A detailed and differentiated market outlook over the next ten years for the applications of the promising material graphene comes from the British market researcher IDTechEx ('Graphene Market & 2D Materials Assessment 2023-2033'). Conclusion: The markets for graphene and its derivatives are developing along the hype curve typical in the high-tech sector, with the expected commercialization making steady progress and achieving significant growth rates in the coming years.

IDTechEx forecasts that the market for graphene materials will grow from <100 million dollars in 2020 to 1 billion dollars by 2032. The study is divided into granular forecasts from 18 application areas and contains data-intensive estimates and benchmarks. A total of 150 companies were contacted and profiles of more than 60 players in the market were created. It is not easy to break down and differentiate between the individual aspects of graphene development and the various configurations and types of material. IDTechEx notes some progress in standardization, the associated legislation and qualification guidelines. However, according to the authors of the study, Dr. Richard Collins<https://www.idtechex.com/en/team/dr-richard-collins/2096> and Conor O'Brien<https://www.idtechex.com/en/team/conor-obrien/2845>, this also presents a certain challenge. Graphene nanoplatelets (GNP), graphene oxide (GO) and reduced graphene oxide (rGO) appear to be the closest to significant commercial use. The authors see them in a rapid growth phase, with real applications for polymer compounds in automobiles, heat dissipation in smartphones, industrial elastomers, anti-corrosion coatings and more.

It is also difficult to decide which graphene configuration is best suited to applications with multifunctional requirements. According to the authors, current users accept the fact that the most suitable material type cannot be determined a priori, but rather results from the results of the respective application and its parameters. This determines the morphology and required purity of the material. It is now clear to end users that this is where the know-how for the application lies - a key factor for competitiveness, which early adopters are trying to gain through external or in-house knowledge. The various processes for graphene production have their specific strengths and weaknesses, especially the classic top-down process of exfoliation from the liquid phase and oxidation-reduction. The report explains these processes in detail and also mentions alternatives with different starting materials to improve efficiency and the end product.

Consolidation of the manufacturing base: There are currently a large number of graphene manufacturers, which is likely to decrease significantly as the manufacturing base consolidates. The report analyzes the progress made by individual manufacturers, citing their sales, profitability, manufacturing capacity, pricing, intellectual property, partnerships and more. Production facilities of sufficient size have already been installed to enable volume production. However, according to IDTechEx, the expansion process is likely to take some time. Currently, manufacturing capacity is outstripping demand. As in other industrial sectors, China has become a competitor to be taken seriously in terms of production capacity and R&D expenditure. This is also broken down in more detail in the aforementioned report. In light of the fact that much of this activity is in volume additive manufacturing, price and cost are important factors: prices for graphene span several orders of magnitude, with many suppliers doing their best to avoid reaching a bottom too quickly in a race-to-the-bottom. Overall, according to the report, the graphene industry is still operating on the losing side, with a few profitable suppliers. This leads to investors' expectations being disappointed on various occasions, especially as public and private funding still plays a decisive role. The report also looks at this in detail.

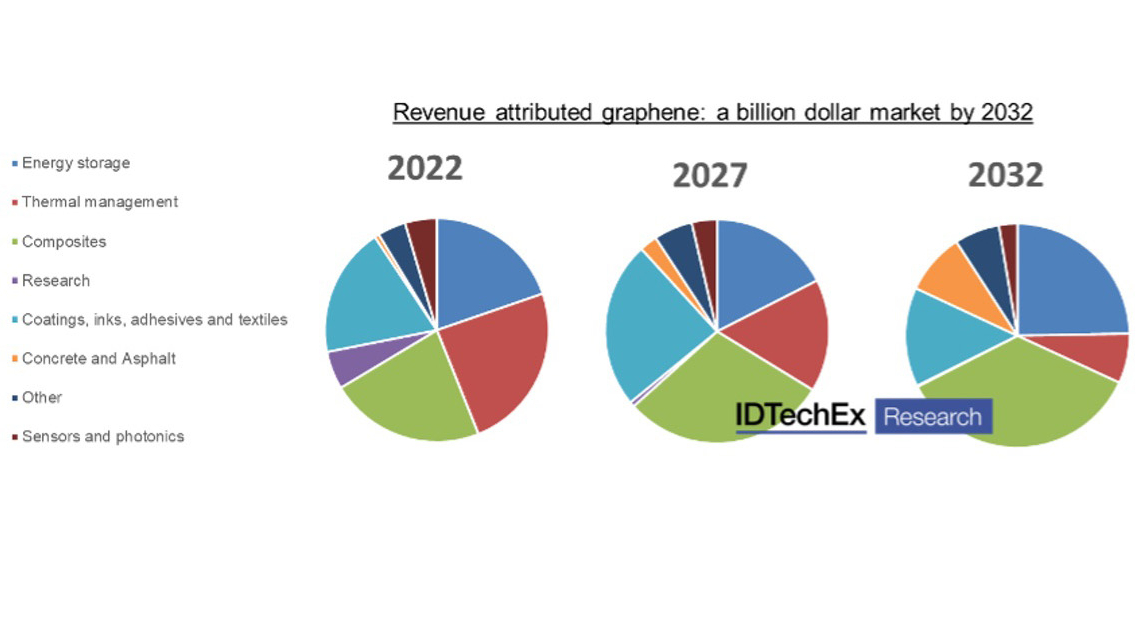

It also focuses on the potential applications in which there is a high demand for solutions. The general market drivers are: Advances in thermal management, sustainability, weight savings, product lifespan and more. This raises the question of where the real focus of graphene applications will be - energy storage, coating, heat dissipation? Or in graphene-based textiles? Figure 1 provides an overview of this, and the text of the report contains a discussion of a roadmap for getting there. The production of graphene films and wafers, which is typically carried out using CVD processes, gives a rather reticent impression. The obvious potential for transistors has been studied intensively, but the absence of a band gap and the advantageous properties of existing materials have created barriers. However, advances in manufacturing and further developments give renewed hope, particularly for sensors and optoelectronic components. Here, IDTechEx sees promising developments for various end-user markets over the next ten years.

Other 2D materials besides graphene: With the activities surrounding graphene, a whole family of other 2D materials has emerged, all with specific properties and commercial potential. Almost all of them are at an early stage of development. The IDTechEx report provides a detailed assessment with a focus on boron nitride, transition metal dichalcogenides or MXenes (two-dimensional inorganic compounds). The most important technical advances, prospective applications, profiles of the (start-up) companies involved and other details are listed in the report.

Graphene is not the first nanocarbon material to find its way out of the labs and into the fabs. Most applications use graphene as an additive material - which has consequences for competitiveness. Carbon black is currently the most commonly used conductive carbon powder. It comes in numerous grades and opens up long-term prospects for GNPs and rGOs if suitable high-volume applications can be found. In a mature industry sector such as this, the number of manufacturers is already consolidated, with a global presence and reduced profit margins.

Finally, the report refers to the commercial development of multi-walled and single-walled carbon nanotubes. MWCNTs have historically gone through a rash expansion of manufacturing capacity - for modest niche applications. It is only in recent years that significant sales have emerged for them, so that the next expansion steps are taking hold. This is mainly thanks to their use in the cathode of lithium-ion batteries. SWCNTs, on the other hand, still have important commercial applications to develop despite their promises. The report also deals with this complex situation in detail.