Power steering, ABS or dynamic (77 GHz) distance radar, all these systems had one thing in common. After the market launch in the luxury class, rapid growth followed with the introduction into the entire car market. The LiDAR system is now also on this threshold as the key to automated driving. The question is: who will do the business?

LiDAR (light detection and ranging) is a method of optical distance and speed measurement that is related to radar. Instead of radio waves as in radar, this system uses laser beams, explains Wikipedia

Market forecasts 2025

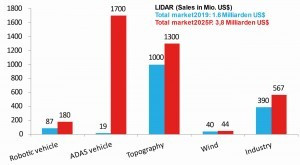

Fig. 2: Market development of LiDAR systems by segment 2019-2025 in USD millionAccordingto Yole,theLiDAR market reached a sales volume of USD 1.6 billion in 2019(Fig. 2) and is expected to grow to USD 3.8 billion by 2025. This corresponds to a compound annual growth rate (CAGR) of 19%.

Fig. 2: Market development of LiDAR systems by segment 2019-2025 in USD millionAccordingto Yole,theLiDAR market reached a sales volume of USD 1.6 billion in 2019(Fig. 2) and is expected to grow to USD 3.8 billion by 2025. This corresponds to a compound annual growth rate (CAGR) of 19%.

The forecasts in the 5 main application segments of LiDAR vary greatly. The automated driving segment (ADAS vehicle) is expected to grow by 114% per year until 2025. Vehicles with built-in LIDAR in Europe currently include the Mercedes EQS, the S-Class, the A8 from AUDI and the BMW 7 Series from 2022, which are capable of Level 3 - partially automated driving. In the AUDI A8, a VALEO LiDAR system with a rotating mirror was used as standard for the first time.

Topography LiDAR, which is used to create 3D terrain models, for example, is only expected to grow by 6% per year. Wind LiDAR remote sensing systems, which can detect wind speed, wind direction and turbulence, are forecast to grow by 2% per year. The Industry LiDAR segment is expected to contribute growth of 5% p.a. by 2025. An annual growth rate of 12% CAGR is forecast for the robotic vehicles segment.

