The new Infineon chip factory in Dresden is just one fab among many: For the EU, it is finally a presentable example that the European Chip Act is working. Meanwhile, there is growing evidence of Taiwanese involvement in Saxony. The Free State has already shown a few times how long-term high-tech policy can work. The most recent example can be found a few kilometers to the east.

Escorted by high-ranking political celebrities, Infineon CEO Jochen Hanebeck symbolically swung the first spade for the German semiconductor manufacturer's new chip factory in Dresden in May: EU Commission President Ursula von der Leyen (CDU) and Federal Chancellor Olaf Scholz (SPD) also traveled to the Dresden Heath especially for the occasion. This 'grand opening' is hardly surprising, even though this is 'only' the fourth Infineon plant in Dresden. The reasons:

- Firstly, with investment costs of around €5 billion, the plant is entering dimensions that are otherwise more common for megafabs in Asia or North America.

- Secondly, it is one of the first major projects to receive a fifth of its funding from the new European Chips Act - which prompted Ursula von der Leyen to emphasize: "In times of growing geopolitical risks, it is great news for Europe that Infineon is investing massively in the production of semiconductors in Dresden. We need more such projects here in Europe because the demand for microchips continues to grow rapidly. The EU Commission and the member states are investing €43 billion over the next few years as part of the European Chips Act to make Europe stronger and more resilient in the digital sector." What she didn't mention is that in the USA, China, South Korea and Taiwan, governments and semiconductor companies are juggling billions of euros to achieve or expand global leadership positions in microelectronics.

- Thirdly, the new fab will produce special power semiconductors and mixed-signal circuits for charging stations, electric cars, heat pumps and other ingredients of the federal heat transition. And this also explains why Chancellor Scholz was in a good mood when he swung his spade in Dresden: "Chips are the oil of the 21st century," he explained. "This is where the components are made that are needed for the upcoming investments in environmentally friendly technologies."

Construction site for the new fab in Dresden, which will produce power semiconductors and mixed-signal circuits from 2026

Construction site for the new fab in Dresden, which will produce power semiconductors and mixed-signal circuits from 2026

"Not the last investment in Silicon Saxony"

The Chancellor took the opportunity to fuel the rumors that have been circulating for months that the world's largest semiconductor contract manufacturer, the Taiwanese foundry TSMC, will soon build a factory in or near Dresden: "In my talks with international investors, I got the impression that this was not the last investment in Silicon Saxony," he said, without naming TSMC expressis verbis. Saxony's Minister President Michael Kretschmer (CDU) made similar comments shortly afterwards.

Background: In view of the severe supply chain disruptions during the coronavirus crisis, the tensions between China and Taiwan and tempting subsidies, TSMC has abandoned its decades-long focus on its home market. Since then, the company has also been building semiconductor factories outside Taiwan. A large factory complex in the USA is already in place and another in Dresden is now considered likely. TSMC also wants to move closer to its customers in Europe, particularly the German automotive groups.

Debate about billions in subsidies for microelectronics continues

However, the billions in subsidies for the semiconductor industry are anything but uncontroversial: only recently, President Reint Gropp of the Leibniz Institute for Economic Research Halle (IWH) criticized the EU and the federal government for completely over-subsidizing microelectronics investments such as those made by Intel in Magdeburg or Infineon in Dresden, in some cases with up to one million euros per job. The money would be better spent elsewhere. Ifo head Clemens Fuest also warned a little later against a debt-financed and self-destructive subsidy race with the USA.

Martin Dulig, Saxony's Minister of Economic AffairsButthere are also dissenting voices: The subsidized establishment of chip factories should not be assessed solely in terms of the jobs created in the respective factory, but has strategic importance for numerous branches of industry in Germany and throughout Europe, argued Saxony's Minister of Economic Affairs Martin Dulig (SPD), for example, at the request of PLUS: "The IWH is completely wrong with its argumentation."

Martin Dulig, Saxony's Minister of Economic AffairsButthere are also dissenting voices: The subsidized establishment of chip factories should not be assessed solely in terms of the jobs created in the respective factory, but has strategic importance for numerous branches of industry in Germany and throughout Europe, argued Saxony's Minister of Economic Affairs Martin Dulig (SPD), for example, at the request of PLUS: "The IWH is completely wrong with its argumentation."

Dulig emphasized that the Free State of Saxony in particular, with its post-reunification economic policy aimed at preserving GDR microelectronics and attracting new chip factories, had shown what an upswing, what windfall effects and how many surrounding jobs a flourishing semiconductor industry could trigger at a location. On the other hand, corona, supply chain disruptions and the US economic wars against China have recently shown how quickly the assembly lines in Europe come to a standstill if the chip supply from the Far East and overseas dries up even for a short time: "The entire industry needs these chips." This is why highly subsidized semiconductor locations in Europe are an investment in the future. Last but not least, every cleverly invested subsidy euro also pays off financially.

