Although the coronavirus pandemic, which has lasted more than two years, has led to disrupted supply chains worldwide, it has not 'prevented' further growth in the PCB industry in 2021. This is confirmed by the first interim statistical results of the national trade associations. One significant side effect is a rethink of the purpose and security of global supply chains that have emerged through extensive outsourcing across continents.

To start with this side effect: in the developed industrialized countries of the world such as Japan, the USA and Germany, there has been a return to strengthening their own manufacturing base. The result is growing sales figures for PCBs produced domestically. This process of 'homesourcing' is likely to continue in the coming years.

Otherwise: For many years, the author's method of information gathering was based on direct personal contact, but two years of non-travel would have dried up his information - if the Internet had not enabled him to work diligently every day to gather information in this 'alternative way'. In fact, a lot of it has accumulated, but it changes from day to day.

As this post was nearing completion, there was only one week left until the end of 2021 and the author was thoroughly fed up with working from home. He plans to resume traveling in January 2022, but many countries have continued to close their doors to travelers due to the sudden and rapid spread of the Omikron variant of Covid-19. They require two weeks of quarantine if you still want to enter, which the author is not comfortable with. There will certainly be other new virus variants in the future.

This report primarily uses information that is relevant to understanding the status and development of the international and national PCB industries during the coronavirus period, which has now lasted more than two years. This information provides indirect, sometimes even direct, explanations for the situation that has also arisen in the European and German electronics industry.

A more detailed study will follow in 2022. A preliminary note on some of the following tables provided by the national PCB industry associations: they are retained here in their original form, as the company names, for example, are also inserted in the national language for greater accuracy.

Taiwan

PCB sales continue to rise significantly in 2021

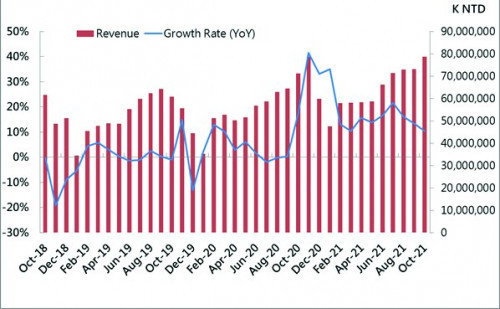

The review of 2021 will begin with Taiwan. The focus will initially be on material and board producers. It should be noted that these companies generate their revenue both in domestic factories and in foreign production facilities, primarily in China. Figure 1 shows that the turnover of PCB manufacturers also fluctuated considerably from month to month in the years 2018 to 2021, as did the annual growth rates (YoY, year-on-year). However, the chart shows significant growth for 2021 compared to 2019 and 2020, despite the coronavirus problem. It can be seen that Taiwan's PCB production ran in a 'perfect' cycle. For example, according to Figure 1, the country's major board manufacturers generated around $2.87 billion in October 2021 (based on an exchange rate of USD 1 = TWD 27.84).

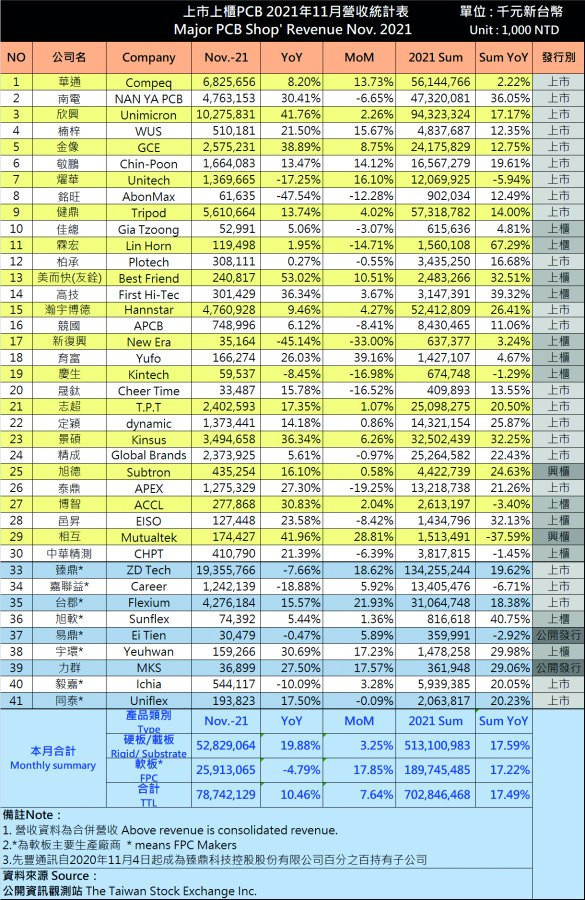

Tab. 1: Revenue development of selected large and medium-sized PCB manufacturers in Taiwan for November 2021 and 2021/2020 in thousands of TWD

Tab. 1: Revenue development of selected large and medium-sized PCB manufacturers in Taiwan for November 2021 and 2021/2020 in thousands of TWD

