Success is only rented, rental payments are due daily

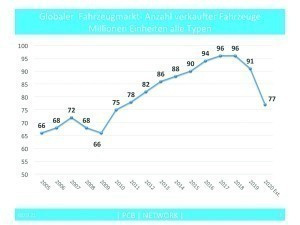

Exacerbated by the coronavirus pandemic, the global automotive market slumped by a further 15% in 2020, following a decline of 5.2% in 2019(Fig. 3). At -24%, the European passenger car market plummeted even further in 2020. The USA also suffered a decline of 14.7% for the year as a whole. The world's largest market, China, slumped only briefly at the beginning of 2020, but recovered quickly and remained only -6.1% below the previous year's level for the year as a whole(Fig. 4).

Fig. 2: Battery pre-assembly 45 to 77 kWh for the ID 3

Fig. 2: Battery pre-assembly 45 to 77 kWh for the ID 3

Only sales of electric vehicles in Germany reached new record levels thanks to generous bonuses. 194,000 fully electric passenger cars (BEV) and 200,500 plug-in hybrids (PHEV) were registered here in 2020(Fig. 1 and 2).

Things are looking up again

It can be assumed that the market situation will slowly improve this year. However, the declines of 2020 will not be fully offset. The higher growth rates expected in the coming months should not be overestimated in light of the low sales figures during the lockdown phase in spring 2020. This is likely to be primarily a 'technical upswing'. With the exception of China, vehicle sales in the respective markets will only slowly approach pre-crisis levels. Growth of 12% to 13.4 million new vehicles is expected for Europe in 2021. In the USA, sales are expected to increase by 9% to 15.8 million units in 2021. At 21.4 million units, the Chinese passenger car market will already exceed the pre-corona level again with growth of 8%. Following a 15% slump in 2020, the global passenger car market is therefore expected to grow by 9% to 73.8 million this year. However, even this sales volume is still well below the pre-corona level.

The sales figures in detail

In Europe, a total of just under 12.0 million new passenger cars were registered in 2020, 3.8 million or almost a quarter (-24%) fewer than in the previous year(Table 1) The five largest markets all recorded double-digit declines. In Germany, new registrations fell by almost a fifth (-19%). In France, the sales volume fell by a quarter (-25%). In Italy (-28%), the United Kingdom (-29%) and Spain (-32%), almost a third fewer cars were registered in each case. All countries that are part of the European market closed 2020 with a negative balance. Although there have been signs of a slight recovery in recent months, car sales in Europe were still 4% below the previous year's level in December at more than 1.2 million units.

Tab. 1: Passenger car registration figures in the most important sales markets 2020 versus 2019

|

Sales in units |

Dec 2020 |

+/- % |

2020 |

+/- % |

|

Western Europe (EU14+EFTA+UK)* |

1 093 400 |

-3,6 |

5 756 200 |

-24,5 |

|

USA** |

1 608 900 |

6,4 |

14 463 900 |

-21,9 |

|

Japan |

315 200 |

10,9 |

3 810 000 |

-11,4 |

|

Brazil** |

233 000 |

-7,6 |

1 954 800 |

-26,7 |

|

India |

253 000 |

13,6 |

2 435 100 |

-17,8 |

|

China |

2 328 000 |

7,2 |

19 790 000 |

-6,1 |

|

* excluding Malta ** Light Vehicles |

||||

In the USA, the light vehicle market (passenger cars and light trucks) closed 2020 with just under 14.5 million vehicles sold (-15%). For the first time since 2012, the US market no longer exceeded the 15 million mark. Sales of passenger cars fell by 28%, while sales in the light truck segment, which now accounts for 76% of the light vehicle market, fell by 10%. In December, 1.6 million light vehicles were sold (+6%).

China has largely put the coronavirus pandemic and its serious consequences for car sales behind it. Thanks to a rapid recovery, the decline in 2020 was reduced to 6% (19.8 million units). In December, 2.3 million vehicles were delivered to Chinese customers. This is an increase of 7% compared to the previous year and the eighth monthly increase in a row. With 3.8 million cars sold in 2020, the Japanese new car market was 11% down on the previous year. Sales thus fell below the 4 million mark for the first time since 2011. In December, sales amounted to 315,200 units, 11% more than in the same month last year.

