Difficult times for PCB manufacturers: slump in orders, difficult working conditions due to coronavirus, cheap Chinese products. However, research has shown that many board manufacturers are using the time to push ahead with digitalization and invest in new machines and technologies. This two-part article presents the plans and problems of 14 PCB companies. Part 1 deals with German PCB producers, part 2 with PCB producers from other EU countries. The BMBF's new flagship initiative 'Trustworthy Electronics' is also discussed.

In order to better understand the situation of the German PCB industry, we will first look at the development of the entire electrical industry in Germany. Board manufacturers are embedded in this industry as suppliers and are therefore one of its components. It can be assumed that a significant proportion of the PCBs manufactured in Germany are also used in the local electrical industry, which in turn acts as a supplier for other industrial sectors such as automotive engineering, automation technology, medical technology, etc. There are also carriers manufactured abroad, primarily in China.

The situation in the electrical industry that uses PCBs therefore has a more or less direct impact on the situation of PCB producers, and the situation in the electrical industry is in turn closely linked to the situation of the final customers of electrical products in other industrial sectors and countries. Conclusion: If the latter are doing badly, this extends down to the PCB manufacturers as an important part of the supply chain.

A good example of this is the Schweizer Group with Schweizer Electronic in Schramberg. In its press release from November 6, 2020 on business development in the third quarter and the first three quarters of the year, the company wrote that total turnover amounted to €69 million, which corresponds to -26.8% compared to the previous year.

In order to lower the break-even point at the plant in Schramberg, short-time working was introduced for both production and administration in the second and third quarters of 2020. In order to counteract the impact of declining business volumes and falling margins, numerous cost-cutting measures were implemented in personnel and material costs in the last financial year. These were continued in the reporting period. Compared to September 2019, the number of employees in Schramberg fell by around 10% at the end of the third quarter of 2020.

Incoming orders in the first three quarters of 2020 amounted to € 38.7 million, which corresponds to -36.2% compared to the same period of the previous year. Orders on hand amounted to € 101.7 million at the end of the third quarter of 2020 (31.12.2019: € 126.7 million). However, according to the Management Board, the company's business development stabilized again in the third quarter, i.e. it showed an upward trend. Paradoxically, the positive sales impetus for this period came primarily from the automotive sector. This sector had caused a certain slump for many PCB manufacturers since 2019. The Executive Board expects the recovery trend to continue in the fourth quarter of 2020. This forecast is supported by a positive trend in order momentum and an increase in business volume at its new plant in China. As the ZVEI figures below show, Schweizer has followed the general trend in the local electrical industry during the coronavirus crisis, only more drastically.

Difficult situation in the electrical industry

The German electrical and electronics industry is going through one of its most difficult times this year due to Covid-19. This is once again confirmed by the figures published by the ZVEI in October 2020. In the period from January to August of this year, incoming orders were 10.3% lower than the corresponding figures from the previous year. Cumulative industry turnover for January to August amounted to €112.8 billion, which was 9.7% lower than a year ago.

In August 2020, the German electrical industry recorded 12.4% fewer orders compared to the previous year. Domestic orders fell by 5.6% and foreign orders by 17.0%. Domestic sales fell by 9.4% to €53.3 billion and foreign sales by 9.8% to €59.5 billion. Sales to the eurozone fell short of the previous year's level by more than a tenth (-11.4% to € 21.7 billion). Sales with third countries fell by 9% to € 37.8 billion. Price-adjusted production in the sector also fell sharply again in August, down 15.2% on the previous year. Cumulatively over the first eight months of this year, output missed the previous year's level by 10.2%. These figures reflect the fact that the global coronavirus pandemic is naturally also depressing the economy on a large scale.

Nevertheless, the ZVEI noted that the business climate in the German electrical and electronics industry improved in September 2020, as it has done for the last four months in a row. Both the assessment of the current situation and general business expectations increased in September compared to August. This is some light on the horizon for both the German electronics industry and its PCB manufacturers.

However, the ZVEI is also of the opinion that there were increasing signs in October that the road back to pre-crisis levels will be a longer one. "We are heading towards a slower, U-shaped recovery instead of the hoped-for rapid V-shaped one," explained ZVEI economic expert Peter Giehl. Especially as the decline in August was greater than in June (-1.1%) and July (-11.3%). The ZVEI can hardly say how extensive this 'U' will be at the moment, as the coronavirus situation has changed rapidly worldwide since it issued its press release on the situation in the PCB industry on September 3 - including in Germany. In this situation, predictions are only of a momentary nature and can be significantly outdated within a short period of time. The uncertainty about the speed and size of the economic upturn makes it difficult for Germany and almost all European countries to plan with any degree of accuracy. The companies are involved here.

It is also unclear how the stricter measures imposed by the German government against coronavirus on October 28 will affect economic life. It may be possible to make more precise forecasts and plans again at the end of November, when the stricter measures expire or are withdrawn.