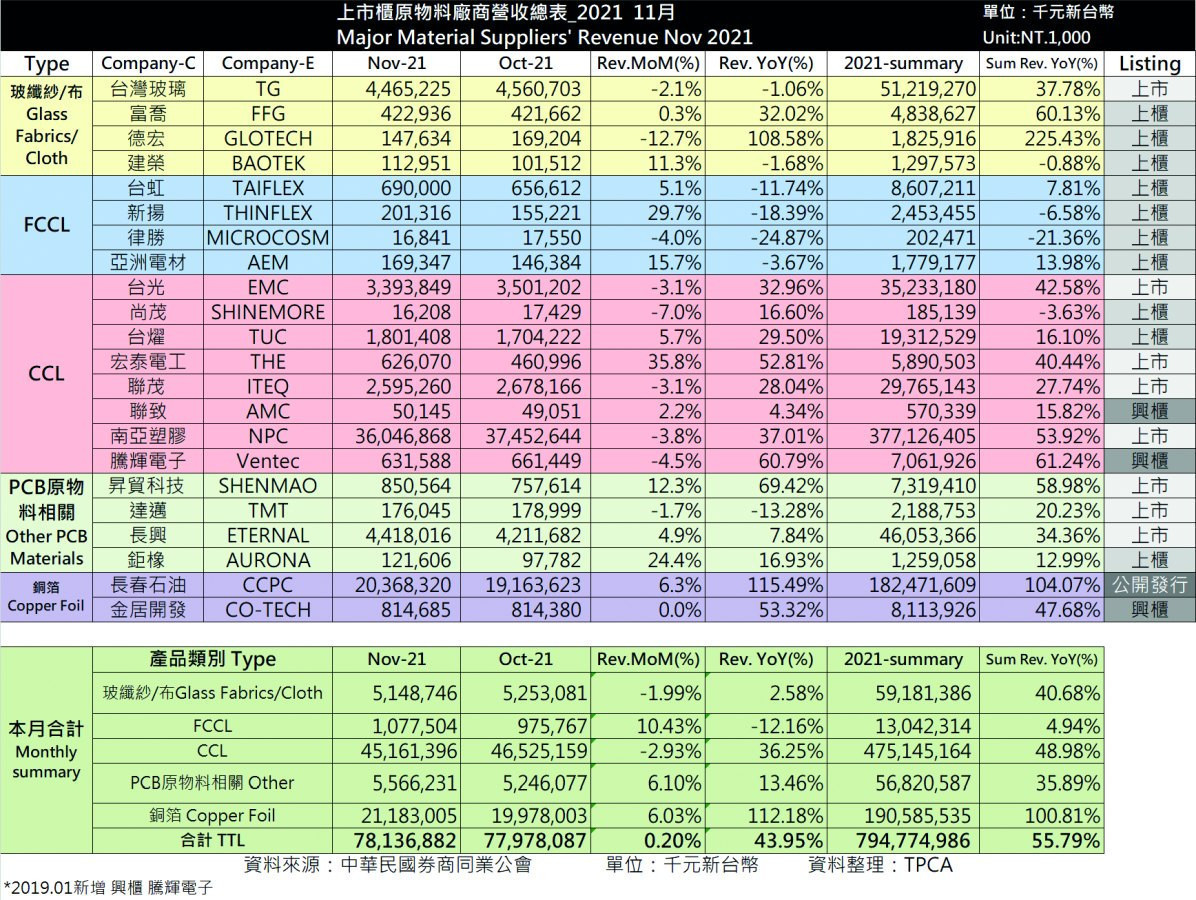

Tab. 2: Revenue development of selected large material suppliers in Taiwan for October/November 2021 and 2021/2020 in TWD thousand

Tab. 2: Revenue development of selected large material suppliers in Taiwan for October/November 2021 and 2021/2020 in TWD thousand

If the cumulative values are broken down into individual board producers(Table 1), a differentiated picture also emerges. Although many of the 41 manufacturers listed show declines in month-on-month (MoM) sales for November 2021, the cumulative sales increases compared to the previous month are still well into positive territory. Looking at the 2021/2020 YoY summary values, the picture also varies by company, but the high growth rates of large companies such as NAN YA PCB (36.05%), Chin-Poon (19.61%), Hann Star (26.41%), Kinsus (32.25%), Tripod (14%), etc. are quite astonishing. It is reported that Apple suppliers such as ZD Tech, Flexium and Compeq expected good results for December 2021 in addition to November. The same applies to the automotive PCB suppliers Chin Poon and Tripod listed above. They are doing well. The 17% YoY summary growth rates by PCB type in Table 2 apply to all board types.

