In Saxony, more and more private investment and state subsidies are flowing into microelectronics - and this is fueling a spirit of optimism. At the same time, there is no end to the discussions about the path once taken: economists ask how healthy and sustainable such a heavily subsidy-driven high-tech upswing is. Others argue that even more should be pumped into the sector in order to catch up with Asia and America. It is clear, however, that chip plant projects, related research projects and new settlements are mutually reinforcing.

The federal and state governments are providing a further €795 million for nine particularly important projects of European interest (Ipcei) in the Saxon chip industry. Including the participating companies' own investments, these innovation projects have a volume of just under €1.8 million. This was announced by Saxony's Minister of Economic Affairs Martin Dulig (SPD).

"With support from the federal and state governments, ground-breaking innovations for autonomous driving, intelligent medical technology, energy-efficient control electronics and artificial intelligence will be developed in and around Dresden in the coming years," announced Martin Dulig. "We will only achieve technological independence from Asia and the USA if we produce locally in Europe and are self-sufficient."

The funded projects include new design methods for chips in Industry 4.0, the energy industry, autonomous electric driving and medical technology, which Globalfoundries Dresden intends to develop. Bosch is working on circuits that are networked with computer clouds, support augmented reality (AR) and are primarily intended for the automotive industry. The university spin-off 'Ferroelectric Memory', on the other hand, wants to prepare the mass production of innovative memories that remember data even without a power supply, but work much faster and more economically than today's flash memories, for example in USB memory sticks. Freiberg-based Compound Materials GmbH, a leading manufacturer of semiconductor materials, is using the Ipcei money to develop technologies to scale up the new substrates gallium arsenide, indium phosphide and gallium nitride to wafer sizes for industrial production. Meanwhile, Infineon and Siltectra Dresden want to develop new materials, concepts and processes for pressure, environmental and 3D sensors and microphones.

Dresden puts together infrastructure package for TSMC & Co.

Meanwhile, local business development agencies, the energy supplier 'Sachsenenergie', the city drainage system and other players in the city are putting together an additional infrastructure package worth millions to secure TSMC's chip factory and other semiconductor expansion projects in Dresden. This includes a stronger electricity and water supply for the entire semiconductor industry in the north of Dresden as well as better transport connections. This was announced by Steffen Rietzschel, Head of the Economic Development Office.

How much the additional municipal 'welcome package' for TSMC and the other technology giants in Dresden will ultimately cost - over and above the relocation subsidies - has not yet been calculated exactly. However, half a billion to a whole billion euros should be on the safe side.

