MicroLEDs are expected to significantly outperform conventional LCD screens in terms of brightness, contrast and displayable color gamut. They may even slow down or prevent the market breakthrough of (organic) OLED panels. However, they are not yet technically ready.

There are great expectations for inorganic light-emitting diodes based on InGaN technology with micrometer dimensions as the technological basis for 'emissive pixels' in TV or tablet displays. But we are not there yet. The title question can therefore be interpreted in both directions.

The technology approaches of MicroLEDs are not yet fully developed, and large-scale production is also still causing problems, especially in terms of costs. However, the industry is working on the realization of MicroLED displays with great resources and innovative ideas, as a look at the Wikipedia page on the new flat screens impressively shows.

The first commercial products with MicroLEDs were launched by Sony in 2012 in the form of the 'Crystal LED Display', albeit with considerable hurdles in the mass market due to prohibitive production costs. Only since 2014, following the acquisition of the Silicon Valley start-up LuxVue Technology by Apple Computer, have MicroLEDs (micro light emitting diodes) been considered a promising emissive display technology.

This is the conclusion reached by Dr. Xiaoxi He, analyst at IDTechEx and author of the new market study 'Micro-LED Displays 2021-2031: Technology, Commercialization, Opportunity, Market and Players'. She discusses the prospective applications of Micro-LEDs, analyzes the technologies, suppliers and supply chains, and provides an outlook on the most important markets.

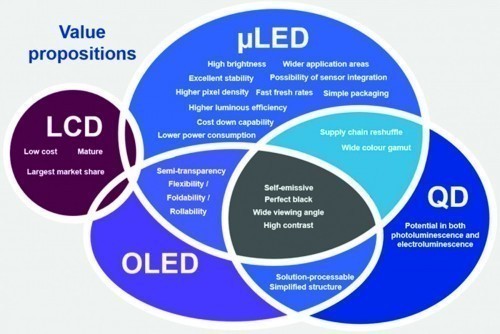

MicroLED displays offer an attractive range of benefits, such as a wide color gamut up to saturated black, high brightness, low power consumption, excellent stability and long lifetime, wide viewing angles, wide dynamic range, i.e. high contrast, fast refresh cycles, panel transparency, seamless system integration and possible integration of sensors in the image area. Not bad compared to LCD, OLED and QD. With the appearance of the first commercial MicroLED displays from several manufacturers, emissive LED-based displays have attracted a lot of attention from OEMs and material suppliers, investors and users. Some examples are shown in Table 1.

Table 1: Manufacturers of Micro- and MiniLED displays, compiled by IDTechEx

|

Spec. |

Sony Crystal LED Display |

Samsung The Window |

LG Micro LED Signage |

Konka Smart Wall |

TCL The Cinema Wall |

|

Size |

Various |

75" |

175" |

118" |

132" |

|

Resolution |

3840x2160 |

3840x2160 |

3840x2160 |

3840x2160 |

3840x2160 |

|

PPI |

20 |

58,7 |

25,2 |

37,3 |

33,4 |

|

Others |

1M:1, 140 % sRGB, 1000 nits, 120 fps |

10 K:1, 1600 nits |

- |

10 M:1, 147 % DCI-P3, ≥ 3000, 2 M:1 HDR |

2.5 M:1, 1500 nits, 16 bits |

At the same time, LCD production, which has long been established, is currently moving to China on a large scale due to costs and is finding well-prepared industrial infrastructures there. Some LCD manufacturers are considering giving up the business. Samsung has announced that it will abandon the traditional LCD segment and focus on QD and OLED (and more recently also on MicroLEDs) in future. LG Display has discontinued the domestic production of LCD panels, Panasonic and JDI (Japan Display Inc.) are following the same line. AUO, Innolux and other Taiwanese suppliers want to reduce their investments in LCD or OLED.

