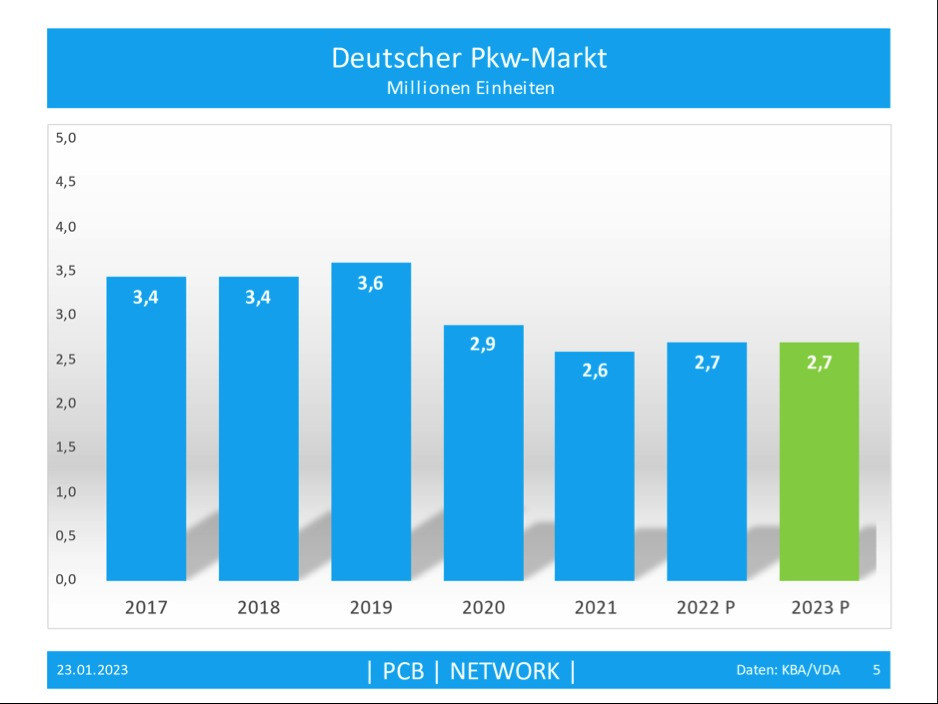

After record sales of 3.6 million vehicles in the pre-coronavirus year 2019, the German passenger car market has lost over a quarter of its volume by 2022(Fig. 3). Following the chip shortage for assistance systems and the associated lack of vehicle availability, there is currently a reluctance to buy. This is due to economic reasons among consumers, but also to the political uncertainty caused by the end of the combustion engine. Currently, sales have leveled off at between 2.6 and 2.7 million vehicles.

Fig. 3: German passenger car market in millions of units

Fig. 3: German passenger car market in millions of units

Germany's global market share is shrinking

Only 26.5% of total German passenger car production now takes place in Germany and 73.5% abroad, compared to 34.2% five years ago(Fig. 4). This means that the relevance of Germany as a production location is continuing to decline, accelerated by the EU's and Germany's unfriendly automotive policy. The market share of German car manufacturers on the global market is also shrinking. In 2019, the German global market share was still 20% and had shrunk to 18.5% by last year. This corresponds to a drop of 2.9 million vehicles no longer built by German manufacturers. It is more than the total sales on the German market of 2.65 million vehicles in 2022.

Fig. 4: Passenger car production in Germany and foreign production by German manufacturers 2017-2023(P) in million units (data: VDA, graphic: Friedrichkeit)

Fig. 4: Passenger car production in Germany and foreign production by German manufacturers 2017-2023(P) in million units (data: VDA, graphic: Friedrichkeit)

