The FBDi (Fachverband der Bauelemente Distribution e. V.) looks back on the turbulent second quarter of 2022 and ventures an optimistic forecast. Incoming orders from construction element distributors remain above a healthy level, while the turnover of its members is expected to be a record year.

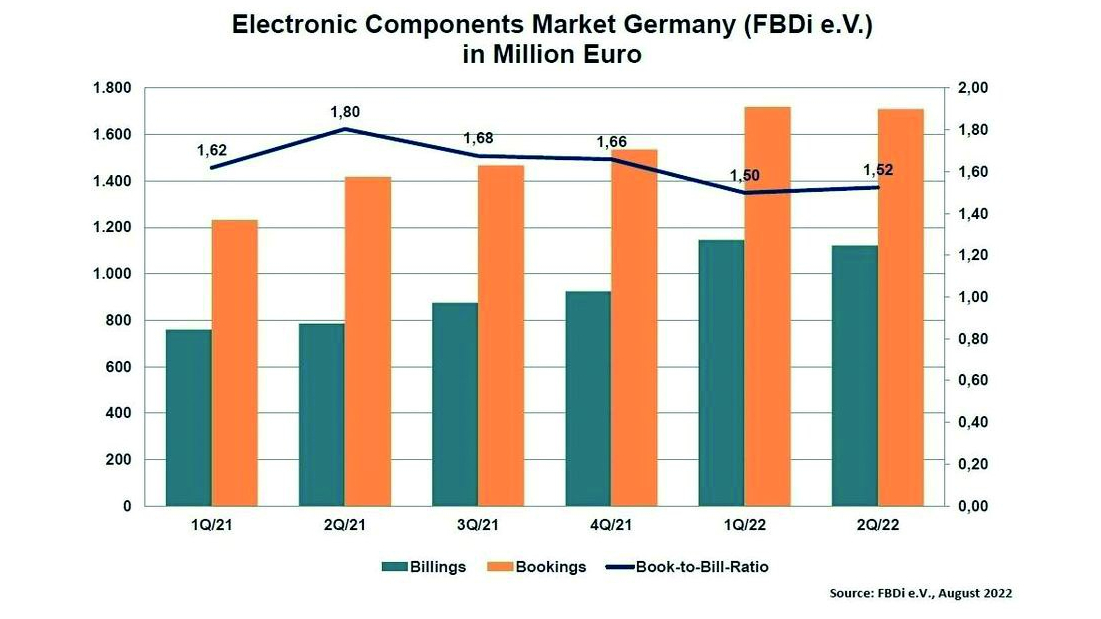

According to FBDi Chairman of the Board Georg Steinberger, building component distributors are expecting a record yearThe turnover of distributors reporting to the FBDi rose by 43% to €1.12 billion in the second quarter, while incoming orders increased by 21% to €1.71 billion. This roughly corresponds to the first quarter. Although the order intake in the form of the book-to-bill rate has left last year's record level, it remains at a high level of 1.52. The first half of the year recorded sales of just under € 2.3 billion and new orders of € 3.5 billion.

According to FBDi Chairman of the Board Georg Steinberger, building component distributors are expecting a record yearThe turnover of distributors reporting to the FBDi rose by 43% to €1.12 billion in the second quarter, while incoming orders increased by 21% to €1.71 billion. This roughly corresponds to the first quarter. Although the order intake in the form of the book-to-bill rate has left last year's record level, it remains at a high level of 1.52. The first half of the year recorded sales of just under € 2.3 billion and new orders of € 3.5 billion.

While semiconductors increased by 47% to € 756 million, liabilities were somewhat lower at € 135 million, up 34.7%. Electromechanics normalized at +28.4% and € 139 million in sales. Other products such as power supplies, sensors, displays, assemblies and systems grew by between +31% (assemblies) and +75% (sensors). The differences in incoming orders were more pronounced: Semiconductors +26 %, Passives -2.3 % and Electromechanics +10.4 %. The distribution of sales in Q2 was somewhat different: semiconductors with a share of 68%, passives and electromechanics with 12% each, power supplies just under 4% and 4% for the remaining products (power supplies, sensors, displays, assemblies and systems).

FBDi CEO Georg Steinberger states that incoming orders remain very high. From a book-to-bill ratio of 1.2, one speaks of shortages. However, German component distribution has remained above 1.5 since the beginning of 2021. However, normalization can be seen in product areas outside of semiconductors. Inflation, energy prices and impending shortages, the war in Ukraine and tensions with China are reducing the general growth prospects. It is to be expected that the growth opportunities offered by digitalization, e-mobility, 5G, renewable energies and investments in public and private infrastructure will not be realized as quickly due to a lack of funding.

In the long term, there are bright prospects for the European high-tech market. "Further growth in demand and innovation will not disappear if things slow down," concludes Steinberger. "However, the prerequisite is that we have the necessary raw materials and technical skills and, above all, that we have the necessary, well-trained employees. The shortage of young talent in all technical professions that can be seen everywhere could become the biggest brake on growth."