Material producers benefit from the upward trend

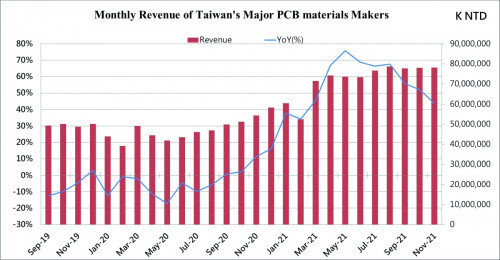

The upward trend in the national PCB industry has also brought Taiwanese material suppliers significant sales growth in 2021 compared to 2020(Fig. 2). However, growth slowed somewhat in August 2021.

If we look at the development of sales of important suppliers of glass fabric, copper clad laminate for rigid and flex PCBs (CCL and FCCL), copper foil and other PCB materials in Table 2, there is a wide range of growth rates for most companies in the overall YoY comparison 2021/2020. They range from around 7% to 100%. TG, for example, was able to increase its turnover in glass fabrics by almost 38%, FFG by 60% and Glotech by as much as 225%. Considering the huge differences in the production volumes of the three companies, TG is all the more significant.

The picture is mixed for manufacturers of copper clad laminate for flex printed circuit boards, with both increases and decreases in turnover. Stable growth in the range of 15% to 61% was recorded for copper clad laminate for rigid PCBs. The increases in sales of copper foil by CCPC (104.07%) and CO-Tech (47.68%) are particularly noteworthy. CCPC is part of the Chang Chun Group and has been producing copper foils for all quality classes and types of printed circuit boards since 1987. CCPC's entry into the supplier market for battery production for electric cars offers lucrative opportunities to increase production, which could potentially have a negative impact on the security of supply for traditional printed circuit boards in the electronics industry.

Strong increase in mechanical engineering

2021 was also a successful year for Taiwanese manufacturers of PCB production equipment. Figure 3 shows that although sales increased significantly in 2021 compared to 2020, machine sales did not synchronize with PCB sales.

Table 3: Sales development of selected major Taiwanese machinery manufacturers for October/November 2021 and 2021/2020 in thousands of TWD

Table 3: Sales development of selected major Taiwanese machinery manufacturers for October/November 2021 and 2021/2020 in thousands of TWD

Table 3 contains information on the sales development of 26 companies that manufacture machines for PCB production. With a few exceptions, they also show double-digit increases in turnover for 2021 compared to 2020.

Growth through modernization and capacity expansions

It is interesting to note that the more or less significant increases in turnover in PCB production were mainly generated by investments in capacity expansions and modernization of existing factories, but also by reprofiling production. In other words, the corona period was used in many places to realize performance increases, which obviously benefited companies in their own country or in Asia in general. Here are a few examples to illustrate this.

- The manufacturers of IC PKG substrates Unimicron, Nanya PCB and Kinsus have expanded their production capacities - Unimicron rebuilt its IC PKG substrate plant that caught fire in 2020 and built a new plant in Yang Mei, Taiwan, with the help of Intel (investment of one billion US dollars). In addition, Unimicron expanded capacity at its IC PKG plants in Suzhou (China) and Hsinchu (Taiwan) - Nanya PCB upgraded its plants in Shulin (Taiwan) and Kunshan (China), which now produce ABF-based (Ajinomoto Buildup Film) PKG substrates - Kinsus converted the FPC plant in Hsinchu into an IC PKG substrate plant and is focusing more on ABF-based substrates alongside BT at other plants in Taiwan

- Zhen Ding Tech is also aiming to increase its capacity for IC PKG substrates in China

Due to these efforts, ABF materials are in short supply. In the near future, 4 millionm2 of ABF will be needed per month. ABF is a trade name for dielectric material produced by Ajinomoto, which is now being challenged by Sekisui Chemical, Taiyo Ink, etc. Ajinomoto Buildup Film is the primary dielectric for SAP, semi-additive processes. It is a series of very thin dielectrics made with epoxy/phenolic hardener, cyanate ester/epoxy and cyanate ester with thermoset olefin and used for boards with L/S values around 25 µm.

Geopolitical tensions between Taiwan and China

China treats Taiwan as one of its own provinces 台湾省 (Taiwan Province). This results in some peculiarities. PCB-related documents published in Taiwan often use the term 両岸 or 'two sides' to refer to Taiwan and China, and refer to China as 'mainland 大陸' (mainland China). These documents often use the terms 中国台湾 or 'China Taiwan' to indicate the 'nationality' of Taiwanese companies as if it were a part of China, perhaps to avoid unduly upsetting the Chinese government's stance.

Geopolitical tensions between Taiwan and China have been at a high level for decades, involving the US, Japan and other democratic allies in the world. For Taiwan's industry, including the PCB industry, tensions are a major concern. Nevertheless, PCB manufacturers continue to invest in China. More than 60% of Taiwan's PCB production is made in China.

According to a recent survey, 85% of Taiwanese want Taiwan to remain independent because they know that the freedom they currently enjoy will eventually be gone once Taiwan officially becomes part of China, despite the Chinese government saying one country, two systems. Think of what happened in Hong Kong.