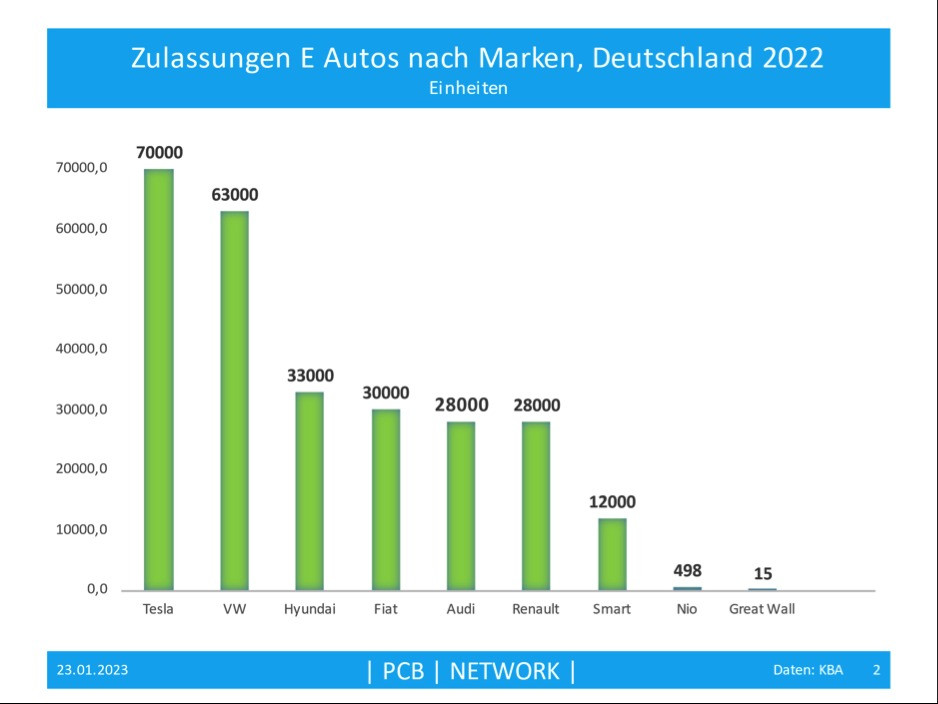

Tesla overtakes VW in e-cars, China is in the starting blocks

According to the German Federal Motor Transport Authority (KBA), 471,000 BEVs (battery electric vehicles) were registered in Germany in 2022. This corresponds to growth of 30.1%, although the reduction in subsidies has certainly had a distorting effect here. It is interesting to note that Tesla outperformed Volkswagen in 2022 with 70,000 vehicles (previous year: 40,000) and 63,000 electric cars (previous year: 72,000)(Fig. 6). The Korean Hyundai Group is in 4th place ahead of Fiat (5th), Audi (6th) and Renault (7th).

Fig. 6: Registrations of electric cars by brand, Germany 2022 in units (data: KBA, graphic: Friedrichkeit)

Fig. 6: Registrations of electric cars by brand, Germany 2022 in units (data: KBA, graphic: Friedrichkeit)

Registrations of Chinese manufacturers such as NIO, Great Wall and 'Built your Dreams' (BYD) are still rare in Germany. However, this will change significantly over the next few years. BYD, currently China's second-largest manufacturer, sold a total of 515,000 e-cars worldwide last year, while Tesla is still the frontrunner with 1.31 million units.

Looking at the production shares of e-cars by German manufacturers, the following picture emerges:

|

Rank |

Manufacturer |

Production share of e-cars |

|

1 |

Opel |

20,3 % |

|

2 |

Porsche |

16,3 % |

|

3 |

Audi |

13,3 % |

|

4 |

VW |

13,1 % |

|

5 |

BMW |

11,2 % |

|

6 |

Mercedes |

10,3 % |

In a nutshell

- The global market for passenger cars/light vehicles reached 70.2 million units. This corresponds to -16.2% compared to the top years 2017/2018

- Europe shrank from 16.8 million vehicles sold in 2017 to 11.3 million vehicles in 2022, which corresponds to a decrease of 33

- Germany's global market share fell from 20% in 2019 to 18.5% in 2022 - in terms of units, this corresponds to a production loss of 2.9 million cars

- Only 26.5% of total German passenger car production took place in Germany and 73.5% abroad, with a further downward trend

The European and US markets have shrunk over five years from 2017 to 2022, while the Chinese market has recovered significantly and is approaching its record sales of 2018 again. The entry of Chinese and other Asian manufacturers into the German market for battery electric cars is creating a new competitive situation. These manufacturers are leaders in battery technology, as well as in software. Chinese manufacturers have also mastered the electric motor and the battery management system (BMS) - and after years of technology transfer by Western car manufacturers, they have learned to build appealing cars. Remember the Chinese concept: market access in exchange for technology transfer through a mandatory 51% joint venture with a Chinese manufacturer. The prices for Chinese e-cars in Germany are attractive, as are the delivery times.

I reported on the falling registration figures of German manufacturers in China in PLUS 11/2022. There is no doubt: the Chinese market is going electric. But the signs are there: without the German manufacturers! As the Handelsblatt wrote: "Being the inventor of the car does not prevent someone else from reinventing it."

Despite everything, stay fierce, because we have a lot to lose.

Best regards

Yours

Hans-Joachim Friedrichkeit

Contact