As in Germany, it is likely that many public and private modernization investments in equipment and systems will be put on the back burner in favor of overcoming the coronavirus crisis. Money can only be spent once. Many countries are currently running up huge debts by spending horrendous amounts of money on dealing with the consequences of the coronavirus pandemic and taking out huge loans to do so. This is also causing growing uncertainty for the economy.

Although the PCB industry has benefited from the increased demand for electronic equipment brought about by coronavirus, many companies have not been able to compensate at least halfway for the loss of orders due to coronavirus and other various reasons. What these other various reasons are will play a role later in this article. There are other fundamental risk factors for German board manufacturers in addition to coronavirus.

Corona is only exacerbating the weakening year 2019

At the end of October, the ZVEI did not yet have any data available for a concrete assessment of the situation in the PCB industry in German-speaking countries (DACH) in the third quarter of 2020 as a whole. However, based on the development of sales in 2019 and the first half of 2020, it is unlikely that they will be much better in the third quarter of this year - on the contrary. The Swiss group cited above is proof of this.

According to a ZVEI press release from March 2020, 2019 was already characterized by falling sales and fewer incoming orders for PCB manufacturers in the DACH region:

- Turnover fell by 11.1% in 2019

- The value of new orders fell by 11.4% over the year as a whole.

The reasons given for this were

- Primary uncertainties due to Brexit

- Crisis in the automotive industry

- Trade conflict between the USA and China and the USA and Europe.

The growing influence of the Chinese PCB industry on Germany was not mentioned - directly, as Chinese companies themselves are becoming increasingly active on the European market. Indirectly, the influence is growing as German PCB dealers such as Skytech and some PCB manufacturers themselves are placing more and more orders with Chinese companies - often to the detriment of local board producers. Even Schweizer Electronic is causing further uncertainty among German PCB companies that only manufacture in Germany with its new PCB factory in China, which is five times larger than the one in Schramberg.

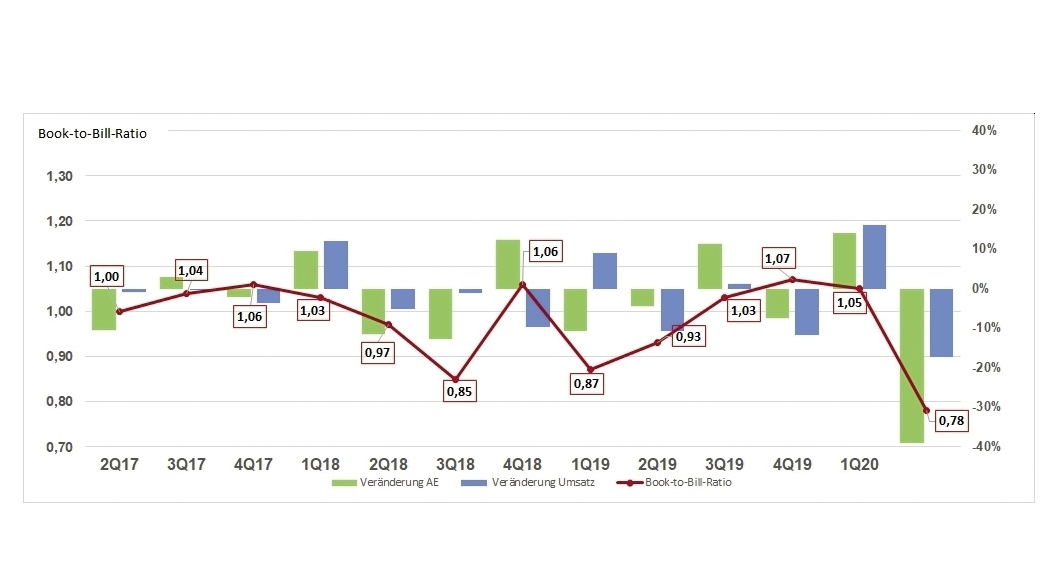

At the beginning of 2020, PCB manufacturers did not expect any significant improvement in the year due to the continued risks mentioned by the ZVEI alone, but also because of the situation just described. This situation was then compounded by the coronavirus pandemic, which further worsened the situation. In the first quarter, board manufacturers in Germany, Austria and Switzerland already suffered a 7.5% drop in sales compared to 2019. In the second quarter of 2020, revenue was down 17.4% on the same period of the previous year. In the middle of the year, the PCB industry predicted a decline in revenue of around 10% to 15% for 2020 as a whole compared to 2019(Fig. 1). This could be in line with the Swiss Group's expectations.

Incoming orders also fell by a substantial 39% in the second quarter of the current year compared to the previous quarter. Not only were orders lower, but existing orders were also postponed or canceled - even at short notice. In the first quarter, however, PCB manufacturers benefited from the fact that China had been unable to deliver since January due to the coronavirus crisis and orders were shifted back to the DACH region. However, China quickly regained its footing in PCB production, meaning that this temporary support for the German PCB market has disappeared.