Japan

According to the IMF, inflation in the US rose to 6.8% in November 2021, compared to 4.9% in the EU. In Japan, which has been suffering from deflation since the end of 1980 and whose GDP has been oscillating like a yo-yo, it was only 0.1 %. Despite this unstable situation, the Japanese PCB industry recorded strong growth. Boards for the automotive sector and IC PKG substrates contributed to this trend. Table 4 contains the values of Japanese domestic PCB production for the months of January-September 2021, taken from the statistics of JEITA (Japan Electronics and Information Technology Industries Association). According to these statistics, boards worth around 4695 billion yen (approx. 4.2 billion US dollars at an average exchange rate of 114 yen per US dollar in 2021) were produced during this period. The growth rates compared to the same month of the previous year (YoY Growth) are interesting. They fluctuate between around 15% and 50% - despite coronavirus restrictions in Japan!

|

month |

Turnover |

Annual growth |

|

January |

423,65 |

20,57 % |

|

February |

475,04 |

15,97 % |

|

March |

530,04 |

25,20 % |

|

April |

517,77 |

25,13 % |

|

May |

476,90 |

27,86 % |

|

June |

554,00 |

38,85 % |

|

July |

572,53 |

43,53 % |

|

August |

530,16 |

49,52 % |

|

September |

614,80 |

50,14 % |

|

october |

||

|

November |

||

|

December |

||

|

total |

4694,89 |

For comparison purposes,Table 5 contains the sales figures of some leading Japanese PCB manufacturers for the months of April-September 2020 and 2021. Here, too, the YoY values are similar to those in Table 4. The average growth of the five companies in Table 5 was 34.8% within just one year, and their total production was around USD 3.9 billion. The figures in the two tables allow conclusions to be drawn as to where a considerable proportion of the laminates and other auxiliary materials for PCB production produced in Asia and Japan itself went during the two corona years. Japan is also increasingly producing PCBs in its own country.

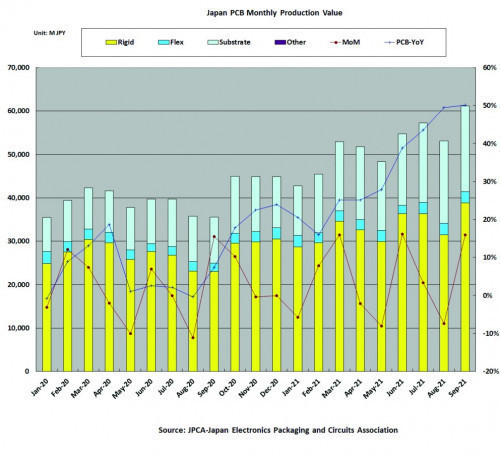

Fig. 4: Development of Japanese PCB production, broken down by month for the period from January 2020 to September 2021 and by board type (million yen)

Fig. 4: Development of Japanese PCB production, broken down by month for the period from January 2020 to September 2021 and by board type (million yen)

|

Manufacturer |

2020 |

2021 |

growth |

Core business |

|

Mektron |

1224 |

1461 |

19,3 % |

FPC |

|

Ibiden |

741 |

1153 |

56,0 % |

IC PKG Sub |

|

Shinko |

513 |

793 |

54,6 % |

IC PKG Sub |

|

Meiko |

532 |

695 |

30,5 % |

Automobile |

|

CMK |

320 |

387 |

21,0 % |

Automobile |

|

total |

3330 |

4488 |

34,8 % |

Figure 4 contains information on Japanese domestic PCB production, broken down by month for the period from January 2020 to September 2021 and by board type. While the production of flex boards remained roughly the same over the months despite slight fluctuations, there were significant increases in rigid PCBs and IC substrates. This is particularly the case from March 2021. It would be interesting to see how this trend correlates with the development of the coronavirus situation in the country and beyond.

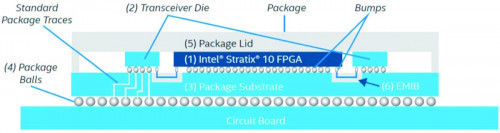

High-tech racer IC substrates

IC-PKG substrates make the largest contribution to Japanese domestic production. As can be seen in Table 5, Ibiden and Shinko Electric are currently the only two fixed suppliers of high-end FCBGA products such as Intel's EMIB package (10 + 2 + 10, 500 x 750 mm). EMIB stands for Embedded Multi-die Interconnect Bridge(Fig. 5). Numerous bridges can be integrated into a single substrate, enabling high I/Os and well-controlled electrical interconnect paths between multiple chips as required. Since the chips do not need to be connected to the package via a silicon interposer with TSVs, performance is not compromised. Intel uses micro bumps for high density signals and standard flip chip bumps with a coarser pitch for direct power and ground connections from the chip to the package.

