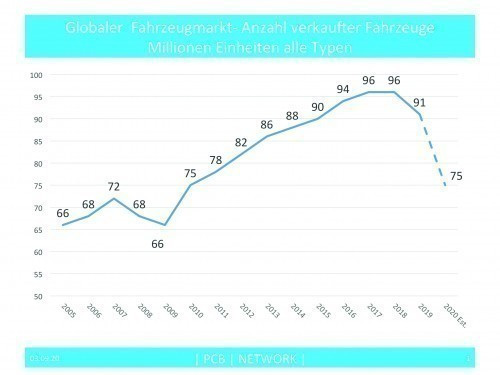

The global vehicle market (Fig. 1) has been in a serious crisis for several years, which has now been drastically exacerbated by the coronavirus pandemic. In 2017, the hitherto permanent upswing came to a standstill with around 96 million units worldwide. After zero growth in 2018, the downturn began in 2019 with -4.5 %. According to industry experts, the vehicle market could shrink by around 20% to 75 million units in 2020.

Fig. 1: Global vehicle market - number of vehicles sold in millions of units, all types (Image: PCB-NETWORK/OICA)

Fig. 1: Global vehicle market - number of vehicles sold in millions of units, all types (Image: PCB-NETWORK/OICA)

Germany is losing out as a production location

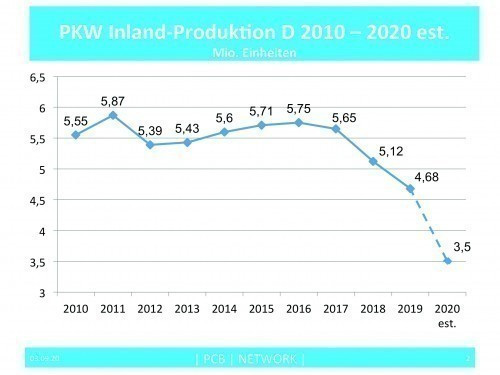

The domestic production figures for passenger cars in Figure 2 show the dilemma facing the German and European supplier industry. At 5.75 million units, 2016 was the last peak. After that, things went downhill year after year. In 2017, domestic production shrank moderately by -1.8%, in 2018 it was -9.3% and in 2019 -8.9%. This means that domestic production has already shrunk by a whopping -20% between 2017 and 2019. Now comes the coronavirus crash in 2020, conservatively estimated at a further -25%. On average, 390,000 cars were produced per month in Germany in 2019, compared to 11,000 units in the lockdown month of April 2020. The disaster for the smaller national and European suppliers could hardly be greater.  Fig. 2: Domestic car production D 2010-2020 in millions of units (Graphic: PCB-NETWORK/VDA)

Fig. 2: Domestic car production D 2010-2020 in millions of units (Graphic: PCB-NETWORK/VDA)

The fact is, however, that Germany as a production location is continuously losing ground, even without the coronavirus pandemic!

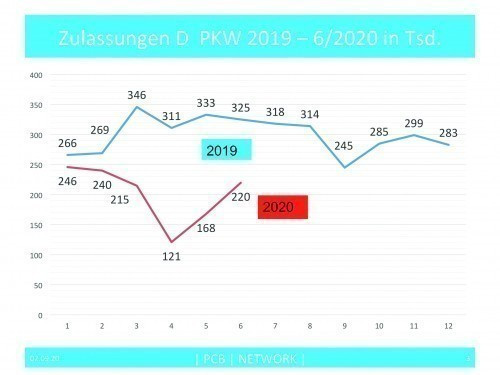

In terms of registrations, too, 25% of new car sales are missing somewhere (Fig. 3) if you compare the poor sales year 2019 (blue) with the coronavirus year 2020 (red).  Fig. 3: Car registrations in Germany 2019 to 6-2020 (Graphic: PCB-NETWORK/VDA)

Fig. 3: Car registrations in Germany 2019 to 6-2020 (Graphic: PCB-NETWORK/VDA)

Western Europe, USA and Japan shrink at different rates

Following an unprecedented slump in the first six months of this year, the international automotive markets stabilized somewhat at the start of the second half of the year. The Western European market (EU14 & EFTA & UK) shrank by only -2.2% in July, after a year to date (YTD) decline of -35% (Tab. 1).