It is also unlikely that sales results will grow significantly again at the end of the year or at the start of 2021, as the book-to-bill ratio - the ratio of incoming orders to sales - only reached 0.78 in the second quarter. The uncertainty surrounding coronavirus is simply preventing a more positive assessment.

Carry on - one way or another?

In view of these less than encouraging figures and trends, the question arises as to how the situation is affecting PCB manufacturers and how they are reacting to developments in the electronics industry and among end customers. Are they resigned or are they facing up to the new challenges that have arisen, and if so, how? However, it should be noted that board manufacturers in the DACH region have so far come through the coronavirus period in very different ways: Some with full order books and full capacity utilization, others with worry lines on their foreheads and more or less severe slumps in sales as well as temporary short-time work. A detailed assessment would require a specific survey, but this would be very time-consuming as there are still around 200 board manufacturers in Europe, 65 of which are in Germany.

However, an initial impression can be gained by evaluating press releases and information on the companies' websites that they published between March and November 2020. In the following, the author briefly presents the attitudes and reactions of 12 German PCB producers of various sizes, from SMEs to large companies. Two companies from our neighboring countries round off the picture. A key question is whether board manufacturers are optimistic about the future despite the difficult working conditions, e.g. by continuing to invest in their companies, and if so, in which direction.

Insolvent companies

According to press reports, the coronavirus pandemic has led to a slight decline in the number of PCB manufacturing companies. Two examples of the worst-case scenario of PCB production being discontinued are the German companies Straschu and Schoeller Electronic Systems. The following overview will begin with them. However, such negative information is still an exception in the industry.

Straschu PCBs

On August 28, 2020, Straschu Holding in Stuhr announced that Straschu Leiterplatten GmbH will cease production on November 30. For over 40 years, around 60 of the company's employees have manufactured boards, primarily for industry, but also, for example, UL-certified high-tech carriers for special applications. According to the Straschu spokesperson, the main reasons for this unavoidable step are the energy and environmental conditions and, in particular, the competitive pressure from the Far East in this very labor-intensive product segment. Cost-covering production was no longer possible. Only the holding company's printed circuit board production division is affected by the closure.

Schoeller Electronic

Systems GmbH

It was announced on May 7 that the PCB manufacturer Schoeller Electronics Systems GmbH (Wetter) was undergoing preliminary insolvency proceedings under strange circumstances (see Plus 6/2020). On November 3, the insolvency administrator announced that the company could not be saved despite a targeted and active search for investors. The last remaining interested party had also announced that it was withdrawing from the bidding process. Production operations with 180 employees will be discontinued by January 31, 2021 at the latest. Schoeller was one of the smaller leading PCB manufacturers in Europe. The company specializes in special technology circuits in flex and rigid-flex or HDI designs, boards with metal cores or special base materials, for example for HF circuits. Its customers include major European electronics groups.

Difficult times, but new goals for many other companies

Fig. 2: Automatic optical inspection system CIMS GalaxyThefollowing examples demonstrate that many companies in the German PCB industry are optimistic that they will successfully overcome the current difficult economic situation and complicated working conditions. They are setting themselves new goals. They are struggling and using the time to advance the organizational, technological and mechanical basis and thus adapt to changing, greater internal and external requirements. The important thing is that these companies provide public information about their investments and thus send important positive signals to the local electronics industry and customers.

Fig. 2: Automatic optical inspection system CIMS GalaxyThefollowing examples demonstrate that many companies in the German PCB industry are optimistic that they will successfully overcome the current difficult economic situation and complicated working conditions. They are setting themselves new goals. They are struggling and using the time to advance the organizational, technological and mechanical basis and thus adapt to changing, greater internal and external requirements. The important thing is that these companies provide public information about their investments and thus send important positive signals to the local electronics industry and customers.

During the author's research, however, there were also PCB manufacturers who have shown little or no transparency this year as to how their company is developing and what its plans are. These include, for example, the Berlin-based companies Contag AG and Andus Electronic. The company presentation begins with medium-sized companies, followed by KSG and Würth Elektronik, two high-end companies.

Elekonta Marek

According to a press release from Notions Systems on October 27, 2020, the medium-sized board manufacturer Elekonta Marek is continuing its strategy of using n.jet soldermask inkjet printers by acquiring another machine in October. Elekonta intends to consistently continue on its path of digitalization. The n.jet soldermask is an inkjet system that prints digitally. The inkjet process for non-contact printing of solder masks replaces a number of conventional process steps. According to the manufacturer, it is extremely easy to maintain, reduces waste water and energy consumption and thus makes electronics production more ecological and economical. According to Lars Presche, Managing Director of Elekonta Marek, the inkjet technology structures open up new possibilities in PCB production.

