For more than a year, many larger companies, particularly in Germany, have been in a wait-and-see mode. In addition to the general economic imbalance in the traditional markets of electronics and mechanical engineering, there was another globalization problem: the isolation of their own markets and a further shift in value creation to Asia and North America.

For some, it was a wake-up call and confirmation of a new way of thinking, a new proactive approach. For others, it was a reason to go into reverse. And I'm not even talking about the hard-hit automotive industry. In completely different sectors, too, people dutifully switched to emergency mode according to the business management cornerstones they had learned. If the current pandemic had not so unexpectedly superimposed all the existing economic shortcomings (such as the suspension of the obligation to file for insolvency and extended short-time working regulations), job cuts and cuts to research and development activities would probably have been more immediate and direct.

Inevitably, the thought of the well-known and dreaded hog cycle comes to mind again. The electronics industry in particular can tell you a thing or two about this. For manufacturers still working in Germany, short-time working is now being followed by overtime after overtime, combined with increased costs. In addition, there is a shortage of components and increased material prices - also effects of increased dependence on China. Much of this is home-made. Some of you may remember that we once had a strong electronics production, supply and development industry in Europe. I am talking about the outsourcing of many core competencies in production, development and brands during the 1990s and 2000s. There are plenty of examples of this change: Grundig, Loewe, Siemens, Alcatel.

What does all this actually have to do with innovation? A lot! We'll get to that now.

In most cases, innovations fall by the wayside when cost-cutting measures are implemented too quickly, as is the case with all hasty actions. Many things are put on the back burner or disappear completely into a drawer or out of people's minds.

In this context, I recently became aware of a rather small presentation by one of today's innovation drivers. It took place before the IAA, very much in the style of Apple and Samsung. This innovator by the name of TESLA is putting a real spanner in the works of the existing strategies of the traditional automotive companies and their owners and, with the Gigafactory Berlin-Brandenburg, is also building up a lot of pressure in the land of the car. And this is not just happening through simple car production. TESLA tends to think in terms of the big picture - and this will soon become a reality if the framework conditions allow.

Source: Global Innovation Index Database, WPO, 2021

Source: Global Innovation Index Database, WPO, 2021

This big picture also includes battery production, charging stations including the entire infrastructure and another new detail. I'll go into this in more detail later. Oh yes: the complete package also includes TESLA becoming an electricity provider. Bold, but consistent. The established manufacturers from Germany simply do not provide for this to this extent and with this consistency in their structures and financing. What a pity.

Let's take another look inwards. It is positive that there is now a commitment at both state and federal level to do something to strengthen innovation through massive subsidy programs. Other regions of the world have already shown how it can be done. In microelectronics (to the donors: please don't forget the rest of the electronics industry), semiconductor production in Germany is now to be kept and sustainably established with innovation packages worth billions (non-repayable subsidies) - see Bosch, Intel and others. However, many billions more in subsidies will be needed to close the technological gap.

In any case, semiconductors are needed in more and more areas. I don't just mean mobile devices such as smartphones and the booming sensor and security technology. I'm also thinking of robotics - smart robotics, another point of innovation for Industry 4.0. At this point, I would like to refer to the TESLA PR event mentioned above ... hosted by Elon Musk. His statement during the presentation was: TESLA will 'throw' a smart robot called TESLABOT onto the market in 2022. A car manufacturer and a 'humanoid' robot? Exactly - this could be a stroke of genius. Why?

It's not as if Musk is the first with this idea. But innovations are also characterized by successful use. And this is where the overall package will score points.

A smart robot like this can be used in many areas. This would make exoskeletons for human employees and the associated ethical discussion about the pros and cons superfluous. Is 'the factory of the future' emerging here?

For me, Elon Musk's many activities, which may have been detached until now, make sense - a strategy with great innovative power.

