The coronavirus pandemic is not only revealing weaknesses in society in general, but also in the industry. The author looked at ten PCB manufacturers to find out how they are communicating the special conditions of the coronavirus period to the specialist public. This revealed clear differences, some of which have to do with inadequate use of the internet for public relations work.

In order to contain the consequences of the coronavirus pandemic for people, governments have had to adopt numerous measures since March of this year, which have had serious consequences for the population and therefore also for the economy. During the peak of the lockdown in April and May, a movement of discontent began to develop in Germany against the government's restrictive measures. It accused the government of being too tough on Germany during the lockdown and of not communicating the necessity of the measures to the population enough.

Corporate communication - the be-all and end-all

Just like the government, companies are bearing the brunt of the new pandemic situation. At their level of responsibility, they also had to define certain measures to protect the workforce, which in turn had an impact on the function of the company and therefore also on customer relationships. In addition, there were changes in the supply chains in which the companies are embedded.

Tab. 1: European companies in the NTI Top 100 World List 2017* and 2018 [1]

| Company | Country | NTI 100 rank | Turnover (million USD) | Growth % | Number of employees (approx.) | ||

| 2017 | 2018 | 2017 | 2018 | ||||

| AT&S | Austria | 10 | 11 | 1175 | 1218 | 3,6 | 10000 |

| Somacis | Italy | 75 | 77 | 181 | 187 | 3,3 | |

| KSG | Germany | 83 | 81 | 154 | 182 | 5,2 | 900 |

| Würth Electronics | Würth Elektronik Germany | 85 | 92 | 158 | 166 | 5,1 | 1000 |

| Swiss | Germany | 100 | 97 | 138 | 148 | 7,2 | 800 |

Consequently, we can also ask here how the company management communicates the new situation, including the measures taken for the company, not only with its own employees, but also with the professional public and in particular with customers.

To what extent has the principle of transparency between the company and the public or the company and its customers been applied, for example through announcements on the company's own website or through regular press releases on the company's situation? Has the customer been given a sufficiently informative picture of the situation so that he can continue to have confidence in his business partner? After all, many company managements are of the opinion that there have not been such abrupt changes in the working conditions of companies as there are now, at least not in the last 50 years, which should then also lead to corresponding considerations in company communication. Fig. 1: AT&S develops and produces miniature boards for medical capsules

Fig. 1: AT&S develops and produces miniature boards for medical capsules

In the following, the question of how 10 companies of quite different sizes and operating forms from the printed circuit board sector communicated the special conditions of the Covid-19 pandemic to the outside world is examined. In order to gain an initial impression, the author looked at the websites of the companies in question and their press releases regarding current information on the coronavirus situation. The starting point of his considerations is that the websites of the companies are now their most important 'shop window' for interested parties in general and for potential and real customers in particular and should therefore be maintained accordingly. However, the impressions gained in this way can only provide a partial (albeit important) picture of the companies' information policy, as it is highly likely that customers are also informed via internal e-mailings, which are not accessible to the public and therefore not to the author.

The big 'players' in the PCB sector

First of all, it should be said once again that this article is not about in-depth analyses of the respective companies, but about initial impressions of their approach. For an in-depth analysis, the research and analysis effort would have to be considerably greater.

In the following, we will first focus on four 'top dogs' in the European PCB industry: AT&S, KSG, Würth Elektronik and Schweizer. Six smaller PCB manufacturers are then briefly examined for comparison.

The position of these major players in global board production is shown in Table 1, an excerpt from Dr. Nakahara's NTI Top 100 list for 2018 [1]. The companies listed are therefore also the top 5 European PCB manufacturers.

To make it easier to form an opinion about the quality of the information activities of the PCB manufacturers included here, some important key data characterizing the company are presented first. It can be assumed that not every reader will be familiar with these.

AT&S

The full company name of Europe's largest PCB manufacturer is AT&S Austria Technologie & Systemtechnik Aktiengesellschaft. It manufactures mainly high-quality HDI printed circuit boards and IC substrates at six plants in four countries (Austria-Leoben, Fehring; India-Nanjangud; China-Shanghai, Chongqing; Korea-Ansan). A total of around 10,000 people work for AT&S. In China alone there are around 7000 employees.

