The global smartphone market is becoming less attractive for PCB manufacturers. In contrast, the PCB demand for electromobility is competitive and challenging. In his article, which is based on his presentation for the 16th Technical Snapshot webinar of the EIPC on March 23, the author presents findings from current market observation.

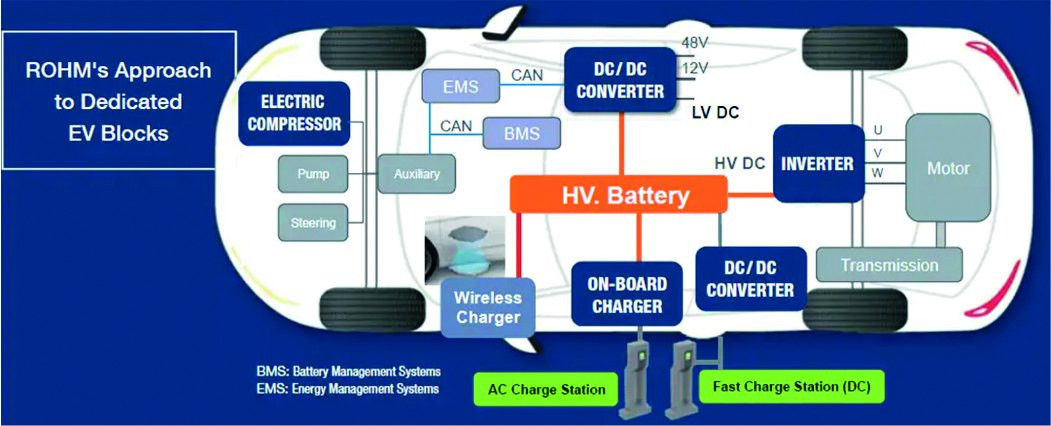

Although the smartphone market recorded quite respectable growth of 7% in 2021 compared to the previous year, it is now clearly falling back to pre-Covid levels of around 2% annual growth. This is despite the fact that 5G-enabled devices are expected to account for more than half of all smartphones sold in 2022. From 2024, the current IDC forecast expects 5G to account for around two thirds of all devices sold(Fig. 1). IDC remains rather cautious with its forecast overall.

Fig. 1: Cautiously estimated global sales development for smartphones by technology generation

Fig. 1: Cautiously estimated global sales development for smartphones by technology generation

The ranking of the top five in the smartphone market lists Apple ahead of Samsung, Xiaomi, OPPO and vivo in terms of sales - and if you look at the market in terms of the number of devices sold, only the top is reversed: Samsung sold 272 million devices, Apple just under 236 million(Tab. 1 and 2).

|

Company |

4Q21 Shipment Volumes |

4Q21 Market Share |

4Q20 Shipment Volumes |

4Q20 Market Share |

Year-Over-Year Change |

|

1. apple |

84,9 |

23,40% |

87,5 |

23,40% |

-2,90% |

|

2. samsung |

68,9 |

19,00% |

63,7 |

17,00% |

8,10% |

|

3. xiaomi |

45 |

12,40% |

43,3 |

11,60% |

3,90% |

|

4. OPPO |

30,1 |

8,30% |

33,8 |

9,00% |

-11,10% |

|

5. vivo |

28,3 |

7,80% |

31,8 |

8,50% |

-10,90% |

|

Others |

105,2 |

29,00% |

114,2 |

30,50% |

-7,80% |

|

Total |

362,4 |

100,00% |

374,3 |

100,00% |

-3,20% |

From the perspective of some PCB manufacturers, the smartphone market is becoming increasingly less attractive in view of this situation. This has an impact on the structure of HDI PCB production capacities, which is reflected in two opposing trends.

On the one hand, the South Korean manufacturers IG Innotek, SEMCO and Isu-Peatsys have stopped producing HDI boards altogether. Daeduck Electronics' HDI production continues to shrink. Ibiden Beijing is up for sale. Ibiden Malaysia no longer produces HDI boards.

