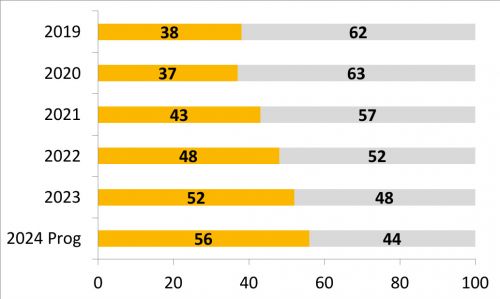

Five years ago, foreign manufacturers still sold 62% of all passenger cars registered in China (combustion engines + new electric vehicles). The picture has steadily changed in favor of Chinese manufacturers. 2023 was the first year in which less than half (48%) of foreign brands were sold. Apart from Tesla, German, Japanese and Korean manufacturers in particular have had to cope with a significant decline in sales.

Accelerated by the rapid Chinese shift towards e-mobility, around 56% of all passenger cars will come from Chinese manufacturers by 2024 (Fig. 2). In terms of technology and volume, China has become the world leader in New Electric Vehicles (NEV). Vertical integration of all key components has resulted in cost advantages that are passed on to customers. In addition, in contrast to Germany, small, low-cost electric vehicles are also produced. In addition, there is software tailored to customer tastes with games and entertainment.

China is becoming an automotive dominator

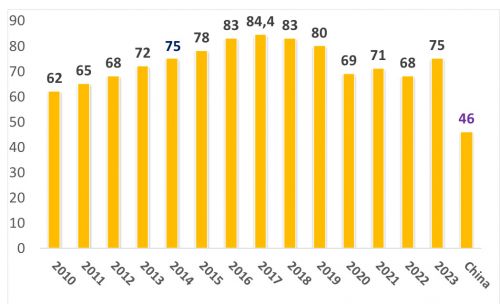

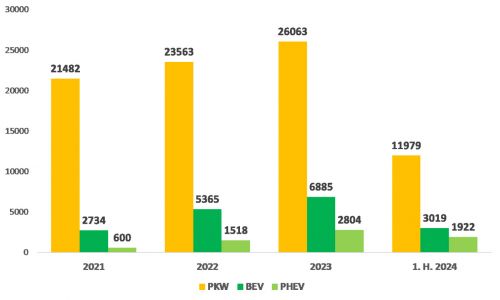

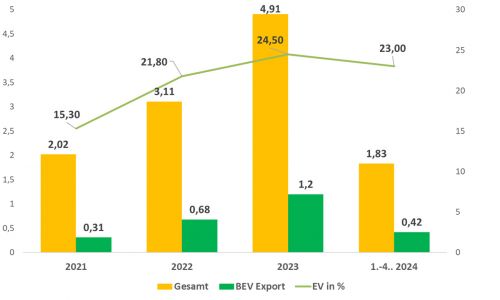

According to experts, China's production capacity for passenger cars currently amounts to 46 million units. This is more than 50% of global car production of around 80 million units. This compares with sales of 26 million cars (Fig. 3). So there is room for improvement here. Accordingly, car exports are rising steeply. While there were still 1 million cars in 2020 and 5 million units in 2023, exports are estimated to reach 6 million cars this year, with the share of e-cars currently rising to just under 25 %. (Fig. 5). BYD (33%) and Tesla (28%) account for around 60% of Chinese NEV exports. Whether rare earths, raw materials such as lithium and cobalt or the know-how for the world's best batteries: China has strategically gained access to the entire supply chain for e-cars. This poses a considerable risk for German and other foreign manufacturers of being forced out of the market in the next ten years. With 26 million cars sold, China was not only the world's largest overall market, but also led this market segment with 6.9 million e-cars (BEV) and 2.8 million plug-in hybrids (PHEV)(Fig. 4).

BYD market leader in the EV sector

On its 30th anniversary, BYD has just launched its ten millionth NEV (battery electric + hybrid). There are several key factors behind the company's success:

In-house production with high added value: this enables BYD to keep costs low. The company manufactures as many components as possible itself and integrates them. For example, BYD manufactures all components of the low-cost, successful Dolphin model itself, with the exception of the windows and tires. The price in China is around €13,000, in Germany around €32,000.

- Battery subsidiary: BYD has its roots in battery production, making it the first battery manufacturer to successfully develop into a vehicle manufacturer. After starting battery production in the late 1990s, BYD entered the automotive industry in 2003 and has since changed the industry significantly. One of BYD's outstanding innovations is its cell-to-pack technology with large 'blade cells' that increase efficiency. What sets BYD apart from other companies is its control over the entire battery supply chain: BYD manufactures key components such as electrolyte, separators and lithium carbonate etc. itself. This comprehensive approach has enabled BYD to achieve the lowest production costs for LFP batteries, even surpassing the world battery market leader CATL.

- Optimization of structural components: BYD is integrating parts such as its 8-in-1 E-axle, which includes the motor, inverter and BMS, to reduce costs. According to insiders, BYD has just invested in building an 'integrated body' die-casting project, also known as gigacasting, for the future platform of its vehicles.

- Innovation: BYD employs 900,000 people worldwide. 100,000 employees work in the research and development department. This enables BYD to maintain a high pace of development and bring new technologies to market quickly.

- State support in China: It should not be forgotten that BYD's rise has been facilitated by strong support from the Chinese government. This includes subsidies, incentives and favorable tax regulations for manufacturers of electric vehicles.

