The question of an occupation or blockade is not if, but when

How endangered is the world's supply of semiconductors, assembly services (EMS/ODM) PCBs, laminates etc. in the event of an occupation by the People's Republic of China?

One piece of news may have gone somewhat under the radar in the run-up to Christmas. TSMC, the world's largest semiconductor foundry, is building a second plant next to FAB 21 in Arizona(Fig. 1). Instead of the previously planned $12 billion investment for FAB 21, the figure is now up to $40 billion. The tool-in ceremony at the beginning of December was attended not only by President Biden, but also by the CEOs of Apple, Nvidia and AMD as customers for this plant. Top managers from the major suppliers Applied Materials, LAM Research, Synopsys and Arm were also present. The FAB 21 is expected to produce 20,000 to 24,000 wafers per month with 4 nm structure widths. Mass production is scheduled to start in 2024.

The second plant for 3 nm structure widths with an investment volume of US$ 28 billion is scheduled to start production by 2026.

For comparison: TSMC has capacities of 150,000 wafers per month in its large plants in Taiwan. Almost 4 million wafers are produced there each quarter.

For more details, see my article in this column 'Semiconductor industry in the USA gears up for battle over security of supply'[1].

Made in Taiwan was yesterday

The Chinese market is particularly important for Apple as a growth market(Fig. 2). In addition, Foxconn production in Shenzhen/China is the most important production site for iPhones.

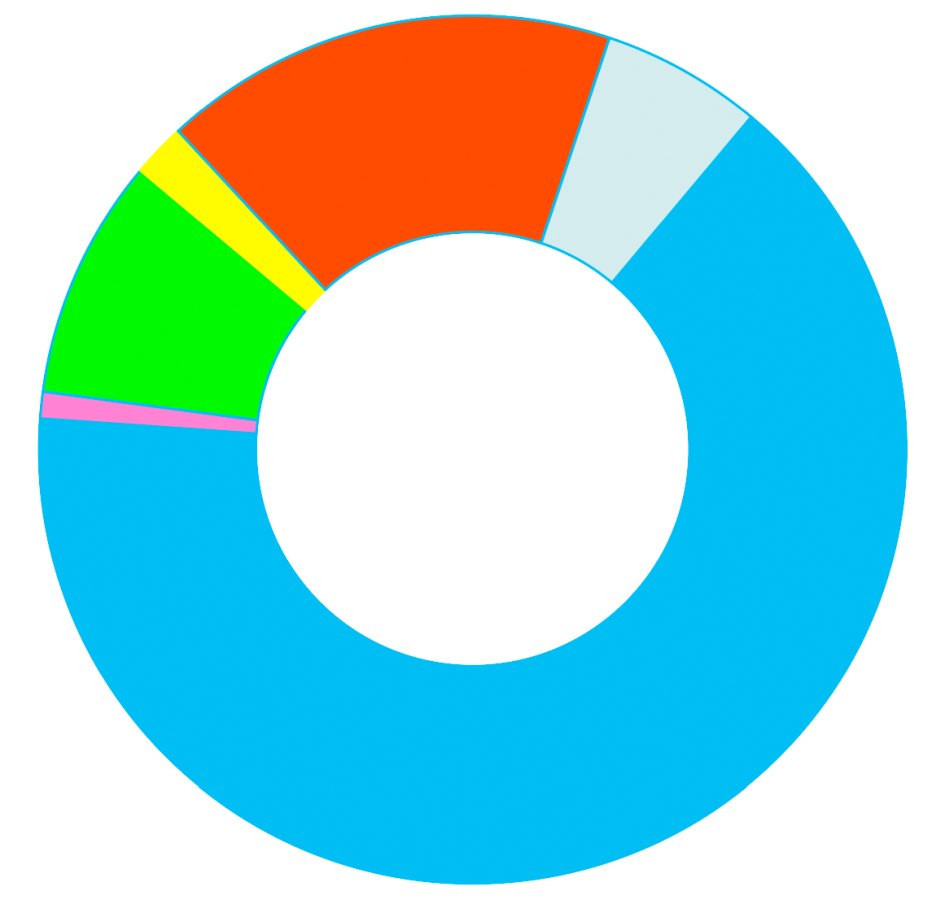

Fig. 2: Apple sales by region 2022, Greater China incl. Hong Kong and Taiwan

Fig. 2: Apple sales by region 2022, Greater China incl. Hong Kong and Taiwan

Hon Hai Precision Industry Co, Ltd, also known as Foxconn, is the 20th largest company in the world by revenue. Foxconn is the world's largest manufacturer of electronic products, the world's largest provider of electronic services, one of the world's largest employers, the largest private employer in China and China's largest exporter by volume. According to Wikipedia, the majority of smartphones, laptops, computers and games consoles sold worldwide are produced by Foxconn.

China is therefore extremely important for Apple, which ensures a corresponding level of goodwill. In 2022, Apple asked Taiwanese suppliers to refrain from using the 'Made in Taiwan' label in future. 'Made in Taiwan, China' or 'Made in Chinese, Taipei' is now politically correct.

This issue will most likely also set a precedent for other Taiwanese companies that supply to China. In this way, Taiwan is increasingly being stripped of its identity.

Semiconductor sales

In Q2 2022, the semiconductor industry generated global sales of USD 152.5 billion according to the SIA and WSTS. China was the largest customer with 32%, followed by Asia excluding China with 27%. The USA accounted for 24 %, Europe for 9 % and Japan for 8 % of semiconductor sales.

Single point of failure

A single point of failure is a component of a system that causes the entire system to fail if it fails. Accordingly, as with airplanes, three redundant systems are often installed or several suppliers are commissioned or a one-stop store that has several production sites in different regions.