Another example of such a long-term high-tech location policy in Saxony can be found around 100 kilometers to the east of Dresden: Görlitz, on the border with Poland, was long regarded as the deepest province, where wagon construction, the largest industrial employer since the political changeover, has constantly struggled for economic survival. At best, the beautifully renovated city center, a few Hollywood productions and the cheap cigarette stands on the other side of the border provided some daytime tourism. However, Görlitz is now regarded as a magnet for top researchers, supercomputer experts and hydrogen technologies - and as a new beacon of hope for the microelectronics region 'Silicon Saxony'. For some time now, research institutions have been setting up in the city - in some cases massively subsidized and politically supported by the EU, federal and state governments - which have the potential to sooner or later lead to numerous spin-offs, high-tech orders and company acquisitions in the region.

"The tax returns sooner or later more than make up for the subsidies used."

Martin Dulig, Saxon Minister of Economic Affairs

Astrophysics with exit coal

The Casus Institute has lured some of the world's leading AI and supercomputer experts to GörlitzExamples: With money from the coal phase-out fund, the 'German Center for Astrophysics' will be established in Görlitz over the next few years, which has registered a huge demand for innovative digital measurement and analysis technology. The Helmholtz Association has established the Casus Institute here, which uses supercomputers to investigate complex phenomena such as climate, traffic, epidemics and neutron stars in space. TU Dresden is building a development laboratory for the future of construction, a 'Construction Future Lab' (CFLab), in the city on the border with Poland. The focus topics include the use of robots, automation, reliable wireless networks, the use of data glasses for augmented reality (AR), large-format 3D printing and highly integrated digital process planning on future construction sites - all topics that are likely to generate many start-ups and orders for companies specializing in these areas.

The Casus Institute has lured some of the world's leading AI and supercomputer experts to GörlitzExamples: With money from the coal phase-out fund, the 'German Center for Astrophysics' will be established in Görlitz over the next few years, which has registered a huge demand for innovative digital measurement and analysis technology. The Helmholtz Association has established the Casus Institute here, which uses supercomputers to investigate complex phenomena such as climate, traffic, epidemics and neutron stars in space. TU Dresden is building a development laboratory for the future of construction, a 'Construction Future Lab' (CFLab), in the city on the border with Poland. The focus topics include the use of robots, automation, reliable wireless networks, the use of data glasses for augmented reality (AR), large-format 3D printing and highly integrated digital process planning on future construction sites - all topics that are likely to generate many start-ups and orders for companies specializing in these areas.

Senckenberg is also expanding its collections in Görlitz, Fraunhofer is establishing a hydrogen lab, Siemens an innovation campus, Deloitte has set up shop right next door - the list goes on.

The whole of Lusatia and Saxony are also striving for closer ties with neighboring Silesia and the scientific and economic region of Wroclaw. In this respect, it is not unreasonable to predict that 'Silicon Saxony' will not only continue to grow into a Central German high-tech region in the future via Intel Magdeburg, the Federal Cyber Agency Halle and X-Fab Erfurt, but could also receive new impetus from the East.

Large apprentice training center planned for Saxony's semiconductor industry

But back to Dresden and the present: a long-term strategy is needed to attract enough skilled workers for all these new locations - the entire industry is aware of this. By 2030, the high-tech industries in the Dresden-Chemnitz-Freiberg triangle will need 27,000 additional skilled workers. This was estimated by the industry association "Silicon Saxony" in a strategy paper in 2023. In view of the resulting strong demand from the Saxon semiconductor industry for microtechnologists, mechatronics engineers and other specialists, a 'Saxon Training Center for Microtechnologies' (SAM) is now to be established in the Dresden area. The plan is for a complex that can train up to 1,000 apprentices per year for the large chip factories of Infineon, Globalfoundries, Bosch and X-Fab in Dresden, but also for smaller microelectronics companies, solar companies and related businesses. This would make the planned SAM far larger than previous in-company and inter-company training centers in the microelectronics location of Saxony.

Supported by two renowned training companies from Dresden and the surrounding area, the center will have three clean rooms with 100 mm wafer technology for practical semiconductor training and 44 trainers. The opening is planned for the summer of 2025, if the hoped-for funding flows, especially from the federal government.

Closing ranks between Saxony and Taiwan

Saxony's Science Minister Gemkow and NARLabs Managing Director Yu-Hsueh Hsu sign a cooperation agreement between Saxony and Taiwan in TaipeiThetopic of 'long-term generation of skilled workers for microelectronics' also plays an important role, albeit not the only one, in another Saxon coup: a high-ranking delegation of Saxon politicians, scientists and business representatives recently flew to Taiwan. There, Saxony's Science Minister Sebastian Gemkow (CDU), Taiwan's Science Minister Tsung-Tsong Wu (non-party) and other stakeholders signed a series of agreements, all of which are aimed at closer cooperation between the two semiconductor regions in the future. Plans include cooperation between Fraunhofer and TU Dresden as well as Taiwanese universities and research institutions, joint funding applications for European technology funding programs such as 'Horizon Europe', cooperative microelectronics research, the establishment of joint degree courses and lectures as well as the exchange of teachers, researchers, students and pupils. The partners have also agreed to organize conferences together.