New expansion stage for chip research center Ceasax

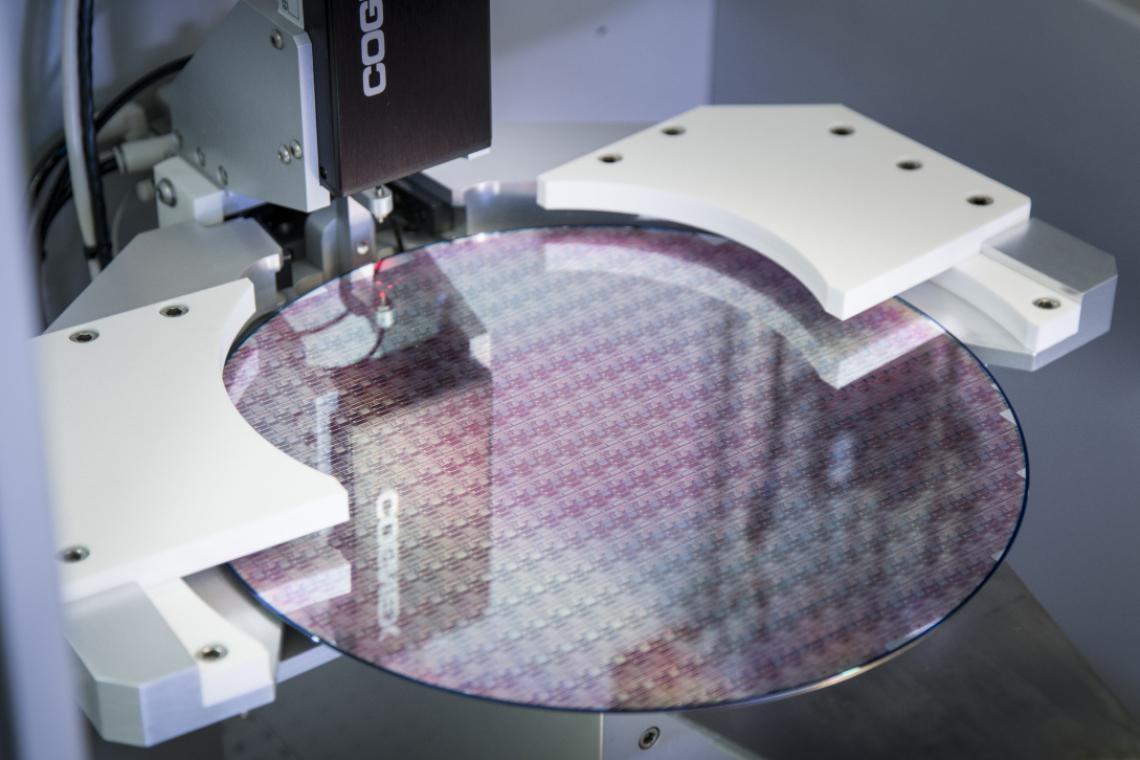

In the meantime, Fraunhofer is also expanding its fledgling microelectronics research center 'Center for Advanced CMOS & Heterointegration Saxony' (Ceasax) in the north of Dresden. The extension building in sight of Bosch, the AMTC chip mask center and the building site for the upcoming TSMC chip factory is already ready for rough construction. The additional building is intended to equip the researchers for new projects together with Saxony's expanding semiconductor industry.

"Ceasax is a beacon of semiconductor research," says the Fraunhofer Photonics Institute IPMS from Dresden, which is one of the founders of Ceasax together with the 3D integration center 'Assid'. Ceasax, which was established a year and a half ago in a former digital paper factory, offers 'the complete value chain in 300 mm microelectronics and thus the prerequisite for high-tech research for future technologies in the state of Saxony'.

Fraunhofer concentrates microscreen research

And another change of direction from Fraunhofer: for years, two Dresden-based Fraunhofer Institutes have been developing new microscreens for data glasses, motorcycle helmets and other devices in parallel. This is now changing: the Photonics Institute IPMS is taking over the 'Microdisplays & Sensors' business unit from the Fraunhofer Institute for Organic Electronics, Electron Beam and Plasma Technology (FEP) with retroactive effect from the beginning of 2024.

"The Microdisplays & Sensors business unit played a significant role in the dynamic development of the FEP," commented FEP Institute Director Prof. Elizabeth von Hauff. "The transfer to the Fraunhofer IPMS opens up further development potential for this business field on the one hand and enables the Fraunhofer FEP to focus on strategic topics in the field of electron beam and plasma technologies on the other."

"In the future, the Fraunhofer IPMS will increase its involvement in this field and focus more intensively on the area of heterogeneous integration of various chiplet technologies in conjunction with CMOS microelectronics," announced IPMS Institute Director Prof. Harald Schenk. "This future-oriented technology also includes the integration of organic semiconductors, for example Oled, and novel emitter technologies, for example µLED, which opens up new avenues in micro-/optoelectronics and microsystems technology."