Fig. 5: Principle example of an EMIB package from Intel (the bridge is marked with (6))

Fig. 5: Principle example of an EMIB package from Intel (the bridge is marked with (6))

Unimicron and AT&S are also trying to supply such substrates. Mass shipment of EMIB packages (Intel) and similar (for AMD etc.) is scheduled for 2022. The combined investments of Ibiden and Shinko over five years amount to more than US$ 5 billion

Reasons for domestic strength

One reason for the remarkable advancement of board producers is the high-end IC PKG substrates, which are all manufactured in Japan. About 60% of Japanese PCBs are manufactured overseas, mainly in China and Southeast Asia (SEA). In both regions, production has been reduced or even temporarily halted due to factory closures caused by the spread of Covid-19. In China, severe power shortages were added to the closures due to Covid-19. These were artificially induced in order to promote aCO2-neutral policy in China. Japanese PCB manufacturers in the country were also affected by the power shortage. In Malaysia, Thailand and Vietnam, where Japanese PCB manufacturers have many plants, factories were also frequently closed from June to October due to Covid-19, disrupting supply chains. Japanese customers could no longer afford to wait for PCBs to arrive on time from these regions. As a result, domestic production had to be increased - and as you can see, quickly and with great success.

China

Many German companies source PCBs from this country, so some information about the PCB production situation in China may be important to them. Similar to Taiwan, but less than Japan, the overall growth in PCB manufacturing from January to September 2021 for listed manufacturers was around 20%. Common to the notes in the financial reports of PCB manufacturers in both countries is a greater emphasis on PCBs for the automotive industry and IC-PKG substrates. IC-PKG substrate production in China is nowhere near Japan's Ibiden and Shinko in terms of advanced technologies, but Chinese manufacturers will eventually catch up, as they have done in the regular PCB sector.

The basic approach of China's PCB industry today is similar to that of Japan from the early 1970s to the early 1990s: first copying foreign technologies and then developing their own. This was also the approach in South Korea. One major difference, however, is the massive state subsidies in China.

The fastest growing application area for PCBs is electric vehicles (EV). It is said that there are more than 200 EV start-up projects in China, of which around 20 are already supplying EVs. Even Huawei is now in the EV business. Recently, it was announced that Huawei will deliver its first REV model in February 2022.

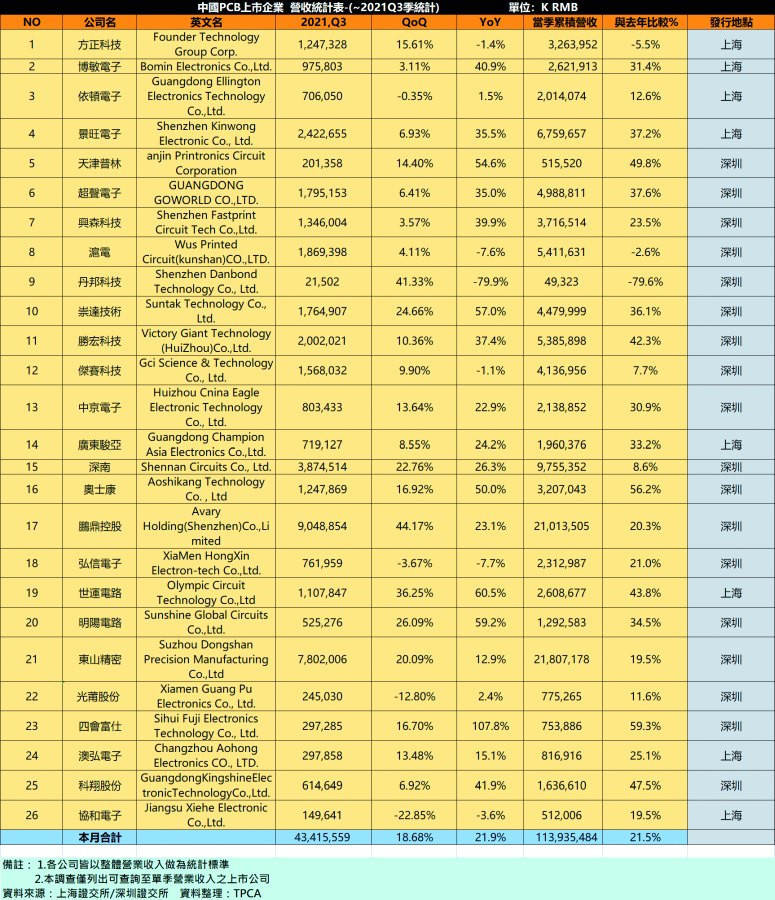

Tab. 6: Production data of 26 Chinese listed board producers in Q3 2021 and YoY result compared to 2020 (1000 RMB)

Tab. 6: Production data of 26 Chinese listed board producers in Q3 2021 and YoY result compared to 2020 (1000 RMB)

What was the situation in the Chinese electronics industry in 2021 and specifically for PCB manufacturers? How does the situation compare with Taiwan and Japan? Table 6 contains data on the production of 26 Chinese listed board producers in Q3 2021 and the YoY result compared to 2020. It was compiled by TPCA, the Taiwan Printed Circuit Association, and left here in its original form.