The Group's customers are heavily concentrated in the areas of communications technology, automotive, industrial and medical electronics and advanced packaging (embedded component packaging) (Fig. 1). The new NADCAP accreditation from January 2020 will also allow the company to manufacture printed circuit boards for the aerospace industry in future, thus creating a further mainstay.

As its name as a public limited company suggests, the company has been actively and regularly providing information to its shareholders and customers on its website, particularly during the coronavirus pandemic. In February and March alone, four of the seven press releases dealt in detail with the coronavirus situation in China and Austria. These were also published on the company's website.

In the press release dated February 3, the company's management informed that the pandemic has been affecting AT&S's production in China since December 2019 to such an extent that revenue in the fourth quarter of 2019 was below expectations and that AT&S's existing revenue and earnings forecast for the 2019/20 financial year had to be revised downwards as a result. After all, production in China generates a large part of the Group's revenue, as the majority of the Group's employees are concentrated there, and a further expansion is already planned.

In the news on February 4, AT&S announced that the outlook for the financial year 2019/20 had to be adjusted downwards due to the coronavirus. However, in cooperation with a leading semiconductor manufacturer, AT&S remains committed to expanding production capacities for IC substrates at the Chongqing and Leoben sites. The investment volume amounts to up to EUR 1 billion over the next five years.

On February 14, it was announced that in principle all three AT&S PCB factories in China are back in operation, albeit with various restrictions. Plant I in Chongqing was able to continue working in part despite the pandemic. Fig. 2: Printed circuit boards for 5G are an important company focus at AT&S

Fig. 2: Printed circuit boards for 5G are an important company focus at AT&S

On March 16, the Group management announced that strict measures regarding the coronavirus had been introduced at its sites in Austria as a preventive measure, i.e. before the Austrian federal government's requirements came into force. They are based on those that have already proven effective in the Chinese AT&S plants over the past two and a half months. These include working from home and the absolute obligation to wear masks in the company based on high-quality masks with valves. As a result, no Covid-19 infections have been diagnosed there so far and AT&S was one of the first companies in China to be allowed to resume production. The aim is to maintain operations without interruption and thus meet delivery obligations in full and on time. By mid-March, all of the company's sites in Europe and Asia were 100% available. There were no restrictions on order processing until then. The same applies to the supply of the required production materials. By mid-March, all three plants in Shanghai and Chongqing were in full operation.

On March 26, the Group Executive Board commented on the economic impact of the pandemic on the 2020/21 financial year, stating that it cannot be quantified at present. In view of the worldwide impact on global logistics and production chains, it is assumed that there will also be a reduced demand situation in some of AT&S's customer segments. For the time being, the situation and general conditions will be evaluated on a short-cycle basis and appropriate measures will be introduced (Fig. 2). There was no official talk of short-time working in Austria until the end of May.

One example of the short-term measures taken to stabilize production is that AT&S has entered into numerous new collaborations with manufacturers of ventilators since the outbreak of the coronavirus pandemic - for example in the USA and India. The site in India was defined by the Indian government as a manufacturer of essential goods for the Indian state because the company switched production to the manufacture of printed circuit boards for life-saving ventilators at short notice.

As a result of the tense situation due to the coronavirus, the Group Management Board announced on May 12 that, subject to the approval of the Supervisory Board, it was decided to propose a dividend of € 0.25 per share for the financial year 2019/20 to the 26th Annual General Meeting on July 9, 2020 (dividend for 2018/19: € 0.60 per share). AT&S pursues a transparent dividend policy based on the investment cycles and the Group's earnings. This proposal for a significantly lower dividend payout than in the previous year reflects the upcoming investments in additional capacities and new technologies as well as the impact of the Covid-19 pandemic on earnings development.

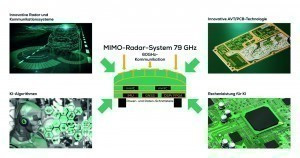

According to the Management Board report of May 14, consolidated revenue for the past financial year 2019/20 was once again above the one billion euro mark despite challenging conditions, but fell slightly by 2.7% year-on-year to € 1,000.6 million (previous year: € 1,028.0 million). Strategically, AT&S is on a promising course. Fig. 3: Development of the 79 GHz MIMO radar system

Fig. 3: Development of the 79 GHz MIMO radar system

In the interests of spending discipline, a reduced budget of up to € 80 million is estimated for basic investments (maintenance and technology upgrades), depending on market developments. As part of the strategic projects, the management is planning investments of up to € 410 million for the 2020/21 financial year, depending on the progress of the project.