Ilfa Feinstleitertechnik GmbH

As a long-standing manufacturer of high-tech prototype and series PCBs that offers a wide range of technologies, Hanover-based owner-managed Ilfa strives to achieve an ever-higher technological level in order to meet customer requirements, according to a press release from September 2020. This applies to both high-tech and middle-tech products. Customers are companies and research institutes that are active in areas such as aerospace, satellite technology, robotics and medical technology. Ilfa does not produce for the mass market, as this is mainly supplied by South East Asia. Its medium series range up to 100,000 boards per type. For larger series, the company has offices in the Taiwanese capital Taipei and in Shenzhen, China.

On November 1, Ilfa announced that it had taken over the German PCB dealer Skytech Europe GmbH (based in Nagold) and its 12 employees in Germany. As a result, the Hanover-based company is significantly expanding its capacity and expects to become one of the top 5 independent PCB suppliers in Germany in 2021. As Ilfa's annual turnover in 2019 was €18 million, Skytech's turnover would then have been several times that of Ilfa. Incidentally, the abbreviation Ilfa stands for industrial electronics and PCB manufacturing of all kinds.

According to press releases, Skytech supplied around 45 million PCBs in 2018, primarily to the automotive industry. Around 80% of customers come from Germany.

In May, the Hannoversche Allgemeine Zeitung reported that the manufacturer had also been affected by the economic impact of the crisis and was having to fight hard. Short-time working had already been considered, but so far the company had been able to keep all employees in full employment.

Ilfa also announced at the end of September that it had analyzed the latest status of PCB production as part of a benchmarking process and had made several investments on this basis as part of an overall factory technology and competence upgrade. The manufacturer employs around 160 people. Since the fall of this year, the number of trainees has increased to four young people.

As part of its technology upgrade, for example, the company decided to purchase CIMS Galaxy automatic optical inspection systems and atg-LM Flying Probe electrical test systems(Fig. 2). The CIMS Galaxy AOI offers the latest optical inspection technology parameterized by CIMS. The CIMS Galaxy is part of the CIMS SPARK technology. The CIMS AOI systems are capable of working with the wide range of base materials and surface finishes that Ilfa can offer to its widespread customer base worldwide. The atg-LM technology is partly an extension and partly a replacement for the atg-LM equipment that has been in use at the producer for over a decade. In particular, the A7 model, equipped with the latest in E-Test technology, can now test even finer pitches, smaller pads and also any type of surface finish. It also allows the testing of embedded components and is prepared for 4-wire testing.

The decision for the CIMS AOI and atg-LM should help Ilfa to remain a leader in the prototype to mid-volume segment of rigid/rigid-flex to highly complex PCB manufacturing, i.e. hybrid and embedding technology. In addition to the investments, the PCB manufacturer launched a major advertising campaign on the Evertiq information platform in the fall.

Richter Elektronik GmbH

Fig. 4: Direct imagesetter from Swiss Printprocess AG at RichterThemedium-sized company based in Schmallenberg, Sauerland, also known as Richter Leiterplatten, announced in a press release at the beginning of September that it could look back on a successful first half of the year with its 60 employees and had received a great deal of confirmation for its strategy. Sales manager Ralf Langefeld emphasized that the exclusive production of the boards in Germany and the immediately available contacts for all questions were expressly recognized.

Fig. 4: Direct imagesetter from Swiss Printprocess AG at RichterThemedium-sized company based in Schmallenberg, Sauerland, also known as Richter Leiterplatten, announced in a press release at the beginning of September that it could look back on a successful first half of the year with its 60 employees and had received a great deal of confirmation for its strategy. Sales manager Ralf Langefeld emphasized that the exclusive production of the boards in Germany and the immediately available contacts for all questions were expressly recognized.

Richter was founded in 1978 as a family business, has a production area of 4,200m2 and produces around 23,000m2 of boards per year. The company manufactures DKL, multilayer, IMS and semiflex substrates for more than 280 active customers(Fig. 3, title). The smallest structure width (L/S) is 90 µm. The express service delivers within two days.

The manufacturer reported that it has continued its investment activities even in an uncertain situation. For example, an additional direct imagesetter with automation from Swiss company Printprocess AG has been supplementing photo printing since July(Fig. 4). CAM, electroplating, mechanical processing and electrical testing capacities were already increased last year. With the high-quality Nan Ya NPG-170TL laminate, a TG 170 °C (DSC) variant was added to the halogen-free base material range. The material has flammability class V-0. The manufacturing process is fully UL-approved for Canada and the USA. The advantages for customers are robust redundancy and reduced order lead times. Digitized processes now make it possible to sustainably reduce ancillary costs. With the development measures taken so far, the Schmallenberg-based company is confident that it will be able to further expand its high reliability and ability to deliver at short notice.

Polytron-Print GmbH

Fig. 5: The new 5-spindle Speedmaster HDI drilling machine with automatic loading from SchmollTheBlack Forest PCB manufacturer Polytron-Print, based in Bad Wildbad, announced at the beginning of August that it was using the coronavirus crisis year to invest in new machines and technology in 2020 in line with its corporate strategy. In addition, the internal and external appearance will be further developed. The company wanted to set the course for the future in its anniversary year. In October, the company celebrated its 50th anniversary with around 100 employees. The coronavirus crisis has not yet had any negative impact on the board manufacturer.

