"The Swiss watch manufacturer Rolex enjoys a worldwide reputation for its expertise and the quality of its products. All Oyster Perpetual and Cellini wristwatches manufactured by Rolex are certified as superlative chronometers for their precision, performance and reliability and are characterized by their excellence, elegance and unique reputation," reads the official company portrait of the watch manufacturer.

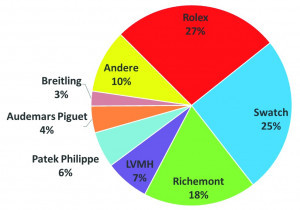

Fig. 2: Global market share of Swiss luxury watches by group If you want to buy a Rolex today, you need to have a good relationship with a Rolex concessionaire and a lot of patience on a waiting list. The market leader in luxury watches records sales of over CHF 8 billion and allocates its products.

Fig. 2: Global market share of Swiss luxury watches by group If you want to buy a Rolex today, you need to have a good relationship with a Rolex concessionaire and a lot of patience on a waiting list. The market leader in luxury watches records sales of over CHF 8 billion and allocates its products.

This was not always the case. From 2010, Hong Kong and China became the No. 1 export country for Swiss luxury watches with sales of around CHF 5 billion. Rolex watches in particular were a nice little and inconspicuous 'bribe gift'. The gray market boomed and many a watch found its way back to Europe as a re-import - at lower prices.

Today, the gray market has pretty much dried up and - as already mentioned - it is allocated. A remarkable strategy to successfully differentiate itself from competitors and technological newcomers such as the Apple Watch or Samsung, Garmin and other smartwatches with a luxury image.

Why the new Mercedes luxury strategy could be successful

'Less is more' is a perhaps banal-sounding saying. However, it is not only Rolex that is showing us how to achieve higher yields through scarcity, but unfortunately also Russia in terms of gas and oil. Which brings us to the economic topic of price elasticity: This, as Wikipedia explains, measures the relative change in supply or demand following a price change.

Fig. 3: Ola Källenius, Mercedes-Benz CEO, proclaimed luxury as a strategy in the spring of this year The announcement by Ola Källenius(Fig. 3) that the A-Class and B-Class will be discontinued without replacement from the middle of the decade fits in with this. With the new Mercedes-Benz strategy, the entry-level price will rise from currently under €30,000 to around €40,000.

Fig. 3: Ola Källenius, Mercedes-Benz CEO, proclaimed luxury as a strategy in the spring of this year The announcement by Ola Källenius(Fig. 3) that the A-Class and B-Class will be discontinued without replacement from the middle of the decade fits in with this. With the new Mercedes-Benz strategy, the entry-level price will rise from currently under €30,000 to around €40,000.

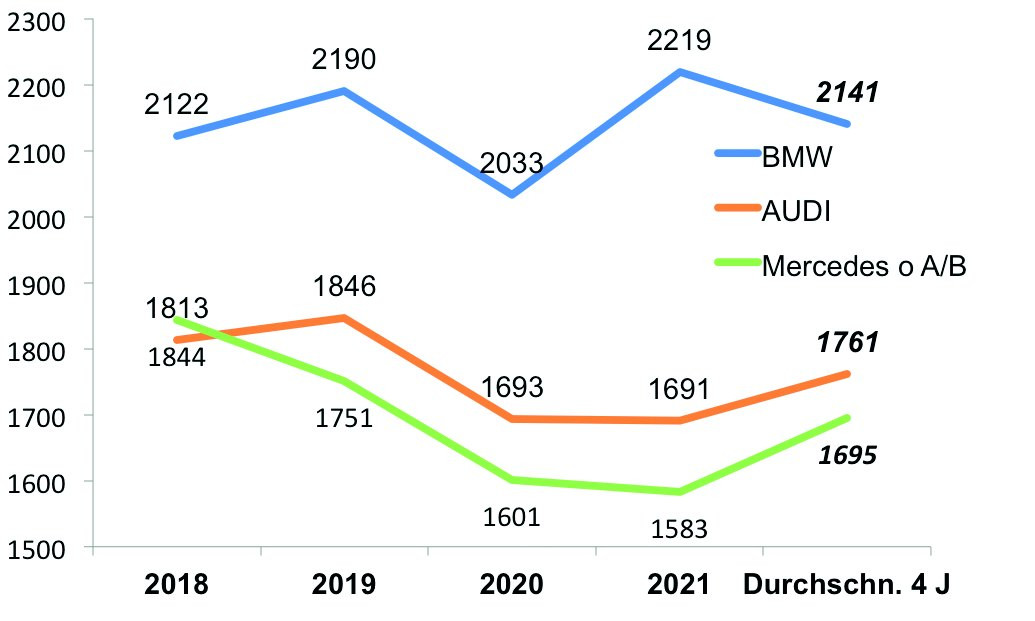

The strongest year to date for Mercedes in terms of millions of cars sold was 2019, although the previous sales plateau had already been reached in 2017, long before coronavirus. The Smart brand has not played a role in terms of unit sales since 2020(Fig. 4).

Looking at the latest figures from the first half of 2022, the GLC SUV model continues to be the best-selling individual model. In second place is the C-Class, followed by the E-Class. The B-Class is already playing a subordinate role, as is the A-Class.

E-mobility overturns previous targets: Volume classes no longer relevant for fleet consumption

With the discontinuation of the A-Class and B-Class and - already completed - of Smart, Mercedes-Benz is selling fewer vehicles than BMW and AUDI based on today's figures(Fig. 4).