With regard to Taiwan, the question of system relevance for the global economy arises.

Semiconductors

Looking at the top 10 semiconductor foundries worldwide, geopolitical risks are obvious. TSMC is the world's third largest semiconductor manufacturer after Intel and Samsung and the world's largest independent contract manufacturer for semiconductor products (foundry). With a global market share for foundries of 54%, TSMC is a technological leader, followed by UMC with a 7% market share(Table 1).

|

Company |

Market share |

Country |

|

TSMC |

54 % |

Taiwan |

|

Samsung |

17 % |

South Korea |

|

UMC |

7 % |

Taiwan |

|

GlobalFoundries |

6 % |

USA |

|

SMIC |

5 % |

China |

|

HuaHong Group |

3 % |

China |

|

PSMC |

2 % |

Taiwan |

|

VIS |

2 % |

Taiwan |

|

Tower Semiconductor |

1 % |

Israel |

|

DB HiTek |

1 % |

China |

|

Others |

6 % |

N/A |

Source: Friedrichkeit

TSMC's largest customer is Apple, followed at some distance by Nvidia, Qualcomm and, further behind, European manufacturers such as NXP and Infineon. Overall, 65% of foundries are currently concentrated in Taiwan(Fig. 3). As TSMC is also investing billions of dollars in chip packaging and is slowly mutating into an IDM, the cluster risk is becoming even greater.

Fig. 3: Semiconductor foundry sales by country in percent (data: Trendforce 12/21)

Fig. 3: Semiconductor foundry sales by country in percent (data: Trendforce 12/21)

EMS/ODM

Taiwanese service providers such as electronic manufacturing services (EMS) and original design manufacturers (ODM) also have a global market share of over 60%(Table 2). However, most of the production facilities of these Taiwanese companies are in China anyway.

|

Rank 2021 |

Company |

Country |

|

1 |

Foxconn |

Taiwan |

|

2 |

Pegatron |

Taiwan |

|

3 |

Wistron |

Taiwan |

|

4 |

Jabil |

USA |

|

5 |

Flex |

Singapore |

|

6 |

BYD Electronics |

China |

|

7 |

USI |

USA |

|

8 |

Sanmina |

USA |

|

9 |

New Kinpo Group |

Taiwan |

|

10 |

Celestica |

Canada |

Source: Friedrichkeit

Printed circuit board laminate

Laminators based in Taiwan account for around 40% of the global market for PCB laminates(Table 3).

|

Rank |

Company |

Country |

|

1 |

Kingboard |

Hong Kong |

|

2 |

Shengyi/SYTECH |

China |

|

3 |

Nan Ya Plastics |

Taiwan |

|

4 |

Panasonic |

Japan |

|

5 |

EMC |

Taiwan |

|

6 |

ITEQ |

Taiwan |

|

7 |

TUC |

Taiwan |

|

8 |

Hitachi Chemicals |

Japan |

|

9 |

Doosan |

Korea |

|

10 |

GDM |

China |

Source: Friedrichkeit

Printed circuit board manufacturers

The five Taiwanese PCB manufacturers account for over 30% of the global market(Table 4).

|

Rank |

Company |

Country |

|

1 |

ZDT |

Taiwan |

|

2 |

Unimicron |

Taiwan |

|

3 |

DSBJ |

China |

|

4 |

Nippon Metron |

Japan |

|

5 |

TTM |

USA |

|

6 |

Compeq |

Taiwan |

|

7 |

Tripod |

Taiwan |

|

8 |

Shennan Circuits |

China |

|

9 |

Ibiden |

Japan |

|

10 |

Hann Star |

Taiwan |

Source: Friedrichkeit

Brought to you

- TSMC, the world's largest semiconductor foundry with a 54% share of the global market, is building a second plant next to FAB 21 in Arizona. The total investment volume for both plants is 40 billion dollars.

- The foundry's global market share for Taiwan is 65%.

- Taiwan has a global market share of over 60% for EMS/ODMs. However, the majority of production facilities are located in mainland China.

- Taiwan's share of the global market for PCB laminates is around 40%, although the main capacities are located in China.

- The top 5 Taiwanese PCB manufacturers account for more than 30% of the global market.

Most China think tanks agree that China will gain access to Taiwan sooner or later, but most likely within the next ten years. There are many scenarios as to whether this will happen after President Biden is voted out of office, if he turns out to be a lame duck, or during the Taiwanese presidential elections in 2024 or at a later date.

Only the rulers in Beijing know whether there will be a bloody occupation or isolation through an air-sea blockade - as partially practised in a maneuver a few months ago.

The fact is that the global economy would be severely affected by the end of this decade, primarily in the semiconductor industry. This is why 29 semiconductor FABs are currently under construction worldwide, with a total capacity of 1.15 million wafers per month (based on 300 mm equivalent). To make matters worse, TSMC is not only the global market leader with 54%, but also the technology leader.

In all other segments mentioned above, such as EMS/ODM, PCB laminate and printed circuit boards, the vast majority of Taiwanese companies' capacities are in mainland China anyway and, in the event of a blockade, outside their own access.

Let us adapt to this situation as far as possible. But if we believe in childish naivety that we can impress China with sanctions and lecturing in the event of a conflict, we will gamble away the rest of our once proud industrial nation.

We were once world soccer champions, we were world export champions, we were technology leaders, we were ...

Let's wish for a more peaceful world in Europe in the new year and no giga-conflict in the Far East

Best regards

Yours

Hans-Joachim Friedrichkeit

Contact us at

References

[1] PLUS 4/2022