Fig. 5: The new 5-spindle Speedmaster HDI drilling machine with automatic loading from SchmollTheBlack Forest PCB manufacturer Polytron-Print, based in Bad Wildbad, announced at the beginning of August that it was using the coronavirus crisis year to invest in new machines and technology in 2020 in line with its corporate strategy. In addition, the internal and external appearance will be further developed. The company wanted to set the course for the future in its anniversary year. In October, the company celebrated its 50th anniversary with around 100 employees. The coronavirus crisis has not yet had any negative impact on the board manufacturer.

From the very beginning of the company's activities, quality thinking in terms of production and service has been the top priority. That is why Polytron-Print still produces exclusively 'Made in Germany' to this day. Suppliers also preferably come from Germany and the region. The use of cheap imports, even in certain areas, is consistently rejected. According to the management, this conscious attitude has proven to be the right decision for sustainable success. As a result, Polytron-Print is now one of the top 10 PCB manufacturers in Germany. The guiding principle for the tradition-steeped, self-confident company is a mix of down-to-earthness and family structures as well as innovative strength and market orientation. On a production area of 13,000m2, the company manufactures a wide range of printed circuit boards from prototypes to mass production, including boards with UL approval. The company's dynamic technology roadmap includes the transition to minimum structure widths and distances of 50 µm as a target for 2020, and 80 µm for blind vias laser technology.

Polytron-Print benefits from its solid customer base with a good distribution across several sectors: industrial electronics, building technology, automotive, optoelectronics, white goods, communications and medical technology. Individual service, sophisticated logistics concepts and personal communication at eye level lead to long-term customer relationships and are a prerequisite for planning freedom and independence.

In the Corona year, the Black Forest-based company is focusing specifically on increasing the performance and capacity of the drilling department. A new 5-spindle drilling machine from Schmoll has been in operation since the summer(Fig. 5). It meets the demand for ever more holes per unit area and helps the company to keep pace with the trend towards ever smaller PCBs. The machine is just one part of the total of over 1.5 million euros invested in new machinery this year alone. Two machines for surface treatment were also put into operation: a fully automatic foil laminator and a system for coating the PCBs with electroless nickel/gold to ensure optimum solderability and bondability of the boards.

In March of this year, the company was also officially classified as a supplier of critical infrastructure in accordance with the BSI Critical Infrastructure Ordinance (BSI Critis V), as the company's high-quality products are also used in the medical sector in particular.

Meco Elektronik GmH

The medium-sized company Meco (Asslar-Berghausen) has become an important pillar this year, particularly for medical device manufacturers in Germany and Europe, as it had already focused part of its production on high-quality supplies for the medical sector in the past. Examples:

- Rigid-flex printed circuit boards for hearing aids/hearing systems from all leading manufacturers

- Multilayer and flex PCBs for operating tables, inhalation devices

- Boards for non-invasive patient monitoring and diagnostic/patient monitoring systems.

In order to ensure stable production even in times of crisis, the range of products and services has already been extended to application areas with different economic cycles(Fig. 6):

- Safety and sensor technology

- Drive and automation technology

- Building automation

- Measurement and control technology

- heating technology

- lighting technology.

The range of applications for Meco's IMS printed circuit boards for high-power LED applications is constantly growing, which contributes to a continuous broad production. Meco relies on German manufacturers, e.g. Lackwerke Peters, for many chemicals such as masking lacquers, marking printing, etc. High quality standards and UL certification are basic characteristics of Meco. Additional experienced specialists have been recruited to strengthen the CAD/CAM department and the mechanical processing department in line with the company's forward-looking orientation. In the summer, personnel were also sought to expand the quality management and quality assurance departments. Recent investments include an improved exhaust air purification system, e.g. wet separators.

Becker & Müller Schaltungsdruck GmbH

Since its foundation in 1985, the PCB manufacturer near Offenburg has specialized in printed circuit boards in prototypes and small series, including rush systems. The product spectrum ranges from single-layer boards and 20-layer multilayers to rigid-flex carriers and special HF substrates. The customer base primarily includes engineering offices and development departments from a wide range of industries.

According to the press release from November 3, the basic maxim is the continuous improvement of PCB production. For example, a sub-process of PCB production in the company has been optimized in the in-house continuous improvement process. The latest investments include the Targomat multilayer registration system for precise placement of registration holes and a riveting system. With the investment in the new rivet welding module, a further increase in quality has been achieved. "As a prototype manufacturer, we are always keen to see exactly what's new and how we can improve," says Xaver Müller, one of the company's two managing directors. Standstill in production is not good and so the company is always looking for new opportunities for optimization. The future at Becker & Müller is therefore set to include further investment in a new waste water system and a new milling machine. This is another step towards staying at the cutting edge of technology.

