The technology war between the USA and China has been boosted by the Ukraine disaster and the new East-West conflict. The race for the chip industry has begun. The desire for security of supply and protection of technology, particularly in the defense sector, has led to a multi-billion dollar wave of investment in new semiconductor production plants in the USA(Fig. 1).

This increase in US manufacturing capacity comes at a time when the economic war between the US and China is leading to a decoupling of certain technologies, including semiconductor chips. Companies wishing to sell technology to China are considering setting up outside the US to avoid falling foul of US export control regulations. Conversely, the US government is investing huge sums of money to encourage the return of key technologies that have migrated back to the US.

Massive investments in IC fabs worldwide

There are currently 6 IC fabs under construction in the USA, which we present in more detail below. In Europe, 3 IC production plants are under construction or about to start construction. Japan and Korea each have 2 new IC plants. In Taiwan, construction started on 6 fabs in 2021 and a further 2 will begin in 2022. China is currently building 8 IC fabs. This means that 29 semiconductor production facilities are currently under construction worldwide, with a total capacity of 1.15 million wafers per month (based on 300 mm equivalent).

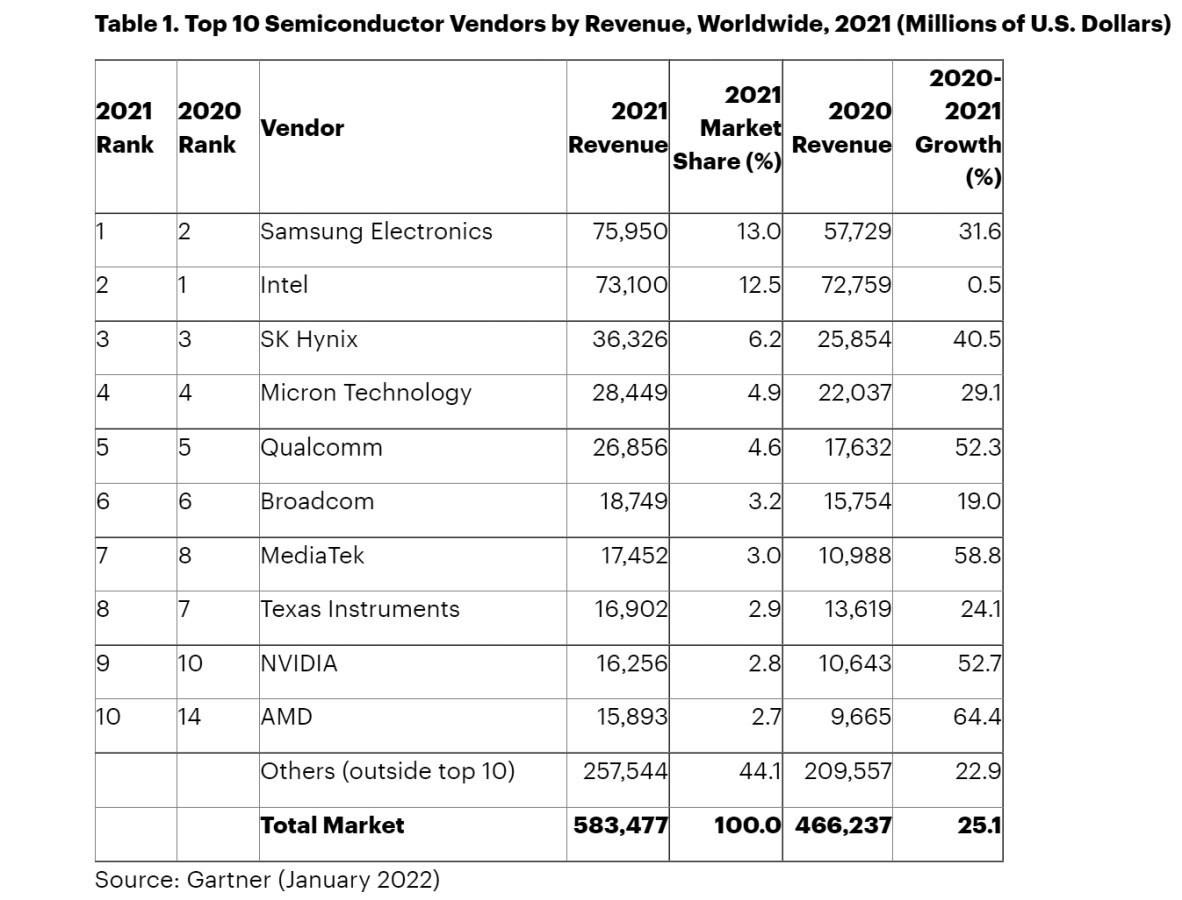

Intel lost first place among semiconductor manufacturers to Samsung Electronics Co., Ltd. in 2021 and fell to second place with growth of just 0.5% - the lowest growth rate among the top 25, as Gartner data shows(Fig. 2).

Fig. 2: Top 10 semiconductor manufacturers worldwide by turnover in million US$ 2021

Fig. 2: Top 10 semiconductor manufacturers worldwide by turnover in million US$ 2021

However, Intel has not only fallen behind in absolute sales figures. TSMC, the Taiwanese contract manufacturer, has also overtaken Intel in terms of technology. A race to catch up has begun here. These factors and the US government's realization of how vulnerable it has become by shifting large parts of chip production to Asia have led to a radical rethink in the USA.

Revenge: The Intel Arizona Project

Fig. 3: Intel's newest Fab 42 in Chandler, ArizonaInSeptember, Intel laid the foundation stone for two factories in Arizona as part of a turnaround plan(Fig. 3). The $20 billion facilities will bring the total number of Intel fabs on the campus in the Phoenix suburb of Chandler to 6.

Fig. 3: Intel's newest Fab 42 in Chandler, ArizonaInSeptember, Intel laid the foundation stone for two factories in Arizona as part of a turnaround plan(Fig. 3). The $20 billion facilities will bring the total number of Intel fabs on the campus in the Phoenix suburb of Chandler to 6.