AT&S does not appear to be investing significant resources in expanding capacity at its two major HDI plants in China, but is spending billions of dollars on IC packaging substrates. TTM Technologies, once a major supplier of HDI printed circuit boards for iPhones, has sold its two most important plants in China to the Chinese manufacturer AKM Meadville Technology.

|

Company |

2021 Shipment volumes |

2021 Market share |

2020 Shipment Volumes |

2020 Market Share |

Year-Over-Year Change |

|

1. samsung |

272,0 |

20,10% |

256,6 |

20,00% |

6,00% |

|

2. apple |

235,7 |

17,40% |

203,4 |

15,90% |

15,90% |

|

3. xiaomi |

191,0 |

14,10% |

147,8 |

11,50% |

29,30% |

|

4. OPPO |

133,5 |

9,90% |

111,2 |

8,70% |

20,10% |

|

5. vivo |

128,3 |

9,50% |

111,7 |

8,70% |

14,80% |

|

Others |

394,3 |

29,10% |

450,5 |

35,20% |

-12,50% |

|

Total |

1354,8 |

100,00% |

1281,2 |

100,00% |

5,70% |

On the other hand, we are seeing the opposite trend among Taiwanese companies such as Compeq, Unimicron, Zhen Ding Tech and others. They are continuing to expand their HDI capacities. And Chinese manufacturers of HDI printed circuit boards are also expanding their production capacities. In China, HDI and IC packaging substrate are currently two equally important buzzwords. Overall, these observations lead to the conclusion that HDI PCBs are becoming a 'me-too' product. They are under pressure in markets that are barely growing in some cases, which makes it necessary to adapt production structures.

Current growth in the PC market

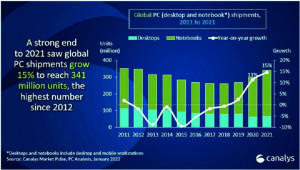

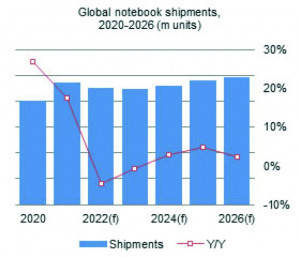

In contrast to smartphones, there still appears to be considerable growth in the PC market, particularly in the notebook segment. However, this market stagnated and even shrank in some cases before the pandemic and its impact on working behavior turned it around significantly - at least for 2021 as a whole, even though the 4th quarter of last year closed at -5% according to Gartner figures. The positive trend is likely to continue for the next 2 to 3 years, with market research institutes estimating the level differently(Fig. 3 and 4)

Fig. 3+4: The PC market, which barely grew in 2017 and 2018, experienced a strong boost due to the pandemic (top). This will slow down again somewhat

The global tablet market is behaving similarly to smartphones, while the market for wearables - i.e. smart watches and other additions/extensions/substitutes, especially for smartphones - is performing quite well. All in all, however, it is already clear that these products are no longer experiencing major market growth.

The situation is completely different in the electromobility market - and the major players in the above-mentioned markets see this. EVs as a component and message of the regular presentation events of Apple or Foxconn or the Sony-Honda cooperation clearly show that they are reacting to this.