LiDAR technology trends

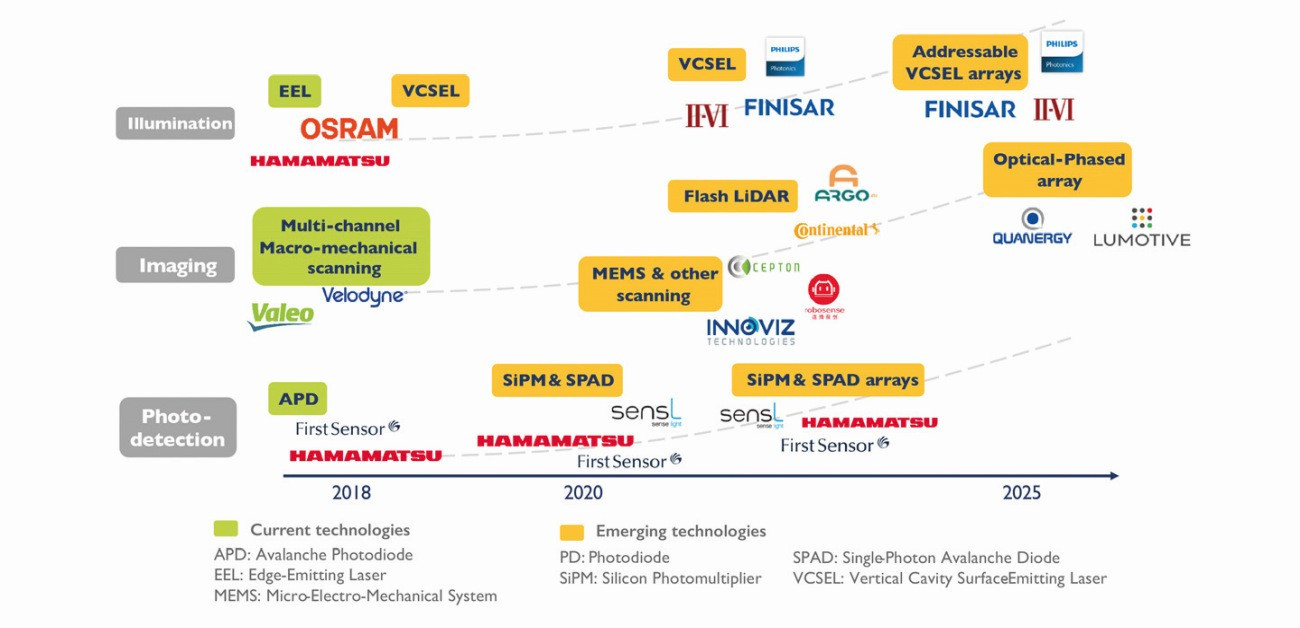

The majority of manufacturers rely on cost-effective CMOS technology with a wavelength in the infrared range of 830 to 940 nm. Another group is focusing on short-wave infrared in the 1000 nm to 1600 nm range based on InGaAS (indium gallium arsenide) semiconductor technology. LiDAR rotation scanners are increasingly being replaced by so-called solid-state LiDAR systems without moving parts based on flash and MEMs(Fig. 3).

Fig. 3: LiDAR technology roadmap 2018-2025

Fig. 3: LiDAR technology roadmap 2018-2025

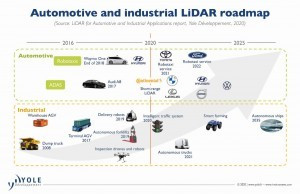

Figure 4 shows the strong growth of 114% p.a. by 2025 in automated driving from 2020. For example, Toyota Robotaxis with LiDAR were in use at the 2021 Olympics in Tokyo. In the industrial segment, LiDAR applications are increasingly found in automated transportation systems. However, they will also find a new area of application in the field of smart farming with automated agricultural machinery.

High Resolution 3D Flash LiDAR

Fig. 4: LiDAR roadmap Automotive and Industrial 2016- 2025 The Hi-Res 3D Flash LiDAR without moving parts complements the current portfolio of environmental sensors required to realize automated driving. A key advantage of Hi-Res 3D Flash LiDAR sensor technology is that it offers both real-time image understanding and environment detection capabilities. This technology enables a much more comprehensive and detailed image of the entire vehicle environment both day and night and works reliably even in adverse weather conditions up to 300 meters. The pulse laser scans the surroundings with signals that are received by a highly integrated sensor chip similar to a digital camera. The pulse transit time per pixel is recorded, which corresponds to the distance to the object.

Fig. 4: LiDAR roadmap Automotive and Industrial 2016- 2025 The Hi-Res 3D Flash LiDAR without moving parts complements the current portfolio of environmental sensors required to realize automated driving. A key advantage of Hi-Res 3D Flash LiDAR sensor technology is that it offers both real-time image understanding and environment detection capabilities. This technology enables a much more comprehensive and detailed image of the entire vehicle environment both day and night and works reliably even in adverse weather conditions up to 300 meters. The pulse laser scans the surroundings with signals that are received by a highly integrated sensor chip similar to a digital camera. The pulse transit time per pixel is recorded, which corresponds to the distance to the object.

The combination of 2D color camera, 24 GHz and 77 GHz radar and the new 3D Flash LiDAR enables Continental, for example, to create a reliable model of the environment. This includes dynamic information on other road users, static objects such as lane markings, highly accurate information on the driver's own position and traffic control.

The 2D color cameras operate in the visible light range, i.e. 400 nm to 700 nm. The 3D flash LiDAR covers the 1550 nm wavelength. The 77 GHz radar has a wavelength of 3.9 mm and the 24 GHz radar has a wavelength of 12.5 mm.

Full sensor stack system for Level 2+ to Level 4

The HRL131 long-range LiDAR(Fig. 5) from Continental features innovative and pioneering micro-MEMS technology. The patented AEye-LiDAR technology based on MEMS offers extremely high reliability and enables the best sensor performance even in difficult weather and road conditions.