MOS Electronic GmbH

The owner-managed medium-sized company with around 60 employees, which is based in Neuweiler, has been producing printed circuit boards for more than 30 years. Its customers include companies of all sizes, including from the automotive, medical technology, mechanical engineering, EMS and telecommunications sectors. Rush production for prototypes as well as emergency production of large quantities directly to the assembly line have been part of the company's daily business since 1985. The quantities range from 1 to large series.

In addition to the efficient and highly modern in-house production, customers benefit from a transparent partner network in Europe and Asia, the MOS network. Since 2005, MOS Electronic has been working with established Asian series manufacturers so that it can offer all types of printed circuit boards in all series sizes. Special technologies, e.g. special layer structures, cavities, copper inlays, further expand the technical possibilities for customers. The UL listing is an advantage for the company. All in all, the company is able to react in an extremely flexible and balanced manner with regard to board types, quantities, delivery times and the sectors in which its products are used. Although the company also manufactures for the automotive sector, its dependence on this sector is manageable and not as extreme as that of some other PCB manufacturers.

Because power and control electronics are growing ever closer together and power electronics itself is penetrating ever new applications, MOS Electronic is increasingly opening up this area of application technologically. An important basis for this is IMS technology(Fig. 7). The manufacturer sees great potential in the growth market of power electronics. MOS can already build on many years of experience in thick copper applications with up to 400 µm copper on inner and outer layers as well as IMS technology.

Fig. 7: IMS technology is an important future technology for MOS

Fig. 7: IMS technology is an important future technology for MOS

"The ability to combine HDI, high-frequency and power applications on a single board is one of the key advantages of production geared towards a broad product portfolio, as is the case at MOS Electronic. Often there is not just one solution approach," explained Michael Klingler (Technical Sales) in a press release on June 15 of this year. "Around ten years ago, there was already an increasing trend towards power electronics among our customers. In recent years, we have made targeted investments in the further development of our portfolio. In addition to etching and pressing capacities, this involves many small adjustments that make up a reliable product." Among other things, the capacities of the plating line are to be increased in 2020. According to the job advertisement, the internal sales team is also to be strengthened. According to the management, continuous further development and constant investment in new technologies will secure MOS a leading position in the PCB industry in Germany.

Rohde & Schwarz

Fig. 8: Horizontal chemical tinning line 'Höllmüller by TSK'The owner-managed company Rohde & Schwarz is one of the few 'mixed groups' that still operates its own printed circuit board production. The number of employees is unknown. The factory is located in Teisnach and is mainly self-sufficient. As a competence center for transmitters and systems, the Teisnach plant manufactures and supplies, for example, radio transmitters, body scanners and customer-specific radio communication systems. This results in high and specific requirements for the boards as well as for the assemblies, which are also manufactured in-house. However, the Group also supplies PCBs to other companies as a service, probably to improve capacity utilization in PCB production.

Fig. 8: Horizontal chemical tinning line 'Höllmüller by TSK'The owner-managed company Rohde & Schwarz is one of the few 'mixed groups' that still operates its own printed circuit board production. The number of employees is unknown. The factory is located in Teisnach and is mainly self-sufficient. As a competence center for transmitters and systems, the Teisnach plant manufactures and supplies, for example, radio transmitters, body scanners and customer-specific radio communication systems. This results in high and specific requirements for the boards as well as for the assemblies, which are also manufactured in-house. However, the Group also supplies PCBs to other companies as a service, probably to improve capacity utilization in PCB production.

The Teisnach plant is a PCB specialist for standard carriers based on different laminates, for chip-package assemblies and special solutions. It supplies prototypes and functional samples on request in rush orders, but also larger series.

According to a press release dated July 8, 2020, Rohde & Schwarz in Teisnach did not introduce short-time working or layoffs at the time, despite rumors of planned job cuts. The company has coped well with the past few months. The Teisnach site reacted to fluctuations in capacity utilization with "internal transfers and the reduction of vacation days and time credits". A press release from October 22, 2020 confirmed the Group's stable economic situation in the 2019/2020 financial year, not least due to the accelerated transition to 5G networks. This is also likely to place greater demands on the PCB production area.

There is hardly any press information from Teisnach about PCB production. Therefore, on September 22, we learned from TSK Schill GmbH that Rohde & Schwarz is being supplied with new system technology for chemical tinning "Höllmüller by TSK"(Fig. 8). TSK briefly stated that following the delivery and successful installation of a horizontal chemical tinning line at the Rohde & Schwarz plant in Teisnach, the customer is now equipped for the future. The new system is currently in the qualification phase.

KSG GmbH

It is not without reason that KSG, as a large company, is the first to come to the fore here, even before Würth Elektronik, because on the one hand it is based in East Germany and on the other hand it had to fight extremely hard after reunification to completely adapt to the different Western economic system in a very short time. With a great deal of energy, KSG was able to move up into the front ranks of the major companies in the PCB sector in Europe. None of the West German board manufacturers ever had to endure such a situation, not even Würth CBT, which is presented in this article.

