Russia's PCB industry is building up new production capacities both because of and despite the sanctions imposed by Western countries, which were significantly tightened in spring 2022 after the start of the Russian war against Ukraine. It is also flirting with manufacturing in low-wage countries. Part two of an analysis.

Some Russian electronics manufacturers admit without hesitation in the country's trade press that they source their PCBs from Asia rather than Russia itself, partly for economic reasons. These are mostly

- higher-quality boards in medium quantities such as HDI or rigid-flex multilayers (South Korea, Taiwan, China) or

- simple boards as inexpensive mass-produced goods (China)

Very high-quality complex HDI boards with very narrow conductor tracks came from Germany in small quantities. The manufacturer overview for PCBs 2022 in [7] shows that of the 27 companies listed there, less than a handful are really technologically capable of producing boards with a line/space value ≤ 50 µm (class 7 according to GOST standard). The profitability of production as well as the stable reproducibility of such PCBs is yet another question. The majority of companies specify class 5 (L/S ≤ 100 µm). However, this is not the level of performance that can successfully meet the increasing demands of the Russian electronics industry in the coming years, especially if the dependence on 'western' countries (Germany, South Korea, Taiwan) and possibly China for high-tech boards is to be reduced. The Russian electronics industry is aware of this.

There are currently investors who are prepared to invest in the expansion of existing facilities and in new locations for board production. Such investment projects are being implemented in particular by the existing PCB manufacturers Rezonit LLC, Technotech LLC, Kernel Fab Dubna LLC and Consult-Technology LLC (GS Group). Different company strategies are being used.

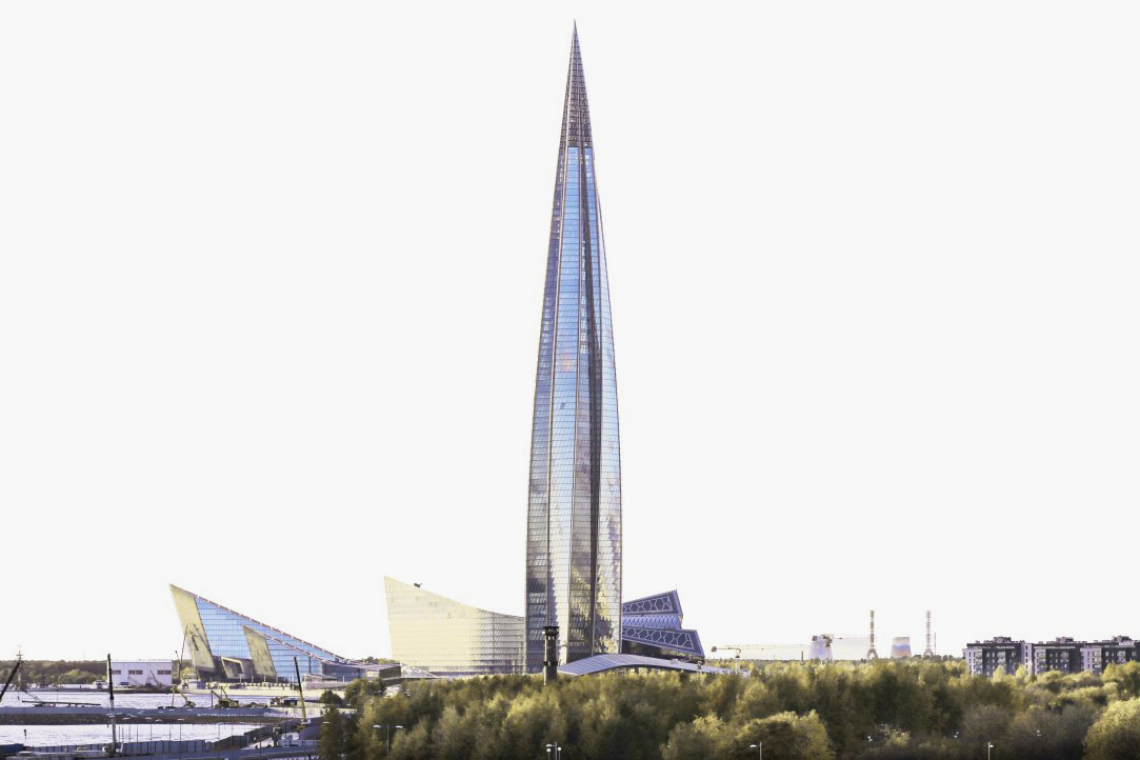

Rezonit, for example, which was founded in 1997, relies on the many years of engineering experience of its own project group and concentrates fully on purchasing equipment, chemicals and production control software from Russian production in its own program in order to create a sanctions-resistant base of machines and technologies [8]. There is clear evidence of progress in Russia's self-sufficiency program, but this cannot be described in detail here for reasons of space. Rezonit's latest plant in the Technopolis special economic zone near Moscow will go into operation in 2023 and will significantly increase board production and EMS performance(Fig. 3). Automation and IT solutions that have been successfully implemented and tested at Rezonit's existing production sites will be used. The new assembly hall for the EMS area will also be equipped with Russian equipment and software. A team of young developers from Taganrog has created the basis for this.

