Oil used to be the lifeblood of the economy, today it is semiconductor chips. The future of the semiconductor industry in Europe has become a top priority. Does Europe need a megafab? Many microchips 'Made in Germany' come from Saxony. Its chip industry is booming. For this reason, extensive expansion of capacities has begun.

Infineon, Globalfoundries and X-Fab are investing heavily, while Bosch is putting Europe's most modern chip factory into operation in Dresden. Fraunhofer and Helmholtz institutes as well as various university institutes are researching the latest generations of semiconductors, e.g. for quantum computers. A large research center for nanotechnology is being built in Lusatia.

Chip industry in transition or upheaval?

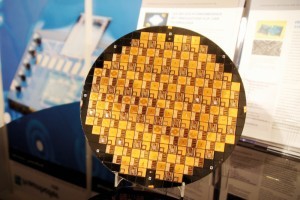

Test wafer for 3D integration from Fraunhofer-IZM DresdenAll overthe continent, the assembly lines in car factories are at a standstill due to a shortage of semiconductors, and extraordinary measures are unavoidable. Elon Musk (Tesla) explained in an analyst conference: "We were able to use alternative chips and then write the firmware at short notice. It's not just about replacing a chip, you also have to rewrite the software." But even this reserve will soon be used up. In fact, there is a flood of orders from the automotive industry. On the one hand, this is due to the trends towards electronics-intensive driver assistance systems, autonomous driving and electric cars, which require more and better power electronics than traditional combustion engines. On the other hand, the industry has recovered faster from corona than initially thought. And this is leading to demand shortages and chip supply bottlenecks, especially as the lead time in chip production is very long at 4 to 6 weeks. And this does not even include developments, adjustments, certifications and other steps. In addition, the IT industry has received a huge boost from the pandemic, and chip factories are also having to meet soaring order numbers from other sectors, e.g. ICT, consumer and entertainment electronics, medical technology, general industry and, due to the efforts to achieve the energy transition, the supply of alternative energies.

Test wafer for 3D integration from Fraunhofer-IZM DresdenAll overthe continent, the assembly lines in car factories are at a standstill due to a shortage of semiconductors, and extraordinary measures are unavoidable. Elon Musk (Tesla) explained in an analyst conference: "We were able to use alternative chips and then write the firmware at short notice. It's not just about replacing a chip, you also have to rewrite the software." But even this reserve will soon be used up. In fact, there is a flood of orders from the automotive industry. On the one hand, this is due to the trends towards electronics-intensive driver assistance systems, autonomous driving and electric cars, which require more and better power electronics than traditional combustion engines. On the other hand, the industry has recovered faster from corona than initially thought. And this is leading to demand shortages and chip supply bottlenecks, especially as the lead time in chip production is very long at 4 to 6 weeks. And this does not even include developments, adjustments, certifications and other steps. In addition, the IT industry has received a huge boost from the pandemic, and chip factories are also having to meet soaring order numbers from other sectors, e.g. ICT, consumer and entertainment electronics, medical technology, general industry and, due to the efforts to achieve the energy transition, the supply of alternative energies.

The industry is therefore outdoing itself with announcements of new capacities. The world's largest semiconductor foundry TSMC in Taiwan plans to invest USD 100 billion in the expansion of its plants within three years. A mega plant in Arizona/USA is planned for USD 12 billion. The group is also considering building large chip factories in Kumamoto, Japan, and in Europe. The Globalfoundries Group (GF) also wants to invest billions worldwide. Samsung has big plans. Even Intel wants to invest billions in the global foundry business, investing in the USA and also in the EU. China wants to produce 70% of the semiconductors it needs itself. Apple wants to switch at least partially to in-house production with the M1 chips in the new Mac.

Federal Economics Minister Peter Altmaier has now launched the IPCEI-2 funding program for European microelectronics for Germany. "We see a good chance that Saxony will benefit from this," emphasized Silicon Saxony Managing Director Frank Bösenberg. "And not just the big players, but also the small and medium-sized companies that make up 'Silicon Saxony'." On August 26, the largest microelectronics cluster in Europe and one of the largest ICT clusters in Germany, the Silicon Saxony industry association, celebrated its 20th anniversary.

Mega chip factory for Europe?

"Europe needs its own mega chip factory quickly. The EU should strive to attract large contract manufacturers from the chip industry in order to become less dependent on the Far East and the transatlantic region," Joachim Hofer wrote in Handelsblatt in January.

At the beginning of 2021, various EU states, including Germany, agreed to channel €145 billion from the coronavirus recovery funds into an IPCEI program to reduce Europe's backlog in microelectronics. 'Important projects of common European interest' (IPCEI) in microelectronics have been and are now being realized with subsidy rates of 30% and more.

