China, the world's largest automotive market, continues to grow. According to statistics from the China Association of Automobile Manufacturers (CAAM), 13,239,000 cars were sold in the first half of 2023, an increase of 9.8% compared to the previous year. The proportion of NEVs (New Electric Vehicles) is booming at 28.3% of all vehicles sold. With 3,745,000 NEVs, this means growth of + 44.5% for the NEV market compared to the first half of 2022. For comparison: 1,396,870 passenger cars were registered in Germany, 299,500 of which were electric cars.

Definition: In China, battery electric vehicles (BEVs) are counted as NEVs, as are hybrid vehicles (PHEVs). However, the latter must have an electric range of at least 100 km, which means that almost all German hybrid models cannot be sold in China.

Head to head BYD and Tesla

BYD from Shenzhen sold 1.26 million electric cars including hybrids (NEVs) in the first half of the year, of which 616,810 were all-electric vehicles (BEVs). BYD's target for 2023 is to produce at least 3 million NEVs, with at least 1.9 million BEVs planned.

Tesla sold 889,000 BEVs in China in the first year, with a target of 2 million battery electric vehicles for 2023.

Volkswagen produced a total of 321,600 BEVs in the same period and sold 62,400 of them in China, which corresponds to a market share of 1.7% in China. Worryingly, VW's market share for internal combustion engines (ICE) in China in 2022 was still 19%.

Record sales in June

With sales of over 800,000 New Electric Vehicles (NEVs), the Chinese market boomed after sluggish sales at the start of the year.

- BYD: 251,685 (128,196 BEV + 123489 PHEV)

- Tesla: 93,680 (of which 19,468 exported)

- GAC Aion: 45,013

- Leap Motor: 13,209

- Neta: 12,132

- NIO: 10,707

BYD E-platform 3.0

The ATTO 3 is equipped with the innovative 'BYD E' platform 3.0(Fig. 1), which was developed exclusively for electric vehicles and is designed to offer greater safety and efficiency when driving. By integrating BYD's own 'Blade' battery into the vehicle structure, the e-platform 3.0 doubles the body rigidity. It therefore plays a crucial role in improving the body and its safety performance. Equipped with the world's first mass-produced 8-in-1 electric powertrain, which includes the motor, motor controller, transmission, charger, inverter, high-voltage distribution, vehicle controller and BMS, the overall system efficiency is up to 89%. By evolving from a distributed electronic architecture to an integrated architecture, the efficiency of the system has been significantly improved.

The hybrid market in China is booming

Fig. 1: 'BYD E' platform 3.0 with the in-house 'Blade' battery

Fig. 1: 'BYD E' platform 3.0 with the in-house 'Blade' battery

Germany in reverse gear

According to statistics from the German Association of the Automotive Industry (VDA), 1,396,870 passenger cars were registered in Germany in the first half of 2023 (+13% compared to the previous year). Of these, 70% are German brands and 30% are foreign brands.

That sounds like growth, but it is not. From January to June 2019, i.e. in the last six months before the coronavirus crisis, 1,849,000 cars were registered, i.e. registrations are currently still down -25%.