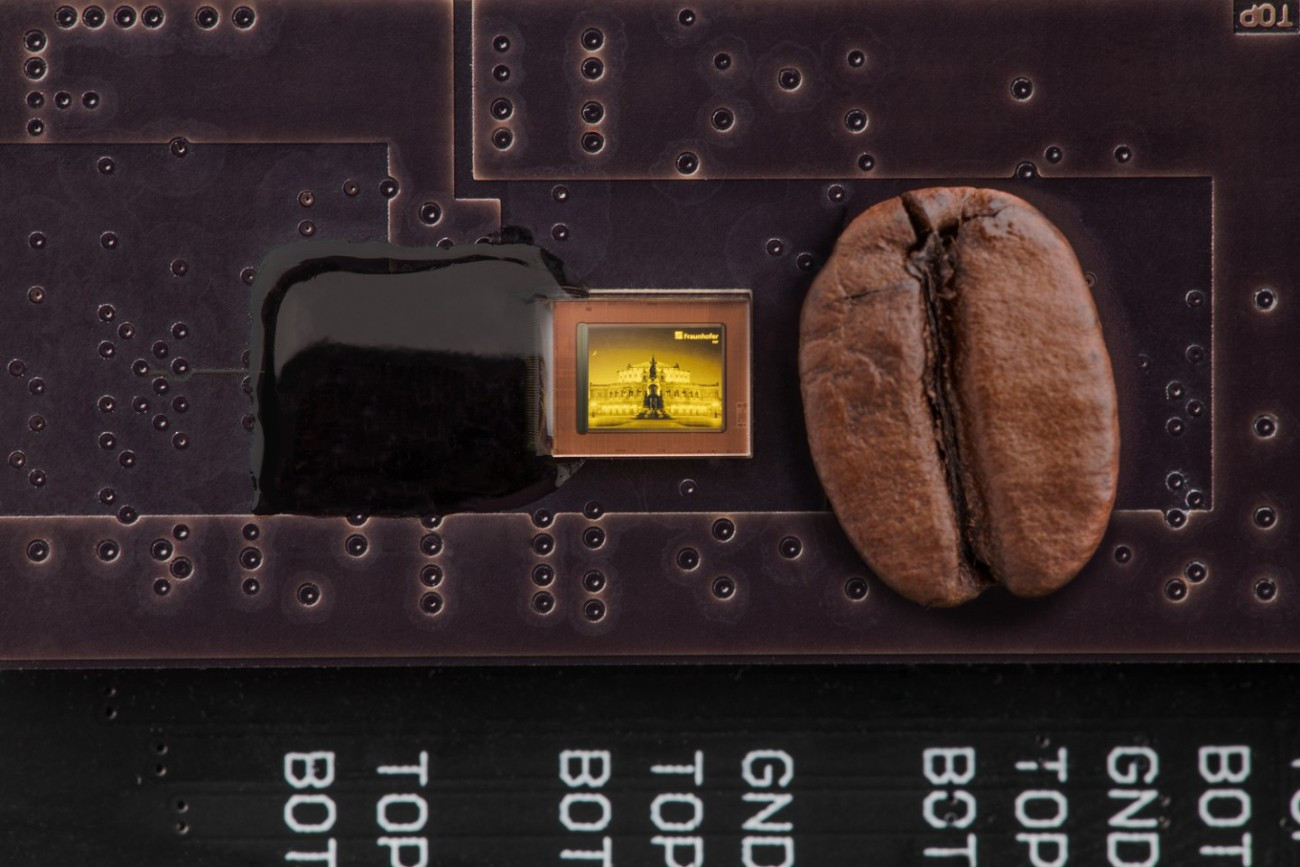

Oled microdisplay from Fraunhofer Dresden

Oled microdisplay from Fraunhofer Dresden

Silicon Saxony: EU plans for the chip industry are "utopian"

Above all the expansion projects and restructuring, however, the discussion about the major economic policy decisions in Saxony continues. Managing Director Frank Bösenberg from the Saxon microelectronics association 'Silicon Saxony' has described the EU plans to increase the global market share of the European semiconductor industry to around 20% by 2030 as downright 'utopian'. "We can increase our capacities and are already doing so here in Saxony," said Bösenberg during a presentation to East German microelectronics alumni at the Technische Sammlungen Dresden. But how the Europeans, with their comparatively low capital investment, intend to catch up with or even overtake Asia and the USA in terms of expansion speed is completely beyond him.