KSG

The PCB manufacturer, which originally emerged from the East German company Kontakt- und Spezialbauelemente Gornsdorf, has been operating as KSG Leiterplatten GmbH since 1990. On November 1, 2018, the company changed its name to KSG GmbH and the Austrian PCB producer Häusermann GmbH became part of KSG GmbH as KSG Austria.

The board manufacturer took third place in the European ranking of PCB manufacturers in 2018. It manufactures more than 350,000m2 of high-quality PCBs per year for around 1,000 customers on a cumulative production area of 45,000m2 in Gornsdorf and Kamp. KSG GmbH employs around 900 people in total. The company produces exclusively in Europe, from prototypes to mass production, and sees itself as a technology leader and pioneer in HF solutions as well as in high-current and thermal management. The aim is to achieve short lead times, even for carriers for complex applications.

As part of its own research work, the company is working with partners to develop an embedding technology for the AI radar sensor with a system-integrated planar antenna or autonomous SMD-mountable 3D antenna (Fig. 3). The INDUGIE project is also a major challenge. This involves the development of a PCB technology for the integration of high-performance coils by integrating HF strands in cavities in a 20-layer hybrid FR4-HF multilayer structure with conductor pattern structures <50µm line/space.

After the takeover of Häusermann in 2017, KSG had to deal with the restructuring of the newly formed group of companies until 2019, so that the coronavirus subsequently caused the company unexpected additional problems. One feature of the restructuring is now the company's rather fresh and brisk website. In contrast to the websites of some other German PCB manufacturers, KSG attaches great importance to a high level of transparency towards the professional public and presents the current key figures of the group of companies as well as its corporate goals openly and clearly visible.

KSG first informed the specialist public about the impact of the coronavirus on the company in a press release on March 18, which was also available on its website. Detailed information was provided on the measures introduced to protect employees, changes to organizational processes and the current delivery situation.

This information was important for customers, for example:

- Due to the measures laid down, capacity losses are expected in future

- The necessary shortening of production shifts may lead to delays in delivery in certain areas

- The effects should be kept to a minimum

- From March's perspective, the supply of raw materials and supplies to the plants is secured for the near future because the supply chain has already been monitored for some time

- It can be assumed that delivery times for certain primary materials (e.g. base materials) or production resources for manufacturing will be extended

The management asked for support in this difficult situation and for immediate notification of any changes to business activities, e.g. significant changes in demand, changes to goods receipt times or impending closure of production sites.

On April 1, the company announced, almost exactly as Würth had done a few days earlier, that KSG had started production of printed circuit boards for ventilators, medical monitoring systems and intensive care electronic equipment at both sites. The company is able to accept and process orders at short notice, produce smoothly and deliver reliably.

The latter indicates free production capacity, which is confirmed by press reports from Austria. On April 20, the Austrian newspaper NÖN reported that KSG Austria was already working according to a short-time working model at the time. However, no such announcement can be found on the company website.

Irrespective of this, in mid-May the plant was looking for three-shift production employees for the manufacture of printed circuit boards on the Jobwald job portal. KSG Gornsdorf was also searching job portals in May for software developers to further expand the plant's IT infrastructure.

The press release from May 19 shows that KSG is working purposefully and despite the coronavirus crisis to consolidate its production foundations. The company's quality management system was successfully recertified in accordance with the automotive standard IATF 16949. Nevertheless, it can be estimated that only the bare minimum has been published about the impact of Covid-19 on the company.

Würth Elektronik Circuit Board Technology

When talking about Würth and circuit boards in general, you have to take a closer look, because the globally active Würth Group has a huge product portfolio in various product areas of the economy. Electronic components are produced within the Würth Elektronik Group. It is a legally independent group of companies within the globally positioned and family-run Würth Group. Printed circuit boards come from the Würth Elektronik Circuit Board Technology (CBT) product and business division of the Würth Elektronik Group.