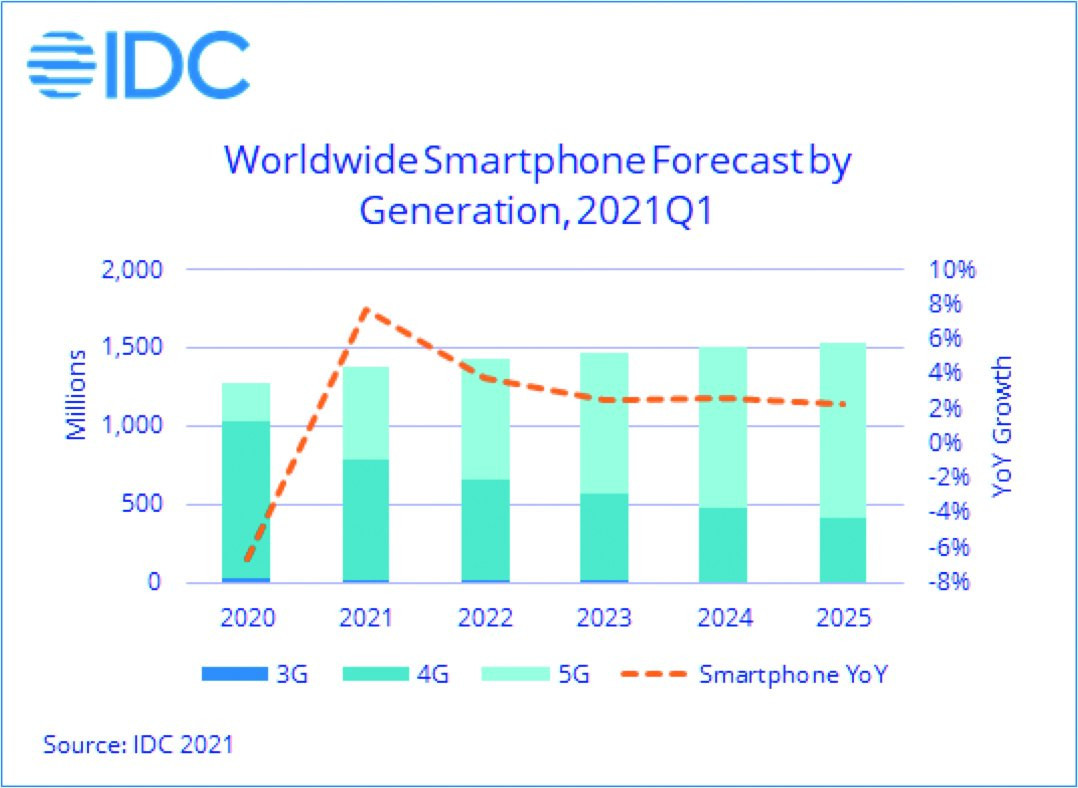

With estimated annual sales totaling around 83 million vehicles for 2021, the automotive market as a whole is stagnating. However, an increasingly strong EV wave is building up in this market(Fig. 5): 6,495,388 electric cars (BEVs and plug-in hybrids) were sold worldwide in 2021. That was 8% of total car sales for the year and 108% more in the EV sector than in the previous year. Looking at sales for January and February 2022, there will be a similar increase from 2021 to 2022. The top 5 in the industry have a total share of 51.3% of these sales - in detail (the resulting percentage market share is shown in brackets) Tesla 936,173 (14.4%), VW 757,994 (11.7%), SAIC incl. SAIC-GM-Wuling 683,086 (10.5%), BYD 593,878 (9.1%) and Stellantis 360,953 (5.6%). In Europe, just under 2.3 million EVs were sold last year - 19% of total car sales; of these, 681,410 EV units went to Germany, which accounted for 26% of the total car market there, and in Norway, where 152,000 EVs were sold last year, they achieved a market share of 86%.

Fig. 5: While the overall automotive market is stagnating, a strong EV wave is clearly building up

Fig. 5: While the overall automotive market is stagnating, a strong EV wave is clearly building up

The rapid upward trend in the electromobility market is also experiencing headwinds.

Rising prices for lithium carbonate - from $7900/t in Q1 2021Q1 to $78,000/t in Q1 2022, which is almost a tenfold increase in just one year [2].

Increasing nickel shortages and high nickel prices are having a major impact on high-end batteries, as nickel and/or cobalt are used as cathodes; on February 25, 2022, the price shot up by $24,000 to $100,000/t, largely due to the Russian invasion attempt into Ukraine launched the day before and the subsequent sanctions imposed on Russia. Russia is an important supplier of nickel. The nickel price had fallen back to $80,000/t on March 8, 2022.

China is scrapping subsidies for the purchase of electric cars at the end of 2022. However, this could lead to an increase in the sale of electric vehicles (NEVs in China) later in the year, as buyers want to make use of the remaining subsidy period. And even beyond that, it can be assumed that sales of electric vehicles in China will continue to grow despite the negative factors.

Automotive PCB driver

A relatively large proportion of PCBs required for electromobility differ little from those used in conventional cars with internal combustion engines (ICEs). ICEs and EVs have information systems in common, which are important for Ethernet communication. In addition, there are sensors for monitoring, safety and assistance functions, which can number up to 300 per vehicle. These range from the simple (rain sensor, tire pressure sensor) to slightly more complex (camera, radar, LiDAR, etc.) and extend to ADAS functionalities (automatic parking assistance, accident avoidance, lane change warning and all other 'amenities' and 'safety features'). Ultimately, these functions will be combined to enable autonomous driving, although it will be a long time before 'perfect autonomous level 5' is reached.