Based on international analyses, 'Silicon Saxony' points out that Europe currently accounts for around 9% of global semiconductor production. Other market analysts put the figure at 7%. The EU Commission itself assumes ten percent. In order to reach the 20% target set by Brussels, Europe's chip industry would theoretically have to double or even triple its capacity. In practice, however, Europe would have to build at least four times as many chip factories as it does today in order to achieve the targets it has set itself. This is because other countries and regions are also currently investing massively in the development and expansion of their microelectronics economy.

The USA, for example, which already has a market share of around 38%, plans to invest at least USD 200 billion in its semiconductor industry over the next few years. In Taiwan, market leaders such as TSMC, UMC & Co. are investing around USD 100 billion, although state subsidies play a rather minor role here. Japan is pumping around one to 2 trillion. ¥ (the equivalent of around 6 to 12 billion) in this sector, while China is investing around 150 billion dollars. Even India now wants to set up its own chip industry and is planning to spend $10 billion on it. All this is far surpassed by South Korea, where the state and industry have agreed to invest around 452 billion dollars in microelectronics. In Europe, this contrasts with only around €43 billion from the European Chip Act and grants for 'Important Projects of Common European Interest' (Ipcei I and II) in microelectronics that have not yet been finalized.

Ifo researcher: Billions in subsidies make little economic sense

Joachim RagnitzMeanwhile,the fundamental concerns have not fallen silent either: Prof. Joachim Ragnitz from the Ifo Institute in Dresden, for example, considers the billions in subsidies for Intel, TSMC, Wolfspeed and other technology companies to make "little economic sense". On the other hand, Germany can hardly escape the global race for locations, which is being fought out with ever-increasing subsidies and is becoming ever more heated. "You can't get out of this subsidy race."

Joachim RagnitzMeanwhile,the fundamental concerns have not fallen silent either: Prof. Joachim Ragnitz from the Ifo Institute in Dresden, for example, considers the billions in subsidies for Intel, TSMC, Wolfspeed and other technology companies to make "little economic sense". On the other hand, Germany can hardly escape the global race for locations, which is being fought out with ever-increasing subsidies and is becoming ever more heated. "You can't get out of this subsidy race."

"There is no way out of this subsidy race"

The economic researcher argued that it is understandable that Saxony, Saxony-Anhalt, Saarland and other target regions are very interested in such large-scale settlements. "But they are not real game changers." If you look at Tesla's car factory in Brandenburg or the Chinese Catl Group's battery plant at Erfurter Kreuz, for example, economic boosts for the entire federal state have largely failed to materialize. "The effects so far have been rather modest and limited in time," says Ragnitz. In addition, it is not foreseeable that Germany and Europe will be able to become noticeably less dependent on supplies from Asia, as is often formulated as a goal. For example, a company such as TSMC or Intel will not necessarily sell its circuits produced in Dresden or Magdeburg in Germany, but will also use them to supply international customers.

Nevertheless, the economist warns that it would not make much sense to suddenly revoke the subsidies once promised to companies from the USA, Taiwan or other global players due to current budgetary constraints: "The loss of confidence in Germany among investors would otherwise be considerable."

IG Metall & Co. profile themselves as digital trade unions

However, the opinion that microelectronics will be sustainable in Central Germany seems to dominate among employee representatives - and the trade unions are also staking out new claims. In view of the dynamic - and state-supported - growth in the German microelectronics sector, they are organizing their own nationwide semiconductor conference in Dresden in April 2024. This was announced by the IG Metall industrial union. They want to debate the effects of these industrial trends together with politicians and researchers - and no doubt also campaign for more collective agreements in chip factories.

"The semiconductor industry in Germany is developing at a rapid pace," emphasize the IG Metall representatives. "New production capacities amounting to 40 billion are currently being created in eastern Germany. Supported by high subsidies, Germany has made a name for itself throughout Europe and internationally as a strong semiconductor location, which is leading to more and more investments and therefore thousands of new jobs." Dresden is an important growth center for German microelectronics with well-known companies such as Infineon, Bosch Semiconductor and the new TSMC subsidiary ESMC.

