The current ranking of manufacturers of single-chip microcontrollers for control systems (MCUs) shows a strong concentration of market shares that has increased significantly in recent years. The expansion in the MCU segment is being driven by the demand for embedded control systems for industrial automation and their associated sensor technology, according to the compilers of the ranking at US market analysts IC Insights. This market momentum, which MCU suppliers have not always been able to keep up with in terms of delivery volumes, was triggered by the sharp upturn in 2021 following the pandemic-related global recession in 2020.

After a 7% decline in 2019 due to the weak global economy and a further 2% drop in 2020 due to the Covid crisis, MCU sales rose very quickly in 2021, increasing by 27% to a record volume of USD 20.2 billion. This is the largest increase since 2000.

The average selling prices (ASP) for MCUs climbed by 12% - another new record since the 1990s. However, due to the tense situation on the production side, MCU deliveries only grew by a full 13% in 2021, to a total of 31.2 billion units.

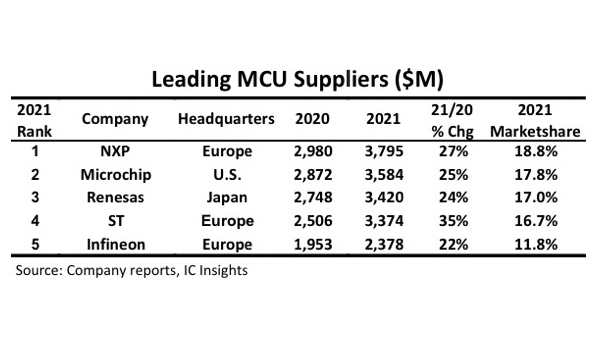

In the continued market recovery of MCU sales last year, the ranking of the five largest microcontroller suppliers remained unchanged compared to 2020, as the 2022 McClean Report by IC Insights shows.

Three of the top five in 2021 were based in Europe (NXP, STMicroelectronics and Infineon), one in the USA (Microchip) and another in Japan (Renesas). The largest microcontroller manufacturers develop and market ARM-based MCUs. In 2021, they accounted for 82.1% of global MCU sales, up from 72.2% in 2016. According to IC Insights, the growth of the industry leaders is primarily the result of mergers and acquisitions.

The second half of the top ten (Texas Instruments, Nuvoton, Rohm, Samsung and Toshiba) recorded a total of USD 2.3 billion in MCU sales last year, corresponding to 11.4% of the total market. The rest of the suppliers had a modest market share of just 6.5%.

In 2021, market leader NXP slightly increased its MCU sales over number two Microchip by $103 million. Microchip, for its part, extended its lead over third-placed Renesas by around $40 million. STMicroelectronics, in fourth place, recorded a 35% increase in sales in 2021, coming close to its Japanese rival Renesas. The latter was previously the largest MCU supplier, but was pushed back to a market share of 17% in 2016 following NXP's acquisition of US manufacturer Freescale. Infineon remained in fifth place in 2021 due to the acquisition of Cypress Semiconductor in 2020, with a 22% increase in sales to $2.4 billion - just under a billion less than STMicroelectronics.