Tab. 1: New registrations/sales of passenger cars worldwide January to July 2020

|

Number of sales |

July 2020 |

+/- percent |

1 to 7 2020 |

+/- percent |

|

Western Europe (EU14+EFTA+UK)* |

1 161 900 |

-2,2 |

5 756 200 |

-35,0 |

|

USA |

1 227 100 |

-12,1 |

7 656 600 |

-21,9 |

|

Japan |

330 800 |

-12,8 |

2 156 800 |

-19,1 |

|

Brazil** |

163 400 |

-29,8 |

928 700 |

-37,4 |

|

India |

182 800 |

-3,9 |

993 800 |

-43,1 |

|

China |

1 630 000 |

+8,5 |

9 343 000 |

-18,5 |

*excluding Malta, **Light VehiclesPCB-NETWORK/VDA

Developments in the five largest individual markets varied last month: in the United Kingdom, car sales rose by 11%. Passenger car sales also increased slightly in France (+4%) and Spain (+1%). In Germany (-5%) and Italy (-11%), on the other hand, further declines were reported.

In the USA, a drop of 12.1% was recorded in July. The sales volume on the US light vehicle market (passenger cars and light trucks) amounted to 1.2 million new vehicles in July. Since the beginning of the year, the market has thus shrunk by 22% to just under 7.7 million vehicles. In the light truck segment, which accounts for three quarters of the total market, sales fell by 17%. The passenger car segment fell by more than 34%.

The automotive business in Japan recorded a decline of 13% in July (330,800 cars). Over the course of the year, the Japanese market is now 19% below the previous year's level with just under 2.2 million passenger cars sold. While sales in India fell by a single-digit percentage, sales figures in Brazil were again down massively.

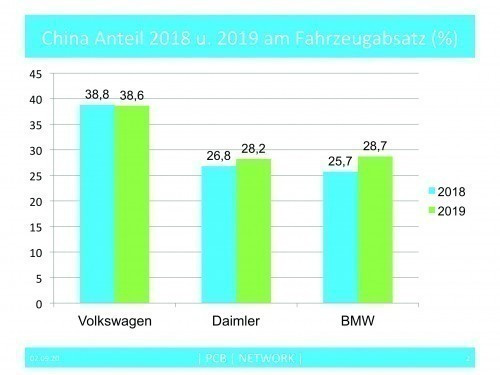

China: beacon of hope for German car manufacturers

In China, on the other hand, sales increased for the third month in a row, rising by 8.5% in July. Reasons for this include catch-up effects as a result of pent-up demand during the lockdown and comprehensive government measures to promote sales. The last time there was growth over such a period in the People's Republic was in the second quarter of 2018. At 1.6 million vehicles, sales there were almost 9% higher than in July of the previous year. Over the course of the year, however, there was still a significant drop of 18% (9.3 million cars).

China has become a lifesaver for German car manufacturers (Fig. 4): 5.5 million passenger cars were sold by manufacturers VW, Daimler and BMW in the world's most important car market in 2018. That was 35.6% of their global sales. These figures are based on a new study by management consultants EY. These are high-yield mid-range and luxury models with many additional features.  Fig. 4: China's share of vehicle sales in 2018 and 2019 in percent according to manufacturers (Graphic: PCB-NETWORK)

Fig. 4: China's share of vehicle sales in 2018 and 2019 in percent according to manufacturers (Graphic: PCB-NETWORK)

To the point:

After an unprecedented slump in the first six months of this year, the international automotive markets stabilized somewhat at the beginning of the second half of the year; i.e. the decline has slowed down. The Western European market (EU14 & EFTA & UK) shrank by only -2.2% in July, after a year-to-date (YTD) decline of -35%.

In the USA, a drop of 12.1% was recorded in July. Since the beginning of the year, the market has shrunk by 22% to just under 7.7 million vehicles. The passenger car segment fell by more than 34%.

In Japan, passenger car sales fell by 13% in July. Over the course of the year, the Japanese market is now 19% below the previous year's level.

At 1.6 million vehicles, sales in China were a pleasing 9% higher than in July last year. Over the course of the year, however, there was still a significant drop of 18%.

The importance of Germany as an automotive production location is steadily declining. While 5.75 million cars were produced in 2016, the figure in the pre-corona year 2019 was 4.66 million units, a drop of around 20%. This year, we will be lucky if car production only shrinks by -25% to 3.50 million units. Suppliers with a global presence with several plants in the most important markets can compensate for this, while those with a mono-location should come up with something.

Corona is the burning glass that is painfully ensuring that we all get fire under our buttocks. This applies not only to many business models, but also to regulatory policy, i.e. the framework conditions set by the federal government.

I wish you a spirited start to the fall.

Best regards

Yours

Hans-Joachim Friedrichkeit