Family-owned KSG GmbH, based in Gornsdorf, is the fourth-largest manufacturer of printed circuit boards in Europe with an annual turnover of €113 million in 2019 and around 900 employees. According to Dr. Nakahara's NTI 100 list(Plus 8/2020), KSG's sales fell by around 26% in 2019 compared to 2018, meaning that the company entered the coronavirus year in a difficult position. It subsequently caused the company unexpected additional problems. This may be another reason for the reduction in annual turnover, as short-time working was announced in Gars am Kamp, for example.

Fig. 9: KSG has been training eight apprentices since SeptemberTheKSG Leiterplatten plant in Gornsdorf, Saxony, and the KSG Austria PCB plant in Gars am Kamp in Lower Austria belong to the KSG Group. More than 350,000m2 of substrates are produced on a total area of 45,000m2. Multilayer and rigid-flex boards, SBU and HDI PCBs, HF carriers, PCBs with integrated high-current and thermal management, carriers for LED applications and embedded components boards are manufactured. High wiring density, HF suitability and integrated functions are KSG's specialty. The products are used in various application areas: Industrial, automotive, medical and consumer electronics, communications, data and lighting technology.

Fig. 9: KSG has been training eight apprentices since SeptemberTheKSG Leiterplatten plant in Gornsdorf, Saxony, and the KSG Austria PCB plant in Gars am Kamp in Lower Austria belong to the KSG Group. More than 350,000m2 of substrates are produced on a total area of 45,000m2. Multilayer and rigid-flex boards, SBU and HDI PCBs, HF carriers, PCBs with integrated high-current and thermal management, carriers for LED applications and embedded components boards are manufactured. High wiring density, HF suitability and integrated functions are KSG's specialty. The products are used in various application areas: Industrial, automotive, medical and consumer electronics, communications, data and lighting technology.

KSG GmbH is a company whose economic, organizational and technical development, especially since the takeover of Häusermann GmbH in 2017, is difficult to describe in brief, as it is a fluid process that is far from complete. For this reason, the explanations here should be somewhat more extensive.

Following the takeover of Häusermann in 2017, KSG still had to deal with the restructuring and expansion of the newly created group of companies until 2019. In particular, technical and logistical processes were to be optimized and automated.

In the press release dated October 28, 2019, KSG outlined the progress made since the takeover. Within three years, € 35.3 million has been invested at the two sites:

- Almost € 17 million was spent on modernizing the mechanical, lithography and chemical production facilities and eliminating capacity bottlenecks

- Almost €12 million was spent on the construction of a new

for the construction of a new central warehouse - 3 million each was spent on measurement technology

and IT infrastructure and the ERP system.

"We are questioning many things and rethinking our processes," said Matthias Stickel, Head of Process Engineering, describing KSG's situation at the time. KSG wants to set the pace in Europe and actively shape the future as a technological market leader with both production sites. Specifically, an inventory control system has already reduced the lead time for series products from 25 to 16 working days in 2019 and an improved material flow has freed up space for new production capacities. The aim is to automate and digitalize all business processes.

The work packages already in progress in October 2019, which will continue into 2020, include the following:

- End-to-end traceability

- Predictive maintenance

- Conversion to SAP for automatic data exchange with customers.

In a press release dated October 13, 2020, the company commented on its current technology and investment projects. This year, around €11.6 million has already been invested in its two plants, €10.8 million of which in Gornsdorf and €800,000 in Gars. The aim is to increase expertise in HDI/SBU PCB boards and to do even more to ensure security of supply, high product quality and flexibility.

The largest investment projects are aimed at expanding technological possibilities, increasing capacity and enhancing process reliability in key processes. These include, among others:

- installation of the plugging process for filling boreholes and blind holes

- an additional laser drilling machine

- the installation of a measuring machine for measuring the conductor runs of highly complex antenna structures.

An SES system (stripping/etching/stripping), a copper recycling system and an electroplating system are also planned in Gornsdorf and will be installed in 2021. This will provide security of supply coupled with technological expansion for the reliable production of highly complex HDI/SBU assemblies. The higher integration densities possible with this process would offer PCB designers considerable space savings and fewer restrictions in the layout of complex circuits.

"Semiconductors are still driving the development of PCB technology. For us, this means that we must continue to perfect the properties of PCBs with ever smaller dimensions," says Swen Klöden, CTO at KSG. Today, twelve-layer HDI multilayers with a line/space of 100 μm and smaller are state of the art in Europe. Optimized signal integrity requires an even higher integration density. To achieve this, PCB designers are forced to combine impedance-controlled multilayers with layer structures greater than twelve layers with complex SBU structures 3+x+3 and ultra-fine conductor patterns smaller than 75/75 μm line/space.