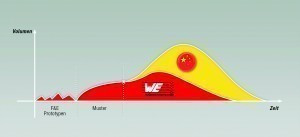

According to Table 1, Würth Elektronik (CBT) ranked 92nd in the World Top 100 list in 2018 with total sales of $166 million and recorded growth of 5.1% compared to 2017. In the European top ranking, the company took fourth place after AT&S, Somacis and KSG, ahead of Schweizer Electronic. Fig. 4: Würth's criteria for PCB production in Germany and Asia

Fig. 4: Würth's criteria for PCB production in Germany and Asia

The spectrum of over 4500 customers ranges from large corporations to one-man development offices. Accordingly, customers are offered PCBs ranging from prototypes or samples to large-scale production. The vast majority of the approximately 1000 employees work in the three German production plants: Rot am See, Niedernhall and Schopfheim. However, Würth also relies on manufacturing partners in China for PCB production.

The company assures its customers that boards ordered online from WEdirekt come exclusively from Germany. The majority of them are produced in Rot am See. WEdirekt stands for the PCB online store of Würth Elektronik GmbH & Co. KG, which is located in Rot am See. Figure 4 shows the approximate criteria used to decide on the processing of board orders: Germany or Asia.

- Assuming that the company has a huge customer base in Europe

- occupies one of the top ranks in the European PCB industry

- has its boards manufactured in both Germany and Asia

one could assume that the management has stepped up its public relations work on its website due to the special situation caused by the coronavirus pandemic. However, a look at the press work in the period from January to May 2020 shows that this was not the case. Information on the impact of the pandemic was only released twice in March and not again thereafter.

In a news release dated March 20, the company management reported on the current impact of the coronavirus on Würth Elektronik CBT and the protective measures taken, including on PCB deliveries from Asia. It states, among other things:

- The majority of the Asian partners' plants are now back to 80% to 100% of production capacity

- Production at the three German sites is running at 100% capacity

- The delivery situation from Asia has stabilized despite certain logistics bottlenecks and goods are being delivered regularly again

- By increasing stocks, the supply of raw materials and supplies to the German plants is currently secured for the near future

- The production sites have the necessary resources and materials to accept orders for system-relevant products and manufacture them with the utmost care

- Increased order intake in recent weeks has led to longer delivery times

In the news from March 26, Würth Elektronik CBT announced that it had taken over the production of printed circuit boards for the manufacture of intensive care ventilators and mobile ventilators at short notice (Fig. 5). The company is in a position to accept and process orders at short notice, produce them smoothly and deliver them reliably. All three of the company's German plants work in three shifts. The production sites have the necessary resources and materials to accept orders for system-relevant products and manufacture them with the utmost care. Fig. 5: Symbolic image of printed circuit boards for ventilators

Fig. 5: Symbolic image of printed circuit boards for ventilators

From this, one could conclude that Würth Elektronik CBT's capacity utilization was good to very good even in the first quarter of 2020 and that the order situation for the second quarter is also satisfactory. However, as the company does not publish any corresponding figures on the business situation, we can only speculate in this regard. Short-time working has apparently not been an issue so far.

Schweizer Electronic

Looking at the origins of the company, Schweizer Electronic AG can look back on almost 170 years of history. Together with its partners Elekonta Marek GmbH & Co. KG, Meiko Electronics Co., Ltd. and WUS Printed Circuit Co., Ltd., the company offers cost- and production-optimized solutions for small, medium and large series in its traditional Electronic division. Schweizer has entered into a partnership with the Japanese PCB manufacturer Meiko, which primarily manufactures in other Asian countries, particularly for high-volume delivery quantities. One of the main customers for PCBs to date has been the automotive industry.

The family-run but listed manufacturer employed around 800 people at the end of 2019. Turnover amounted to €120.7 million, 3.7% less than in 2018. In the 2017 financial year, turnover was also €120.9 million. According to Table 1, Schweizer was the 97th largest PCB producer in the world in the 2018 NTI 100 ranking. Although Germany accounted for the lion's share of Group sales in 2019 at 53%, this fell significantly compared to the previous year - as did Europe's share. In contrast, growth was recorded in Asia and the USA.

As revenue has stagnated since 2017, the Group has set itself a clear strategic signal for growth, is establishing the new Systems division and has been building a new high-tech PCB embedding plant in Jintan (China) since August 2018. Despite the temporarily difficult conditions caused by the coronavirus, the new production facility is scheduled to go into operation in 2020. Infineon Technologies AG, which along with WUS Kunshan also holds a stake of just under 10% in Schweizer Electronic AG, is showing great interest in establishing the joint chip embedding technology on the global market.

