Much has been written and speculated about the chip crisis, especially in the automotive industry - but what are the actual facts?

First of all, there is also a pecking order in the semiconductor industry with tier 1, tier 2 and tier 3 countries, industries and suppliers. This results in priorities for development budgets, production priorities and ultimately supply. The supply chain problem starts with a lack of foundry capacity and extends to a shortage of substrates(Fig. 1) for packaging.

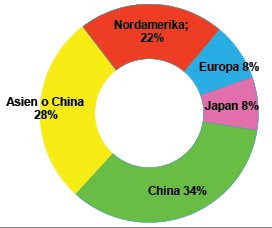

Fig. 2: Semiconductor sales worldwide by country in percent, as of November 2021

Fig. 2: Semiconductor sales worldwide by country in percent, as of November 2021

Fig. 3: Semiconductor demand worldwide by industry in percent

Fig. 3: Semiconductor demand worldwide by industry in percent

Let's start top-down with figures from the Semiconductor Industry Association (SIA): at the end of last year, 2/3 of semiconductor sales went to customers in China and Asia, 22% to North America and only 8% each to Europe and Japan(Fig. 2).

Automotive industry in last place

A similar picture emerges when looking at semiconductor demand by industry worldwide: The total market amounted to around $440 billion in 2020.

2/3 of demand goes to computer manufacturers with 33% and communication manufacturers with 31%. The consumer and industrial sectors each consume 12%. In last place is the global automotive industry with 11% to date - if the military segment is neglected in the listing with 1%.

Business optimization of scarce chip capacities

It is therefore no wonder that the automotive industry was not exactly the top priority for semiconductor manufacturers when many orders were canceled in the spring of 2020 due to the coronavirus pandemic.

What's more, the automotive industry is also known for its very price-focused buyers. It is easy to understand why chip manufacturers then optimized their business management of scarce semiconductor capacities when demand increased again by leaps and bounds across all sectors worldwide.

It is no secret that the automotive industry and other sectors are optimizing their production for higher yields due to the limited availability of semiconductors. At Mercedes, for example, the new EQS and the new S-Class have a higher priority when it comes to being equipped with assistance systems. The mid-range and lower mid-range vehicles, on the other hand, will have to wait and, for the E-Class, there is even an order freeze for the current model until the end of 2022.

|

2020 |

2021 |

2022 F |

|

|

Europe |

-5,8% |

25,6% |

7,1% |

|

Americas |

21,3% |

24,6% |

10,3% |

|

Japan |

1,3% |

19,5% |

9,3% |

|

2021 = $ 553 bn |

2022F= $ 601 bn |

||

|

total |

6,8% |

25,6% |

8,8% |

According to a forecast by the World Semiconductor Trade Statistics (WSTS) from November 2021, Table 1 shows the sudden jump in demand for semiconductor growth worldwide. As mentioned above, Europe in particular is breaking all barriers here with a decline of -5.8% in 2020. This is followed by an exorbitant increase in demand of 25.6% in 2021. It is questionable how many double reservations and precautionary fear orders exist here.

Semiconductor demand in the automotive industry doubles by 2025

According to an analysis by Gartner from mid-2021, global demand for semiconductors is set to rise from USD 422 billion to USD 626 billion with a compound annual growth rate (CAGR) of 7.4% from 2019 to 2024(Table 2). The automotive industry's CAGR of 15.7 % stands out. This clearly reflects the technology shift from combustion engines to battery electric drives. However, the biggest demand drivers are the large number of new assistance systems in preparation for semi-autonomous and autonomous driving. Demand is therefore expected to almost double in absolute terms from the current USD 41 billion to USD 80 billion by 2025.

Geopolitical cluster risk for foundries

Looking at the top 10 semiconductor foundries worldwide, geopolitical risks are obvious. TSMC is the world's third-largest semiconductor manufacturer after Intel and Samsung and the world's largest independent contract manufacturer for semiconductor products (foundry). With a global market share for foundries of 54%, TSMC is a technological leader, followed by UMC with a 7% market share.

TSMC's largest customer is Apple, followed at some distance by Nvidia, Qualcomm and, further back, European manufacturers such as NXP and Infineon. Overall, 65% of foundries are currently concentrated in Taiwan. In the meantime, the US administration has become aware of the great dependence on Taiwan. Only Intel has chip development, production and packaging in the USA, and only for part of its requirements. That is why there are currently several semiconductor production plants under construction in the USA, each with an investment of around 20 billion. Germany is also hoping to be awarded the contract for a production plant.

|

Market size |

2019 Mill. US$ |

2024 F Mill. US$ |

CAGR % |

|

Smartphone |

106 |

155 |

6,7% |

|

PC |

86 |

110 |

2,6% |

|

Consumer electronics |

43 |

67 |

7,8% |

|

Automotive |

41 |

73 |

15,7% |

|

Industrial electronics |

50 |

75 |

10,2% |

|

Infrastructure (i.e. base stations) |

36 |

49 |

5,9% |

|

Server, datacenter, storage |

61 |

99 |

8,0% |

|

total |

422 |

626 |

7,4% |

Now we all know about China's massive push to take over the 'renegade province of Taiwan'. The Chinese hunger for semiconductors, especially after former President Trump's export bans, is enormous. The world-leading Taiwanese cutting-edge technology with structure widths of 2 nm and smaller would give China a huge advantage here.

China's own chip industry is to be built up with 80 billion dollars, financed by the China National IC Industry Investment Fund together with provincial funds. The goal is to achieve 70% self-sufficiency by 2025.

In a nutshell

- Global semiconductor sales were 34% in China and 28% in Asia excluding China. The USA followed with 22 %, while Europe played a minor role with 8 % demand from the global market.

- By industry, the computer segment has the largest chip demand with 33%, followed by the communication segment with 31%. The industrial and consumer sector consumes 12 %. The automotive sector currently brings up the rear with 11%.

- The automotive sector still had a chip demand of USD 41 billion in 2019 and is expected to double to USD 80 billion by 2025F. This corresponds to a growth rate of 15.7 % CAGR.

The shortage of semiconductors will continue for a few more years. Firstly, demand in the automotive industry is increasing rapidly due to new assistance systems, which will soon also enable class 2+ and 3 semi-automated driving in mid-range and smaller cars. Let's not forget that instead of almost 90 million passenger cars being built in 2020, only 68 million were built in 2020 and 71 million in 2021.

Secondly, new technologies such as the linking of virtual reality and augmented reality in new worlds such as Metaverse require very powerful computers and components, which further increases chip requirements. Thirdly, the billions of US dollars invested in new greenfield semiconductor production plants require at least 2 ½ to 3 years before ramping up production. So a lot of patience is still required.

Despite a world that is currently difficult to predict, I wish you a strong start to the spring

Yours

Hans-Joachim Friedrichkeit