Semicon West in San Francisco is a legendary classic among industry events in North America. This year (12 to 14 July) as Semicon West 2022 Hybrid with presence and online elements organized by the US industry association SEMI, it attracted 200 experts and tech visionaries from semiconductor and electronics manufacturing to the Moscone Center and the surrounding hotels. They gained an exciting insight into the currently confusing trends in microelectronics.

The event was also dedicated to current topics such as sustainability, smart technologies and the digital transformation of industrial manufacturing. In addition, an assessment of government interventions such as import/export regulations and subsidies and their impact on the entire industry. In the USA, this is the heavily modified U.S. Chips Act, which is apparently close to its final passage in Congress. In terms of the market outlook for semiconductor and electronics manufacturing, SEMI is sticking unwaveringly to its optimistic forecasts from the second quarter of 2022 - the uninterrupted expansion.

Connected as always were the FLEX Conference, an annual event that discusses innovations in flexible, hybrid and printed electronics, and the long-running (59th) Design Automation Conference<https://www.semiconwest.org/special-features/design-automation-conference> (DAC), which focuses on IC and system design. The newly added Global Sustainability Summit<https://www.semiconwest.org/programs/sustainability-summit> advocates collaboration in the semiconductor industry in order to come closer to the goal of decarbonization. Launched by SEMI and McKinsey, it is programmatically linked to another high-minded activity: the SEMI Sustainability Initiative<https://www.semiconwest.org/programs/sustainable-manufacturing-semi-sustain.

On July 11, the SEMI Market Symposium<https://www.semiconwest.org/programs/market-symposium> opened the series of keynote and product presentations with the industry's market trends and technology drivers, with an intensively commented outlook on the semiconductor manufacturing equipment and materials market in light of the currently uncertain global supply chains. The show floor featured various large joint stands, such as the Smart Manufacturing Pavilion<https://www.semiconwest.org/programs/smart-pavilions/smart-manufacturing>, the Smart Mobility Pavilion<https://www.semiconwest.org/programs/smart-pavilions/smart-mobility>, the Smart MedTech Pavilion<https://www.semiconwest.org/programs/smart-pavilions/smart-medtech> and the Workforce Development Pavilion<https://www.semiconwest.org/programs/wfd-pavilion>, which is also currently a top priority in the USA.

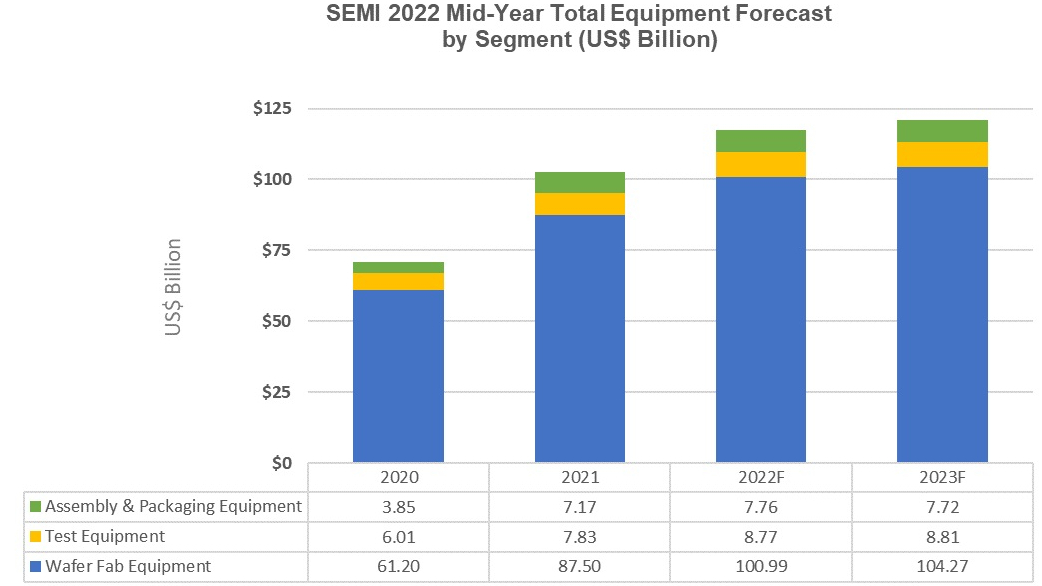

In terms of the market outlook for semiconductor and electronics manufacturing, SEMI is sticking to its optimistic forecasts from the second quarter of 2022 - the uninterrupted expansion. Investment in wafer fabs and their process technology is expected to expand by 15.4% this year, to a new record high of $101 billion, followed by a more modest 3.2% growth to $104.3 in 2023. "Under determined pressure from the semiconductor industry to expand and upgrade capacity, the wafer fab segment promises to reach the $100 billion milestone for the first time in 2022," says Ajit Manocha, President and CEO of SEMI.

However, after the sensational growth of 86.5% in assembly and packaging equipment in 2021, Manocha also predicts a slowdown of 0.5% to a total of 7.7 billion dollars in the coming year. Taiwan, China and Korea are likely to remain the regional pillars of fab equipment. Taiwan holds the top position.

Away from the official announcements, however, a cautious nervousness could be felt on the show floor at Semicon West 2002 as to how the semiconductor and equipment industry might fare in view of the inflation-induced decline in demand for high-quality consumer goods such as smartphones and video panels. Robert Maire, a well-known financial advisor to high-tech companies and investors, sounds quite pessimistic. He wonders whether Semicon West represents "the calm before the storm" (SEMICON West the Calm Before Storm? CHIPS Act Hail Mary? Old China Embargo New Again?<https://semiwiki.com/semiconductor-services/semiconductor-advisors/315521-s