Large performance increases 2020/21 for printed circuit boards

The YoY column of the table shows that the vast majority of Chinese board manufacturers recorded double-digit percentage sales growth from Q3 2020 to Q3 2021. The best among them achieved values between 50% and 107%. Some of the high growth rates continued in the third quarter of 2021 with QoQ averages of almost 19%. Top growth rates are between 30 and 40%.

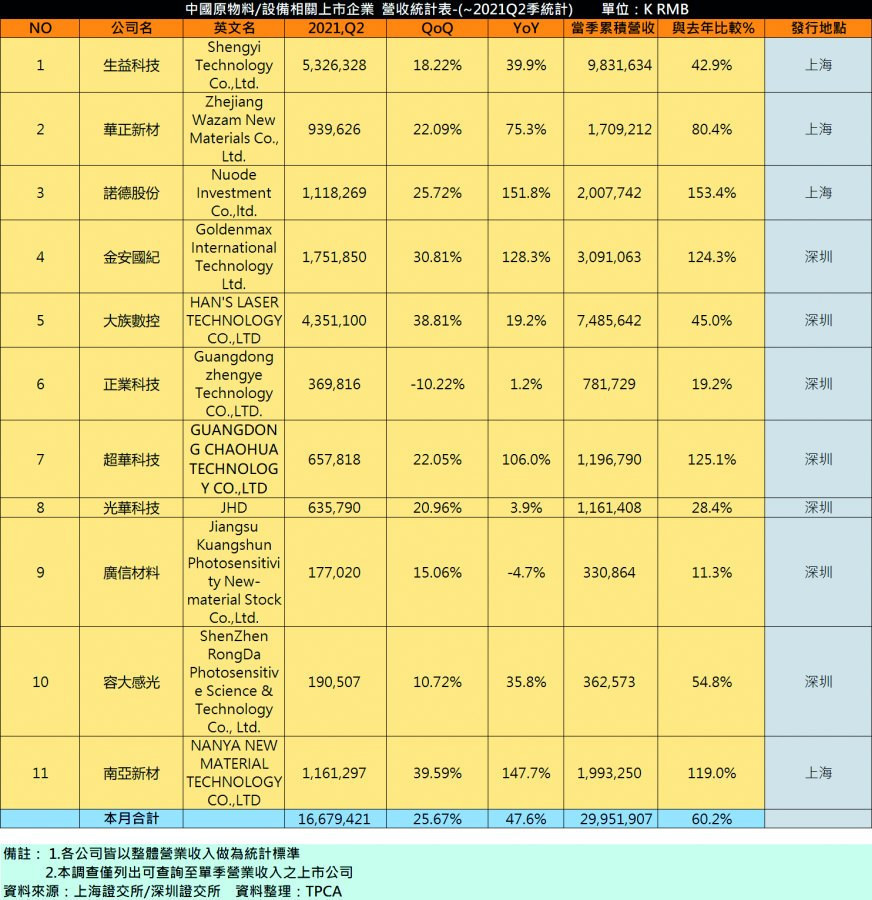

Significant increases for material and machine manufacturers

At 47.6%, the cumulative YoY figures for 2020/2021 for the 11 listed material and machine manufacturers in Table 7 are even higher than the cumulative figure for the 26 board manufacturers (21.9%) in Table 5. At 25.67%, the cumulative QoQ figures for the third quarter of 2021 are also higher than for the PCB companies. Conclusion: Although the companies listed in both tables only represent a small section of the Chinese electronics industry, at least most of the PCB and supplier companies listed here were able to visibly expand their performance and position despite the sometimes drastic coronavirus restrictions. However, the extent to which the results are more or less representative of the entire Chinese electronics industry cannot be deduced from this.

Tab. 7: Information on the production of 11 Chinese listed material and machinery manufacturers in Q3 2021 and YoY results compared to 2020 (1000 RMB)

Tab. 7: Information on the production of 11 Chinese listed material and machinery manufacturers in Q3 2021 and YoY results compared to 2020 (1000 RMB)

South Korea

As the author does not understand the Korean language and the financial reports of Korean PCB manufacturers in foreign languages are very late, he could only find a few data sets and no graphs to support them yet. For example, based on Q3 reports, Daeduck Electronics expects 20% growth in 2021, SEMCO more than 25% and Simmtech around 15.5%. Total production growth in South Korea in 2021, including the growth of South Korean plants in Vietnam, could be around 15-20%.

SEMCO's PCB sales in Q3 2021 came from rigid-flex boards for iPhone OLED displays. As Apple has switched from RFC to FPC in the 2021 models, SEMCO will discontinue the production of RFC (the company has already discontinued HDI production, which was only done at the Kunshan plant) and convert its Vietnam plant from RFC/HDI to flip-chip BGA technology. An investment of around 900 to 1000 million US dollars is planned for this.