Fig. 3: Rezonit's new production building in Technopolis near Moscow

Fig. 3: Rezonit's new production building in Technopolis near Moscow

According to the company's management, the use of its own equipment and materials for the production and assembly of printed circuit boards can reduce the risks associated with changes in the external economic situation and exchange rate fluctuations, as well as reduce transportation costs and taxes associated with imports, which can have a positive impact on reducing the final cost of production. In general, import substitution is seen as an incentive for the development of the local economy and the creation of new skilled jobs. However, if you look at the overview of suppliers of equipment for electronics production in Russia in 2023, you will notice that the number of suppliers of equipment for board production is extremely small [9]. So where are the suppliers?

Technotech, also mentioned above as a major investor, apparently relies entirely on imported equipment, unlike Rezonit, and has begun expanding and modernizing production in 2022 based on 500 pieces of equipment from leading European manufacturers. Apparently, the modernization concept and the purchase contracts were drawn up before the start of Russia's war against Ukraine [10]. The modernization will increase production volumes by 70 %, establish series production of printed circuit boards up to and including accuracy class 6 (L/S minimum 0.075 mm) and also achieve a high degree of automation. Precision drilling machines from Schmoll, such as 'Schmoll LaserFlex', will enable holes to be drilled up to 50 µm in diameter and thus create the conditions for even more complex HDI multilayers of GOST class 7 (L/S = 50 µm). This massive increase in capacity will have a significant impact on Russian PCB production from 2024(Fig. 4).

Fig. 4: Multilayer production at Technotech

Fig. 4: Multilayer production at Technotech

A new semiconductor plant is also being built at the Technotech site by the company Vostok. Vostok Joint Stock Company is a leading developer and manufacturer of integrated circuits, operational amplifiers, photodetectors and sensors in Russia.

Many major players in the Russian electronics market are also thinking about building their own factories for PCB production in Russia. The reason: The end customers of electronics in Russia demand supply security from the device manufacturers, which cannot be sufficiently guaranteed due to the sanctions and the experience with the corona-related interrupted supply chains from China. In [11], the assumption was already made in 2021 that if all plans were implemented, the production volume of printed circuit boards in Russia could increase many times over in the next five years. This is not at all unlikely, as the technical resources for high-quality PCB production no longer have to be realized as expensive parallel imports from Western industrialized countries by circumventing the sanctions, but can in fact be selected from a very complex, high-quality Chinese basic range [12]. It is foreseeable that the new strict sanction conditions and growing opportunities for self-supply will inevitably at least extremely restrict the preference of many Russian PCB manufacturers to buy everything they need for board production from the West. The PCB industry is finding help with the necessary strategic rethink in new Russian brain companies such as YADRO [13].

More in-house laminate production

Image: AdobeStockSincethe further tightening of sanctions against Russia in 2022, the supply of high-quality laminates of various types to the electronics industry has become a problem. The attempts made since around 1995 to set up their own efficient production facilities in Russia have not been successful. Most of the country's board manufacturers preferred to import laminates from Western countries or China. In order to reduce these dependencies, laminate production in Russia is to be stepped up. For example, the PCB manufacturer Technotech (number 2 in the Russian PCB ranking) has set up its own laminate production facility in Yoshkar-Ola on the Volga as part of the government's drive to replace imports, although the potential production volume is not known. According to the manufacturer, the ML FR-4 and ML FR-4 HiTg fiberglass laminates meet the requirements of the IPC-4101D/26 standard and are said to be on a par with the laminate quality of the world's leading companies. Technotech manufactures up to 2 million dm2 of printed circuit boards per year with semi-automated production.

Image: AdobeStockSincethe further tightening of sanctions against Russia in 2022, the supply of high-quality laminates of various types to the electronics industry has become a problem. The attempts made since around 1995 to set up their own efficient production facilities in Russia have not been successful. Most of the country's board manufacturers preferred to import laminates from Western countries or China. In order to reduce these dependencies, laminate production in Russia is to be stepped up. For example, the PCB manufacturer Technotech (number 2 in the Russian PCB ranking) has set up its own laminate production facility in Yoshkar-Ola on the Volga as part of the government's drive to replace imports, although the potential production volume is not known. According to the manufacturer, the ML FR-4 and ML FR-4 HiTg fiberglass laminates meet the requirements of the IPC-4101D/26 standard and are said to be on a par with the laminate quality of the world's leading companies. Technotech manufactures up to 2 million dm2 of printed circuit boards per year with semi-automated production.

In March 2022, the Russian space systems holding Roskosmos announced the establishment of a competence center for the production of printed circuit boards, including highly reliable multilayers, from domestic raw materials. A closed production and technical complex with a full range of special equipment has been built at the Moscow site, minimizing the influence of the human factor [14].

The Roselektronik company also announced in September 2022 that it had developed a high-quality new laminate for UHF printed circuit boards. Benzocyclobutene derivatives are used as the main components for the production of the dielectrics [15].