Performance data

- Class 1 LASER IEC 60825 (Ed. 3), 1550nm laser

- Field of View: 128°x28°

- Range: 1,000m (300m@10% reflectivity)

- Res: 0.05°x0.075° (DDL)

- Frame rate: 10Hz

- 2-4 returns per pixel

- Temp: -40°C to +85°C

Short Range LiDAR SRL121

Most accidents happen in cities. More than half of them are frontal collisions. The reasons for these accidents are: no braking at all, braking too weakly, braking too late. A cost-effective and highly reliable solution for preventing such accidents is the SRL121 short-range LiDAR sensor(Fig. 6). The SRL121 provides an infrared-based emergency braking assistant (City) and measures the relative distance, relative speed and lateral offset to potentially dangerous objects.

Development cooperation Israel - China

Fig. 7: Real traffic situation and conversion into a 3D representation of the Innoviz LiDAR systemInnovizTechnologies, an Israeli manufacturer of high-performance solid-state LiDAR sensors and perception software, and Whale Dynamic, a China-based autonomous driving company, are collaborating on Whale Dynamic's next-generation autonomous driving (AD) platform(Fig. 7/8).

Fig. 7: Real traffic situation and conversion into a 3D representation of the Innoviz LiDAR systemInnovizTechnologies, an Israeli manufacturer of high-performance solid-state LiDAR sensors and perception software, and Whale Dynamic, a China-based autonomous driving company, are collaborating on Whale Dynamic's next-generation autonomous driving (AD) platform(Fig. 7/8).

Shenzhen-based Whale Dynamic is focused on developing an autonomous driving platform that incorporates multiple sensors, including LiDAR and high-resolution cameras, to provide a complete and detailed overview of the vehicle's surroundings

Tough LiDAR competition from China

While European, American and Israeli companies have dominated the global LiDAR market so far, fierce competition is forming in China. The market is ripe for mass production.

However, not all manufacturers, such as TESLA, are convinced that LiDAR is the best technical solution for autonomous driving. The use of purely optical sensors and the calculation of distance and speed using semiconductors and algorithms are regarded as alternatives.

Fig.8: The first solid-state LiDAR solution of its kind from the Israeli company Innoviz

Fig.8: The first solid-state LiDAR solution of its kind from the Israeli company Innoviz

In the meantime, Chinese car manufacturer Nio has announced that its luxury e-car ET7, which is due to be launched in the first quarter of 2022, will be equipped with a 'high-precision LiDAR' from Innovusion as standard. And Chinese telecoms equipment supplier Huawei has reported that it is also developing a '96-line LiDAR'. According to Chinese car manufacturer BAIC New Energy, this Huawei LiDAR will soon be installed in its electric cars.

At the same time, new partnerships are being formed. RoboSense LiDAR is entering into a partnership with Banma and AutoX to develop a platform for autonomous driving.

AutoX is the market-leading provider of the RoboTaxi in China. It is the only company operating a fully driverless RoboTaxi fleet without safety drivers on public roads in China. The company's self-driving platform is capable of navigating even the densest and busiest urban traffic in cities around the world. AutoX is the second provider in the world to be granted California DMV approval for fully driverless RoboTaxis.

In a nutshell

- In 2019, the market volume for all LiDAR systems amounted to USD 1.6 billion. According to a study by Yole, it is expected to reach an annual growth rate of 19% to $3.8 billion by 2025.

- The market for LiDAR systems in the automotive sector is on the verge of mass application. The market volume of assistance systems is expected to grow from USD 87 million in 2019 to USD 1,700 million in 2025. This means a growth rate of 114 % p. a.

- Technologically, LiDAR systems with movable mirrors are being replaced by solid-state LiDAR systems, e.g. based on MEMS.

- In Europe, LiDAR systems have so far only been used in the Mercedes S-Class, the EQS and the AUDI A8, and from 2022 in the BMW 7 Series.

While Western companies have dominated the LiDAR market to date, Chinese competition is now brewing. LiDAR systems for automotive applications currently cost in the range of 500 to 1500 $/unit. There are now increasing indications that Chinese manufacturers will enter the market with competitive prices of up to 200 $/unit from the end of 2021.

We should remain vigilant to ensure that Chinese manufacturers do not take the butter off our bread here too.

I wish you a strong start to the last third of the year.

Best regards to you

Hans-Joachim Friedrichkeit

Contact

F