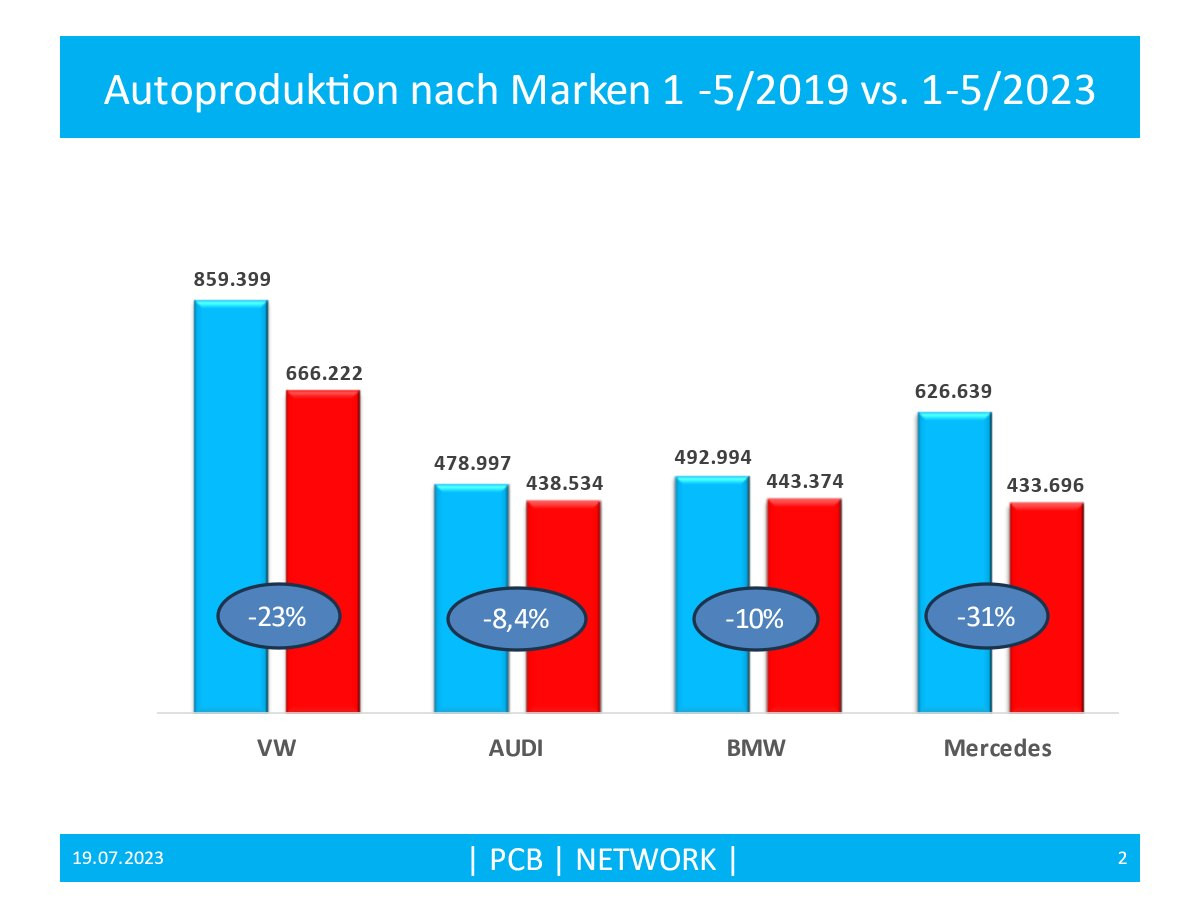

Figure 2 clearly shows the decline in total production. Volkswagen and Mercedes in particular are far behind the pre-corona figures with their production figures.

There are many reasons for this. On the one hand, the success of German models has declined, particularly in China, the world's largest market, as fewer and fewer truly new models are being offered.

Fig. 2: Car production by brand 1-5/2019 vs. 1-5/2023 (VDA data)

Fig. 2: Car production by brand 1-5/2019 vs. 1-5/2023 (VDA data)

AUDI buys electric platform in China

Do you remember AUDI's 'Vorsprung durch Technik' advertisement, in which an A8 with sensationally balanced all-wheel drive drove up a ski jump? Or the old Inuit in Alaska who showed his grandson a tire track in the snow with the respectful exclamation 'AUDI'?

'Vorsprung durch Technik' was yesterday, as AUDI is forced to buy an electric platform from the Chinese automobile giant SAIC. Audi and FAW are currently building a plant in Changchun, China, where vehicles based on the PPE platform will be produced from the end of 2024.

Another reason for the decline is that German electric cars (BEVs) do not meet the public's taste in terms of design, dashboard display and assistance systems, especially in China.

German hybrid vehicles (PHEVs) are not recognized as NEVs in China because they usually do not reach the minimum electric driving distance of 100 km. The hybrid boom there is therefore bypassing German hybrid vehicles.

German car buyers, on the other hand, are unsettled by inflation, significantly higher car prices, lower premiums for BEVs and the loss of premiums for PHEVs.