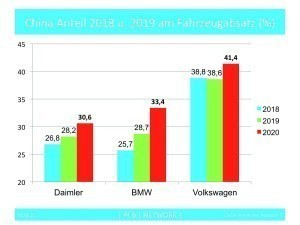

Dependence on China is increasing

The dependence of German car manufacturers on China, the world's largest automotive market, continues to grow. The frontrunner is the Volkswagen Group with its subsidiary Audi, which generated 41.4% of its sales in China last year(Fig. 5). This means that China has long since become the most important single market for VW. BMW also sells one in three vehicles (33.4%) in China. Mercedes follows right behind with 30.6%. As all three manufacturers generally sell fully equipped vehicles, China is the mainstay of the German car industry, not only in terms of volume but also in terms of earnings.

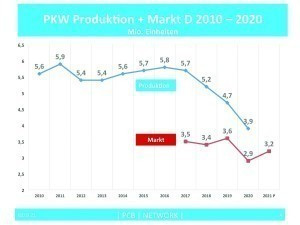

Relocation of car production abroad

Germany as a production location is not only suffering in electronics production. As can be seen inFigure 6, German car production has been shrinking continuously since 2016. After 5.8 million units in 2016, only 3.9 million cars rolled off the production line in 2020. Even if the coronavirus year 2020 is excluded, there is still a 19% drop between 2016 and 2019. In contrast, the German passenger car market remained fairly stable at 3.5 million units in the pre-coronavirus period.

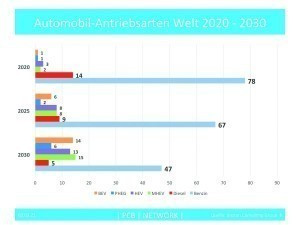

Petrol engines on the retreat - around 50% alternative drive systems in 2030

In 2020, petrol engines still dominate global car production with 78%, supplemented by 14% diesel engines. However, combustion engines are on the decline. Mild hybrids (MHEV) still only account for 2%, hybrid electric vehicles (HEV) for 3% and plug-in hybrids (PHEG) and battery electric vehicles (BEV) for just 1% each.

But this is changing rapidly. By 2025, petrol engines will only account for 67%, diesel for 9% and by 2030 the share of petrol engines will shrink to 47% and diesel to 5%. This means that in less than 10 years, around half of all drive systems will no longer be combustion engines.

China in particular is pushing alternative drive systems, with a strong preference for hydrogen. Korea and Japan are other important drivers here.

To the point :

- According to a study by the Boston Consulting Group, around 50% of all vehicles worldwide will have an alternative drive system by 2030. 47% petrol engines and 5% diesel engines will then be the interim status.

- Since 2016, Germany has been losing ground as a production location for cars (-19% by 2019 or before coronavirus, and -33% in 2020, the year of coronavirus). In contrast, the German sales market remains stable with 3.5 million units until corona.

- China has become by far the most important and highest-margin sales market for the German car manufacturers VW (41%), BMW (33%) and Mercedes (31%)

- China is expected to reach pre-corona levels again in 2021 with 21.4 million vehicles, while Europe will remain well below pre-crisis levels in 2021 with a forecast 13.4 million units after 15.8 million in 2019.

Germany has been shrinking as a production location for years. It is not only the automotive industry that is relocating production facilities, i.e. jobs, abroad; the chemical and electrical industries are also turning their backs on Germany. The coronavirus pandemic has revealed the structural deficits as if through a magnifying glass. These range from horrendous energy costs and inadequate digitalization to a school system in need of improvement. Political demands that have not been thought through to the end, such as a hasty ban on combustion engines, will not save the global climate, but will weaken Germany and Europe as a business location and destroy jobs.

In the midst of the worst crisis since the Second World War, we should realize that prosperity, secure jobs and social peace cannot be taken for granted. Success is only rented and the rent is due every day! I wish you a happy start to spring.

Best regards to you

Yours, Hans-Joachim Friedrichkeit