EU Commissioner Thierry Breton triggered heated discussions about the priorities when he argued in favor of using tens of billions of euros to build our own Euro-Foundry, which can produce 2nm generation semiconductors and stand up to industry giants such as TSMC and Samsung. This would at least partially restore Europe's digital sovereignty and free the German automotive industry from the Taiwanese and South Koreans. The Silicon Saxony association rejects this, as such a project cannot be achieved by European forces in this decade, emphasized Heinz Martin Esser, the long-time president and spokesman of the board, who retired on the anniversary. The author and Leuze Verlag wish him all the best for the future. Dirk Röhrborn (Communardo) and Yvonne Keil (Globalfoundries) will take over his functions. Heinz Martin Esser emphasized to Oiger editor Heiko Weckbrodt that he sees no chance for a 2nm fab before 2030, as there is little demand for chips of this size in the EU. It would be better to strengthen the microelectronics industry that has already grown. According to the Politico portal, analysts and managers warn of the risk of wasting billions of euros with a 2nm fab. However, Saxon microelectronics expert Prof. Bernd Junghans, who co-led the GDR's megabit chip project, said: "Establishing a 2nm foundry by 2025 may be really overambitious, but within seven or eight years such a goal is definitely achievable."

In addition, Europe must first complete value chains through to the end product before it builds giga fabs. So far, there are too few fabless chip design companies in Europe that could utilize the capacity of such a large foundry. Capacities would also first have to be built up to process the processed silicon wafers into ready-to-use chips and finally into complete electronic modules (packaging, backend, post-fab). Most of the factories for this are located in Singapore, Malaysia and China.

Upgrading the microelectronics location

Fraunhofer, Bosch and GF Dresden are developing a new generation of LiDAR radar chips for automotive applications using 22FDX-RF technologyItwould be different if Europe did not have to assemble and utilize such a giant factory of the latest generation itself. EU Commissioner Breton and the French Ministry of Finance are also pursuing the idea of persuading TSMC or Samsung to build a large foundry factory in Europe to meet European needs. Mark Liu from TSMC explained that Germany, and Dresden in particular, is also under discussion. At some locations, TSMC has "reached agreements with local authorities and is in talks with local customers", according to reports from Digitimes and EE News Europe. The rumor mill is churning here, as these companies will undoubtedly make potential fab investments in Europe dependent on high aid quotas and are playing poker.

Fraunhofer, Bosch and GF Dresden are developing a new generation of LiDAR radar chips for automotive applications using 22FDX-RF technologyItwould be different if Europe did not have to assemble and utilize such a giant factory of the latest generation itself. EU Commissioner Breton and the French Ministry of Finance are also pursuing the idea of persuading TSMC or Samsung to build a large foundry factory in Europe to meet European needs. Mark Liu from TSMC explained that Germany, and Dresden in particular, is also under discussion. At some locations, TSMC has "reached agreements with local authorities and is in talks with local customers", according to reports from Digitimes and EE News Europe. The rumor mill is churning here, as these companies will undoubtedly make potential fab investments in Europe dependent on high aid quotas and are playing poker.

The construction of such large-scale factories for chip contract manufacturing is not seen by the domestic chip industry as problematic competition, but rather as a benefit for the entire microelectronics ecosystem in the region. It means investments in the single to double-digit billions and an upgrading of the entire microelectronics location.

The Taiwanese are reportedly discussing a factory in Saxony that produces integrated circuits of the 12 and 16 nanometer structure generations. This is around three generations behind the 2 nm class factory desired by the EU. Nevertheless, this would also be a major step forward for Europe.

In July, the 'Wall Street Journal' reported that Intel was working on a takeover of the GF Group and was thus planning the largest takeover in its history in order to gain new production capacity as quickly as possible. A purchase would probably not replace Intel's planned investments, but would bring additional business much faster. The company, which once dominated the chip market unchallenged, has fallen behind (in 2Q21 only second place in the IC Insights ranking of the top 10 after Samsung). However, the still highly profitable company could easily raise the estimated 30 billion US dollars for GF. The purchase would also fit in with the foundry's new strategy.

There is an unconfirmed rumor that Samsung also wants to invest in GF and expand its Dresden plant. The Korean electronics group wants to strengthen its position in the USA and Europe in order to avoid being caught in the crossfire of the US-Chinese trade war, reports the internet portal Coreteks. "This is speculation and we do not comment on rumors and speculation," explained Karin Raths from GF Dresden when asked. Samsung reacted similarly.