At least one Intel plant will also become part of the Trusted Foundry program. The Trusted Foundry Program, also known as the Trusted Supplier Program, is a US Department of Defense program designed to secure the manufacturing infrastructure for information technology suppliers that provide hardware to the military.

Trusted Foundry Program of the US military

In future, the U.S. Department of Defense (DoD) will rely on Intel's semiconductor plants to produce silicon chips with structures < 5 nm. To this end, the agency is certifying at least one Intel production facility as a Trusted Foundry. The DoD checks all production steps and ensures that no espionage takes place, for example. The chips are used for military applications, for example for control and communication systems, but also in the aerospace industry.

Until now, Globalfoundries has primarily been a supplier in this area, including a semiconductor plant acquired from IBM. However, Globalfoundries has given up the race for the finest production structures and is concentrating on semiconductor structures =/> 12 nm.

As a result, the USA has launched the Rapid Assured Microelectronics Prototypes - Commercial (RAMP-C) program in the form of the National Security Technology Accelerator (NSTXL) consortium in order to have state of the art manufacturing technology at home again in the future.

Intel has announced that it will produce chips for the US Department of Defense from the so-called 18A generation onwards. According to the current schedule, this will be launched from 2025 and will be comparable to TSMC's and Samsung's 2 nm generation production technology. Intel is working together with research and development teams from IBM, Cadence and Synopsys.

The Intel Ohio project

The US government plans to spend $52 billion on the construction of new semiconductor production plants and development centers. Intel's Ohio investment is expected to attract partners and suppliers. Air Products, Applied Materials, LAM Research and Ultra Clean Technology have expressed interest in establishing a presence in the Ohio region, according to Intel.

Based on an initial $20 billion investment, Intel plans to build the world's largest chip production facility in New Albany, Ohio. By the end of the decade, further plants could be built on the campus with a total investment of 100 billion dollars, according to the Intel announcement(Fig. 4 and 5). Construction of the first two factories is scheduled to begin at the end of 2022 and production is expected to start there in 2025.

For Intel, the business as a trusted foundry is lucrative thanks to subsidies. In addition to the RAMP-C program, the DoD has already selected Intel as a packaging partner within the State-of-the-Art Heterogeneous Integration Prototype (SHIP) program in 2020. Intel therefore not only produces the chips, but is also active in packaging.