LG Innotek withdrew from the regular PCB and HDI business two years ago and is now also concentrating on IC PKG substrates and module circuits such as SiP. The growth area of Simmtech, a major supplier of display circuits, often called optoelectronic PCBs, has also been shifted towards IC PKG substrates. Already more than 60% of Daeduck's sales come from IC PKG carriers.

These manufacturers have all given up HDI production or are about to do so. The manufacturers justified these steps to the author with the fierce price war for HDI boards, driven by Chinese competitors. LG Electronics is on the verge of exiting the smartphone business and Samsung is the only major Korean smartphone manufacturer that buys HDI boards locally. As a result, the majority of Korean HDI PCB manufacturers have lost the incentive to produce HDI carriers.

Southeast Asia

There were various coronavirus lockdowns in the SEA countries from July to mid-November, which also affected PCB plants. Major PCB manufacturers in SEA are exclusively foreign companies. Under these circumstances, it is not easy to obtain information on the Southeast Asian share of their production. The author was only able to learn from the Thai domestic board producer KCE that growth of 25 to 27% is forecast for 2021, mainly from PCBs for the automotive industry.

North America

More than 35% of the domestic production of PCBs in North America is used by the defense, aerospace and aviation industries. Defense budgets have increased due to rising geopolitical tensions worldwide. Aircraft orders are growing as air travel picks up again - at least at the end of 2021. As in the case of Japan, supply chains have been disrupted. Supplies, if available, take a long time. Delivery costs are also rising. The cost of a 40-foot container from China to Los Angeles is up to USD 12,000, five to six times more than before. Air freight costs up to 7500 US-$/kg. In light of this development, PCB users in North America are accepting higher costs for locally manufactured PCBs, which may be largely due to the strong economic performance in North America.

The IPC's Economic Update from January 2022 describes the general situation in the USA during the coronavirus period as follows

- Almost nine out of ten electronics manufacturers reported rising material costs, with another four-fifths reporting rising labor costs

- Only 13% of companies in the electronics manufacturing supply chain said that their own inventories are increasing, and one in ten said that their suppliers' inventories are increasing

- Orders, shipments and capacity utilization in the electronics supply chain are increasing, but weak inventories and higher material and labor costs are squeezing profit margins

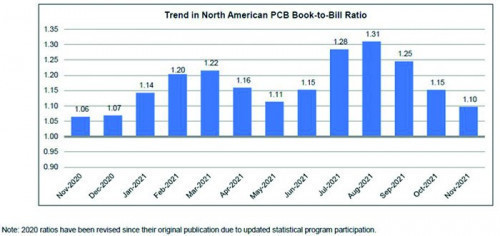

The US industry association IPC published the book-to-bill ratio for the North American (USA and Canada) board industry shown in Figure 6. The temporary increase in incoming orders from July 2021 is not yet reflected in the actual PCB business by the end of 2021(Fig. 7). Growth rates were rather moderate compared to Asia.

Fig. 6: Trend in the book-to-bill ratio of the North American PCB industry from November 2020 to November 2021

Fig. 6: Trend in the book-to-bill ratio of the North American PCB industry from November 2020 to November 2021

Fig. 7: YoY growth trends in the North American PCB business from November 2020 to November 2021

Fig. 7: YoY growth trends in the North American PCB business from November 2020 to November 2021

The development of the PCB industry in the USA is causing concern there. On January 22 of this year, the IPC published a report that was compiled as part of the IPC Thought Leaders Program(www.ipc.org/advocacy/ipc-thought-leaders-program). "The PCB manufacturing sector in the United States is in worse trouble than the semiconductor sector, and it is time for both the industry and the government to make some significant changes to address this," writes O'Neil, principal of OAA Ventures in San Jose, California. "Otherwise, the PCB sector in the U.S. could soon face extinction and jeopardize America's future. The United States has lost its historic dominance in a fundamental area of electronics technology, printed circuit boards, and the lack of significant U.S. government support for this sector is leaving the country's economy and national security dangerously dependent on foreign suppliers."

The report outlines the steps that the U.S. government and the industry itself must take if the board industry in the United States is to survive. The subtitle of the 18-page document is: Rebuilding the U.S. Electronics Supply Chain.

EU countries

A few figures should first make it clear that the EU countries and Germany are far removed from the sometimes high growth rates of PCB factories in the core Southeast Asian electronics countries presented above. According to data4pcb, there were around 1,450 PCB manufacturers in the EU region in 1985. The number decreased to 560 by 2000 and to 187 by 2019. Total production amounted to around €1,784 million in 2019 and decreased to €1513 million in 2020. Output for 2021 is expected to be on a par with 2019, i.e. it will increase moderately again.

According to data4pcb, 44% of PCBs manufactured in the EU in 2020 were used for industrial control systems, 18% for automotive electronics and 13% for the defense industry. In Germany, 54% went into industrial control systems and 28.4% into the automotive industry. Around 34% of the boards produced in France and 31% of those produced in the UK were used in the defense industry in 2020.