The author of the study notes that the production of OLED panels is currently dominated by Korean manufacturers, with large production capacities and technological maturity, availability of materials and equipment as well as well-equipped and complete supply chains. This applies in particular to SDC (Samsung Display Corp.) and LGD (LG Displays). In the consumer segment, Samsung's small and medium-sized OLED panels have found their way into smartphones, while LGD's large OLED panels are used in TV sets. Samsung and LG therefore dominate the small/medium and large OLED panel segments.

Another competitively interesting technology in this context is quantum dots (QD), in their function as photoluminescent elements. By incorporating QD coatings into the LCD structure, the color space can be significantly expanded. QD-based displays are therefore also catching up.

Micro-LED displays consist of emissive inorganic LEDs that act as sub-pixels. They have dimensions in the micrometer range and are used without a package. Assembly differs from the traditional pick-and-place principle. Various processes common in semiconductor production are involved in their manufacture, such as chip design, epitaxy, substrate removal, inspection, bonding and interconnect, test and repair. These aspects are generally well mastered today.

Each display technology has its specific characteristics that define its market value. Figure 1 shows an overview of the competing principles, with overlapping alternatives such as LCD, OLED and QD. The IDTechEx report states that not all value propositions of MicroLED displays are currently feasible due to a lack of technological maturity and unrealistic cost targets. The quantum efficiency (EQE) of the individual MicroLEDs is also relatively low, which has an impact on the power consumption of the panels. The extremely high resolution of micro LEDs is also quite difficult to implement on the scale of large panels from a cost perspective. Fig. 1: Value proposition of current display technologies / Source: IDTechEx

Fig. 1: Value proposition of current display technologies / Source: IDTechEx

Conclusion of the IDTechEx study: Whether or not MicroLED displays will replace OLEDs depends heavily on the targeted applications, at least in the short and medium term. The report examines these questions in detail and evaluates the replacement of existing technologies and the prospect of creating new markets and application situations with MicroLEDs. The most promising fields of application for MicroLED displays: augmented/mixed reality (AR/MR), virtual reality (VR), large video displays, TV sets and monitors, automotive displays, cell phones, smartwatches and wearables, tablets and laptops.

The following applies: LCD displays, which currently dominate the display market, are intrinsically limited by larger panel formats. OLEDs are taking a growing share, mainly in smartphones. QD-LCDs are marketed in premium TVs and are well received by consumers. LED displays can already be found in large public display panels. To compete with all of these, MicroLEDs would need to demonstrate their value proposition more clearly or develop further advantages. The creation of a new display market must therefore be based on the respective usage functions that cannot be represented by alternatives. These would be displays with customer and user-specific designs and integrated sensors. They should also expand and enrich the concepts of existing displays.

Finally, some current developments in MicroLED production. The Canadian start-up eLux Inc. in Vancouver has announced the development of a fluidic assembly tool for displays with a 12.3-inch diagonal. It bypasses the pick-and-place process through a fluid-based transfer of the MicroLEDs from the wafer to the display substrate. This automates, speeds up and reduces the cost of assembly.

Aixtron, a well-known German supplier of semiconductor manufacturing systems, is also pursuing an innovative MOCVD (metal organic chemical vapor deposition) process for MicroLEDs. It uses a process chamber with an 'in-situ' etching process and fully automated wafer handling, which drastically reduces the defect rate and increases the yield.

The French start-up Aledia in Echirolles near Grenoble (spun off from the CEA-Leti research lab in 2012) produces the MicoLED pixels as GaN nanowires in a 3D configuration instead of the planar deposition of GaN on sapphire wafers. In a pilot production, this is also possible for the first time on 300-mm silicon wafers, which makes the technology compatible with standard semiconductor production and can potentially be outsourced to typical silicon foundries. Aledia founder Giogio Anania speaks of a 'disruption in display manufacturing'.

Samsung is already on this path: the first TV sets with extremely large MicroLED screens with a 110-inch diagonal ('The Wall') are set to appear on the market in summer 2021. In 8K premium format at a price of around €150,000.