"IG Metall has long been supporting workforces in the digital economy, the IT sector and the semiconductor industry on the path to a collective agreement," said the employee representatives. And the metalworkers are not alone: the 'Industriegewerkschaft Bergbau, Chemie, Energie' (IGBCE) also claims a new orientation as a semiconductor and digital trade union.

Germany needs a chip academy to catch up

Hubert LaknerIn general,employee concerns are increasingly becoming the focus of the Saxon semiconductor industry, where the shortage of skilled workers has long since arrived. On the one hand, there is the question of how more young people can be recruited for a career as a skilled worker in the chip industry, but also how the supply of academics can be stabilized. This is why Prof. Hubert Lakner, Director of the Fraunhofer Photonics Institute IPMS in Dresden, has now renewed his call for a microelectronics academy for the whole of Germany. This academy should focus on the retraining and further training of highly qualified specialists for the new chip factories in Dresden, Magdeburg, Ensdorf and other German locations.

Hubert LaknerIn general,employee concerns are increasingly becoming the focus of the Saxon semiconductor industry, where the shortage of skilled workers has long since arrived. On the one hand, there is the question of how more young people can be recruited for a career as a skilled worker in the chip industry, but also how the supply of academics can be stabilized. This is why Prof. Hubert Lakner, Director of the Fraunhofer Photonics Institute IPMS in Dresden, has now renewed his call for a microelectronics academy for the whole of Germany. This academy should focus on the retraining and further training of highly qualified specialists for the new chip factories in Dresden, Magdeburg, Ensdorf and other German locations.

In Saxony in particular, the 'Silicon Saxony' association assumes that the number of employees in the high-tech sectors will increase from the current 76,100 to around 102,000 by 2030. This means that around 26,000 new skilled workers will be needed by then - around half of them in Saxony's microelectronics sector.

Data analysts and AI experts increasingly in demand

Added to this is the change in the chip factories themselves: The days when thousands of 'operators' operated and loaded the machines in chip factories are over: Today, the microelectronics industry in Europe is primarily looking for data analysts, software and process engineers as well as maintenance technicians. Experts in artificial intelligence (AI), machine learning (ML), system architectures and designers for circuits that can process both analog and digital signals are also increasingly in demand in the now highly automated semiconductor factories. This is according to the final report of the EU project 'Microelectronics Training, Industry and Skills' (Metis), which was published by the semiconductor industry association 'Semi'.

According to its estimates, semiconductor companies in Europe will need at least half a million new microelectronics experts in the coming decade. In order to meet this immense demand, a 'European Chips Skills Academy' was established in October 2023 as the successor to the Metis network, which certainly has overlaps with the German Microelectronics Academy called for by Professor Lakner. This is a virtual association of universities, companies and other institutions that train such specialists - be they academics, engineers, technicians or microtechnologists.

It includes representatives from Saxony such as Infineon, Fabmatics, DAS and others. "As a follow-up project to the Metis project, the European Chips Skills (ECS) Academy will establish an industrial university network that offers scholarships, training places, access to laboratory facilities, vocational training and online courses," says the industry association 'Silicon Saxony' in Dresden. The association assumes that microelectronics. Software forges and related industries will need at least 25,000 new employees in Saxony alone by 2030 - although this estimate does not even include the influx of skilled workers from the new TSMC and Infineon factories in Dresden. A new chip academy and a new state-wide training center for chip trainees are therefore currently being built in the state.

About the person

Heiko Weckbrodt is a journalist and historian. He runs the news portal Oiger.de in Dresden, which focuses on business, science and innovation policy in Saxony. He also writes guest articles for numerous newspapers and magazines and is the author of the non-fiction book 'Innovationspolitik in der DDR 1971-89'.

Sources:

Silicon Saxony, Dresden Economic Development Corporation, Saxon Ministry of Economic Affairs, Ifo Dresden, IG Metall, Oiger Archive, Semi, Fraunhofer IPMS