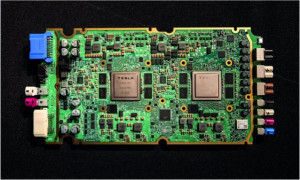

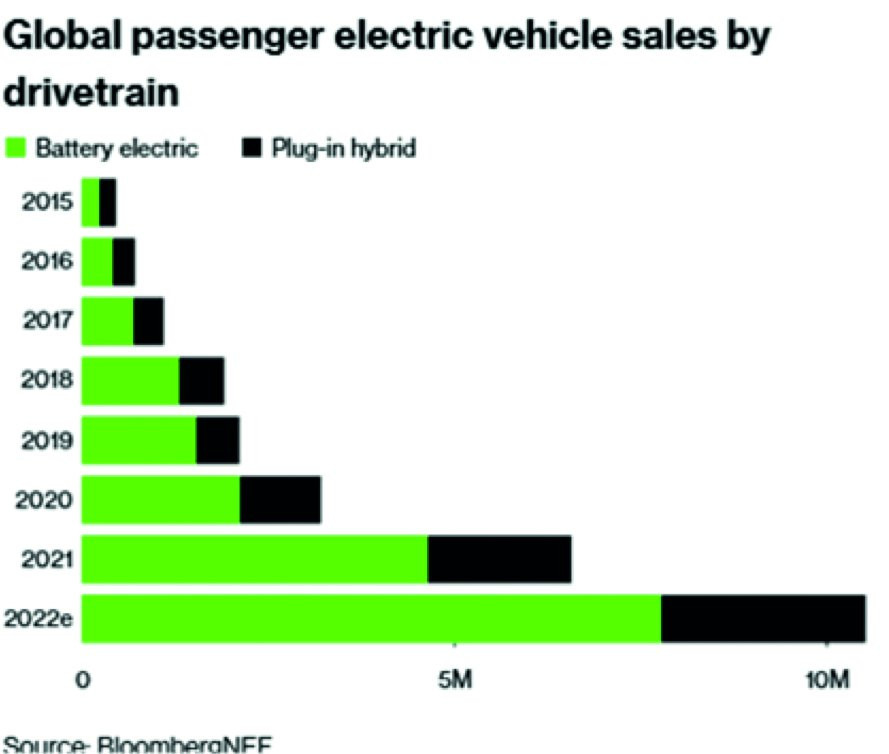

Fig. 6: Some examples of PCBs and assemblies used in the Tesla Model 3

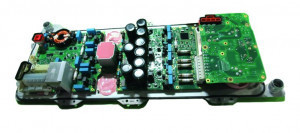

Nevertheless, the total demand for PCBs for EVs is generally 2 to 3 times higher than for ICE vehicles. And in addition to the above-mentioned PCBs and assemblies used jointly by EVs and ICEs, this also includes completely different PCBs and assemblies - especially those required for power electronics applications. These include in particular those for controlling and monitoring the power circuits, the chargers, the battery management system (BMS) and recuperation with their AC-DC, DC-DC and DC-AC inverters. These must operate safely and economically with low losses and be lightweight and compact. This acts as a strong technological driver for combined logic and power applications(Fig. 6). Added to this is the trend towards mechatronic integration(Fig. 7 and 8).

Fig. 7 and 8: In EVs, assemblies and functions are experiencing increasing mechatronic integration

Intel's not-so-new assumption that electronics will account for around 50% of the value of a car by 2030, 20% of which will be semiconductor chips, may already be reached ahead of schedule. In this context, the current global investment plans for chip fabs and foundries should be viewed from a completely different perspective to that of Hans-Joachim Friedrichkeit in his article in this issue of PLUS (p. 479). For the PCB industry, however, this means that the next boom will take place in the area of substrates for IC packaging. The behavior of AT&S and many others mentioned at the beginning of this article indicates that the industry is already working intensively towards this. transl &dir/vti-

References and comments

[1] https://www.vanarama.com/car-interiors-created-by-tech-giants/#the_apple_car_exterior

[2] DigiTimes from March 9, 2022(www.digitimes.com)