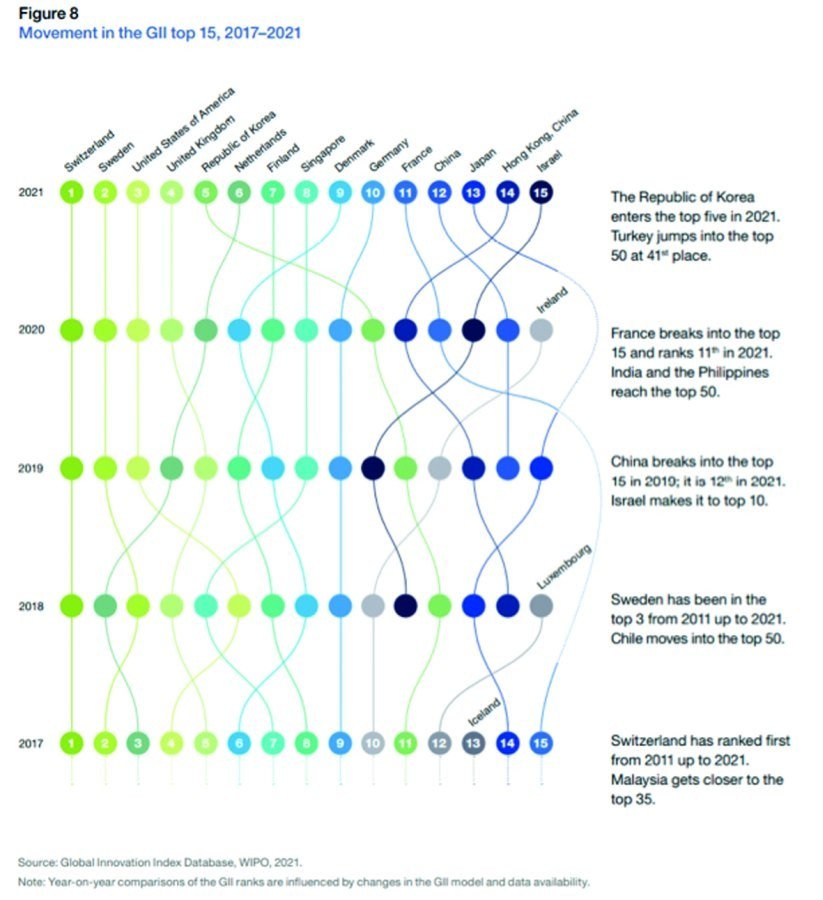

Do you see what I mean? Smart robots are not only needed in car factories. Smart robots - in this case the TESLABOT - will probably be the ones 'walking around' on the moon and Mars in the near future. The rockets (also a Musk company) are already being tested. None of this will be possible without artificial intelligence. And this is where things come full circle for me - with Neuralink and TeslaAI. Musk is driving a complete innovation chain forward, and this at a time when the traditional corporations are fighting for survival and are looking at lost profits. Fear paralyzes and stops true innovation. Unfortunately, this is also confirmed by the current GII 2021 (Global Innovation Index) - see 'Figure 8' from the report. I hope that the pioneering spirit that once made electronics and electrical engineering so strong in this country will finally return to the minds of some decision-makers.

Perhaps it is time for a paradigm shift again.

In some areas of the electronics industry in particular, the outsourcing of skills and manufacturing expertise could be reversed. The last few decades have been and continue to be characterized by the creation of new supply chains, outsourcing and relocation, the transfer of know-how to Asia and new dependencies, which are now a critical economic and political factor.

Can there be a paradigm shift - towards closed production chains with a coherent concept for safe electronics? Here too, microelectronics/microsystems technology could be the 'old new pioneer'. System integration and vertical integration are the keys to new innovations - 'Made in Germany and Europe'.

You can also look at it that way.

Best regards

Jan Kostelnik

Source:

Global Innovation Index2021 Tracking Innovation through the COVID-19 Crisis, 14th Edition, WIPO, Soumitra Dutta, Bruno Lanvin, Lorena Rivera León and Sacha Wunsch-Vincent Editors, ISBN (print): 978-92-805-3249-4 ISBN (online): 978-92-805-3307-1 DOI: 10.34667/tind.44315, 2021.