Fig. 4: Mercedes without A/B Class versus Audi and BMW in thousands of vehicles

Fig. 4: Mercedes without A/B Class versus Audi and BMW in thousands of vehicles

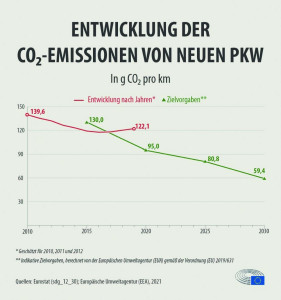

With the switch to electromobility, however, the previous politically set limits for the fleet consumption of all vehicles sold in the EU are losing their significance. The Smart, A-Class and B-Class were helpful in reducing fleet emissions.

Fierce competition from China for battery electric vehicles

Fig. 5:CO2 limit values in grams per km for the fleet consumption of new passenger cars in the EU The politically enforced phase-out of our highly developed and efficient combustion engines marks the beginning of a new era.

Fig. 5:CO2 limit values in grams per km for the fleet consumption of new passenger cars in the EU The politically enforced phase-out of our highly developed and efficient combustion engines marks the beginning of a new era.

Tesla was the pioneer, BYD, Nio, Aiways and others from China are now attacking. Battery technology has been built up over the last 20 years and has the largest production capacities. Electric motors and battery management systems, and soon also power electronics, are no barrier to market entry.

This means that competition in Europe will become even tougher, especially in the low-margin compact and lower mid-range segment. More brands will certainly disappear from the market in this decade.

Less is more

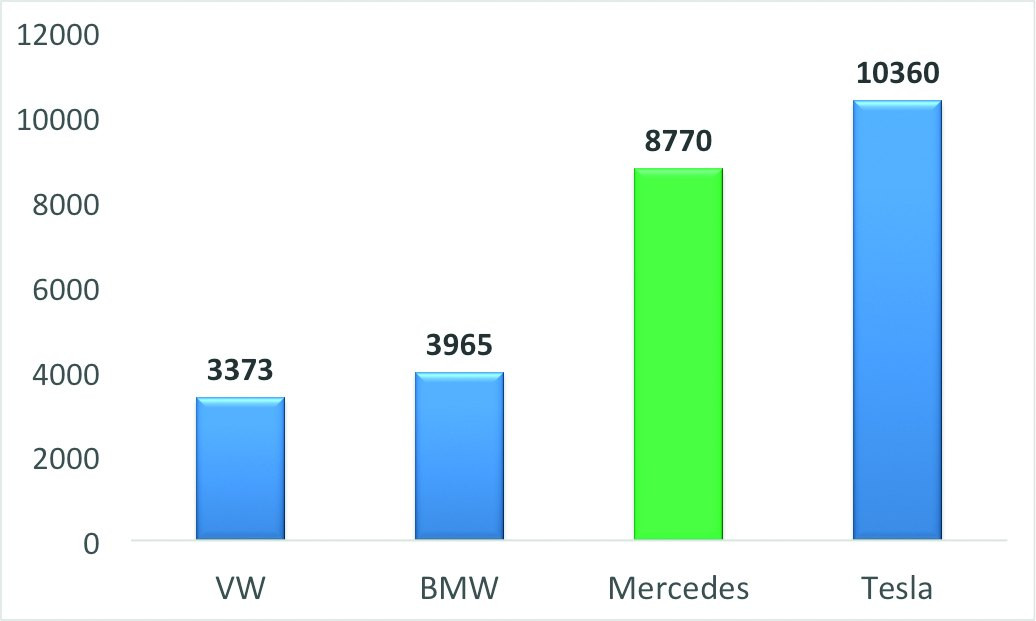

Looking at the average margin in € per vehicle sold in the first quarter of this year, it quickly becomes clear that the new Mercedes strategy is not so far-fetched(Fig. 6). Volkswagen as a mass manufacturer achieves € 3373 per vehicle and BMW € 3965. Mercedes-Benz, on the other hand, achieves a margin of €8870, which is 2.1 times higher than its competitor BMW.

Only Tesla outperforms them all with €10,360 per vehicle, which also means that there is still room for price reductions.

Fig. 6: Average margin per vehicle sold 1st quarter 2022 in euros

Fig. 6: Average margin per vehicle sold 1st quarter 2022 in euros

Brought to you

- The Swiss watch manufacturer Rolex enjoys a global reputation for its expertise and the quality of its products. At the same time, the careful scarcity of its luxury watches ensures stable and continuously rising prices as well as high value retention. With a 27% share of the global market for Swiss watches > CHF 5000, the company generates annual sales of > CHF 8 billion.

- With the discontinuation of the A-Class and B-Class at Mercedes-Benz, the entry-level price increases from < €30,000 to around €40,000. With electrification, both classes and the Smart, which has already been spun off, will no longer be important for reducing fleet CO2 emissions in the future.

- At the same time, Mercedes Benz is exiting the low-margin mass segment, in which even tougher competition is beginning with the market entry of Chinese battery electric vehicles (BEV).

- In the first quarter of 2022, Mercedes Benz already achieved a margin per vehicle more than twice as high as BMW and Volkswagen.

In summary, the Mercedes-Benz strategy, based on the marketing of luxury goods from Patek Philippe and Gucci to Louis Vuitton, seems to have a good chance of success. Today, it is no longer enough to be slightly better than the competition. The goal must be to be a leader in ideas and concepts. These consist of product, service and a viable idea. Only those who market a concept also have price leadership.

Stay with us

Yours

Hans-Joachim Friedrichkeit