What plans do the semiconductor giants have in and with Saxony?

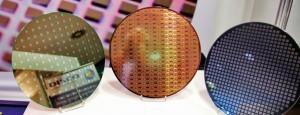

3D system integration from the Interuniversity Microelectronics Centre (IMEC), one of the largest research centers for nano- and microelectronics in Europe; demo wafers for stacked IC, die-to-wafer assembly, flipchip fan-out wafer level package, etc.Globalfoundries (GF), the world market leader in feature-rich semiconductor manufacturing, has extensive global expansion plans. Over the next two years, the company plans to invest a total of USD 6 billion in the expansion of its sites in the USA, Singapore and Germany, including USD 1 billion in Dresden. In October last year, the Group announced plans to increase the production capacity of Europe's largest semiconductor plant in Dresden, which currently employs 3,200 people, to one million wafer starts per year - two and a half times the current production level.

3D system integration from the Interuniversity Microelectronics Centre (IMEC), one of the largest research centers for nano- and microelectronics in Europe; demo wafers for stacked IC, die-to-wafer assembly, flipchip fan-out wafer level package, etc.Globalfoundries (GF), the world market leader in feature-rich semiconductor manufacturing, has extensive global expansion plans. Over the next two years, the company plans to invest a total of USD 6 billion in the expansion of its sites in the USA, Singapore and Germany, including USD 1 billion in Dresden. In October last year, the Group announced plans to increase the production capacity of Europe's largest semiconductor plant in Dresden, which currently employs 3,200 people, to one million wafer starts per year - two and a half times the current production level.

This is to be financed by the IPO planned for the end of 2022, but also through internal savings, e.g. through predictive maintenance of its chip production facilities (several hundred thousand euros per year). The Dresden plant focuses primarily on energy-saving FDX technology. Its customers include the Swiss company CSEM, the French company Greenwaves and the US company Perceive. Manfred Horstmann, Managing Director in Dresden since October, emphasized in February: "I am currently receiving many inquiries from well-known automotive suppliers, even car manufacturers, as we are now certified for the production of such semiconductors. However, you have to reckon with a production lead time of one and a half to two years. We are already running the factory at over capacity and therefore need to expand it."

At the beginning of July, GF CEO Tom Caulfield visited Saxony and confirmed the billion-euro expansion plans for the Dresden site. The focus is on automotive electronic components, ICs for 5G and 6G mobile communications, for local artificial intelligence AI and similar future technologies. Fab 1 in Dresden will be ramped up to 850,000 wafer starts by the end of 2022. As the space in this fab will then be exhausted, an extension will be necessary from 2024. However, Tom Caulfield made such a structural expansion explicitly dependent on subsidies, which he does not wish to describe as such, but rather as "state co-investments in the future" of the Dresden semiconductor location.

Capacities already almost fully utilized

The German semiconductor company Infineon also plans to invest around €1.1 to 2.4 billion in its Dresden site in the coming years, as announced by the two site managers Thomas Morgenstern and Raik Brettschneider in an interview with Oiger in March. Infineon's management is also considering building a fourth factory module on its Dresden site for around €1.3 billion. It is to focus on power electronics. At the same time, the Dresden and Villach power semiconductor lines are to be merged into a virtual factory. "Our capacities are almost 100% utilized, although they are constantly being expanded," explained Thomas Morgenstern. "In a very detailed process, we are constantly working out which systems we need at which time in order to increase capacity in a targeted manner." There is still space available and over €100 million is being invested in the expansion of the site this year. Demand for the semiconductors from Dresden is high. Many orders come from the automotive sector, which has recovered early from the coronavirus crisis. There is demand for driver assistance systems and power electronics for electromobility, solar and wind power electronics as well as 5G mobile communications chips, computer technology for homeschooling, home office, video conferencing or home cinema as well as special chips for sensor technology due to the corona-related digitalization push. Infineon parking aids can now be found in almost every new car.

The US company Intel now wants to expand its business as a contract manufacturer (foundry), i.e. no longer just producing its own chips, but also manufacturing them for customers according to their design specifications. The new CEO Pat Gelsinger wants to spend USD 20 billion on two new Intel factories in the USA and, according to a Handelsblatt report from May 2021, is considering building several mega-fab class chip plants in Germany. Initially two factories and then another four to six within ten years. Locations are currently being sought, with Dresden also under consideration. However, the Group is demanding subsidies for this, "because building a chip factory is extremely expensive - and if the EU goes along and really spends a lot of money, it must be ensured that production is also for Europe." Europe's car manufacturers and other technology-oriented industries would thus gain access to an additional source of particularly finely structured chips beyond Taiwan and South Korea, but would not have to worry about the capacity utilization of such a large foundry site. Intel is not unknown in Europe: Leixlip (Ireland) is already home to several Intel chip factories. In Germany, the sale of Infineon's Wireless Solutions division in 2011 gave rise to Intel Deutschland GmbH with 3,500 employees worldwide and temporary holdings in research centers and companies, e.g. the LTE development site Intel Mobile Communications in Dresden as the successor to Blue Wonder since 2001.