It is clear that KSG wants to compete with the leading Southeast Asian board manufacturers, including the suppliers of chip substrates for semiconductors, in terms of its technological goals. In addition to technical development, the company management also made personnel changes, for example by appointing a new sales manager, Christof Sofsky, in July of this year. The training of new employees is also continuing with determination, as eight apprentices and two working students began their vocational training at KSG in Gornsdorf and KSG Austria in Gars am Kamp in September(Fig. 9).

Würth Elektronik GmbH & Co. KG

Fig. 10: Concept graphic for the arm-hand orthosis with TWINflex stretch PCBsWürthElektronik GmbH (Niedernhall/Schopfheim), which is part of the owner-managed Würth Group, is slightly larger than KSG with around 1000 employees. However, the author found no data on how many people are actually employed in the board production (Würth CBT) itself. The company was ranked 3rd among the largest European PCB manufacturers in Dr. Nakahara's NTI Top 100 list for 2019. According to this list, it managed to move up from 92nd place in 2018 to 80th place in 2019 in the list of the world's largest PCB producers. Compared to the 2018 list, KSG and Würth changed places: Würth moved up and KSG moved down. Würth also works with Asian partners.

Fig. 10: Concept graphic for the arm-hand orthosis with TWINflex stretch PCBsWürthElektronik GmbH (Niedernhall/Schopfheim), which is part of the owner-managed Würth Group, is slightly larger than KSG with around 1000 employees. However, the author found no data on how many people are actually employed in the board production (Würth CBT) itself. The company was ranked 3rd among the largest European PCB manufacturers in Dr. Nakahara's NTI Top 100 list for 2019. According to this list, it managed to move up from 92nd place in 2018 to 80th place in 2019 in the list of the world's largest PCB producers. Compared to the 2018 list, KSG and Würth changed places: Würth moved up and KSG moved down. Würth also works with Asian partners.

Würth's press releases published this year provide little information on current concrete investment projects. In this respect, Würth CBT differs greatly from the East German company KSG, which is also very transparent when it comes to technological development. Both companies pursue different information policies with different focuses. Würth mainly provides information about newly developed products, but not about technological changes or goals.

In a press release dated July 27, 2020, only the following is stated: Würth Elektronik Circuit Board Technology (CBT) is currently the European No. 1 among PCB manufacturers in terms of production volume. The ongoing continuous optimization of service and price/performance ratio also contribute to this - not least in the e-commerce sector. The aim is to further reduce the speed-to-market time. The reason for this is that, in addition to service and product quality, delivery times are playing an increasingly important role for customers, especially in the online segment (note: this topic also coincides with the activities of Eurocircuits). One of the main tasks is therefore the further optimization of the Würth online store. Würth has been operating at 100% capacity and more during the coronavirus crisis.

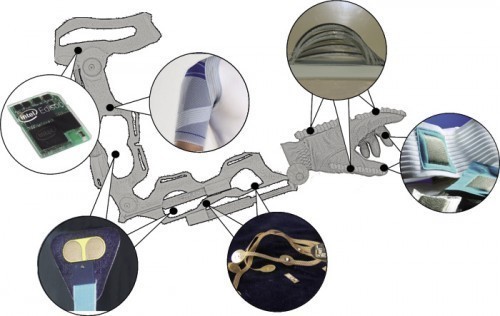

Würth is known for constantly tapping into new market opportunities with new products in order to secure its future and develop further. To this end, it regularly participates in EU and German Federal Ministry of Education and Research (BMBF) funding projects. In the completed BMBF project PowerGrasp, for example, which involved the development of an arm-hand orthosis, Würth succeeded in miniaturizing the electronics and pneumatics through the use of flexible and stretchable TWINflex stretch printed circuit boards(Fig. 10). This result is set to become a key to a new product line.

On September 21, 2020, the manufacturer announced that the new SLIM.flex technology had been added to the production program. With this technology, Würth Elektronik aims to set new standards in terms of the flexibility and robustness of flex PCBs. SLIM.flex PCBs can be manufactured as flex, rigid-flex or multilayer structures. They are extremely thin, very robust in the soldering process (even with repeated lead-free soldering) and ideally suited for harsh-environment applications. They also have a safe dielectric strength of 500V. As a high-tech cable harness, they are suitable for ultra-dense, impedance-defined or shielded signals in the tightest of spaces. Result: 100% more signals in half the space.

On October 26, 2020, Würth Elektronik announced that the company is collaborating with 36 European partners on the new EU project CHARME for rugged electronics. The acronym stands for Challenging Environment Tolerant Smart Systems for IoT and AI. The aim is to develop industrial IoT solutions that are more tolerant of harsh industrial environments. The CHARM project develops technologies for condition monitoring, predictive maintenance, automation, real-time production control as well as optimization and demonstration systems for virtual prototyping systems and tests them in industrial environments. By participating in this project, Würth is securing a great deal of knowledge for the future modernization of its production facilities. In comparison to the investment projects of other PCB manufacturers, the company is taking an additional path with a broader horizon in parallel to the probable current investment activity and is also relying on financial support from the state in the form of a funding project and drawing on the expertise of the other project participants.