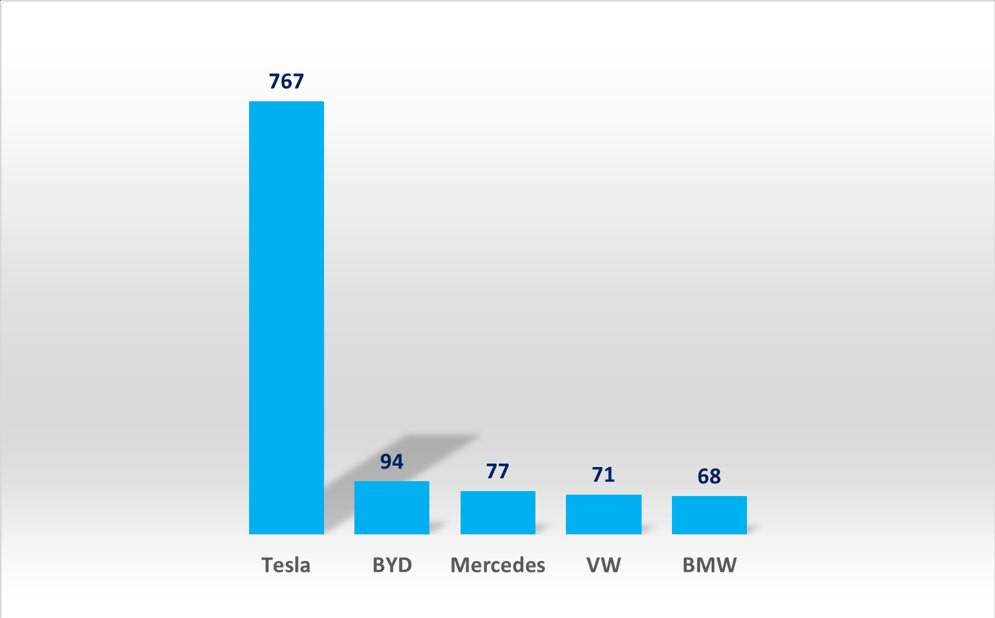

Tesla the stock market miracle

Tesla's market capitalization is more than three times that of Mercedes, VW and Audi combined. A lot of further expectation is priced in here(Fig. 3).

By the end of this year, however, BYD will probably have caught up with Tesla as the market leader on the Chinese market. BYD can then be expected to take over the pool position in 2024, even if Tesla has currently gone on the offensive with price cuts.

Fig. 3: Market capitalization of Tesla, BYD, Mercedes, VW, BMW in billions of euros - as at 13.7.2023 (data: Finanzen.net)

Fig. 3: Market capitalization of Tesla, BYD, Mercedes, VW, BMW in billions of euros - as at 13.7.2023 (data: Finanzen.net)

Brought to you

- With 13.2 million vehicles in H1 2023 (+ 9.8% compared to the previous year), China is further expanding its position as the world's largest car market. By comparison, Germany 1.4 million cars.

- The boom of the New Electric Vehicle (NEV) is reflected in 3.7 million e-cars sold in China (+ 44.5% year-on-year). NEVs account for 28.3% of the total market. In comparison, Germany 299,500 (21% of the total market).

- BYD has the target of selling at least 3 million NEVs including hybrids in 2023, Tesla at least 2 million BEVs.

- With 1.4 million registered cars in the first half of 2023, Germany is -25% behind 2019.

- From 1-5/2023 versus pre-corona, the following are behind in terms of vehicles sold: Mercedes by -31%, VW by -23%, BMW by -10% and Audi by -8.4%

The only industry of global standing, the German automotive industry, is in serious trouble. What was declared as a slip-up at the beginning of the year with the German e-cars on the Chinese market is now becoming a reality, VW has been left behind and the others are not playing a role. The fact that the VW ID3 is temporarily being sold for €15,000 in China, while it costs at least €40,000 here, also shows the great need. With a current combustion engine market share of 19% in China (3.2 million VWs in 2022) compared to the current 1.7% for e-cars, this represents a massive slump. The VW plant in Emden, which is geared towards the production of BEVs, is cutting shifts and extending plant vacations.

As long as Chinese manufacturers have a booming domestic e-car market, export pressure to Europe and the USA will remain moderate. However, this will change massively in two to three years' time when well-equipped e-cars of comparable quality produced in China come up against overpriced German e-cars at attractive prices.

We are currently losing a large part of our profitable volume sales of 33%-39% (Mercedes, BMW, VW) on the Chinese market, followed by fierce cut-throat competition in Europe with Chinese manufacturers.

Without an economic policy framework with competitive energy prices, streamlined bureaucracy, competitive taxes, including through the dismantling of the welfare state, etc., we will become a 'total economic loss'. First shift reductions, then short-time working, bankruptcy, job losses and loss of prosperity for all.

Join the fight for competitive conditions.

Best regards

Yours

Hans-Joachim Friedrichkeit