Saxony's Science Minister Gemkow and NARLabs Managing Director Yu-Hsueh Hsu sign a cooperation agreement between Saxony and Taiwan in TaipeiThetopic of 'long-term generation of skilled workers for microelectronics' also plays an important role, albeit not the only one, in another Saxon coup: a high-ranking delegation of Saxon politicians, scientists and business representatives recently flew to Taiwan. There, Saxony's Science Minister Sebastian Gemkow (CDU), Taiwan's Science Minister Tsung-Tsong Wu (non-party) and other stakeholders signed a series of agreements, all of which are aimed at closer cooperation between the two semiconductor regions in the future. Plans include cooperation between Fraunhofer and TU Dresden as well as Taiwanese universities and research institutions, joint funding applications for European technology funding programs such as 'Horizon Europe', cooperative microelectronics research, the establishment of joint degree courses and lectures as well as the exchange of teachers, researchers, students and pupils. The partners have also agreed to organize conferences together.

Ultimately, these agreements can help both sides. Although Taiwan is by far the stronger microelectronics location than Saxony, it is under strong pressure due to tensions with China and could therefore need an additional anchor in Europe. In addition, as mentioned above, it is likely that the national champion TSMC will soon invest in Dresden, which should make strong links between Dresden and Taipei necessary anyway. Last but not least, the product portfolios of the two countries' chip industries complement rather than compete with each other: The Taiwanese semiconductor industry is strongly characterized by contract manufacturers such as TSMC and UMC, produces above all circuits of the latest structure generations below ten nanometers and is geared towards customers from the consumer electronics industry, among others. The fabs in Silicon Saxony produce more specialized circuits, including for special industrial applications, the automotive sector, security applications and the like - and are primarily active in structure sizes above 20 nm.

Focus on own chiplet value chain for Europe

The two technology paths would complement each other particularly well if the Taiwanese were to include the Saxons in their chiplet ecosystem in future. After all, the charm of chiplet technology is that the circuits produced with it do not have to be manufactured from 'one piece' in a high-end factory, but the 'dies' from processes in different factories are assembled and contacted to form a particularly powerful whole. If TSMC were to contribute its chiplet experience and its sub-10 nm processes and the Silicon Saxony factories were to contribute their highly specialized and in some cases mixed digital-analog semiconductor processes, this could open up innovative perspectives.

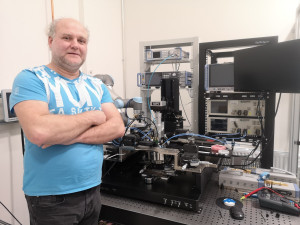

Andy Heinig from Fraunhofer-EAS DresdenManyexperts in Saxony are convinced that chiplet technology can open new doors for the entire European industry. Andy Heinig and his colleagues from the Fraunhofer Institute's Adaptive Systems Development branch (EAS) in Dresden in particular have therefore been forging alliances for some time to build up such chiplet value chains in Saxony together with international partners. The first collaborations with Samsung have already been established and now the EAS engineers are also looking westwards, to North America, for further technology providers. The most recent agreement was concluded with the Californian semiconductor company 'Achronix' from Santa Clara. As an example solution, they want to combine several circuits in a very small space, which can convert and pre-process analog to digital signals particularly quickly. Possible applications for such combination chips include radar eyes for driver assistance systems in modern cars or 5G mobile communications systems. The cooperation partners EAS and Achronix are specifically focusing on the 'Bunch of Wires' (BoW) and 'Universal Chiplet Interconnect Express' (UCIe) approaches as contacting technologies.

Andy Heinig from Fraunhofer-EAS DresdenManyexperts in Saxony are convinced that chiplet technology can open new doors for the entire European industry. Andy Heinig and his colleagues from the Fraunhofer Institute's Adaptive Systems Development branch (EAS) in Dresden in particular have therefore been forging alliances for some time to build up such chiplet value chains in Saxony together with international partners. The first collaborations with Samsung have already been established and now the EAS engineers are also looking westwards, to North America, for further technology providers. The most recent agreement was concluded with the Californian semiconductor company 'Achronix' from Santa Clara. As an example solution, they want to combine several circuits in a very small space, which can convert and pre-process analog to digital signals particularly quickly. Possible applications for such combination chips include radar eyes for driver assistance systems in modern cars or 5G mobile communications systems. The cooperation partners EAS and Achronix are specifically focusing on the 'Bunch of Wires' (BoW) and 'Universal Chiplet Interconnect Express' (UCIe) approaches as contacting technologies.

Ultimately, the idea behind all these efforts to create functioning chiplet value chains in Saxony is that this technology could enable European companies to build high-performance circuits for cars, mobile phone systems or measuring devices - largely on European soil - without the need for multi-billion euro high-end chip factories and even in the event of long-term disruptions to international supply chains.

Sources

Infineon, TUD, SMWK, Fraunhofer IPMS and EAS, Silicon Saxony, SMWA, Ifo, oiger.de