When reviewing Schweizer's website on the subject of corona, the author noticed that there is a complete lack of information from the management on the situation in the company, on precautionary measures taken for the workforce and on changes or adjustments to operating procedures. There are no detailed explanations either on the main website or in the press section that customers and the public could refer to. This clearly distinguishes Schweizer from the PCB manufacturers AT&S, KSG and Würth that we have looked at so far. It could be said that Schweizer, in comparison to the PCB producers mentioned above, has let the influence of Covid-19 on the company 'fall by the wayside'. It should also be added that some of the company's websites need to be revised in terms of data.

Only the press release from April 2 shows that the coronavirus exists there. It was announced that the company was donating 2,000 FFP2 protective masks to the district of Rottweil and that employees of the company who volunteer with the German Red Cross, THW and fire department would be given time off to help in the fight against Covid-19.

A news item from April 21 in preparation for the virtual Annual General Meeting on June 26 inevitably addresses the impact of Covid-19 on the company. It states, among other things:

- While we were able to expand business via our Asian partners WUS and Meiko with an increase of 52.9%, sales from our main plant in Schramberg did not develop satisfactorily at -17.5%. This decline was characterized by the economic downturn since the beginning of 2019, which resulted in a corresponding reluctance to place orders with both automotive and industrial customers

- The export share increased from 43.7% to 47.1%, with Germany (53%) and Europe (excluding Germany) (26%) remaining the most important sales markets

- The effects of the coronavirus pandemic make a reliable forecast for the 2020 financial year very difficult

- Schweizer intends to take advantage of aid offered by the economic stabilization fund and to use short-time work as needed to secure jobs

Covid-19 and the 'little ones'

Six examples are used here to show how differently even medium-sized PCB manufacturers are approaching the topic of 'information strategy in the coronavirus era'.

Straschu Electronics Group

The group, headquartered in Stuhr, comprises nine companies at eight locations. The main companies are Straschu Industrieelektronik GmbH in Stuhr near Bremen, Straschu Leiterplatten GmbH in Oldenburg, Rostock Leiterplatten GmbH in Rostock. With around 400 employees, the group generates an annual turnover of €66 million. In addition to the production of printed circuit boards and electronic assemblies, the trading group also sells electrotechnical components. Boards are only manufactured in Oldenburg.

In a news item on March 20, the management provided brief information on the measures taken in connection with COVID-19 on the Group's website. It was stated that deliveries would continue. The situation was being reassessed with great care on an ongoing basis in order to implement measures and provide information at an early stage. There were no further announcements on the coronavirus situation until the end of May.

ILFA

The full company name of the Hanover-based company is ILFA Industrieelektronik und Leiterplattenfertigung aller Art GmbH. The owner- and founder-managed company has been developing and producing printed circuit boards in the high-tech segment for over 40 years and currently employs around 185 people. A banner image on the company's main website draws visitors' attention to the special coronavirus situation (Fig. 6). A direct link takes the visitor to an information page where they can find out the essentials of the measures taken by Ilfa regarding Corona and the situation at the time. The message is dated March 23. The main statement is: "Our internal operations and production are continuing without restrictions." In addition: "The material stocks are sufficiently stocked. Should there nevertheless be supply bottlenecks, additional material can be obtained from cooperation partners." There has been no new corona-related information since March.

Under 'News', however, the management reported on April 30 that ILFA technicians are developing high-speed printed circuit boards in which optoelectronic components are embedded together with partners as part of the EPho funding project [2] (Fig. 7).

Contag AG

The Berlin-based, multi-award-winning company with around 80 employees sees itself as probably the fastest manufacturer of high-tech PCBs in Europe, which may be true in the 'Superblitz' price category with four hours in certain cases. The former Contag GmbH was transformed into Contag AG in 2012, although according to the company founder, the capital market and share trading played no role in the change of name (Fig. 8). Accordingly, Contag probably sees no need to inform any shareholders or internet visitors about the Covid-19 situation in the company. Fig. 6: Ilfa refers to the corona situation on its main website

