Last year, global PCB production amounted to around 97 billion dollars. Of this, 94% was produced in Asia, while the European share amounted to 2.2%.

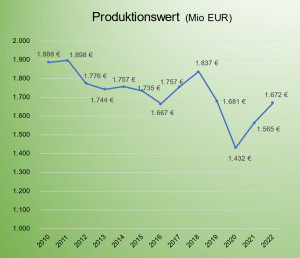

Following the low point in the coronavirus year 2020, with a production volume in Europe of just € 1.4 billion, the European PCB industry has recovered again in the last two years to just under € 1.7 billion, which is 11.5% below the 2010 level(Fig. 1).

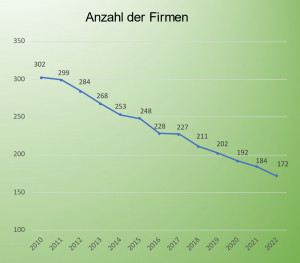

However, the number of companies fell by 43% in the same period to just 172(Fig. 2).

Against the geopolitical backdrop of the US trade war with China, the war between Russia and Ukraine and China's economic decline following the excessive coronavirus measures, the forecasts for global economic growth in 2023 have been revised to just + 2.1% (after + 3.1% in the previous year).

These reasons led to a new perspective on China as a trading partner. While China has developed into the world's undisputed workbench since its opening up through the outsourcing of Western industrialized countries, significant doubts have arisen in recent years about its reliability and options for relocating production facilities have been considered in order to improve supply security. In addition, increasing control and monitoring as well as interference in business processes have met with resistance.

The alternatives are relocation in the Asian region, relocation back to a country within Europe (nearshoring) or even reshoring.

'Just away from China'

In the electronics industry, three countries are often discussed for relocation in Asia: Vietnam, Thailand and India. However, the idea of 'only away from China' plays the dominant role, because supply interruptions due to political decisions (such as lockdowns) are avoided. However, it is overlooked that almost all primary materials have to be procured from China.

Near- or reshoring is a much more expensive decision in comparison, as most costs - above all wages and taxes - are significantly higher. However, there are also savings, such as logistics and transportation costs, customs duties, etc., which offset some of these costs. Several countries in the Baltic region or Central and Southern Europe are possible candidates for relocation to a European country.

As can be seen from Figure 2, the number of PCB manufacturers has fallen continuously over the years - 40 years ago there were almost 1000 manufacturers in Europe, 20 years ago there were still over 500. The local companies were no longer able to compete against the consistent relocation of procurement to China and the cost structure and subsidies there.

While China is home to exceptionally large PCB manufacturers (the 10 largest companies account for more than a quarter of the global production volume at over USD 26 billion), the European PCB industry consists primarily of small to medium-sized companies. Of the 172 companies remaining in 2022, only a quarter had an annual turnover of over €10 million. The remaining 75% either lack the necessary funds to invest or cannot find a successor for the company.

With the EU's changed economic policy towards China, attempts are now being made to relocate key industries and products out of China's sphere of influence. These include semiconductors, of which 68 projects are being supported by the EU Chip Act. However, a chip alone is useless if it is not mounted on a platform, i.e. a printed circuit board.

In this situation, however, there is a completely new consideration: to secure their own supply capability, OEM and EMS companies are investing in their suppliers, either as a participation or as a complete takeover.

Irrespective of such decisions, it is now important to offer the manufacturers remaining in Europe a perspective. The American association IPC, previously known in Germany mainly for its standards, has now taken the initiative to strengthen the interests of the PCB and EMS industry in Brussels [1]. With the help of the IPC, companies are thus given the opportunity to make their voices heard by national and international government organizations.

It is undisputed that of the major European manufacturers, only AT&S is in a position to set up production for substrates, mainly because not only enormous investments but also a lengthy qualification process are required. In order to achieve this goal, the German government and the EU must make an immediate financial contribution so that another production and technology step is not missed.

It goes without saying that this 'high school of electronics production' can only be tackled by a few individual companies - and only with massive support - but it should provide the rest of the industry with important support for conventional technologies.

References

[1] Please refer to the 'Interview of the Month' with Dr. Hans-Peter Tranitz, IPC Electronics Europe, PLUS 6/2023, p. 816