The only program in which Intel is not yet involved is the RAMP program. In this program, the Ministry of Defence is looking for partner companies to design processors and other semiconductor components.

IBM tests 2-nanometer chips

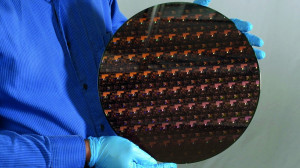

Fig. 6: IBM tests 2-nanometer chips in its research department IBM's research department has produced the first semiconductor component with structure widths of 2 nanometers on a pilot system, i.e. technology of the next but one generation(Fig. 6). 5 nm chips are currently in series production, followed by the 3 nm generation. It will be several years before 2 nm chips go into series production.

Fig. 6: IBM tests 2-nanometer chips in its research department IBM's research department has produced the first semiconductor component with structure widths of 2 nanometers on a pilot system, i.e. technology of the next but one generation(Fig. 6). 5 nm chips are currently in series production, followed by the 3 nm generation. It will be several years before 2 nm chips go into series production.

The graphics chips and x86 processors from AMD and Intel have so far been manufactured using 7 nm technology at best, such as AMD's Ryzen 5000 CPUs at chip contract manufacturer TSMC. However, the latter also already produces 5 nm chips such as Apple A14 and M1 as well as Qualcomm Snapdragon 888. According to IBM's announcement, 2 nm transistor structures will deliver 45 % more performance than the best 7 nm transistor structures with the same power consumption and require a remarkable 75 % less energy for the same performance.

Incidentally, it is not only Intel that is increasing its investments in the USA. Competitors Samsung Electronics and Taiwan Semiconductor Manufacturing Co (TSMC) also have major investment plans there.

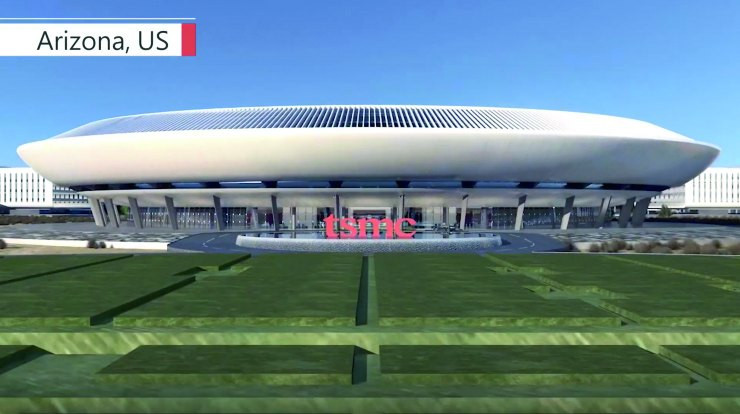

The TSMC Arizona project

Taiwan Semiconductor Manufacturing Corporation (TSMC) is investing USD 12 billion in its first chip production facility in the USA(Fig. 7). An expansion by a factor of 5 is already planned by 2029, which could increase the investment sum to USD 35 billion. From 2024, 5 nm process nodes will be produced here and initially 20,000 wafers per month will be manufactured.

Fig. 7: TSMC's new chip plant in Arizona

Fig. 7: TSMC's new chip plant in Arizona

The Samsung Texas project

Samsung, currently the world's largest chip manufacturer, is expanding its Taylor site near Austin, Texas. The aim here is to produce chips with structure widths of 3 nm. The total investment is 17 billion dollars(Fig. 8).

Fig. 8: The Samsung site in Taylor near Austin, Texas is to be expanded into a 3 nm chip factory at a cost of $17 billion

Fig. 8: The Samsung site in Taylor near Austin, Texas is to be expanded into a 3 nm chip factory at a cost of $17 billion

The ground-breaking ceremony for the site is scheduled for this year and chip production is planned to start in 2024. Samsung is expected to use the new plant to manufacture processors for its own needs and for use in other companies' products.

However, the South Korean giant in the production of memory chips will probably use the plant in Taylor to manufacture chips for other companies as well. Samsung has already manufactured chips for Qualcomm and Nvidia.