Bosch in Dresden - a new player in the industry!

In March, after just three years of planning and construction, the German electronics company began pilot production in its new state-of-the-art semiconductor factory in Dresden, with series production planned for the end of this year. The digitalized, highly networked plant will cost €1 billion to complete. "Chips for the mobility of the future and greater road safety will soon be coming from Dresden," announced Managing Director Harald Kröger.

Chips will be manufactured on 300 mm wafers with up to 31,000 circuits each. The plan is to mass-produce special circuits, primarily electronics for the automotive industry, asics for airbags, parking pilots, engine control or ESP, components for steering systems or for the DC/DC converters of electric and hybrid cars. However, the first chips will not be installed in vehicles, but in drills, angle grinders and other power tools that Bosch manufactures itself.

"Our new semiconductor factory is also setting standards in automation, digitalization and connectivity," emphasized Kröger. Instead of thousands, as was the case in the 1990s, the plant only employs 250 people at the start, but this is set to rise to 700 later on. The reason for this is the strict course of high automation that the German semiconductor industry has taken since then in order to remain competitive and viable. In Dresden, Bosch is focusing on an advanced concept called AIoT, which combines artificial intelligence (AI), Industry 4.0 and the Industrial Internet of Things (IoT). "We no longer have any operators at all," says Production Manager Helmut Wurzer. Humans only intervene where the machines feel overwhelmed. "But many of them also work remotely, so they only connect to the cleanroom virtually." They even control, analyze or adjust the systems from home. In everyday operation, however, the machines negotiate the production processes - 700 process steps in the front end alone - all by themselves. Control is handled by artificial intelligence (AI), where the sensor data from the systems, subfab and analysis labs converge. The neural networks at Bosch Dresden are currently still in data feeding and learning mode, but will be switched online by the end of the year so that the AI can gradually take over real-time control of production. The Dresden plant will be connected both internally and with the Bosch site in Reutlingen via 5G.

Because many specialists from system suppliers could no longer be flown to Dresden during the coronavirus pandemic, Bosch technicians relied on augmented reality (AR) - data goggles into which virtual 3D twins of the machines are fed. These then helped to get the systems installed and up and running on time after all. The first series chips will be produced in July, but will not reach customers until the end of the year. This is due to the need to adjust the process sequences and the large number of process steps.

Bosch also intends to expand its development capacities in Dresden, announced plant manager Christian Koitzsch in June. To this end, the Bosch development subsidiary for MEMS in Saxony will be concentrated on the site of the new plant and a larger development center will be set up next to the clean room in the future. There are also plans to mirror the cleanroom factory at the site in the future. The site for this is available.

Developments in nanoelectronics for the future

The semiconductor industry will spend around USD 71.4 billion on research and development worldwide in 2021, setting a new record (4% year-on-year growth), according to the analysts at IC Insights. New manufacturing technologies need to be developed for the next generation of highly integrated microelectronics.

The aim of the EU project PIN3S, coordinated by ASML Netherlands, is the pilot integration of a 3 nm semiconductor technology, including the defect-free production of high-precision masks. Fraunhofer IIS/EAS Dresden will develop a sensor module for data acquisition for wafer exposure with EUVL.

Silicon is reaching its limits in satisfying the ever-increasing hunger for performance of modern electronics. Alternatives are offered by ultra-thin 2D materials, the best known of which is graphene. In order for these materials to function as electronic components, they must be modified by doping like silicon, e.g. by ion implantation. "This is difficult with 2D materials," explained Slawomir Prucnal from the Helmholtz-Zentrum Dresden Rossendorf (HZDR). His team has therefore provided these materials with a special top layer, the structure of which allows the processes to be controlled very precisely and can also be processed using conventional silicon technology production systems.

