It is not just the weak economy that is preventing family businesses from investing in Germany, according to a press release by the Family Business Foundation. First and foremost, it is the density of regulation.

Family entrepreneurs rate the USA, Poland, India and China as the most popular destinations for foreign investment. In contrast, more than 60% of German family businesses give Germany a rating of 4, 5 or 6. 26% give it a rating of 3. It is true that their investments are currently still predominantly spread across German locations. However, 34% state that these investments will decrease over the next five years.

Family businesses rate Germany as a business location with a score of 4, 5 or 6

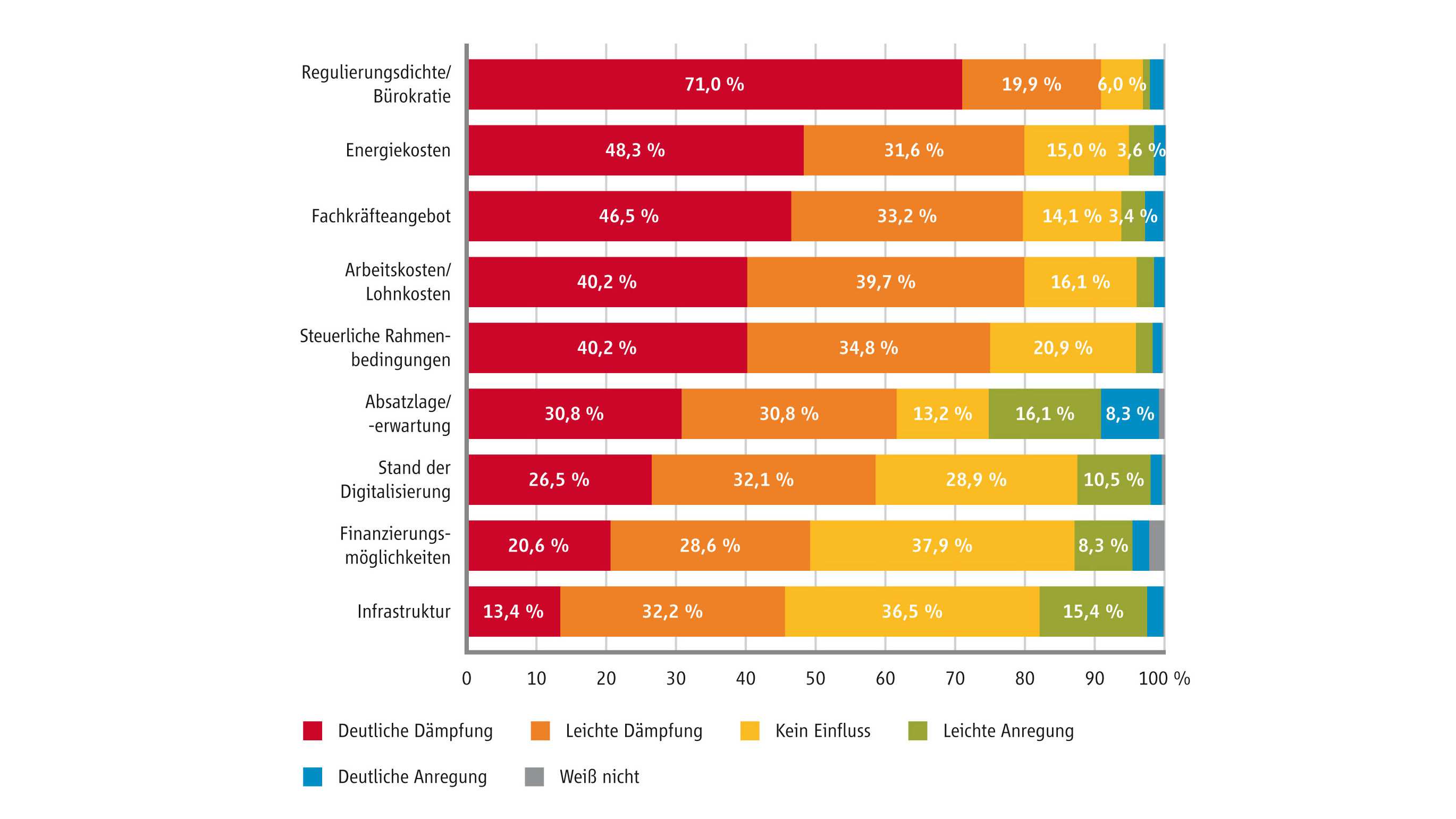

When asked what has a positive or negative impact on their investments in Germany, the answers from family businesses are surprisingly uniform. These are: the density of regulation (90% significant or slight dampening), energy prices (80% dampening) and the supply of skilled workers (80% dampening). These are followed by labor costs and taxes, and only then the sales situation.

Digitalization, financing and infrastructure obviously have less of an impact on investment decisions. This is the result of a recent survey of 1,200 family businesses. The data was collected and analyzed by the ifo Institute in Munich on behalf of the Family Business Foundation.