Like the other investments mentioned, this expansion is taking place against the backdrop of the global shortage of semiconductors. In response, the Biden administration is seeking to bolster chip production in the U.S. to reduce the risk of supply chain disruption and reverse the country's declining share of manufacturing in recent decades. The Senate recently approved $52 billion in subsidies for new chip factories.

But the issue is not limited to the US, it shows the global trend: TSMC has announced plans to invest over $100 billion in new chip fabs over the next three years and Intel plans to spend a similar amount on investment in the US and Europe over the next ten years - German and French sites are well known (see below).

In a nutshell

- The global semiconductor market grew by 25.1% from 2020 to 2021. The market volume amounted to $ 466 billion in 2020 and $ 584 billion in 2021.

- There are currently 29 semiconductor production facilities under construction worldwide, with a total capacity of 1.15 million wafers per month (based on 300 mm equivalent).

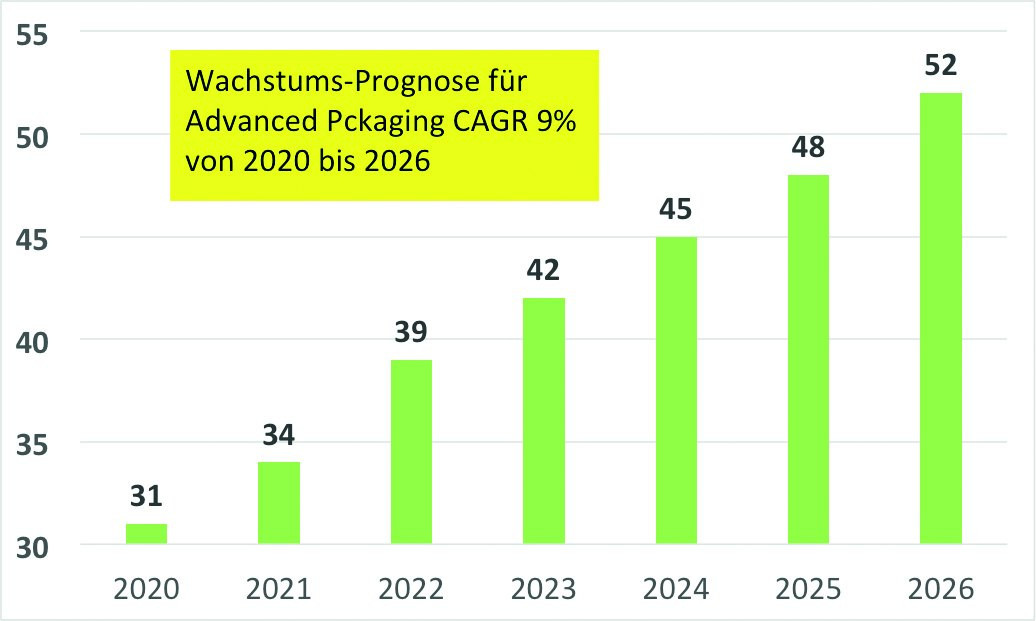

- According to the Yole Market Monitor, the advanced packaging market from SIP to 2.5D/3D to FO is expected to grow from the current USD 31 billion to USD 52 billion from 2020 to 2026(Fig. 9)

- The top 7 manufacturers invested a total of USD 11.9 billion in high performance packaging in 2021, led by Intel with USD 3.5 billion, TSMC with USD 3 billion and ASE with USD 2 billion

Fig. 9: Sales forecast 2020-2026 in billions of US$ Advanced Packaging Market worldwide

Fig. 9: Sales forecast 2020-2026 in billions of US$ Advanced Packaging Market worldwide

The economic war for global economic leadership between the USA and China has been boosted by the Ukraine disaster and the new East-West conflict. The race for the chip industry as a substantial technology has begun. The desire for security of supply and protection of the technology, particularly in the defense sector, has led to a wave of investment in the double-digit billion dollar range in new semiconductor production plants in the USA. This includes billions of dollars of additional investment outside of China. Intel's 17 billion investment in Magdeburg, which is expected to create up to 10,000 new jobs, including the surrounding area, is a positive example for the German electronics industry. Congratulations to the people and the state government of Saxony-Anhalt.

I wish you a confident start to the second quarter.

into the 2nd quarter.

Yours

Hans-Joachim Friedrichkeit

contact

F