The Erfurt-based microchip company X-Fab, which has a factory in Dresden, announced back in February that all of its factories would have to increase output and ramp up capacity in order to cope with the order situation. In particular, micro-lab, silicon carbide, high-voltage CMOS technologies and on-chip voltage isolation skills are in demand. The company and the Leibniz Institute for High Performance Microelectronics (IHP) have announced a partnership with the aim of combining X-FAB's competence with IHP's expertise in wireless communication. IHP's active devices will be directly integrated into the backend of line (BEOL) of X-FAB's 130nm XR013 RF SOI process with Cu and thick Cu based metallization. Further focus areas are SiGe-BiCMOS technologies or silicon-based microfluidic structures directly on CMOS chip, suitable for lab-on-a-chip, DNA sequencing and other medical technologies.

Quantum computer 'Made in Germany' to come

Engineers from Sweden and Saxony are working together to revolutionize microelectronics production. To this end, Swedish company Alix Labs has developed a process designed to simplify and reduce the cost of chip production with structure sizes below 10 nm - without the use of expensive EUV exposure systems. Dresden-based Plasway Technologies is transferring this pitch-splitting method to an industrial scale using atomic layer etching.

So far, companies such as IBM, the Amazon subsidiary AWS, Google and D-Wave from Canada have led the way in quantum computing technologies. Intel has also worked on a silicon-based quantum processor at times. Where once the GDR's megabit memory chip was developed, Saxon scientists are now also working on this technology. Together with 18 other partners, the Fraunhofer IPMS in Dresden is developing a 16-qubit silicon-based quantum processor for large-scale production as part of the EU-funded Quantum Large-Scale Integration with Silicon (QLSI) project.

Infineon Dresden is working on the development of a silicon-based quantum processor as part of the Quasar joint project. This will later be used to build a quantum computer 'Made in Germany'. There are three major collaborative projects in Germany that aim to create the smallest data cells of quantum computers, the 'qubits', using different technology paths: GEQCOS is focusing on superconducting qubits, PIEDMONS on ion trap-based quantum computers and QUASAR on silicon-based qubits. The Quasar project is being led by Forschungszentrum Jülich. In addition to Infineon Dresden, the CNT at Fraunhofer IPMS is also involved.

The Bergakademie Freiberg is sharpening its research profile in nanoelectronics and quantum materials: Dresden physicist and nanowire expert Daniel Hiller has taken up a Heisenberg professorship at the Freiberg Institute of Applied Physics. "The miniaturization of transistors on chips is increasingly reaching fundamental limits," explained Prof. Hiller. He sees a solution in wires just a few nanometers in size, which interconnect to form transistors and ultimately complete computer chips. To ensure that these nanowires organize themselves correctly and conduct signals well, Hiller wants to use physical and quantum chemical effects that have been little used to date. He is also researching quantum materials made of silicon and germanium.

An announcement in May revealed that GF Dresden will in future be involved in the production of innovative photonic quantum chips together with Californian project partner Psiquantum from Palo Alto. The partners are relying on the principle of 'fusion-based quantum computing'.

In July, TU Dresden, the University of Manchester, Racyics GmbH and GF announced the tapeout of the SpiNNaker2 chip, a new chip for artificial intelligence inspired by the human brain. Using GF's 22FDX solution, a neuromorphic AI real-time processor with unprecedented efficiency and sub-millisecond latency for brain-like supercomputers has been created. The young TU spin-off Spinncloud Systems GmbH will then also market the new AI commercially. GF could realize mass production by mid-2022.

For some time now, Saxony has been striving to become a location of national and European importance in the key technology of artificial intelligence (AI). TU Dresden, the HZDR and other players in the state have specialized in the analysis of large data streams (big data), AI transparency and the use of AI in industry and research. The basis for this is the study 'Artificial Intelligence - Skills and Innovation Potential in Saxony' by the Dresden branch of Fraunhofer IIS.

A new large-scale research center for nanoelectronics?

For years, there have been calls in Saxony to establish something in the league of the national microelectronics research centers Cea-Leti in Grenoble (France) or the IMEC in Leuven (Belgium) in the Free State. Earlier attempts to at least encourage the IMEC to establish a research branch in Dresden had failed at the time. Fraunhofer and the Research Fab Microelectronics Germany now lobbied the BMBF in April 2021 to establish such a large-scale research center in Lusatia, Saxony. "The focus should be on nanoelectronics," said Guttowski from the FMD. This would involve both basic research and applications of new semiconductor technologies. However, it has been updated that the center in Lusatia will not be such a central semiconductor network node as Leti or IMEC. As a network of institutes and a virtual chip factory, the FMD itself is more application-oriented.

Sources:

Photos from presentations at the 3D & Systems Summit 2018 and 2020 in Dresden

Silicon Saxony e. V. Newsletter: silicon-saxony.de

News portal Oiger, Heiko Weckbrodt: computer-oiger.de

and further press releases