Personnel and financial problems

Following Russia's accession to the WTO, a situation has arisen in which imports of finished printed circuit boards are subject to a zero rate of duty, while imports of all materials, chemicals and equipment are subject to a duty rate of 5% or more. Among other things, this gives foreign manufacturers a competitive advantage on the Russian market, which is confirmed by the high level of imports from China. Solutions are therefore being sought:

- Setting up Russian PCB production facilities in low-wage countries such as India

- Government support through tax benefits for PCB manufacturers

![Abb. 5: ARPE auf Geschäftsmission in Indien vom 27.-31.3.2023 [16] Abb. 5: ARPE auf Geschäftsmission in Indien vom 27.-31.3.2023 [16]](/images/stories/Abo-2023-11/thumbnails/thumb_plus-2023-11-038.jpg) Fig. 5: ARPE on a business mission to India from 27-31.3.2023 [16]The Russian association of electronics manufacturers ARPE has been exploring the Indian electronics industry locally for around four years through joint conferences and company visits and analyzing opportunities for closer cooperation with Indian companies(Fig. 5) [16]. One reason for this is that most Russian companies have technological lines manufactured in Europe that are designed to work with certain types of imported chemicals. Now, because of the sanctions, Russians are forced to find substitute materials from Asian countries. If these cannot be adapted for their purposes, they may also need Chinese equipment. Some of the latter are in-house developments, but to a certain extent they are also copies or adaptations of Western machines. Replacing the Western equipment used in Russia requires considerable investment. Such problems have an impact on the cost of products, which makes Russian manufacturers less competitive. The Russian PCB market therefore needs support measures from the government. It is currently preparing tax relief for the companies concerned, which is due to come into force in 2023. This relief is part of the programme to localize production in Russia. PCB manufacturers are under strong pressure from customers to whom the state grants benefits that depend on production in Russia.

Fig. 5: ARPE on a business mission to India from 27-31.3.2023 [16]The Russian association of electronics manufacturers ARPE has been exploring the Indian electronics industry locally for around four years through joint conferences and company visits and analyzing opportunities for closer cooperation with Indian companies(Fig. 5) [16]. One reason for this is that most Russian companies have technological lines manufactured in Europe that are designed to work with certain types of imported chemicals. Now, because of the sanctions, Russians are forced to find substitute materials from Asian countries. If these cannot be adapted for their purposes, they may also need Chinese equipment. Some of the latter are in-house developments, but to a certain extent they are also copies or adaptations of Western machines. Replacing the Western equipment used in Russia requires considerable investment. Such problems have an impact on the cost of products, which makes Russian manufacturers less competitive. The Russian PCB market therefore needs support measures from the government. It is currently preparing tax relief for the companies concerned, which is due to come into force in 2023. This relief is part of the programme to localize production in Russia. PCB manufacturers are under strong pressure from customers to whom the state grants benefits that depend on production in Russia.

But there is also the personnel problem in Russia. In order to implement the tasks set, not only financial injections and the construction of factories are required, but also efforts to attract and retain suitably qualified personnel in the country [17]. The following is necessary:

- Support and stimulate programs for university participation in real-world R&D projects (as in the U.S.)

- create practice-oriented engineering schools (similar to the universities of applied sciences in Germany) and open laboratories to provide the necessary personnel.

Addendum

In Plus 3/2016, the author reported on the new construction of a modern printed circuit board production facility by the Russian company 'OOO Svjaz Engineering' in Dubna. This production facility, which was planned and built with the latest Western equipment from an environmental point of view, was praised in the Russian trade press as the beginning of a new era in the Russian PCB industry. Svjaz Engineering' built it to accelerate the replacement of imports and to reduce dependence on Chinese board suppliers. As the author discovered through research this year, production never really got off the ground because Russian equipment manufacturers preferred to continue buying PCBs more cheaply from China. For several years, the machines stood uncovered in the production rooms - a bad investment that cost 'Svjaz Engineering' its existence. This experience and others raise doubts as to whether the Russian PCB industry will be able to successfully realize its new goals.

References

[7] https://russianelectronics.ru/pcb-2022/ (accessed: 16.10.2023).

[8] www.rezonit.ru/news (Retrieved: 16.10.2023).

[9] https://russianelectronics.ru/tehoborudovanie/ (Retrieved: 16.10.2023).

[10] https://tehnoteh.ru/uslugi/izgotovlenie-steklotekstolita/ (Retrieved: 16.10.2023).

[11] https://microwave-e.ru/market/pcb-2021/ (Retrieved: 16.10.2023).

[12] https://engineer.yadro.com/interview/multilayer-printed-circuit-boards/ (Retrieved: 16.10.2023).

[13] https://engineer.yadro.com/about/ (Retrieved: 16.10.2023).

[14] https://russianelectronics.ru/2022-03-17-rogozin/ (Retrieved: 16.10.2023).

[15] https://russianelectronics.ru/roselektronika-razrabotal-material-novogo-pokoleniya-dlya-proizvodstva-pechatnyh-plat_09_08_22/ (Retrieved: 16.10.2023).

[16] http://arpe.ru/news/ARPE_v_Indii/ (Retrieved: 16.10.2023).

[17] https://rg.ru/2022/07/04/stroit-i-zameshchat.html

(Retrieved: 16.10.2023).