Russia is China's main customer

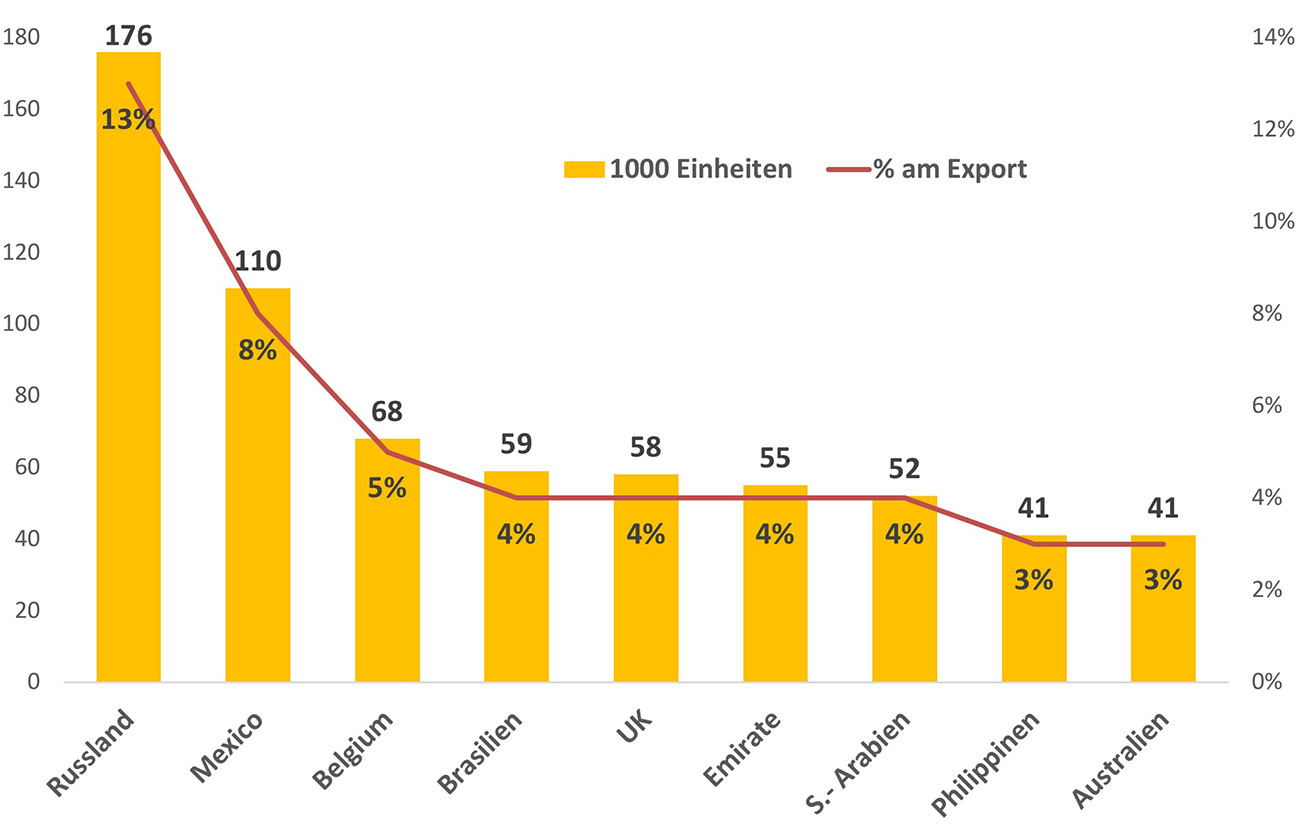

The East-West conflicts are also making themselves felt in the car business. Russia is the main importer of Chinese cars with 176,000 units from Jan. - April 2024. In contrast, Germany is currently not even among the TOP 10 importers with 31,500 primary e-cars in the same period(Fig. 6).

Fig. 6: TOP 10 countries car exports from China Jan. - April 2024 (Data: CAAM)

Fig. 6: TOP 10 countries car exports from China Jan. - April 2024 (Data: CAAM)

In a nutshell

- With the strategic expansion of the automotive industry in China, foreign manufacturers are gradually being pushed out of the market, from 62% 5 years ago to currently 44%. This primarily affects German, Japanese and Korean manufacturers.

- With a current capacity of 46 million cars per year, China has more than half of the approximately 80 million cars produced worldwide.

- With 6.9 million electric cars (BEV) and 2.8 million plug-in hybrids (PHEV) sold in 2023, the country will also be the world leader in this future-oriented segment.

- Car exports from China are rising sharply. While there were 1 million cars in 2020 and 5 million units in 2023, exports are estimated to reach 6 million cars this year. While Russia imports around 700,000 vehicles from China, Germany had 135,000 primary BEVs in 2023.

China is driving forward its long-term strategic goals with great momentum: major manufacturing power in 2025, global manufacturing power in 2035 and leading manufacturing superpower in 2049 to mark the 100th anniversary of the People's Republic of China. For the German automotive industry, there is only damage limitation if it wants to survive with a remnant. Failures in securing raw materials and resting too long on previous successes, as well as the political zigzag course of the EU and the last two federal governments, can hardly be remedied. The AUDI slogan 'Vorsprung durch Technik' was only relevant until the early 2000s.

Remain confident despite the difficult times. However, we need to realize across the board that 'effortless prosperity' only works for storytellers, because nothing comes from nothing! All that remains is to roll up our sleeves in the new year and get our country back on course for growth.

At the end of the year, I would like to thank all the readers who have been following my column for 22 years, as well as for all the suggestions, praise and criticism. My thanks are combined with best wishes for a reflective Advent and Christmas season. Please stay with us in 2025.

Best regards

Yours

Hans-Joachim Friedrichkeit