Fig. 6: Ilfa refers to the corona situation on its main website

The publication of press releases at Contag has come to a standstill since 2018, the publication of the newsletter since May 2019 and the publication of 'real' news since June 2019. Consequently, no information on the coronavirus can be found on the company's website. In a 'News' dated April 20, the management merely states without reference that PCB production is running at full speed: the material warehouse is well stocked, including with many special materials for high-frequency, high-current and high-tech applications. In January 2019, however, it was still newsworthy that the German Red Cross blood donor bus will be on the company premises on 16 January. Fig. 7: The EPho project enables optical and electronic data transmission on a glass subrack

Fig. 7: The EPho project enables optical and electronic data transmission on a glass subrack

Andus Electronic

Andus is a medium-sized family business in Berlin, which celebrated its 50th anniversary in 2019 since it was founded by Lutz Treutler. The latter is also known as the 'father' of the FED. The company likes to produce prototypes and small series of sophisticated boards with innovative solutions. One of its own innovations, for example, is the ZeroGap LED substrate.

However, public information work at Andus has apparently come to a standstill. The management has not posted any company news on its website since January 2019. As a result, visitors to the website cannot see how the coronavirus situation is affecting the PCB producer and what measures have been taken. In fact, a 'black box situation' has arisen. This does not give visitors to the website any good impressions and the opportunities offered by the Internet are more or less wasted.

EES - European Electronics Systems

Two plants belong to this group of companies: Schoeller Electronics Systems GmbH in Wetter and Hans Brockstedt GmbH in Kiel. EES has a broad customer base: Industrial electronics, medical technology, aerospace, defense, automotive. There have been no more press releases on the website since February 2019. There are also no references to the coronavirus situation at EES.

Nevertheless, Schoeller made negative headlines in the spring due to a particular coronavirus case: The GmbH is in preliminary insolvency proceedings. According to the insolvency administrator, business operations will continue with around 200 employees regardless of the ongoing proceedings. Background: The company is currently without management. The managing director is unable to leave the UK due to coronavirus and cannot be contacted.

Aspocomp

Finally, let's take a look outside the box to Finland. The medium-sized PCB manufacturer Aspocomp celebrated its 40th anniversary in January 2020. In 2019, net sales amounted to €31.2 million with around 150 employees and an operating result of €3.4 million. The main customer sectors are automotive, semiconductor, telecommunications, industrial, security, military and aerospace electronics. It delivers to 46 countries. The company has its own production facility in Oulu (Finland) and a partner network in Europe and China.

The coronavirus pandemic impacted Aspocomp's net sales in the first quarter and significantly weakened its operating result: in the first quarter, the manufacturer recorded net sales of € 6.7 million, a decrease of 12% compared to the same period of the previous year (€ 7.6 million in the same period of the previous year). This was primarily due to the automotive and telecommunications segments. Despite the major coronavirus-related uncertainties and growing risks, however, sales and operating income in 2020 are expected to be on a par with the previous year.

Aspocomp has pursued a transparent information policy with regard to the impact of coronavirus on its own plant and partner factories in Europe and China from the outset. Five press releases were issued between January and April to communicate the current situation. On March 16, the company management announced that production in Oulu and at the European partners was running at full capacity and that production in China was almost back to normal.

In addition to the production situation, the news on April 2 also reported on transportation problems due to reduced flight connections, as well as the resulting relocation of production to European manufacturers. The example of Aspocomp shows that even relatively small medium-sized companies have made it their business to make a positive contribution to customer loyalty through regular information work adapted to the situation. Aspocomp took part in an EU-funded project from 2014 to 2020 to further develop its high-tech PCBs for test systems for highly complex semiconductor chips.

Concluding remarks

At present, there is much talk that the digitalization of society is receiving a significant boost from coronavirus. The pandemic will accelerate the development of the economy towards Industry 4.0. However, it should be borne in mind that the internet and companies' websites have been an important part of this advancing digitalization process for over two decades. Nevertheless, in the author's recent experience, it is still the case that some companies do not devote the necessary attention to their websites as the modern, up-to-date 'figurehead' or 'representation platform'. They make insufficient use of the opportunities for positive self-presentation. There is often a gap between the presentation of the company's technical performance and the quality of the information provided to the specialist public. As an aside, it should also be noted that elementary visual or physiological design principles of the pages such as structure, color, contrast of background and font, font sizes, etc. are still not sufficiently observed. The quality of a company's professional work should always match its Internet presence in order to make the best possible use of its own company potential.

References:

[1] PLUS, issue 9/2019, p. 1354ff.

[2] www.elektronikforschung.de/projekte/epho