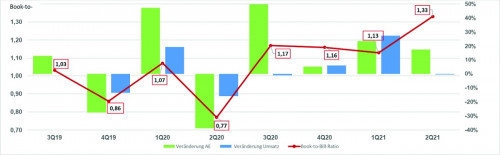

Fig. 8: Development of incoming orders, revenue and book-to-bill ratio in the DACH region from Q3 2019 to Q2 2021

Fig. 8: Development of incoming orders, revenue and book-to-bill ratio in the DACH region from Q3 2019 to Q2 2021

Germany produces around 40% of the PCBs in the EU region. The development of the book-to-bill ratio in the German-speaking DACH region for the period from Q3 2019 to Q2 2021 shown in Figure 8 is based on ZVEI data. As in North America, there were delayed deliveries and higher costs for PCBs from Asia, e.g. due to increased transportation costs. European consumers of PCBs are also tolerating more expensive PCBs manufactured in the region, as in the USA, which is boosting local production.

Special automotive sector

PCBs for the automotive sector play a special role. Total sales of new cars in the EU in 2021 fell compared to 2020 due to supply bottlenecks for semiconductors, among other things. However, sales of electric vehicles (BEV, PHEV, HEV and FCV included) in the EU were phenomenal in 2021. In Germany alone, 68,169 EVs were sold in November last year, a year-on-year growth of 15% and 34.4% of all new cars.

|

Type |

Sales 2021 |

Growth 2021 (%) |

Sales 2022 (F) |

Growth 2022 (%) |

|

Passenger car |

4,473,907 |

38.3 |

6,022,147 |

34.6 |

|

Bus |

165,551 |

18.1 |

198,353 |

19.8 |

|

Van |

86,274 |

56.1 |

126,607 |

46.8 |

|

Heavy trucks |

15,171 |

41.5 |

22,663 |

49.4 |

|

Total trucks |

4,740,903 |

37.7 |

6,369,769 |

34.4 |

Around 1,600,000 electric vehicles were sold in the EU between January and September 2021. It can be assumed that electric vehicle sales in the EU could reach a total of 2 million units in 2021. PCBs for this market are boosting EU production of printed circuit boards, but also global production. This is particularly true for the coming years. The market analysis company Gartner Inc. published the latest figures contained in Table 8 in January 2022, for example. According to this, around 4.74 million EVs of all types were sold worldwide in 2021. InsideEVs.de speculated that as many as 6 million EVs could have been sold globally in 2021. This would mean that the figures for 2022 in Table 8 would have to be significantly higher, at around 8 to 8.5 million vehicles. In any case, according to Bloomberg, around 55% of the total automotive production of 100 million units expected for 2040 could be EVs, i.e. 55 million - unless completely new, perhaps even higher figures emerge in the meantime as environmental problems continue to worsen.

NTI PCB forecast for 2021

|

Region |

2018 |

2019 |

2020 |

2021F |

|

America |

3160 |

3220 |

3200 |

3400 |

|

Germany |

940 |

841 |

743 |

915 |

|

Rest of Europe + Russia |

1330 |

1250 |

1210 |

1350 |

|

Africa + Middle East |

142 |

143 |

120 |

100 |

|

West total |

5572 |

5454 |

5273 |

5765 |

|

China |

42430 |

45420 |

49280 |

57100 |

|

Taiwan |

8140 |

7850 |

7570 |

8330 |

|

South Korea |

7415 |

7220 |

6800 |

7140 |

|

Japan |

5940 |

5830 |

5750 |

6100 |

|

Thailand |

3130 |

2810 |

2650 |

2540 |

|

Vietnam |

2700 |

2890 |

2900 |

3000 |

|

Rest of Asia |

1670 |

1590 |

1450 |

1280 |

|

Asia total |

71425 |

73610 |

76400 |

85490 |

|

World total |

76997 |

79064 |

81673 |

91255 |

This report was created in December 2021 and supplemented in January 2022. It will be some time before final figures on PCB production in the world's regions for 2021 are available. Nevertheless, the author would like to provide an initial estimate here and assumes that the global PCB market will achieve growth of 12% in 2021. The assumption is broken down by region in Table 9. In 2022, automotive PCBs for EV and IC-PKG substrates will be the fastest growing product segment in the PCB industry. This is also supported by the fact that, according to SEMI, investments in semiconductor production and testing worldwide could reach a record USD 100 billion in 2022 in order to stabilize or expand global supply chains in the medium term and, at the same time, increasingly establish their own semiconductor production facilities in Europe and the USA. This further increase in semiconductor production must be mounted on appropriate carriers, which will lead to a further extraordinary rise in demand for PCBs in general and for high-tech boards in the L/S range ≤ 30µm. On the other hand, the market research company IDC assumes that the production of tablets and PCs, for example, will even show significant negative growth in 2022 and 2023, which will reduce the demand for boards.